Commercial property managers face new challenges in 2024. These challenges need to be addressed using knowledge, expertise and technological innovation. As the economic, social, and technological spheres evolve, property managers are forced to look at what measures can be implemented to ensure the smooth operation of commercial spaces.

Based on industry data and expertise, the Bannon Property Management team forecast 6 key challenges for 2024:

Economic uncertainty:

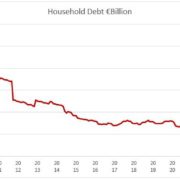

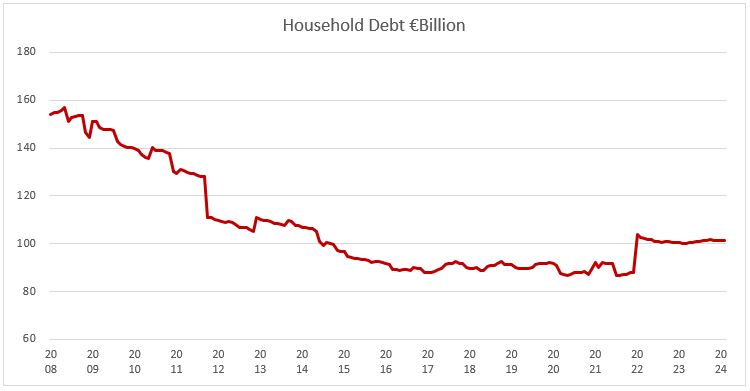

The global economic volatility has impacted businesses and the real estate industry. Maintaining profitability and sustainability of commercial properties whilst navigating inflation, interest rate fluctuation, economic uncertainty and the aftermath of the COVID-19 pandemic, is a complex balancing act. Property managers play a vital role in offsetting these factors by implementing costs saving strategies and ensuring value for money for occupiers. It is also essential that property managers stay informed about market trends, fostering relationships and embracing technology for efficient operation of real estate assets.

Sustainability and Environmental, Social and Governance Compliance:

In 2024 there will be a continued focus on environmental, social, and governance (ESG) criteria in the real estate sector. Property managers are tasked to implement sustainable practices, reduce carbon footprints and enhance energy efficiency in commercial properties. This is driven by both client goals and legislative requirements. Solutions to meet these standards not only contribute to environmental conservation but also enhance the marketability of the properties. Bannon in partnership with sister company Evia has developed and implemented numerous complicated and effective ESG projects on behalf of clients to effectively deliver on these tasks in 2024.

Technological Integration:

The rapid advancement of technology is transforming the way commercial properties are managed. Property managers are faced with the challenge of integrating smart building technologies, data analytics, and automation systems to optimize operations. This will involve significant investments in upgrading existing infrastructure and training personnel to harness the full potential of these innovations. Bannon collates and interprets a huge amount of data in relation to assets under our management. This data and its interpretation offer significant insight to Bannon when recommending projects to clients for individual asset maintenance, management and performance.

Remote Work Impact:

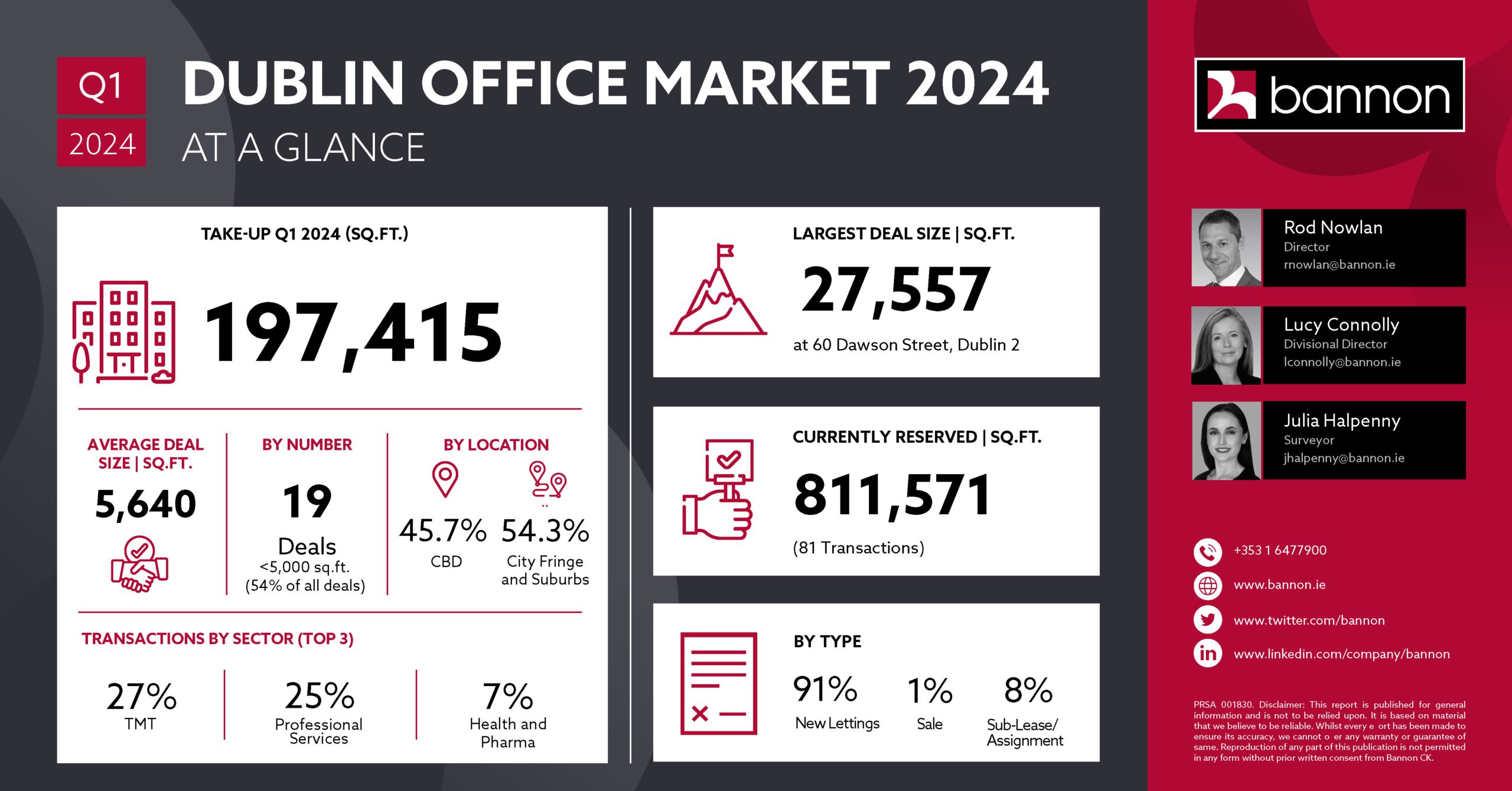

The widespread adoption of remote work has altered the dynamics of commercial spaces. Property managers must respond to the changing demands for flexible office spaces, hybrid work models and the need for advanced digital infrastructure. Adapting commercial properties to meet the evolving needs of tenants in this new era of work will continue to be a crucial aspect of property management in 2024.

Rising Operating Costs:

Escalating operational expenses, including property maintenance, utilities and insurance, pose a significant challenge for property managers. Balancing the need to keep costs in check while delivering high-quality services to tenants requires strategic financial management. Bannon is acutely aware of the impact high operating costs have on the attractiveness of assets from both an owners and occupiers’ perspectives. Cost management underpinned by value for money remains a key cornerstone of Bannon property management ethos.

Tenant Retention and Experience:

With a competitive commercial property market, tenant retention is crucial for property managers. Providing a positive occupier experience, addressing concerns promptly, and fostering a sense of community within commercial spaces are vital to retaining occupiers and attracting new ones.

Commercial property managers continue to navigate a complex landscape. Successfully addressing the issues highlighted requires a proactive approach, strategic planning and a willingness to embrace innovation. As the real estate industry continues to evolve, property managers who can adeptly navigate these challenges will be well-positioned for success in 2024 and beyond. The Bannon property management has a proven track record in embracing and implementing best in class approaches. A certainty for 2024 is that this will remain the case.

Author: William Lambe, Divisional Director, Bannon

Date: 24th January 2024

A disappointing quarter but our Capital Markets director

A disappointing quarter but our Capital Markets director

Bannon’s latest monthly Retail Pulse has now gone live.

Bannon’s latest monthly Retail Pulse has now gone live.

Bannon’s latest monthly Retail Pulse has now gone live.

Bannon’s latest monthly Retail Pulse has now gone live.

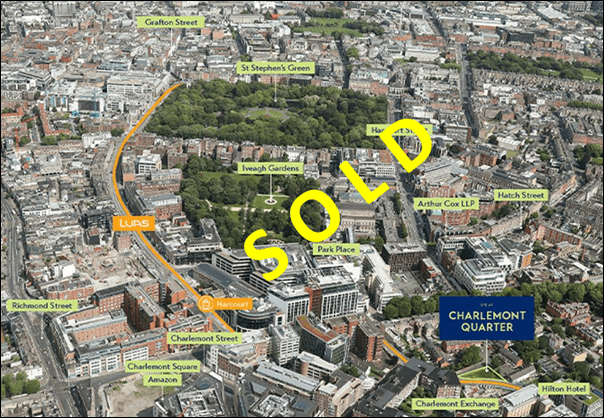

2023 was very much “annus horribilis” in terms of capital market’s activity. Concluding with a total turnover of €1.85 billion it represents the lowest level of activity since 2012. Clearly the pricing uncertainty brought about by the ending of the free money era, driven by a multitude of geopolitical and economic factors, has had the biggest effect.

2023 was very much “annus horribilis” in terms of capital market’s activity. Concluding with a total turnover of €1.85 billion it represents the lowest level of activity since 2012. Clearly the pricing uncertainty brought about by the ending of the free money era, driven by a multitude of geopolitical and economic factors, has had the biggest effect.

Excited to share a recent success story from the Bannon Property Management team. Our client’s decision to bring

Excited to share a recent success story from the Bannon Property Management team. Our client’s decision to bring