General Commentary from Executive Chairman Neil Bannon

The conversation around sustainability in the Irish commercial property sector has evolved over the last 12 months. Although everybody was aware of the significance of the challenge last year this has been brought into sharper focus as the various sources of capital in the market have set out their stall. Access to and cost of capital, both funding and equity, is clearly going to be very different for assets depending upon their sustainability credentials. This has been most evident in the office sector where deals continue to be done in new buildings with market leading green credentials both from expanding entities and those relocating form brown buildings. As investor and funders watch this they are becoming increasingly concerned about the risk of obsolescent for older stock and how the value of older buildings will have to reflect the cost of bringing them up to standard.

It is interesting and, we think, helpful to see the conversation move from an aspirational desire to become more sustainable to a clear financial motivation to protect capital. This will accelerate activity in the market as capital positions itself to ensure it is a net beneficiary. Bringing market forces to bear will help our green transition and is a welcome development.

Property Management from Directors Ray Geraghty and Alex Patterson

As custodians of a nationwide portfolio of real estate the Bannon property management team are involved in multiple projects at any moment in time where the focus is sustainability and energy conservation. There is an awareness about sustainability and ESG measures among property owners, funders, asset managers, occupiers, and service providers which is driving positive change.

In the last 12 months Bannon have been involved in some very significant sustainability projects which are now delivering much need energy savings for stakeholders. One such project was completed at Athlone Towncentre Shopping Centre (in conjunction with the SEAI) at a cost of c.€1.6 million. As a result of the project energy consumption at the shopping centre has reduced by almost 50%.

Retail Agency from Directors James Quinlan and Darren Peavoy

Smaller Domestic Retailers are becoming more ESG aware however have not fully embraced the concept. International and national retailers on the other hand have delivered significant ESG improvements across their portfolios with big improvements in solar generation and logistics improvements being a significant focus. Some international retailers are beginning to commit to BREEAM Good fitouts however are seeking significant assistance from owners to deliver this. Some institutional retail property owners are very focused in improving the BER status of their high street portfolios whereas shopping centre owners are very focused on improving energy usage in common areas within their schemes.

Where the ESG agenda was previously being pushed by the owners, we are seeing a shift in this from a smaller group of retailers who require owners to sign up to their ESG agenda rather than the other way round. Retailers are focused on reputation and branding, and they are utilising ESG credentials as a powerful marketing tool. This focus will begin to see a shift in the retail leasing market as it will influence building design and occupier’s expectations.

Valuations from Managing Director Paul Doyle and Director Niall Brereton

The Bannon Professional Services team continues to embrace ESG within our reporting, whilst also complying with RICS Valuation Practice Guidance Notes on ‘Sustainability and ESG in Commercial Property Valuation and Strategic Advice’. This Guidance Note requires the valuer to demonstrate how they have considered sustainability and ESG credentials in their valuation approach, calculations and commentary. This commentary is required to include a reference to potential future cost liabilities to meet regulatory and investor requirements.

In the past year or so we have noted that our building owner client has become much more aware and reactive to ESG. By example, if we are valuing a trading asset the client will most likely have responses to-hand in terms of our standard queries on the energy efficiency or otherwise of their premises. Elsewhere, if valuing an older office premises, a client will likely have a solution modelled to enhance the property’s ESG credentials. In the case of offices we continue to see a widening value gap between older/stranded buildings and those which are ‘B or better’

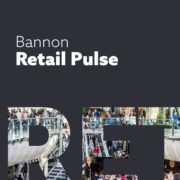

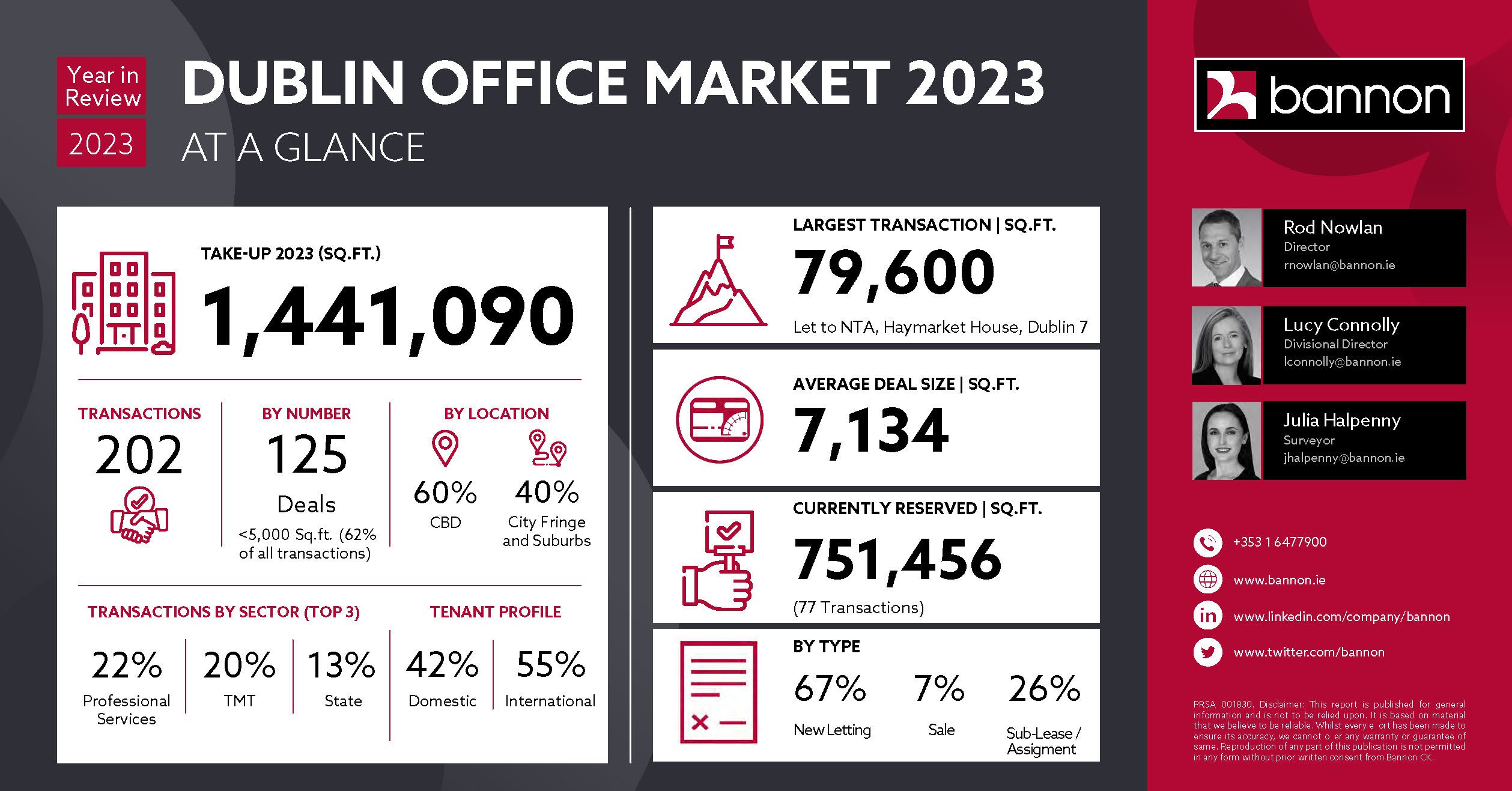

Investment and Office Agency from Executive Director Rod Nowlan

Sustainability has firmly moved to the top of the investment and office leasing agenda across all size requirements. It is no longer a focus of just the larger lots sizes. Its pursuit will be a key factor in the acceleration of “the big switch” where many office occupiers are beginning to act upon what they now determine is their new office size and style requirement in a maturing blended working market. ESG is a key target in this mix. As a consequence, we are going to see a material acceleration in office obsolescence creating a huge opportunity for those with the skills to efficiently transition these buildings back to the institutional mainstream. In this regard, valuing and selling these assets will require an in-depth analysis of the true costs associated with bringing them up to standard.

Sustainability has firmly moved to the top of the investment and office leasing agenda across all size requirements. It is no longer a focus of just the larger lots sizes. Its pursuit will be a key factor in the acceleration of “the big switch” where many office occupiers are beginning to act upon what they now determine is their new office size and style requirement in a maturing blended working market. ESG is a key target in this mix. As a consequence, we are going to see a material acceleration in office obsolescence creating a huge opportunity for those with the skills to efficiently transition these buildings back to the institutional mainstream. In this regard, valuing and selling these assets will require an in-depth analysis of the true costs associated with bringing them up to standard.

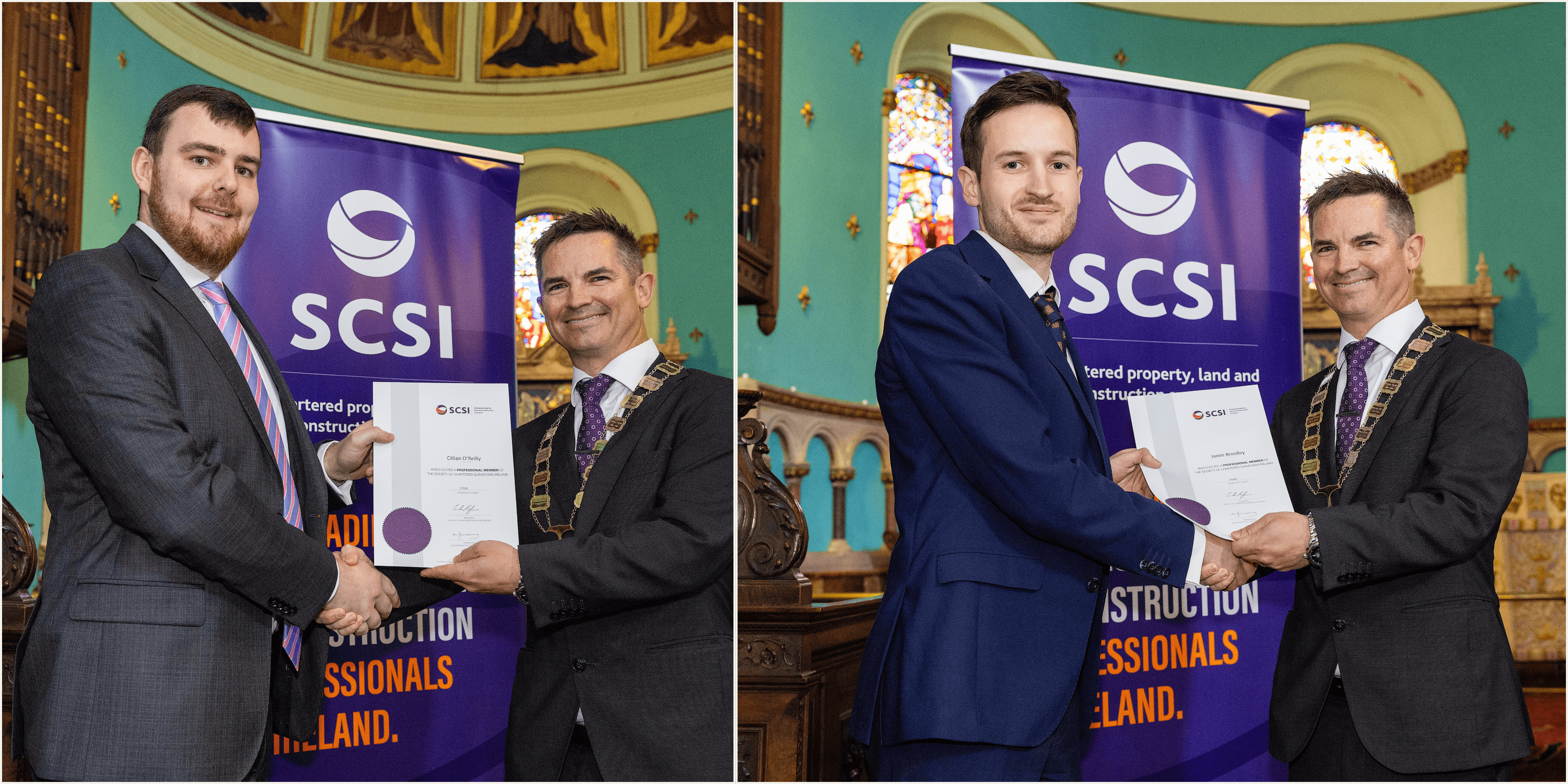

Internal from Chartered Surveyor, Sustainability Manager Cillian O’Reilly

Bannon has always had sustainability in mind within the office ever since Joe Bannon himself monitored how many pages were being printed by each team member. The culmination of this was Bannon developing and implementing an ISO 14001:2015 Environmental Management System which was certified by the NSAI in 2022.

Bannon’s Carbon Footprint is relatively low at 78.7 tonnes CO2E in 2023, none the less the firm has taken steps to target and reduce its largest contributors namely electricity usage and commuting milage. Bannon has made huge strides to curate a greener and more efficient workplace and will continue to be a market leader as trends evolve.

Our latest monthly Retail Pulse has now gone live. In this publication our retail leasing team highlight Irish occupiers and franchisees with ongoing expansion requirements.

Our latest monthly Retail Pulse has now gone live. In this publication our retail leasing team highlight Irish occupiers and franchisees with ongoing expansion requirements.

A disappointing quarter but our Capital Markets director

A disappointing quarter but our Capital Markets director

Bannon’s latest monthly Retail Pulse has now gone live.

Bannon’s latest monthly Retail Pulse has now gone live.

Bannon’s latest monthly Retail Pulse has now gone live.

Bannon’s latest monthly Retail Pulse has now gone live.

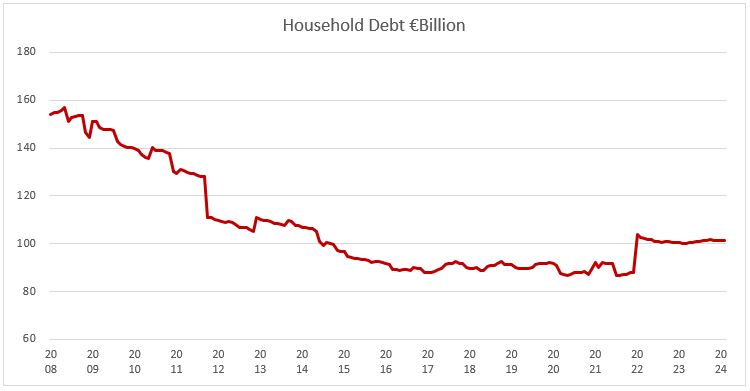

2023 was very much “annus horribilis” in terms of capital market’s activity. Concluding with a total turnover of €1.85 billion it represents the lowest level of activity since 2012. Clearly the pricing uncertainty brought about by the ending of the free money era, driven by a multitude of geopolitical and economic factors, has had the biggest effect.

2023 was very much “annus horribilis” in terms of capital market’s activity. Concluding with a total turnover of €1.85 billion it represents the lowest level of activity since 2012. Clearly the pricing uncertainty brought about by the ending of the free money era, driven by a multitude of geopolitical and economic factors, has had the biggest effect.