Following an extended period of “head burying”, most property fund managers are bracing themselves for material negative valuer adjustments across their portfolios (with the potential exception of retail which has already been massively discounted). This trepidation is clearly derived from the escalating impacts of the war in Ukraine, spiralling inflation, rising interest rates, looming recession in both the US and across the EU, and now the calamitous UK economic situation. However, there is one area of the property market where the impact of these issues will be magnified and, to add to its woes, systemic shortfalls exposed which have been historically overlooked. This is the area of non-ESG (environmental, social and governance) compliant offices, many of which are already on their way to becoming “stranded assets”.

If a building does not meet ESG requirements and the cost of improving it to satisfy these exceeds the required market return, the building in question can be considered a stranded asset. In the valuers’ defence, the office occupational market has been very slow in adjusting to the environmental agenda

Until relatively recently very few valuers were appropriately differentiating between offices that could satisfy occupier ESG requirements and those that could not. This is especially the case for those perceived “modern schemes” constructed in the past 10 years but whose energy conservation specification does not satisfy the 2017 Part L building guidelines — the effective start of the nZEB (nearly zero energy building) standards. Even if ESG upgrades were accounted for, the costs being applied were often only a fraction of the reality. These costs, which include the likes of glass/facade replacement, plant enhancement/replacement, electrical hardware upgrades, new BMS (building management systems), PV (photovoltaic) installation, rainwater harvesting and general water conservation initiatives are now materially higher and rising.

A scarcity of materials and competition for labour and expertise is unlikely to see these costs abate in the next few years as the scale of the issue becomes apparent. The Bannon office team estimates than less than 15 per cent of Dublin’s current office stock is actually ESG compliant.

In the valuers’ defence, the office occupational market has been very slow in adjusting to the environmental agenda, and rent is ultimately the primary driver of value. However, since the ramifications of the EU’s sustainable finance directive (adopted in April 2021) and the UK’s escalating Minimum Energy Efficiency Standards (MEES) have become clearer, and with various recent high-profile climate events driving public (and corporate) opinion, a sea change in attitudes has swept over the occupational market.

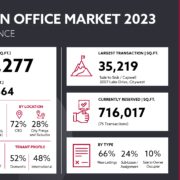

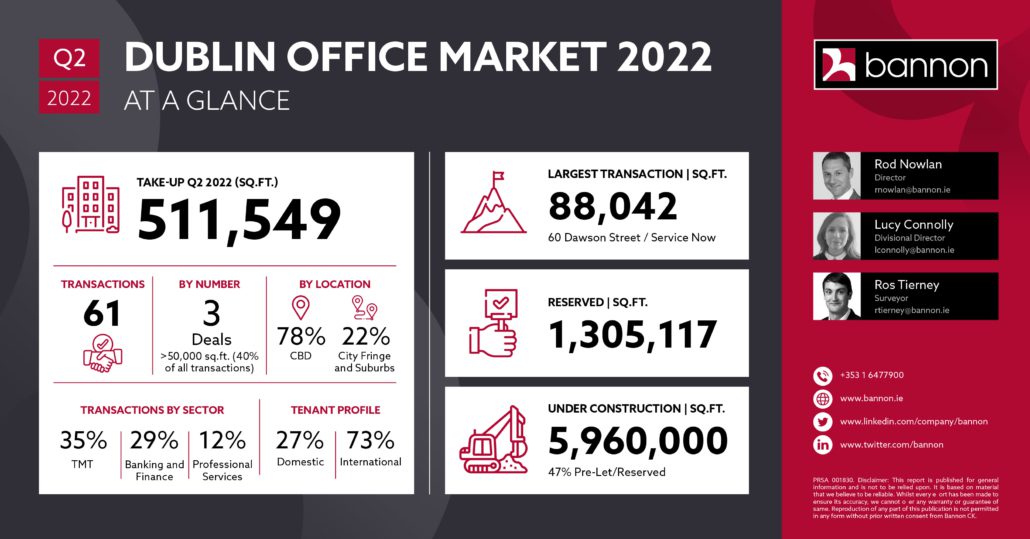

If we look back at this quarter’s office lettings, the transition in the market’s thinking is clear. There was almost 400,000sq ft of take-up in Dublin’s core central business district (Dublin 1, 2 and 4) with 86 per cent of this accounted for by ESG-compliant space. Clearly there is now a firmly established two-tier office occupational market in the city centre, namely ESG-compliant offices and the rest. Interestingly, from a further review of this quarter’s take-up, it is clear that ESG is still not a priority in the more “value-focused” suburban locations with a mere 15 per cent of the 275,000sq ft of take-up outside of Dublin 1,2 and 4 being ESG-compliant. However, the pressure on all occupiers is likely to intensify further in January 2023 when the rest of the taxonomy regulations — technical screening criteria (TSC) and regulatory technical standards (RTS) — and the second phases of financial services sector regulation and the FCA climate-related disclosure regime come into effect.

This will be particularly difficult for suburban assets to react to as the rent available in these locations is unlikely to be sufficient to support ESG retrofits.

The extent of this micro-sector’s woes doesn’t stop there either. The “latent carbon” movement is also upon us meaning that it will become increasingly difficult to knock down existing buildings. Increased density and height can support the economics of ESG which is often maximised by demolition. The increasing focus on preserving latent carbon will mean the best that will be on offer for these buildings is to be extended vertically and horizontally, which will have both structural and planning limitations. As a consequence, valuers are finally consulting their quantity-surveyor colleagues to determine the true scale of the issue. The “tic-tic” of the rollercoaster looks to be falling silent for this part of the market, and I’m not sure the current non-ESG compliant office owners will enjoy the ride to come.

There will however be a huge opportunity for those with the skills to efficiently transition these buildings back towards the institutional mainstream. In this regard, valuing and selling these assets will require an in-depth analysis of the true costs associated with bringing them up to standard. For some, the maths just will not work, while for others pursuing an alternate use may be the only avenue open to them.

Article by The Irish Times

Our Bannon 2025 Review and 2026 Office Pulse highlights a strong year-end performance for the Dublin office market.

Our Bannon 2025 Review and 2026 Office Pulse highlights a strong year-end performance for the Dublin office market.

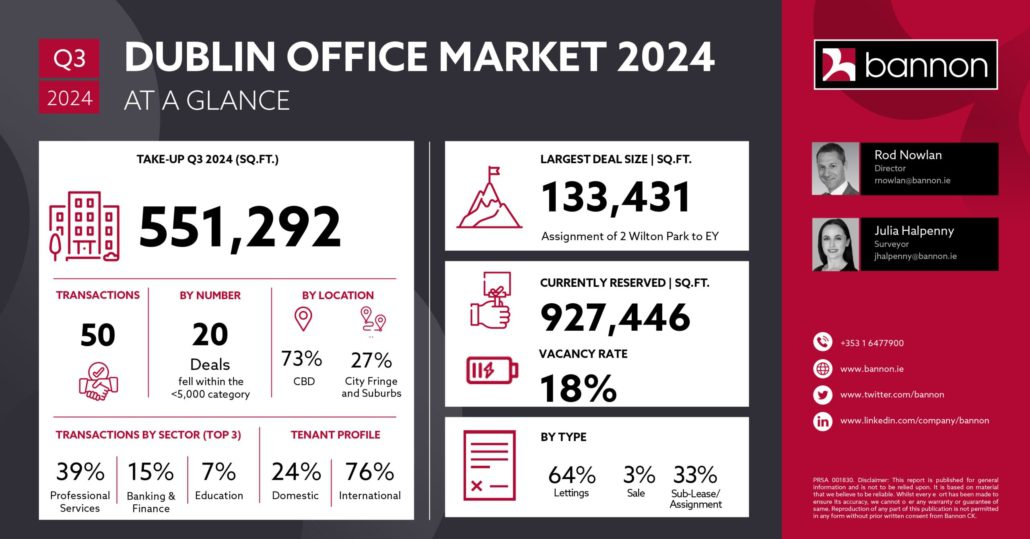

Q3 showcased an important shift in sentiment.

Q3 showcased an important shift in sentiment.

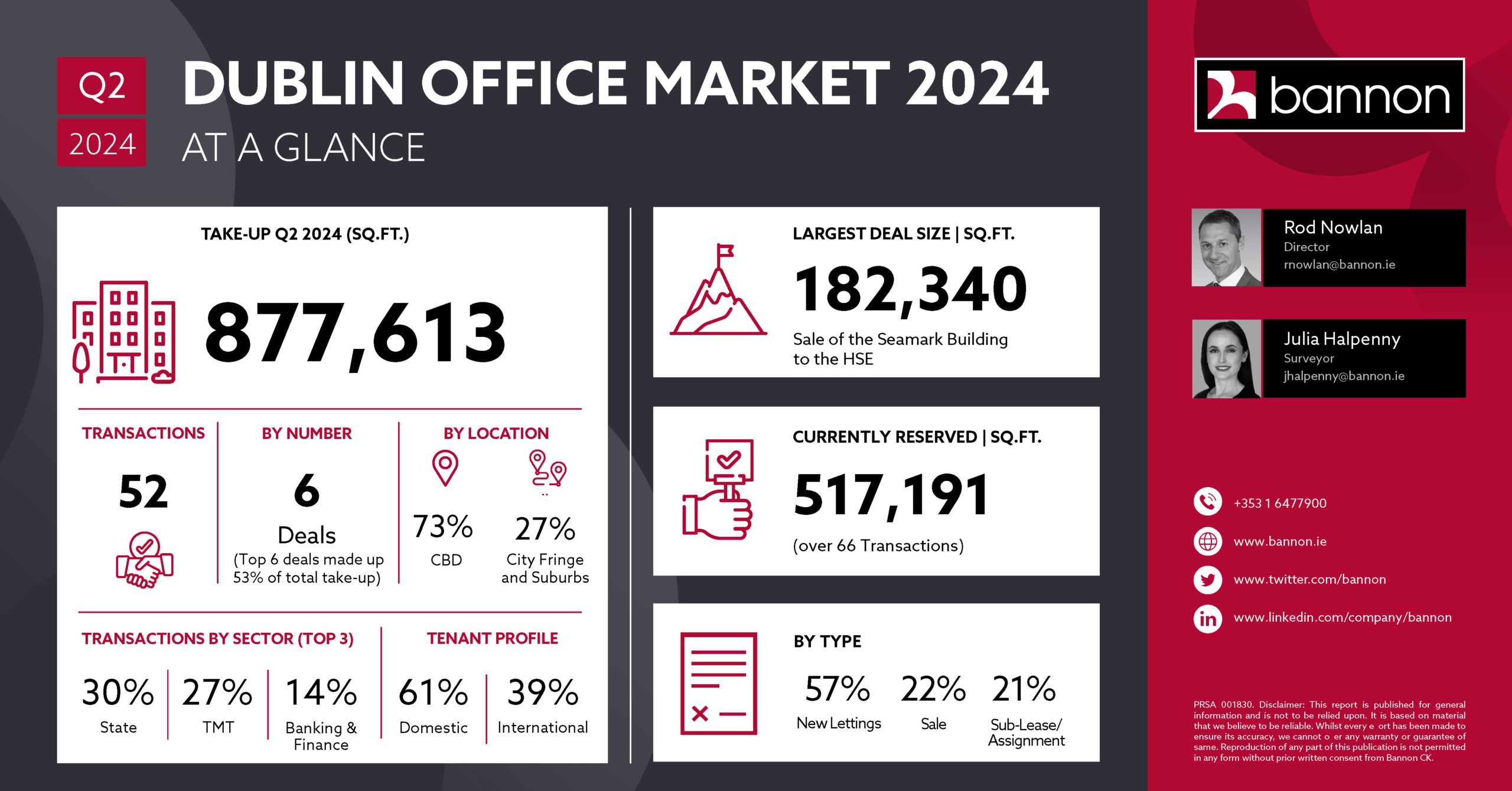

While Q2 2025 saw total office take-up in Dublin rise to 667,989 sq. ft., this figure is largely boosted by a single pre-let deal — Workday’s move at College Square. Excluding that transaction, market activity stands at just 250,000 sq. ft., reflecting a softer quarter.

While Q2 2025 saw total office take-up in Dublin rise to 667,989 sq. ft., this figure is largely boosted by a single pre-let deal — Workday’s move at College Square. Excluding that transaction, market activity stands at just 250,000 sq. ft., reflecting a softer quarter.

Author:

Author:

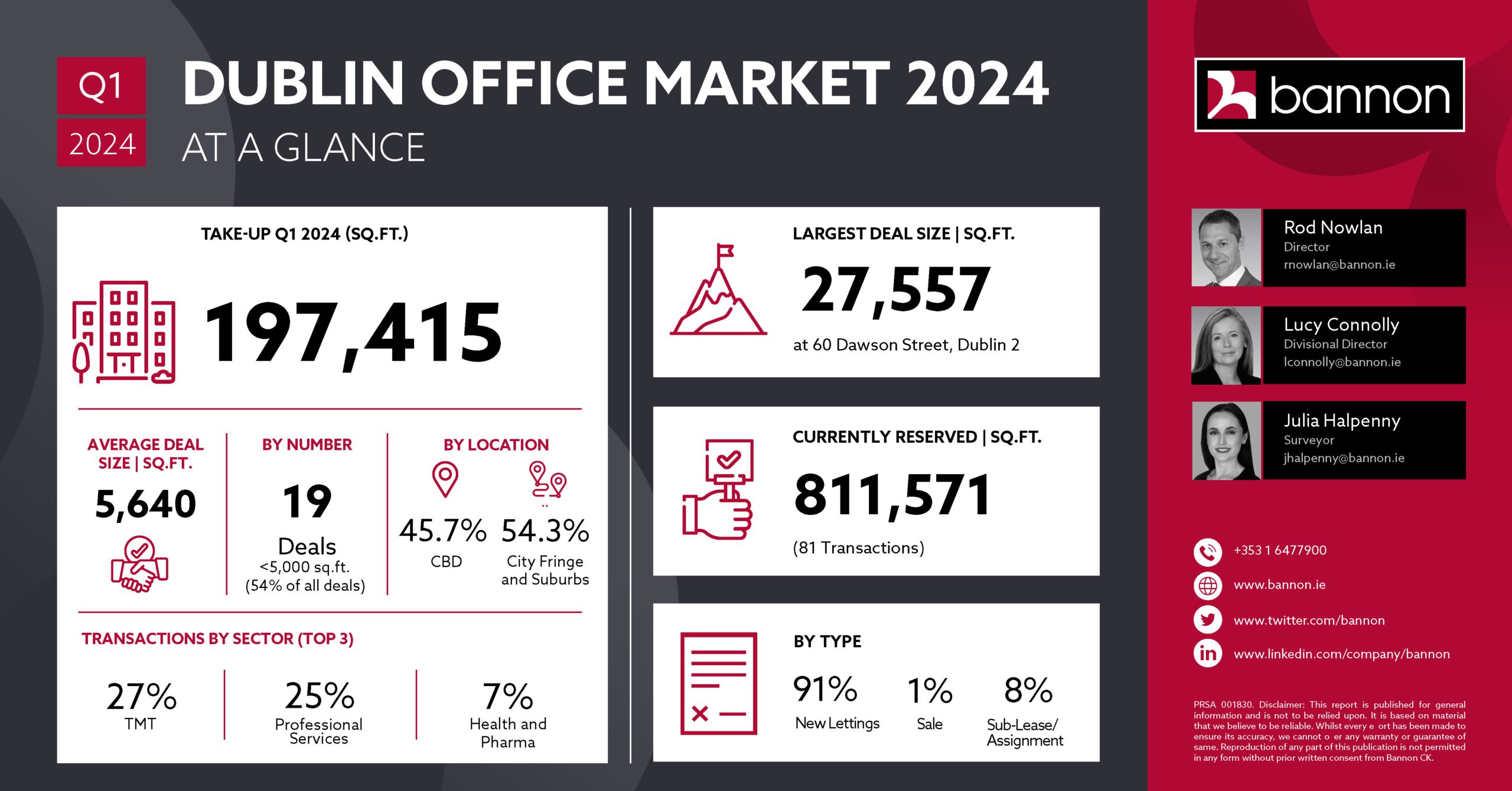

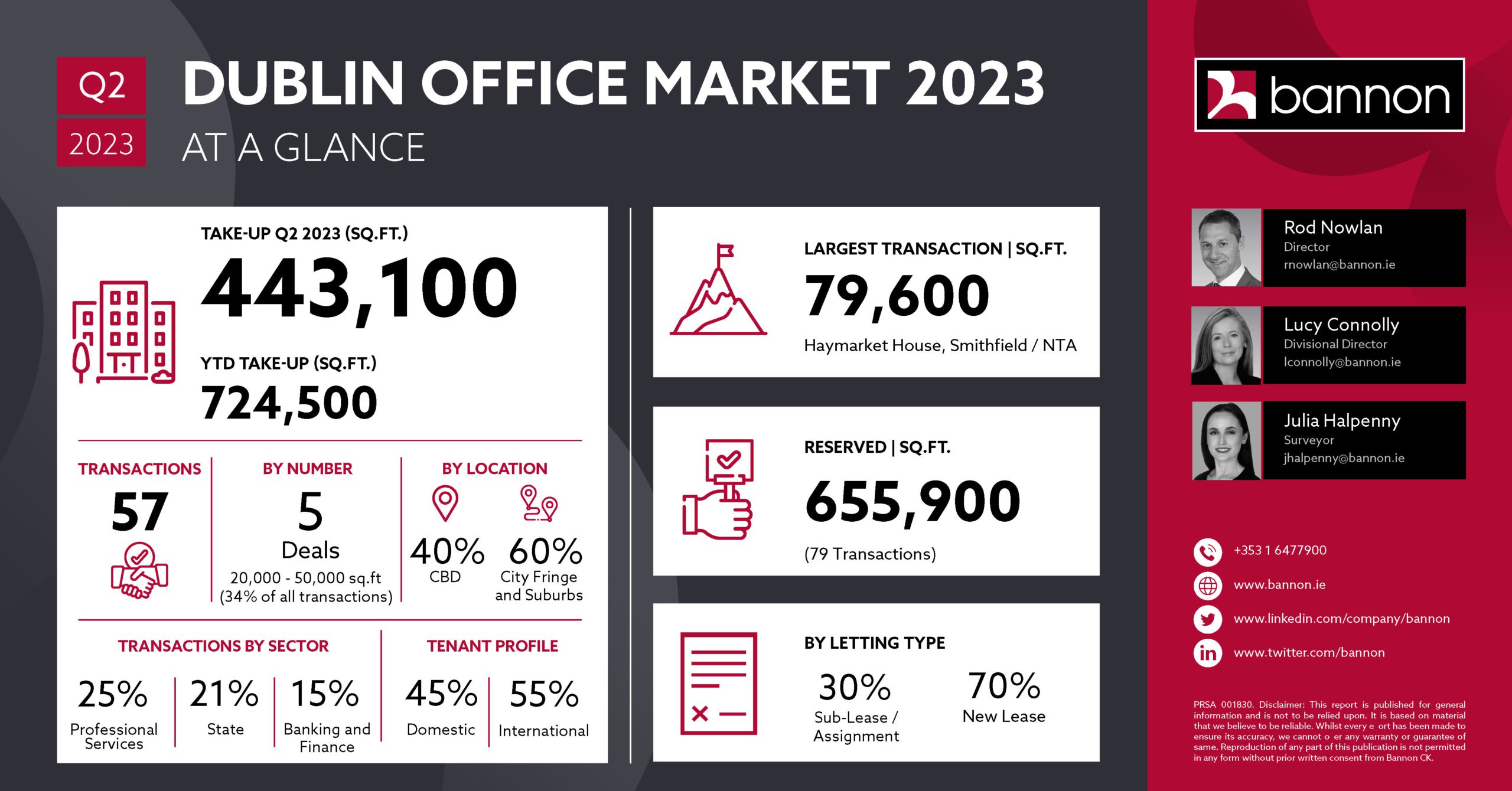

Quarter 2 Dublin office take up exceeded 440,000 sq.ft. resulting in an increase in average deal size to 7,720 sq.ft. (24% increase on Q1 2023)

Quarter 2 Dublin office take up exceeded 440,000 sq.ft. resulting in an increase in average deal size to 7,720 sq.ft. (24% increase on Q1 2023)

The Government has been grappling with a housing shortage for several years. As the demand for housing continues to outstrip supply, creative solutions are needed to address this pressing issue.

The Government has been grappling with a housing shortage for several years. As the demand for housing continues to outstrip supply, creative solutions are needed to address this pressing issue.

Bannon’s latest Office Pulse is now live.

Bannon’s latest Office Pulse is now live.

Bannon’s latest Office Pulse is now live!

Bannon’s latest Office Pulse is now live!

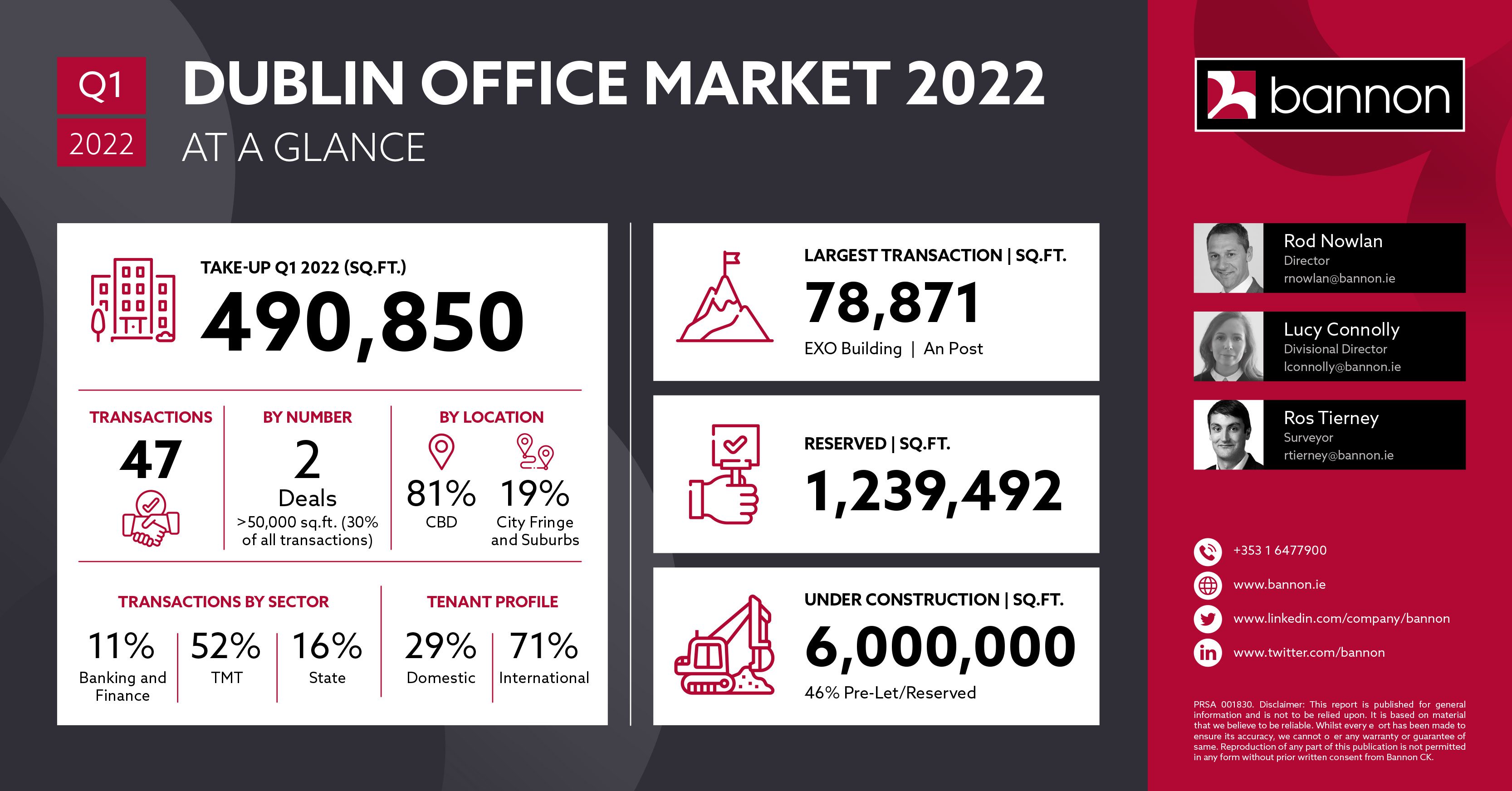

The first Bannon Dublin Office Market Pulse of 2023 is now live. Dublin office market take up exceeded 2,650,000 sq.ft. in 2022, boosted by a busy Q4 with over 804,000 sq.ft. transacting in the final quarter. See full details below together with expert insight from

The first Bannon Dublin Office Market Pulse of 2023 is now live. Dublin office market take up exceeded 2,650,000 sq.ft. in 2022, boosted by a busy Q4 with over 804,000 sq.ft. transacting in the final quarter. See full details below together with expert insight from

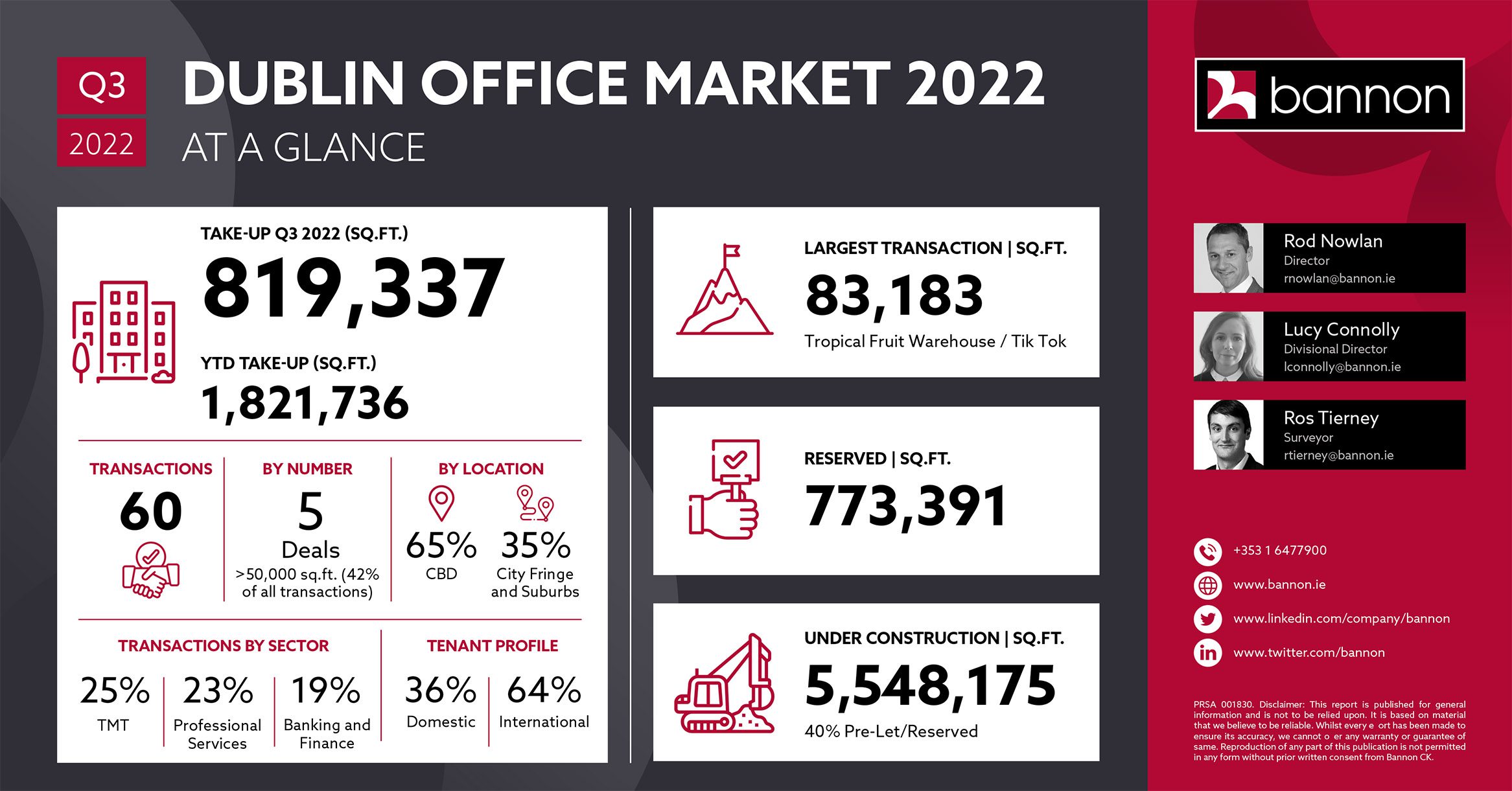

The Bannon Dublin Office Market report is available now. Take up for the third quarter reached 819,000 sq.ft. representing a 60% increase on Q2 and a 77% increase in the same period last year. Lease flexibility continues to be sought in the short term as companies continue to assess their office requirements as remote and hybrid models are fully determined.

The Bannon Dublin Office Market report is available now. Take up for the third quarter reached 819,000 sq.ft. representing a 60% increase on Q2 and a 77% increase in the same period last year. Lease flexibility continues to be sought in the short term as companies continue to assess their office requirements as remote and hybrid models are fully determined.

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/irishtimes/RD72OWG6Z5BTFCE3SO7DUQKALI.jpg)

The commercial rental market is on the cusp of significant change. The true impact of Section 132 of the Land Conveyancing Reform Act 2009 is now impacting all reviews. Learn how our highly experienced team can help you with your rent review.

The commercial rental market is on the cusp of significant change. The true impact of Section 132 of the Land Conveyancing Reform Act 2009 is now impacting all reviews. Learn how our highly experienced team can help you with your rent review.