What is a COP?

The United Nations (UN) annual climate change conference, also known as the ‘Conference of the Parties’ or ‘COP’, brings together world leaders, ministers, and negotiators to agree on how to address climate change.

Since 1995, almost every member nation on Earth has come together in a different country each year, except for 2020.

The UN describes the COP as “the supreme decision-making body” of the United Nations Framework Convention on Climate Change (UNFCCC). It includes representatives of all the countries that are signatories, known as parties, to the UNFCCC. During each COP, the parties review the progress towards the overall goal of the UNFCCC: to tackle climate change.

The negotiating parties include governments that have signed the UN Framework Convention on Climate Change (UNFCCC), the Kyoto Protocol and/or the Paris Agreement. The COPs are also attended by thousands of representatives from civil society, the private sector, international organisations, and the media.

Why is this conference called COP28?

COP28 stands for the 28th Conference of the Parties to the United Nations Framework Convention on Climate Change

Where will COP28 be hosted?

The COP is hosted by a different country each year. COP28 will be hosted by the United Arab Emirates (UAE) and will take place between 30 November–12 December 2023 in Dubai.

Why is COP28 important?

It is hoped COP28 will help keep alive the goal of limiting long-term global temperature rises to 1.5C. This was agreed by nearly 200 countries in Paris in 2015. The 1.5C target is crucial to avoid the most damaging impacts of climate change, according to the UN’s climate body, the Intergovernmental Panel on Climate Change (IPCC).

Long-term warming currently stands at about 1.1C or 1.2C compared with pre-industrial times – the period before humans started burning fossil fuels at scale. However, the world is on track for about 2.5C of warming by 2100 even with current pledges to tackle emissions. The window for keeping the 1.5C limit in reach “rapidly narrowing”, the UN says.

UN Secretary-General Antonio Guterres called for the COP28 talks and agendas to close the climate ambition gap. He also stated that “Leaders can’t kick the can any further. We’re out of road,” condemning a “failure of leadership, a betrayal of the vulnerable, and a massive, missed opportunity. As the reality of climate chaos pounds communities around the world – with ever fiercer floods, fires, and droughts – the chasm between need and action is more menacing than ever.”

What are the key issues to watch at COP28?

- COP28 is important for several reasons, not least because it marks the conclusion of the first Global Stocktake (GST), the main mechanism through which progress under the Paris Agreement is assessed.

- Getting the loss and damage fund (established at COP27) up and running and agreeing on a framework for the Paris Agreement’s Global Goal on Adaptation (GGA).

- Other issues that are likely to receive much attention, and which may be reflected across several negotiating streams, include energy transition and food systems transformation.

- Discussions and negotiations on climate finance.

For more information on COP28

https://news.un.org/en/story/2023/11/1143567

Author:

Author:

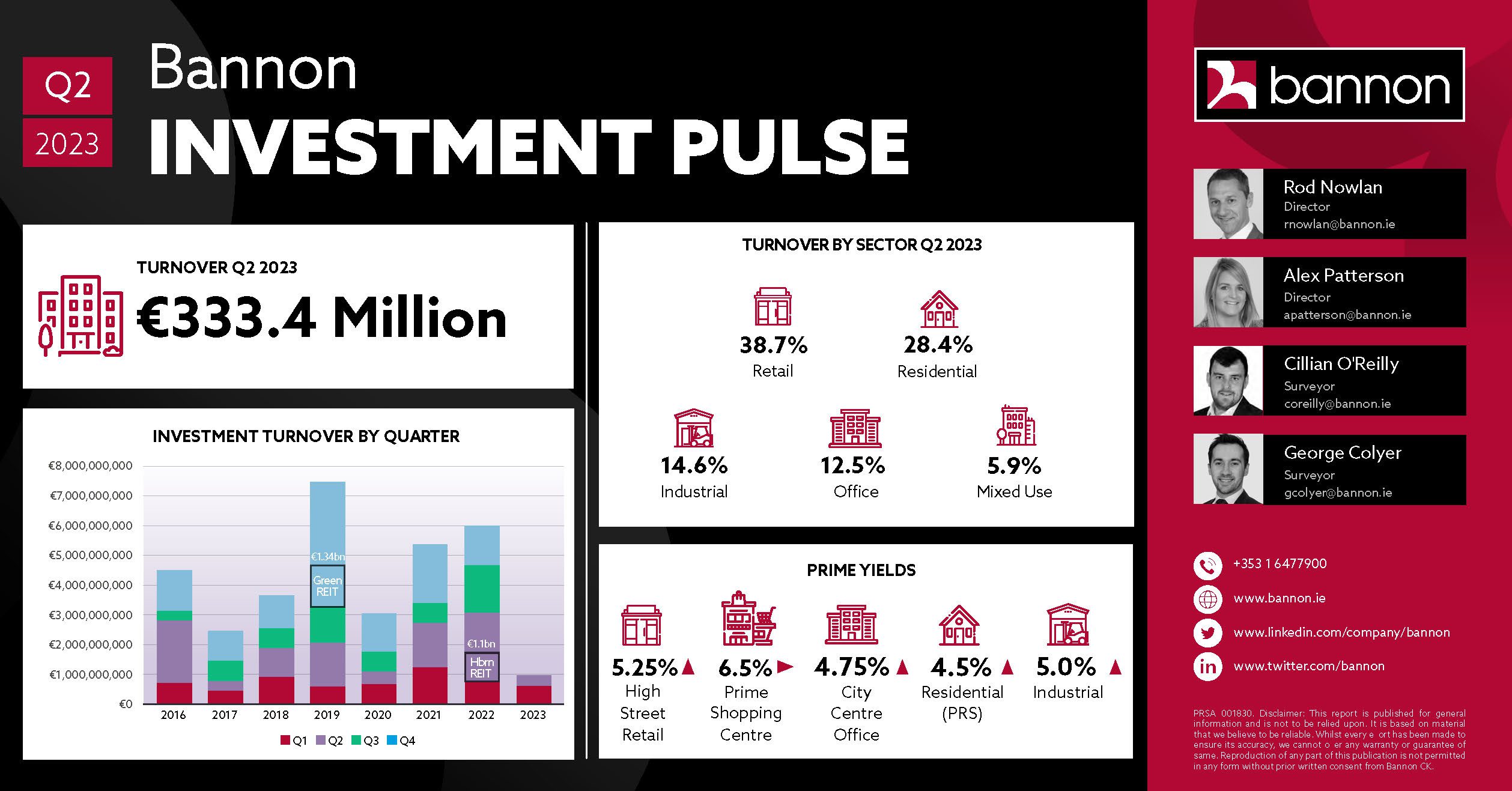

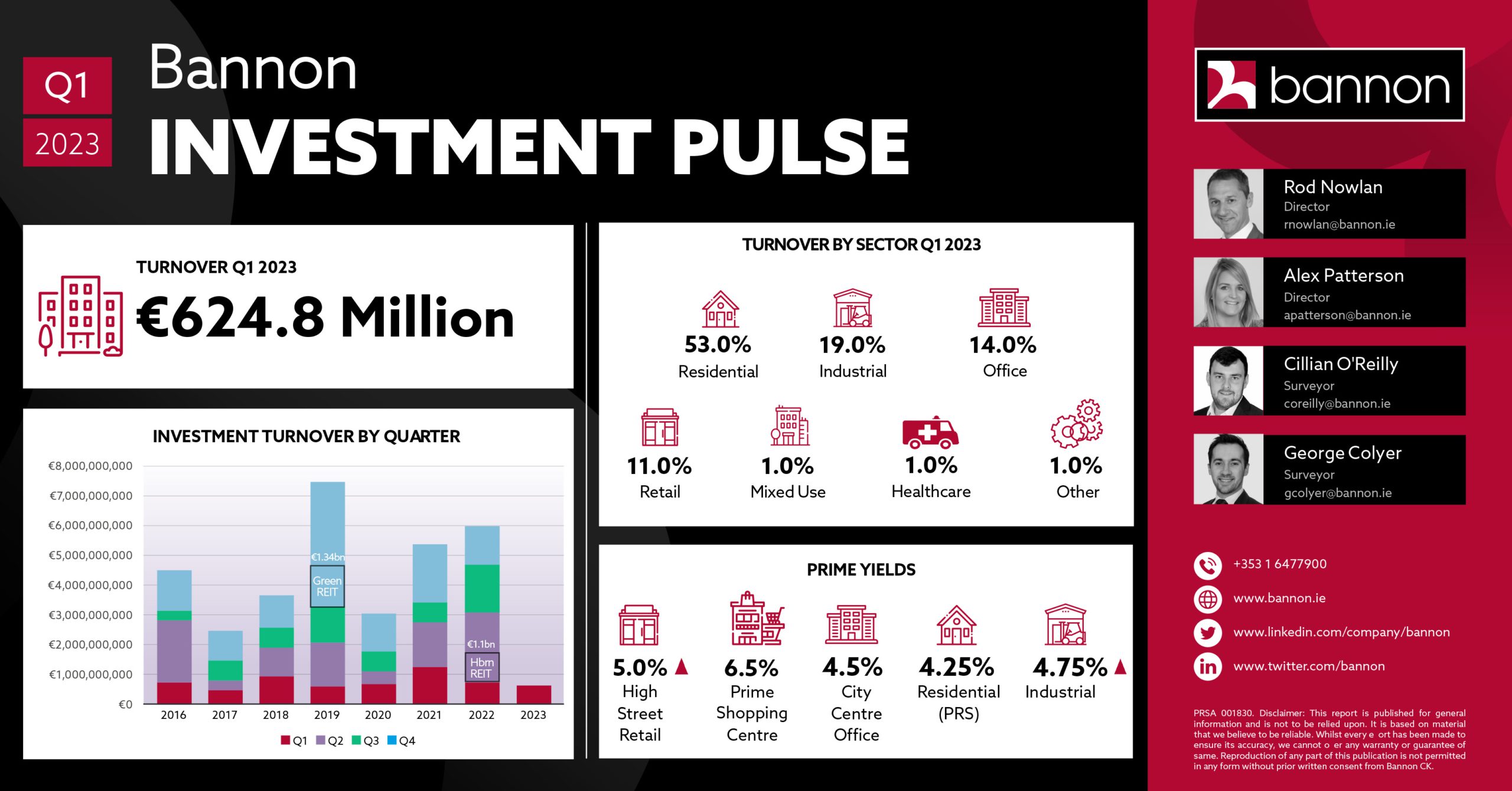

There were two key takeaways from this quarter’s Capital Markets figures. First and foremost, for the first time in almost a decade there were no material PRS transactions. The second was that two purchasers, specifically Davys and French Fund Corum, accounted for almost 50% of the entire quarter’s market turnover with the acquisition of 10 separate assets.

There were two key takeaways from this quarter’s Capital Markets figures. First and foremost, for the first time in almost a decade there were no material PRS transactions. The second was that two purchasers, specifically Davys and French Fund Corum, accounted for almost 50% of the entire quarter’s market turnover with the acquisition of 10 separate assets.

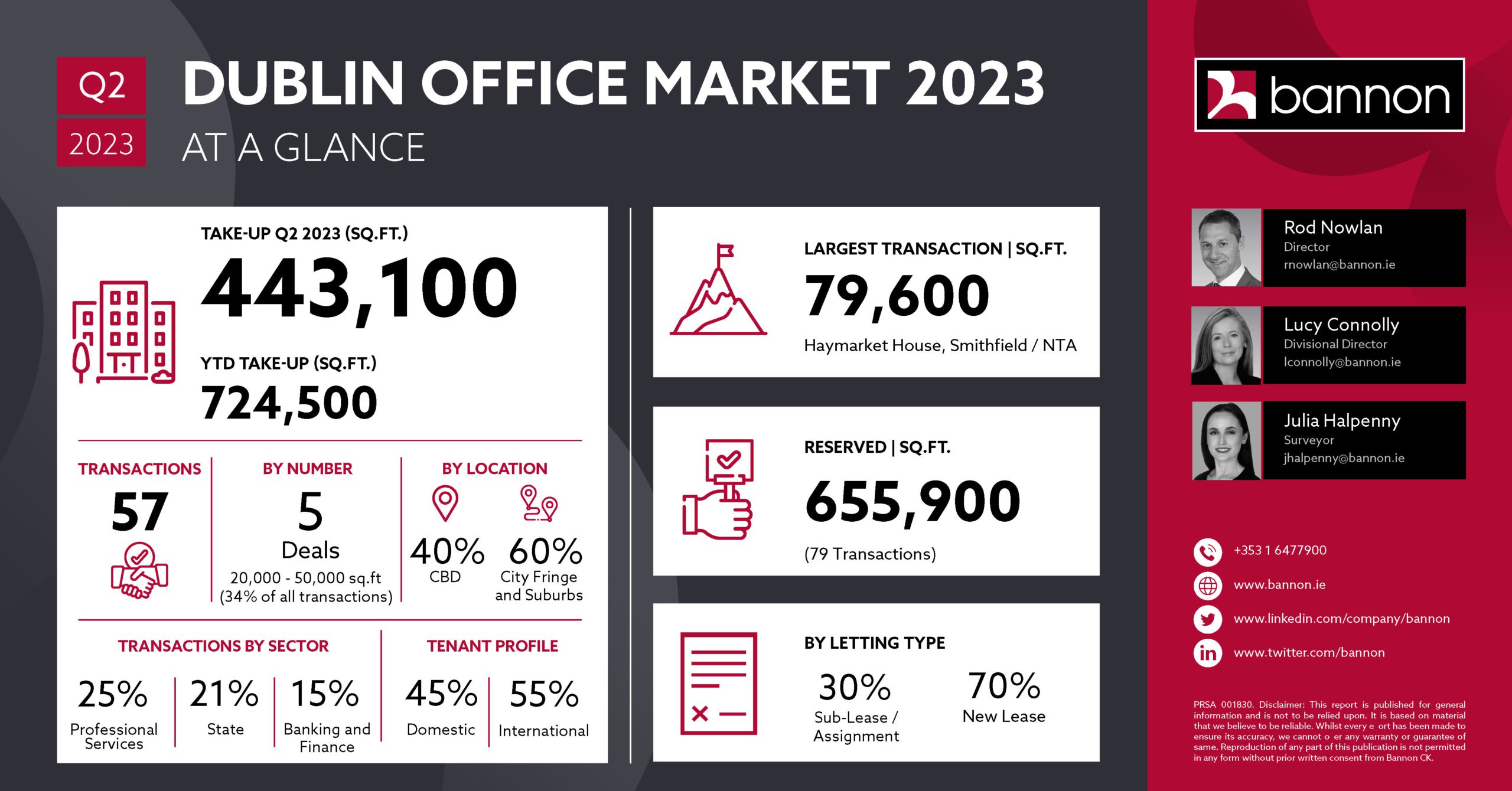

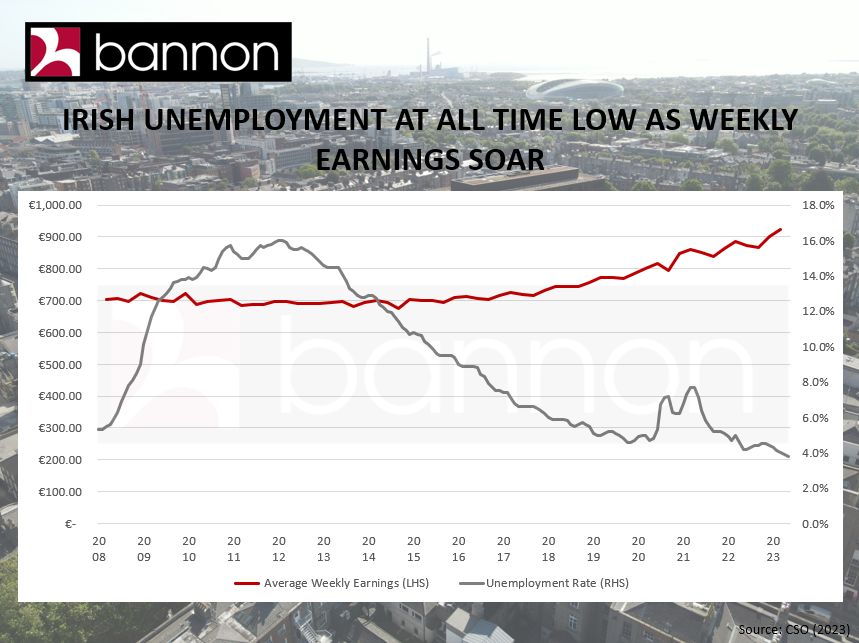

Quarter 2 Dublin office take up exceeded 440,000 sq.ft. resulting in an increase in average deal size to 7,720 sq.ft. (24% increase on Q1 2023)

Quarter 2 Dublin office take up exceeded 440,000 sq.ft. resulting in an increase in average deal size to 7,720 sq.ft. (24% increase on Q1 2023)

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/irishtimes/RD72OWG6Z5BTFCE3SO7DUQKALI.jpg)

The Government has been grappling with a housing shortage for several years. As the demand for housing continues to outstrip supply, creative solutions are needed to address this pressing issue.

The Government has been grappling with a housing shortage for several years. As the demand for housing continues to outstrip supply, creative solutions are needed to address this pressing issue.

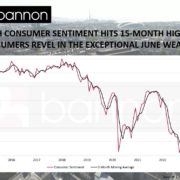

Bannon’s latest monthly Retail Pulse has now gone live.

Bannon’s latest monthly Retail Pulse has now gone live.

Bannon

Bannon

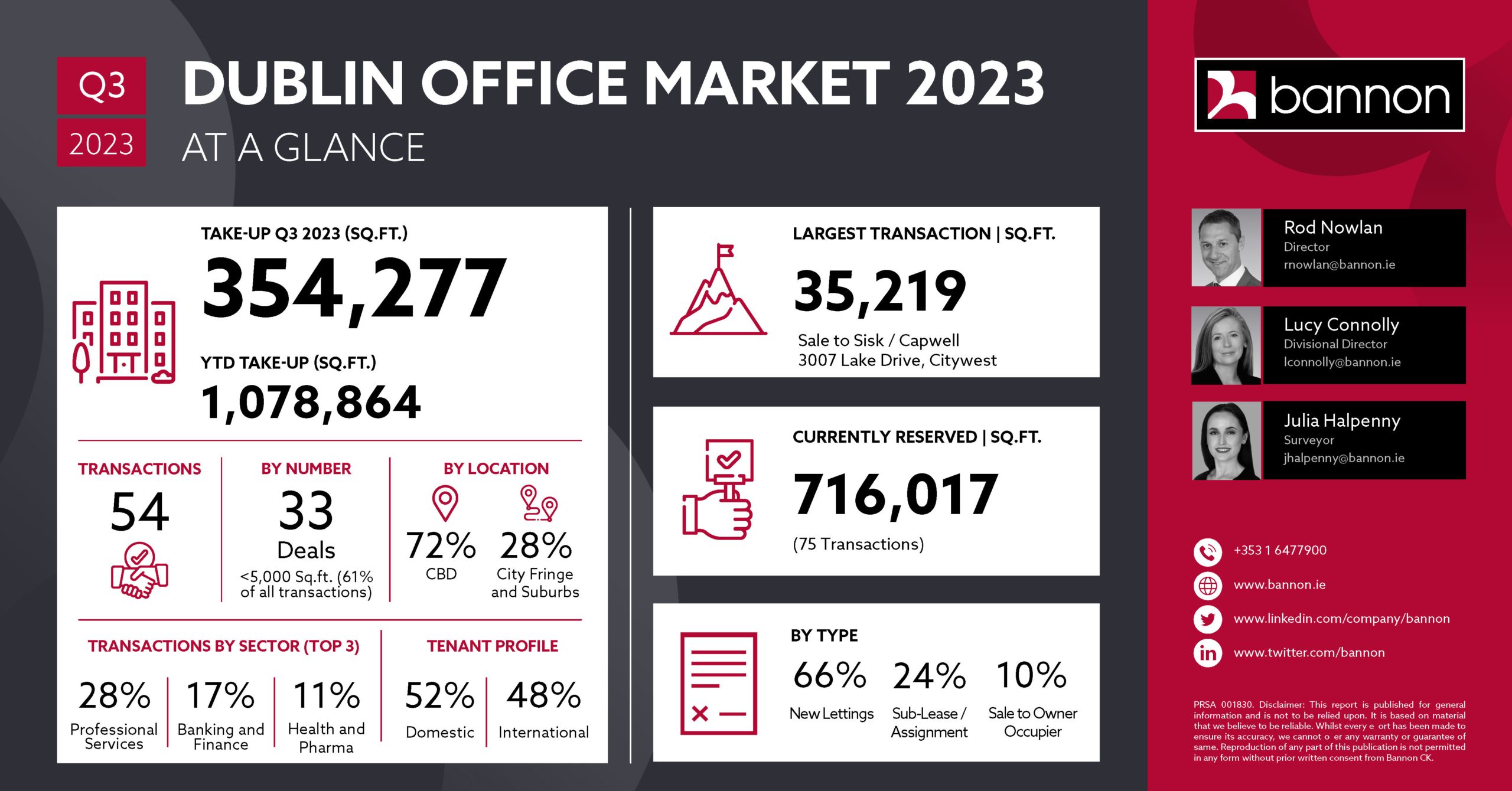

Bannon’s latest Office Pulse is now live.

Bannon’s latest Office Pulse is now live.

Bannon’s latest monthly Retail Pulse has now gone live.

Bannon’s latest monthly Retail Pulse has now gone live.

Bannon’s latest Office Pulse is now live!

Bannon’s latest Office Pulse is now live!