Bannon Office Pulse – November 2023

To view the full report, please click here.

To view the full report, please click here.

Among the recently announced package of fiscal measures introduced by the Government as part of Budget 2024 was a 12-month deferral of the Residential Zoned Land Tax (RZLT). The tax liability, which was due to be paid by landowners as and from 1st February 2024, will not now fall due until February 2025. The RZLT equates to an annual liability equal to 3% of the market value of land which is deemed suitable for residential development.

While the 12-month deferral will no doubt be a welcome development by liable landowners they will face a choice as to the future prospects for their property. Among others, the Bannon Development Land Team has identified three fundamental options open to impacted landowners:

1. Dispose of the land

2. Seek a re-zoning of the land via the Local Authority

3. Undertake residential development.

Under the third option, the RZLT liability will only cease to accrue when completed residential units are delivered and will continue to be incurred during the construction phase.

While the option to seek a re-zoning from residential uses will ultimately result in the tax liability being removed it will also result in a significant diminution in the value of the land. This may not be such an issue for certain owners such as farmers whose primary interest is working the land. However, the vast majority of landowners may be very reluctant to actively seek to diminish the value of their property via rezoning.

Whatever the ultimate course of action it is clear that a lot of important decisions will need to be made by landowners impacted by RZLT in 2024. If this impacts you, talk to the team today to start planning your strategy early.

Author: Niall Brereton, Director, Bannon

Date: 14th November 2023

Huge congratulations to Ian Hunter and the team in Swords Pavilions Shopping Centre on their win at the Pakman Awards. The team are now officially industry leading! The first shopping centre to win this award and a reflection of all the hard work in the centre.

**Exciting opportunity in the heart of the innovative Windmill Quarter in Dublin’s South Docks.**

We are pleased to present the final ground floor suite (front) of 50 City Quay, Dublin 2. Offering a superb waterside location suitable for both office and retail uses, extending to 692 Sq.ft.

Contact Lucy Connolly or Julia Halpenny to schedule an inspection and learn more about this exceptional space.

Sligo’s Quayside Shopping Centre has once again earned the prestigious title of All-Ireland All-Star Shopping Centre of the Year, bestowed by the All-Ireland Business Foundation. This marks the fifth Business All-Star recognition for this esteemed retail destination.

As it enters its 18th year in business, Quayside Shopping Centre stands out for consistently upholding the highest standards of trust, commitment, performance, and customer centricity.

Located at the heart of Sligo Town, Quayside Shopping Centre boasts 400 customer parking spaces and an expansive 130,000 square feet of retail space across four trading levels. The centre encompasses 43 Retail Units, 12 Office Suites and 89 Residential units in total.

Distinguished by its unique combination of open streets and covered malls, Quayside Shopping Centre is meticulously designed to cater to the needs of contemporary retailers while ensuring that customers enjoy a relaxed, secure, and convenient shopping experience.

This All-Ireland All-Star Shopping Centre of the Year accolade elevates the company into an exclusive league of businesses that have achieved a remarkable five-time Business All-Star recognition.

Announcing the news of Quayside Shopping Centre’s achievement, Deputy Chair of AIBF’s Adjudication Board, Kieran Ring, said:

On behalf of the All-Ireland Business Foundation I am delighted to announce that Quayside Shopping Centre have achieved All-Ireland All-Star Shopping Centre 2023-2024. This accreditation is in recognition of the company’s outstanding contribution to quality and standards in the sector over the last 5 years. This accreditation recognises Quayside Shopping Centre’s conduct in the areas of trust, commitment, performance & customer centricity. Quayside Shopping Centre is hereby included in the AIBF Register Of Irish Business Excellence for the fifth consecutive year.

Reacting to the news of her company’s achievement, Quayside Shopping Centre Manager & Head of Marketing, Christine Dolan said:

‘On behalf of everyone working at Quayside Shopping Centre in Sligo, I would like to express our sincere gratitude and delight at being named as All-Ireland All-Star Shopping Centre of the Year for 2023/2024 including receiving Business All-Star accreditation for the fifth consecutive year. We are absolutely thrilled to hear that our centre has once again achieved such a prestigious title. This remarkable accomplishment is a testament to the dedication and tireless efforts of our exceptional team of retailers and staff who work here. We couldn’t be prouder of their commitment to upholding the rigorous standards set by the All-Ireland Business Foundation.

As an integral part of the vibrant community in Sligo, we take our role seriously and are committed to going the extra mile for our customers. While this accolade recognises our efforts, we want to emphasise that much of the work happens behind the scenes.

We are dedicated to continually improving the centre’s services and facilities, ensuring that each visit to Quayside is a remarkable experience. This recognition further inspires us to continue providing a top-tier shopping experience for our valued customers.’

Managing Director of the All-Ireland Business Foundation Kapil Khanna said: The accreditation, which is now held by over 650 firms, is needed by the thousands of small and medium businesses which operate to their own standards but have nothing to measure them by.

He said: We evaluate a company’s background, trustworthiness and performance, and we speak to customers, employees and vendors. We also anonymously approach the company as a customer and report back on the experience. The business goes through at least two interviews and is scored on every part of the process against set metrics.

About The All-Ireland Business Foundation

The All-Ireland Business Foundation is an autonomous national accreditation body tasked with enterprise development and the promotion of Best-in-Class Irish businesses.

As the accreditation body for the Business All-Star mark, the AIBF recognises Best-In-Class Irish businesses. Companies that merit recognition based on an independent audit of their performance, reputation, and customer-centricity.

Article Published by All Ireland Business Times

In this publication our leasing team summarise some of the more significant recent transactions and Neil Bannon focuses on footfall levels on our two most prominent high streets, namely Grafton Street and Henry Street, where current activity has proved very much contrary to previously predicted bad news speculation.

To view the full report, please click here.

In early September I had the privilege of joining Bannon as a Graduate Surveyor. Having completed my internship in Bannon in third and fourth year as part of my Property Economics degree I was already familiar with the office setting and the familiar faces. The positive and friendly atmosphere made this transition seamless. Starting any job can be daunting but I have felt that in Bannon they have been very supportive in every way to help me settle into professional life.

I joined the Capital Markets and Office teams working alongside Rod Nowlan, Lucy Connolly and Julia Halpenny. Having previously worked in this area during my internship I was aware of the fast-paced industry of the investment world. From shopping centres to Georgian offices, I was well exposed to the different avenues of the property industry as well as gaining invaluable experience from my colleagues. It was very satisfying applying theory to practise moving from college to the working world as well as meeting new faces along the way and learning from their past experience.

Throughout my final year of college, I was always supported by my colleagues in Bannon who helped me throughout the year with advice for my thesis and various projects, their support was very reassuring in what proved to be a very stressful academic year. This help has been very much continued as I move into the next stage of my career as I have been assured that if I need anything, they are always there to guide me.

The positive culture in Bannon as well as the friendly and intelligent professionals that work here have definitely played a part in developing my growing knowledge of the property industry as well as helping build my character as a person. I am very grateful to Bannon for the opportunity and I look forward to continuing to work with the great Bannon team!

Author: Brian Morton, Graduate Surveyor, Bannon

Date: 17th October 2023

The Government aims to have 80% of Irish electricity come from renewable energy. As part of Budget 2024 a €380 million fund has been announced to help households with the green transition and reduce greenhouse gas emissions and energy bills. The doubling of the tax disregard in respect of personal income received by households who sell residual electricity from micro-generation back to the national grid will also promote the greening of the housing stock nationwide.

Bannon is proud influencing the greening of the Irish Commercial Real Estate Sector through the procurement 100% Green Renewable Energy across their Property Management Portfolio. In addition to this, Bannon works closely with our partner Evia – Sustainable Real Estate to implement green initiatives to reduce the carbon and improve the sustainability initiatives of commercial real estate assets across Ireland.

It is crucial to prioritise and establish a comprehensive water conservation strategy for any asset. Some factors to consider include:

The primary water conservation objective of an asset is to conserve a natural commodity. It is based on efficiencies like reduced flows, leak detection and the introduction of rainwater harvesting systems for non-potable use (e.g., toilets, general cleaning). Conserving water reduces the need for costly infrastructure expansion and maintenance, providing a positive impact on the environment and service charges.

Once you have developed and integrated water conservation, there is a secondary sustainable measure that can explored.

When we think about sustainability measures, several projects typically come to mind. Solar PV Panels, EV Charging Stations, LED Lighting, Rainwater Harvesting – the list goes on. Asset Managed Water Wells are one of the least utilised sustainability initiatives explored in Ireland. What a missed opportunity given the wet summer we just experienced!

Asset Managed Water Wells are renewable sources that have the potential to provide water to common area facilities such as toilets and tap water (not for consumption) in public spaces. Take shopping centres for example. There are a small number of shopping centres in Ireland that have implemented Asset Managed Water Wells, but why are more centres not doing the same? One barrier is that the drilling process on-site is not a simple option. The site must meet many conditions and most importantly, the drilling must find a water source.

Exploring the eligibility of your site is worthwhile. In line with a decision by the Commission for Regulation of Utilities (CRU) on non-domestic tariffs, a new set of national water and wastewater business charges came into effect on the 1st of October 2021. There has been no change to charges since 2014. Historically, customers would have paid charges based on their local authority. The newer system introduced four bands based on the level of usage. Having an Asset Managed Water Well on site would remove the need for public water which in turn would reduce water rates.

A well-developed and integrated strategy can be used in line with public water systems. This is a visionary objective that should be embraced to protect the long-term vulnerability of this natural resource. From a commercial perspective, the savings are significant.

Be a visionary! Talk to Evia Sustainable Real Estate or Bannon Property Management team in advance of your next budget year to discuss potential savings and projected payback.

Author: Aoife McGovern, Surveyor, Bannon

Date: 13th October 2023

Budget 2024 announced the establishment of a new Infrastructure, Climate, and Nature Fund, which will grow by €2 billion for seven consecutive years, reaching €14 billion. The purpose of this fund is to ensure there is no reduction in capital investment if the economy goes into a downturn. It will be run on a more short-term basis than the Future Ireland Fund. Up to 22.5% of the fund can be used for climate and nature-related capital projects in any year from 2026 up to a cumulative maximum of €3.15 billion.

The fund can also be tapped for general investment in infrastructure, which will take precedence during a downturn. 25% of the fund can be used in a year when there is a significant deterioration in the public finances. The fund will be managed by the National Treasury Management Agency.

As investors, owners and occupiers are conscious of the environmental performance of their buildings, questions have been raised about the future of Georgian office space. Will these buildings become obsolete?

There is still a market for Georgian office space, however, that market has changed. A noticeable shift that the Bannon Office team is seeing in the letting patterns of Georgian office spaces is a departure from the conventional practice of leasing entire buildings to a more dynamic and adaptable approach of floor-by-floor rentals. This change reflects a growing recognition of the versatility and scalability that these historic properties offer. Businesses now have the flexibility to lease only the space they require, allowing for more tailored solutions to suit their specific needs. This trend is not only a reflection of the evolving preferences of tenants but also a testament to the adaptability of Georgian office spaces, which can seamlessly accommodate a variety of businesses in this modern age of flexible workspaces.

The notable shift toward floor-by-floor rentals in Georgian office spaces can be largely attributed to the increasing demand among companies to be located on a single, unified floor plate. While Georgian buildings exude historical charm and elegance, their architectural layouts often prove less suitable for larger businesses seeking consolidated office spaces. However, this transition aligns perfectly with the needs of smaller businesses and startups that value the intimacy and functionality of smaller floor plates. For these companies, Georgian office spaces are emerging as ideal options, offering the perfect blend of history, character, and practicality that caters to their specific spatial requirements, ultimately making them a sought-after choice in the ever-evolving landscape of modern office leasing.

This trend in the Georgian office market represents a compelling opportunity for small businesses to reclaim a central presence in the heart of the city. Georgian offices, with their affordable pricing ranging from €30-€45 per square foot, depending on quality, size, specifications, and location, offer an attractive alternative to the considerably more expensive €60-€65 per square foot rates associated with modern buildings.

Small businesses recognise the essential value of a city centre “hub” to conduct their operations effectively. This affordability enables them to thrive in prime city centre locations, fostering collaboration and networking while contributing to the revival of vibrant business communities in the heart of the city.

Author: Julia Halpenny, Surveyor, Bannon

Author: Julia Halpenny, Surveyor, Bannon

Date: 9th October 2023

There were two key takeaways from this quarter’s Capital Markets figures. First and foremost, for the first time in almost a decade there were no material PRS transactions. The second was that two purchasers, specifically Davys and French Fund Corum, accounted for almost 50% of the entire quarter’s market turnover with the acquisition of 10 separate assets.

There were two key takeaways from this quarter’s Capital Markets figures. First and foremost, for the first time in almost a decade there were no material PRS transactions. The second was that two purchasers, specifically Davys and French Fund Corum, accounted for almost 50% of the entire quarter’s market turnover with the acquisition of 10 separate assets.

To view the full report, please click here.

We are into Q4 and our retail based trackers continue to show improving trends year on year. In our latest Pulse, Neil Bannon considers the question – What does inflation mean for retail rents?

To view the full report, please click here.

Dublin office market take-up reached 354,000 Sq.ft. for the third quarter of the year, bringing the year to date total to just under 1,100,000 Sq.ft. This take up figure represents a 20% decrease on Q2 2023, a 56% decrease on Q3 2022 and a 1.5% decrease on Q3 2019 (pre-covid).

Q3 is traditionally the most subdued quarter following the summer break, however, transactions have remained steady with 54 deals recorded, resulting in an average deal size of 6,500 Sq.ft. (-15% on Q2 2023). There is currently 717,000 Sq.ft. reserved across 75 transactions.

As technological advancements continue to reshape industries across the globe, discussions surrounding the potential impact of artificial intelligence (AI) on various property sector roles have become common. In the Bannon realm of commercial property management, suggestions have been made that human property managers could be made redundant considering AI’s capabilities. Following deeper analysis, Bannon believes that AI is not poised to make commercial property managers redundant but to augment the role and enhance efficiencies.

To paraphrase Mark Twain, the reports of the death of property managers have been greatly exaggerated! We have identified seven key reasons why we think AI will not replace humans in the sector.

The belief that AI will be making commercial property managers redundant is based on a misunderstanding of the nuanced, multifaceted nature of property management. By embracing technology as a tool rather than a replacement, commercial property managers can leverage AI to elevate their roles and provide even greater value to property owners and occupiers alike.

The Bannon Property Management team has been utilising AI for several years to collate and interpret the many data points property managers collect. This has ensured that data is presented in a clear and concise manner to our clients leading to more informed decisions and strategies for the assets we manage. Bannon has embraced AI to ensure we continue to provide best-in-class services to our clients.

Author: William Lambe, Divisional Director, Bannon

Date: 2nd October 2023

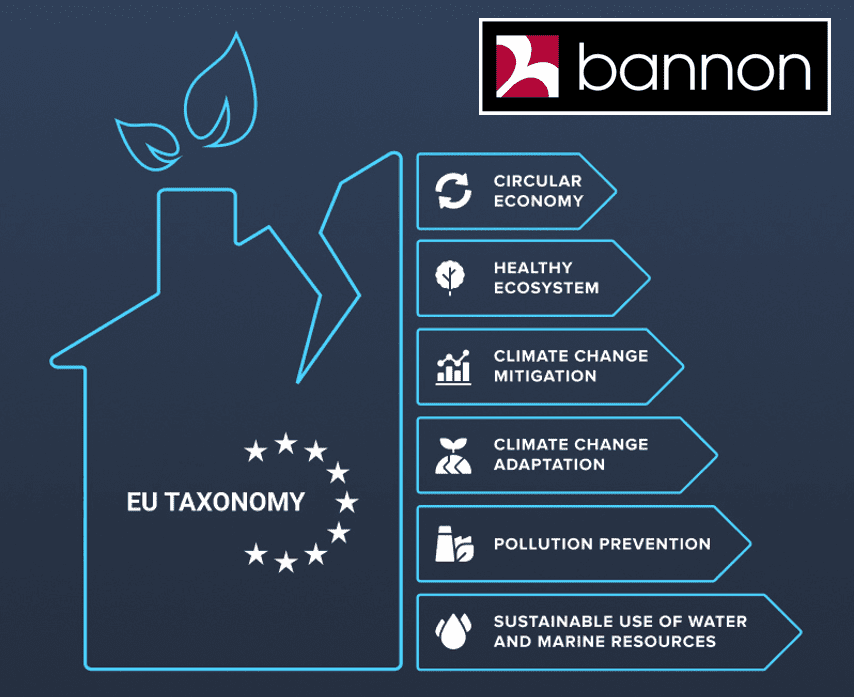

The European Union has taken a significant step towards promoting sustainability by introducing the EU Taxonomy Regulation. This ground-breaking initiative aims to provide a standardized framework for identifying environmentally sustainable economic activities. This article explores the EU Taxonomy, its significance, and the implications it holds for businesses and investors.

What is the EU Taxonomy?

The EU Taxonomy is a system that categorizes environmentally sustainable economic activities, offering clear and consistent guidance for sustainable investments. It helps investors and businesses align their financial choices with environmental goals and encompasses various sectors like energy, real estate, and agriculture.

Key Components of the EU Taxonomy

The Taxonomy focuses on six environmental objectives:

Each objective is accompanied by specific criteria that economic activities must meet to be classified as environmentally sustainable.

One of the core principles of the EU Taxonomy is the Do No Significant Harm principle, which ensures that an economic activity must not cause significant harm to any of the environmental objectives. This means that businesses seeking to be classified as environmentally sustainable must meet stringent criteria to avoid adverse impacts on the environment

Companies are required to disclose the extent to which their activities align with the Taxonomy’s criteria in their financial reporting. This transparency allows investors to make informed decisions about their investments based on environmental considerations.

Significance for Businesses:

Businesses that follow the EU Taxonomy can tap into a growing pool of sustainable finance opportunities, like green bonds and loans that are gaining popularity with investors. Compliance with the Taxonomy can help businesses secure funding from these sources. Moreover, adhering to Taxonomy standards showcases a commitment to environmental sustainability, boosting their reputation and attracting socially responsible investors and customers. It also helps businesses identify and minimize environmental risks, reducing their exposure to regulatory and operational challenges in a world that places a high value on sustainability.

Significance for Investors

Investors can make smarter choices by checking a company’s sustainability disclosures through the Taxonomy. This allows them to match their portfolios with their environmental, social, and governance objectives. Investing in Taxonomy-compliant companies can lower the risk tied to environmental issues and changing regulations. It also helps investors steer clear of investments that might become obsolete as the world moves toward a greener economy.

The EU Taxonomy is a crucial step in promoting environmental sustainability in finance and real estate. It offers a consistent way to identify eco-friendly activities, benefiting businesses and investors. As sustainability becomes more important, the Taxonomy will play a key role in changing how we invest and allocate capital, ultimately helping the environment. Using this framework can bring financial benefits and help create a more sustainable and resilient future for everyone.

Author: Cillian O’Reilly, Surveyor, Sustainability Manager, Bannon

Date: 14th September 2023

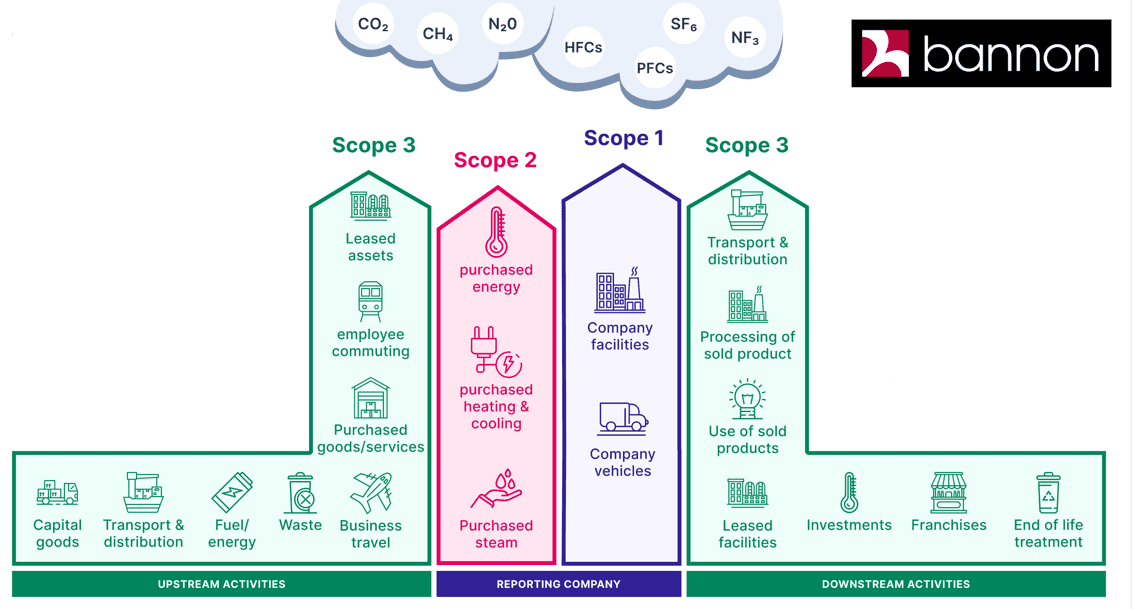

In the ever-evolving landscape of commercial real estate, sustainability is a paramount consideration. As we strive to reduce our carbon footprint and address climate change, understanding and managing greenhouse gas emissions is crucial for the industry’s future. In this article, we’ll explore how Scope 1, 2, and 3 emissions apply specifically to the commercial real estate sector and why they should be at the forefront of our strategies.

Scope 1 Emissions: The Building Blocks

Scope 1 emissions in commercial real estate pertain to direct greenhouse gas emissions resulting from sources owned or controlled by a property owner or occupier. These emissions are produced within the boundaries of the property and are directly tied to its operations. Common examples include emissions from on-site heating, cooling, and electricity generation systems, as well as emissions from owned or leased vehicles used for property maintenance and management. For the commercial real estate sector, tackling Scope 1 emissions can involve upgrading building systems for greater efficiency, transitioning to renewable energy sources, and implementing eco-friendly transportation options for maintenance and management teams. Reducing Scope 1 emissions demonstrates a commitment to environmental stewardship and can improve the marketability of properties.

Scope 2 Emissions: The Energy Equation

Scope 2 emissions are indirect emissions associated with the generation of purchased electricity, heat, or steam consumed by a commercial property. These emissions are linked to energy sources outside the property boundaries, such as the local power grid. In the real estate context, Scope 2 emissions mainly comprise the carbon intensity of the electricity used to power the building and its operations. To address Scope 2 emissions, property owners and occupiers can consider procuring green energy or renewable energy certificates. Transitioning to cleaner energy sources not only reduces the carbon footprint of a property but can also enhance its appeal to environmentally conscious tenants.

Scope 3 Emissions: The Ripple Effect

Scope 3 emissions are the broadest and often the most challenging to quantify in commercial real estate. These encompass all other indirect emissions along the value chain of the property but outside the control of the owner or occupier. For the commercial real estate sector, Scope 3 emissions can include emissions associated activities such as commuting and business travel, as well as emissions embedded in the products and services used in the building. Addressing Scope 3 emissions requires collaboration between property owners, occupiers, and suppliers. Encouraging sustainable commuting options, supporting telecommuting, and sourcing eco-friendly products and services within the building can make a significant impact on reducing the overall carbon footprint.

In summary, understanding and managing Scope 1, 2, and 3 emissions are pivotal for the future of commercial real estate. These three scopes provide a holistic view of your environmental impact, from the direct emissions under your control to the broader, indirect emissions associated with your operations. It’s not only about reducing environmental impact but also about meeting the increasing demand for sustainable and eco-conscious properties. By embracing green building practices, optimizing energy usage, and engaging in sustainable supply chain management, the commercial real estate sector can lead the way toward a more environmentally responsible and resilient future.

Author: Cillian O’Reilly, Surveyor, Sustainability Manager, Bannon

Date: 13th September 2023

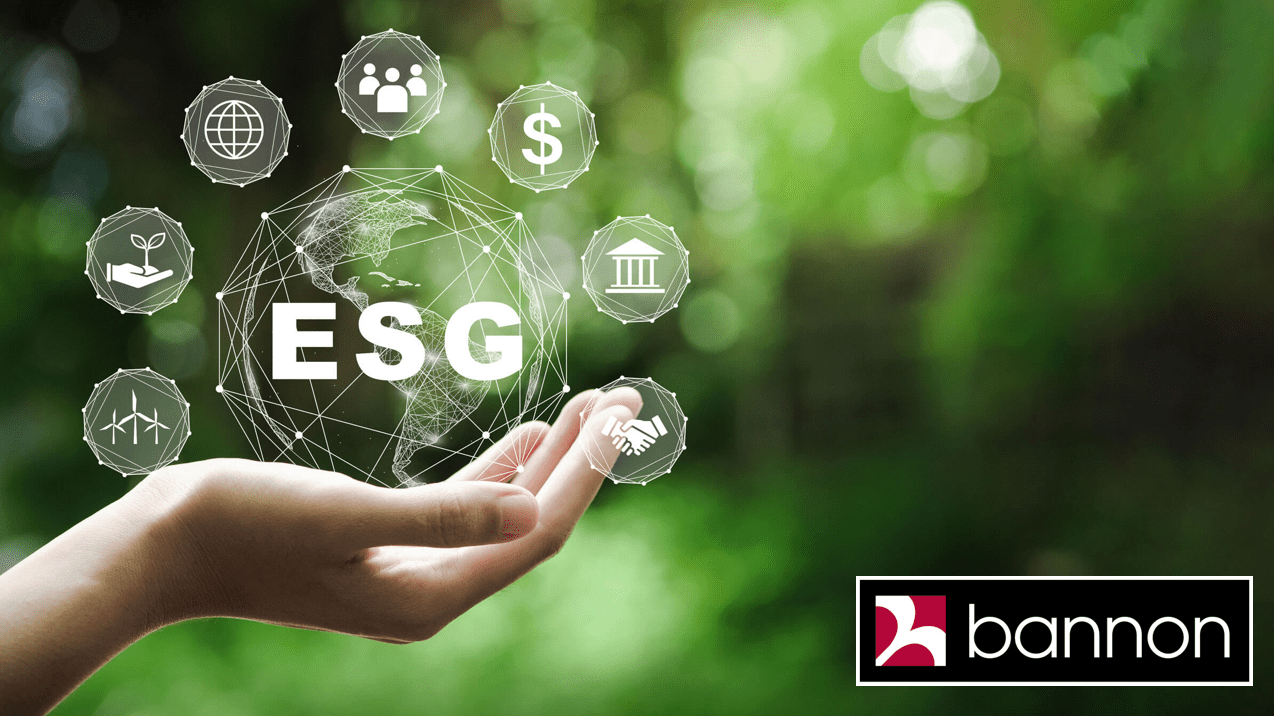

As we begin World Green Building Week, Bannon is proud to launch its 2022 ESG Report. Through numerous initiatives, Bannon far exceeded its ESG goals, achieving a carbon footprint reduction of 34%. Bannon looks forward to working with Owners, Occupiers and all interested parties in the real estate sector to curate a more sustainable future.

To view the full report, please click here.

Our latest Pulse highlights a number of developments bringing new space to the market for the first time in over a decade and the opportunity for European retailers in the Irish market.

To view the full report, please click here.

Quarter 2 Dublin office take up exceeded 440,000 sq.ft. resulting in an increase in average deal size to 7,720 sq.ft. (24% increase on Q1 2023)

Quarter 2 Dublin office take up exceeded 440,000 sq.ft. resulting in an increase in average deal size to 7,720 sq.ft. (24% increase on Q1 2023)

City Fringe and Suburban markets performed particularly well this quarter accounting for 60% of all take-up. Dublin continues to attract a diverse mix of industries with professional services, finance and state agencies the most active sectors this quarter with TMT accounting for just 6% of total take up, a decrease of 35% from the same quarter of 2022. We commence Q3 with over 665,000 sq.ft. of office space currently reserved.

See full details below together with expert insight from Lucy Connolly.

To view the full report, please click here.

Our latest monthly Retail Pulse has now gone live. In this publication our retail leasing team recap on activity at the half year point of the year. Separately in our “Expert Insight” section Neil Bannon looks at two differing perspectives relating to the performance of instore vs online retail. The devil is always in the detail!

To view the full report, please click here.

The development of infrastructural schemes of national importance has long been problematic. Inherently such schemes require the compulsory acquisition of multiple landholdings and as a result many road and light rail schemes have been beset with legal challenges resulting in delayed delivery and in some circumstances the complete abandonment of projects.

There have been numerous examples of schemes that have failed to materialise due to legal challenges which cast aside the merit of the scheme itself. These include the Galway City Outer Bypass which was granted approval by An Bord Pleanála in November 2008, however following a Judicial Review to the High Court and ultimately to the Court of Justice of the European Union (CJEU) the scheme was quashed in 2013. The latest iteration for a relief road around the City (N6 Galway City Ring Road) received approval from An Bord Pleanála in December 2021. Three sets of legal proceedings were taken challenging this decision. This resulted in the High Court remitting the scheme back to An Bord Pleanála for further consideration after the Bord was found to have failed to take into account the national Climate Action Plan. The scheme was then formally quashed by the High Court in early 2023.

The proposed Foynes to Limerick Road (incorporating a bypass of Adare) was approved by An Bord Pleanála in August 2022. It too was the subject of three sets of Judicial Review proceedings which resulted in the scheme being halted. It has recently been reported that those Judicial Review proceedings have been withdrawn however progress on the scheme has been delayed for the best part of a year.

The delivery of critical infrastructure which involve CPO powers should rightly be the subject of scrutiny, however, at present it appears that major infrastructural schemes are ‘open season’ for objectors whether they are directly impacted or not. If important infrastructural projects are to be delivered in a timely manner then our view is that the process of seeking consent to allow the scheme progress to construction requires material reform to ensure that the public good trumps individual objections.

Niall Brereton is Director of Professional Services at Bannon and advises Landowners in respect of Compulsory Purchase Orders across a range of infrastructural projects.

24th July 2023

The second quarter proved to be a challenging period for the Irish capital markets sector, with a total value of only €333 million invested. This marks the weakest performing quarter (and half year at sub €1 billion) in the last six years.

This lacklustre landscape can be attributed to three key factors: the end of “free money” as interest rates rise and inflation runs rife, the post-Covid impact of remote and hybrid working on office space demand, and concerns surrounding necessary capital expenditures for ESG (environmental, social and governance) retrofitting amidst rising construction costs.

However, after years in purgatory, it is the retail sector that has emerged as the star performer this quarter, accounting for 38.7 per cent of turnover. Although this performance is partly supported by the downturn in other sectors, there is no doubt that a significant perception shift has occurred, particularly in the retail park segment.

Notably, six retail parks have traded this quarter alone amounting to approximately €116 million including Liffey Valley B&Q, City East, Blackwater, Carlow, Newbridge and Waterford.

The most high-profile of these, Liffey Valley B&Q, which traded to French fund Inter-Gestion REIM for €26.6m, has thrown off a particularly strong equivalent yield in the mid to late 5 per cent range for an asset with a lease that has less than four years to run. This process saw participants such as Realty, Corum and Iroko compete for the asset.

So, what has driven this remarkable change in fortunes?

The “newfound” popularity of the retail sector can be attributed to a slow but building appreciation for what have been long-standing dynamics in both the supply and demand side of the sector. These dynamics differ considerably from the UK and US markets, where Irish retail investor sentiment used to originate.

Unsurprisingly, that core of the demand has shifted to both domestic family offices and a more central European focus where an appreciation for the fundamentals has shown through.

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/irishtimes/RD72OWG6Z5BTFCE3SO7DUQKALI.jpg)

Since 2011, when the last new shopping centre was completed in Ireland, there has been minimal net additional retail supply. This stands in stark contrast to the substantial expansion witnessed in the office, residential, and industrial sectors.

However, during this period, the number of people employed in Ireland has surged by 37 per cent, retail sales volumes have increased by 38 per cent, and Irish households’ net worth has reached new heights. These are all factors which feed the fundamental sustainability of the retail sector.

When considering the cumulative impact of debt reduction, increased savings, and rising house prices, Irish households are wealthier than ever before, with a net worth surpassing €1 trillion for the first time.

This surpasses the 2007 peak level of €716 billion, which was actually exceeded in the final quarter of 2017. Furthermore, Ireland’s gross debt-to-household income ratio has transitioned from over 200 per cent of the European average in 2011 to being below that European average today.

Combining these fundamentals with the historical correlation between inflation and the growth of retail rents and values, the renewed interest in the sector becomes apparent.

As highlighted by the turnover statistics, retail parks, in particular offer a compelling proposition. They benefit disproportionately from household growth and have proven resilient during economic downturns and the challenges posed by Covid-19.

Additionally, their ability to meet ESG requirements through initiatives like PV panels, rainwater collection, and other environmental measures adds value and attracts investors including new entrants. Similar attributes for high-street properties and grocery-led necessity retail are likely to see further interest in these sectors.

We expect to see numerous quality high-street trades in the third quarter and generally as the environmental benefits of the “centralised-distribution model” reflected by retail warehouses, shopping centres and Ireland’s key high streets becomes apparent.

We are seeing a complete return to pre-Covid footfalls for most the of the regional and necessity-focused schemes with Dublin’s two high streets hitting pre-Covid weekly footfall levels again for the first time last month.

As a consequence, we expect the sector to continue to outperform for the coming quarters with no less than seven shopping centres amounting to over €100 million in value due to trade within the next few weeks.

Rod Nowlan is an executive director at Bannon and heads up its office and capital markets team

The retail sector in Ireland is preparing for the country’s new Deposit Return Scheme (DRS). Starting from February 1, 2024, consumers will be required to pay a small deposit (15c/25c) on plastic and aluminium beverage containers, which they can reclaim by returning the empty containers to designated collection points.

The DRS represents a substantial step toward achieving a more sustainable future. In line with the Single Use Plastics Directive, Ireland must ensure the separate collection of 77% of plastic beverage bottles placed on the market by 2025, with a further increase to 90% by 2029.

Many of the collection points will be located in shopping centres. While the primary objective of this scheme is to reduce plastic waste and encourage recycling, shopping centres will experience notable impacts on their operations and customer behaviours. One immediate consequence of the DRS will be the need for shopping centres to accommodate the significant increase in the volume of recycling. To effectively handle this increase, shopping centres will need to assess their existing infrastructure and make necessary adjustments. Proper management and maintenance of these areas in collaboration with recycling partners will be crucial to ensure a smooth and streamlined process.

With just over six months remaining until the implementation of the DRS, the Bannon Property Management Team is observing larger retailers in the firm’s shopping centre portfolio making preparations for in-store returns. While these changes may require initial investments and adjustments, the implementation of the DRS is likely to bring about positive changes in consumer behaviour, including increased footfall. The introduction of the DRS creates an added incentive for consumers to visit shopping centres. This increased footfall can translate into higher customer traffic, benefiting not only the recycling depots but also other retailers within the shopping centre.

By embracing this transition, shopping centre owners can demonstrate their commitment to environmental responsibility, attract socially conscious customers, and contribute to a greener future.

With over 25% of Ireland’s shopping centres under Bannon’s management, the firm is highly focused on implementing best practices that promote sustainability and reduce environmental impact while enhancing the customer user experience. If you would like more information about the DRS or discuss implementing sustainable practices in your properties, contact the Bannon Property Management Team today.

Author: Alex Patterson, Director, Bannon

Date: 13th July 2023

The Government has been grappling with a housing shortage for several years. As the demand for housing continues to outstrip supply, creative solutions are needed to address this pressing issue.

The Government has been grappling with a housing shortage for several years. As the demand for housing continues to outstrip supply, creative solutions are needed to address this pressing issue.

One potential solution that is gaining traction is the conversion of office spaces to residential units. This has come to the fore over the last number of weeks as the Government faces unyielding pressure to tackle the accommodation shortfall. Minister for Housing Darragh O’Brien is reportedly considering making planning exemptions to rules which would apply to repurposing office space to housing.

In an article in The Irish Times on May 22nd, it was reported that the Minister has “lobbied his Cabinet colleagues Simon Coveney, the Minister for Enterprise, Trade and Employment, on the issue, seeking his support for a plan that would convert offices built during the recent construction boom but are now underutilised”. The question is, is it feasible to repurpose a recently constructed Dublin office building into residential use?

[ ‘I never imagined such places existed’: What’s it like living in a converted office block? ]

The assumption here is that there is an oversupply of recently built office accommodation in Dublin city centre, but that is simply not the case. Offices built in the boom are in the main environmental, social and governance compliant (ESG-compliant), sustainable buildings. As has been widely reported by many in the property industry, these are and will be the buildings that are in demand for office use. The location of these buildings further enhances their desirability for that use, as we are seeing increased demand for well-located city-centre office buildings due to the availability of employee amenities and unrivalled transport links.

Converting offices into residential units presents an opportunity to address this but there are challenges involved, and as we have seen from other countries, caution is advised for such projects

This movement in the market provides vacant possession to the owner to allow for redevelopment or refurbishment of these brown buildings into ESG-compliant offices or alternative uses. This is where the question of residential conversion is most relevant…residential conversion will be most practical where the office value is lowest and the conversion costs to residential use are more sensible than the cost of “greening” the building for office use. Ultimately, it is about sorting the “wheat from the chaff”.

[ Michael McDowell: Nobody is thinking about the aesthetics of our cities ]

Working with our sister company Evia Sustainability consultants, the Bannon office team is assessing the cost and practicality of bringing older buildings up to standard from a green perspective, and what that entails. If the maths don’t add up – that is, if the cost of greening an office asset exceeds the end value – then the owner is looking at a stranded building which is then a candidate for residential conversion.

Without a doubt, Dublin’s housing shortage necessitates innovative solutions. Converting offices into residential units presents an opportunity to address this but there are challenges involved, and as we have seen from other countries, caution is advised for such projects. Consideration must be given to zoning, building and planning guidelines and regulations. This consideration must relate to the practicality and ability to convert but also to the social factors, with access to amenities, transport, employment opportunities and social connections fundamental for the residents of the schemes and thus their successful transformation.

[ The Irish Times view on turning offices into homes: unlikely to provide a quick solution ]

Embracing this potential solution and implementing it correctly may hold the key to not only helping to solve a housing shortage but also providing options to owners of potentially obsolete office buildings.

Lucy Connolly is divisional director and head of offices at Bannon property consultants

Following a subdued Q1, Dublin office take up for the second quarter of the year reached 440,000 sq.ft. across 57 transactions. This brings the year to date figure to 724,500 sq.ft. Whilst Q2 take up is 53% ahead of Q1 figures, it reflects a H1 decrease of 28% versus the same period last year.

Dublin continues to attract a diverse mix of industries with professional services, finance and State agencies the most active sectors this quarter with TMT lagging behind significantly, accounting for just 6% of total take-up.

This quarter proved to be a challenging period for the Irish Capital Markets sector, with a total value of only €333m. Q2 marks one of the worst performing quarters in the last six years. On a positive note, after years in purgatory, the retail sector has emerged as the star performer for the period, accounting for 38% of turnover. Although this quarter’s relative increase is partly supported by the downturn in other sectors, there is no doubt that a significant perception shift has occurred, particularly in the retail park segment where no less than six retail parks have traded this quarter alone amounting to approx. €116m.

To discuss this, please contact Roderick Nowlan, Alex Patterson, Cillian O’Reilly and George Colyer.

Bannon’s latest monthly Retail Pulse has now gone live.

Bannon’s latest monthly Retail Pulse has now gone live.

In this publication we look at retail occupier activity on Henry Street & O’Connell Street and Neil Bannon discusses the juxtaposition of the vacancies created by Debenhams failure in Ireland and the UK.

To view the full report, please click here.

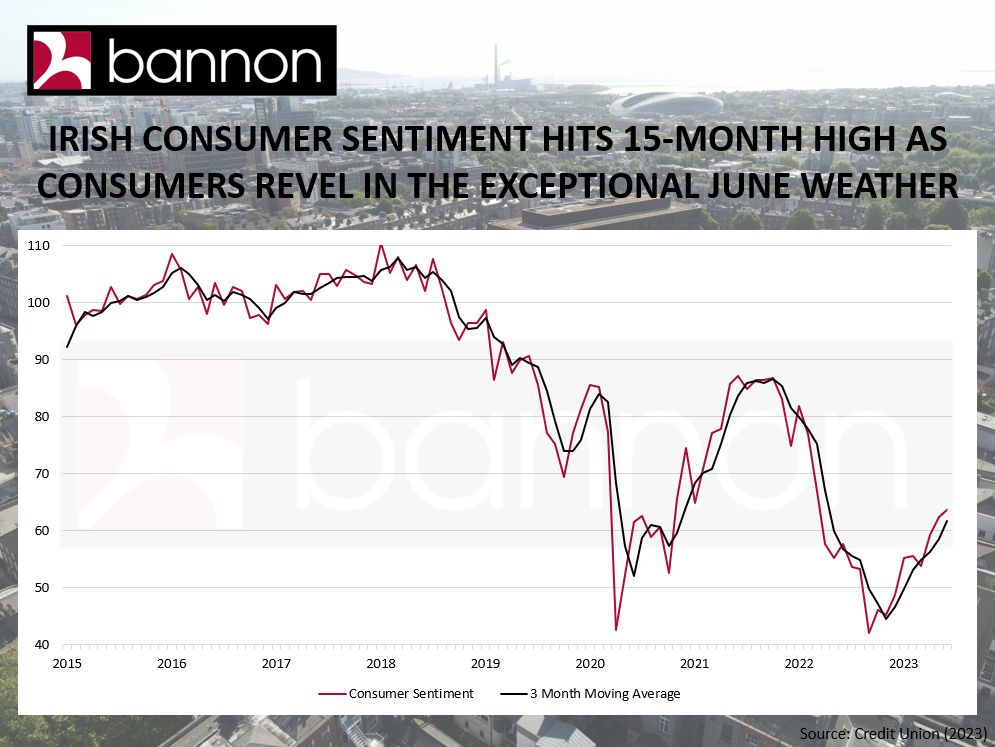

Irish Consumer confidence improved again in June reflecting a 10.4% y-o-y increase. Tentative signs that food and energy price inflation might have peaked seem to have encouraged a slight easing in concerns around household finances. The exceptionally good weather may have also boosted the mood of many consumers, but the modest monthly gain suggests financial clouds are still hanging heavily over many households and economic sunshine is still hazy for some.

Amid reports of a post-Covid hollowing out of city centres like San Francisco, and to a lesser extent New York and Los Angeles, as retailers suffer the effects of working from home, Ireland’s recovery is gathering pace, and by most measures is now stronger than it was pre-pandemic.

But Ireland too has a high reliance on technology workers, who may also be adopting hybrid working practices, so why is the Irish market performing better than the US, the UK, and many other markets?

I asked retail expert Neil Bannon, Executive Chairman at Bannon, and the first reason is that the US, for example, has six times more retail space per capita, than Ireland.

“Just imagine that we had another six Dundrum Town Centres, Liffey Valley’s, Blanchardstown Town Centres and six times every other shop in Dublin, and that is the scale of the over-supply in America,” he said.

In Ireland there has been no new shopping centre built since 2010 and no new retail park developed since 2007.

While our construction of new homes has been too slow, it has recently hit record levels, and this too, is driving demand.

There are just over two million households in Ireland, he told me, and the Housing for All Plan aims to produce another 300,000 new homes by the end of the decade.

‘In Ireland there has been no new shopping centre built since 2010‘

But there seems to be consensus that we need 500,000 new homes, which represents one new home for every four existing homes, “a staggering increase”, he added.

The impact of this growth is already being seen on Ireland’s 73 retail parks, 20pc of which are managed by Bannon.

Retail parks are the conduit for the overwhelming majority of spending associated with housing, Mr Bannon said – for example couches, TVs, white goods and floor coverings – with 85pc of sales taking place in store, according to Central Statistics Office figures.

“If every house in Ireland spends €2,500 annually on household goods, that’s up to €12.5bn of spend. If 500,000 new homes are built, and the average cost of kitting them out is €25,000, that’s another €5bn of expenditure,” he said.

One result is that Ireland’s retail parks are largely at full occupancy and rents are rising.

“We had expected some fall-off from the post-Covid DIY boom, but in fact, footfall and spending levels are stronger than pre-pandemic,” Mr Bannon said.

‘Ireland’s retail parks are largely at full occupancy and rents are rising.’

The most valuable retail park units were always those few with an ‘open user’ planning consent, permitting, for example, fashion retailers and not one that is just restricted to bulky goods.

However, a shift in the market is that furniture retailers are now out-bidding even open user retailers as evidenced by a deal just signed at Liffey Valley Retail Park where Danish brand JYSK has taken a 10,000 sqft unit plus mezzanine at a rent of approximately €25 per sqft.

That is, Mr Bannon notes, “a 40pc higher rent than pre-Covid”.

JYSK have taken half a dozen 10,000-15,000 sqft units in Ireland and continues to expand.

Another expanding brand that is already operating on several retail parks is EZ Living Furniture which also recently rented a 10,000 sqft unit plus mezzanine at Liffey Valley Shopping Centre.

It is not just the Dublin area as Limerick One Shopping Park has also seen new outdoor clothing and equipment retailer Mountain Warehouse recently lease a 7,000 sqft unit at approximately €28 per sqft.

The theme for the year ahead is “competition for space among brands and rising rents”, Mr Bannon concluded.

The effect hybrid working and ESG has, or will have, on office demand from office occupier, investor and owner standpoints cannot be considered in isolation. These influences must be considered within the wider office market ecosystem and how they operate in tandem to drive occupier decision making at lease event dates. The Covid Pandemic brought an instantaneous change to how we work whereas ESG requirements and regulations have been coming into the market at a steadier rate. While there is also uncertainty around the future of working models, that can be adapted and changed rapidly, there is no uncertainty about the increasingly important and dominant role ESG will play in the office sector. The ESG roll out will be slower and changes can be anticipated, however the ability to bring the stock to standard is a far more timely and resource intensive exercise.

Hybrid working for businesses will effectively assess how staff utilise office space as a resource to produce output. Ultimately it is the company who can decide how to implement their working models and the decisions will be led by the type of work carried out by the business, the need to attract and retain talent and the model that allows the business to grow and produce output efficiently. Both staff and workspace are a factor of production for a business and how the two are utilised against each other effectively to generate product should ultimately be the key focus of any commercial business. This should craft the post-pandemic workplace in the years ahead and this will likely differ industry by industry.

ESG considerations will continue to become more prominent drivers in the decision-making process for both occupiers, owners and investors. Currently, ESG in commercial real estate is very much lead by the private and financial markets, with factors such as corporate mandates and lender requirements influencing the demand for ESG grade space. It is envisaged that the regulatory environment (in an EU context) around occupation and investment will become more scrutinous and this will further drive the demand (and requirement) for ESG grade space in the future.

Occupiers will be looking into the impacts, whether they be positive of negative, that revised working models have on their ability to create an attractive and productive workspace as well as any ESG led requirements that are being implemented on a company specific or regulatory basis. The implementation of these will likely crystallise at either a lease break or expiry where spatial requirements can be most practically revised. Property owners will have to be cognisant of their occupiers’ requirements against key lease dates and how these correspond with asset management strategies to protect both the rental and market value of the building. Alternatively, investors must consider how to preserve or improve on an asset’s income at purchase or where opportunities may lie in bringing brown buildings into a green market.

Bannon have a suite of services available to assist CRE owners, occupiers and investors in strategic real estate decisions and ESG insights. Please feel free to reach out to discuss by emailing consultancy@bannon.ie.

Author: George Colyer, Surveyor, Bannon

Date: 16th June 2023

Bannon’s latest monthly Retail Pulse has now gone live. In this publication Neil Bannon shares some insights on what impact significant new housing supply will have on the retail sector.

Bannon’s latest monthly Retail Pulse has now gone live. In this publication Neil Bannon shares some insights on what impact significant new housing supply will have on the retail sector.

To view the full report, please click here.

Environmental, Sustainable & Governance (ESG) requirements for buildings are becoming of increasing importance to both investors and occupiers for buildings. There is no doubt that ESG will become an increasingly prevalent element within the commercial real estate (CRE) landscape, becoming an important driver of asset value. This means current owners will be facing important considerations. How do you attract good quality occupiers, achieve strong rents and ensure a competitive market of buyers for your asset at exit. ESG-led objectives are becoming increasingly commonplace in investment and fund criteria for institutional real estate owners. As these owners are significant sources of capital in CRE markets a likely result will be a somewhat forced divestment from ‘brown’ assets (non-ESG compliant assets) and a channelling of capital towards ‘green’ (ESG compliant) assets.

The market is not balanced, green assets in Ireland are typically buildings constructed or extensively refurbished after the 2014 Building Regulations came into play. We estimate that the green market comprises less than 15% of Dublin’s office stock, with the majority of this space located in Dublin 2 and Sandyford, the prime office locations. With multiple players competing for a limited supply of stock and available capital being funnelled into this small sector an expectation is prices will be driven up by competitive bidding in both the investor and occupier markets. The net effect of these events will be an increase in asset value through growth income complimented by strong occupier covenants and yield compression.

By contrast, we expect a shift in the brown asset market. Company mandates or client requirements will oblige some occupiers to occupy green buildings, seeing the demand for brown space shrink and the market becoming increasingly oversupplied. The pressures resulting from falling demand and increased void costs, will create a lower rent environment. An exit of institutional grade investors will see the demand drop for these buildings with ESG rules preventing purchase. The remaining investors will have to consider the cost and value associated with bringing an asset into the green market. While the market for this in prime locations may be viable, there are greater challenges for suburban/out of centre locations where the end rental value that can be achieved may not support viability of refurbishment.

Rescuing these potentially stranded buildings represents an opportunity for investors and developers and Bannon working with our sustainability business Evia are available to provide technical insights to ESG building upgrades. Feel free to reach out to discuss.

Author: George Colyer, Surveyor, Bannon

Date: 9th June 2023

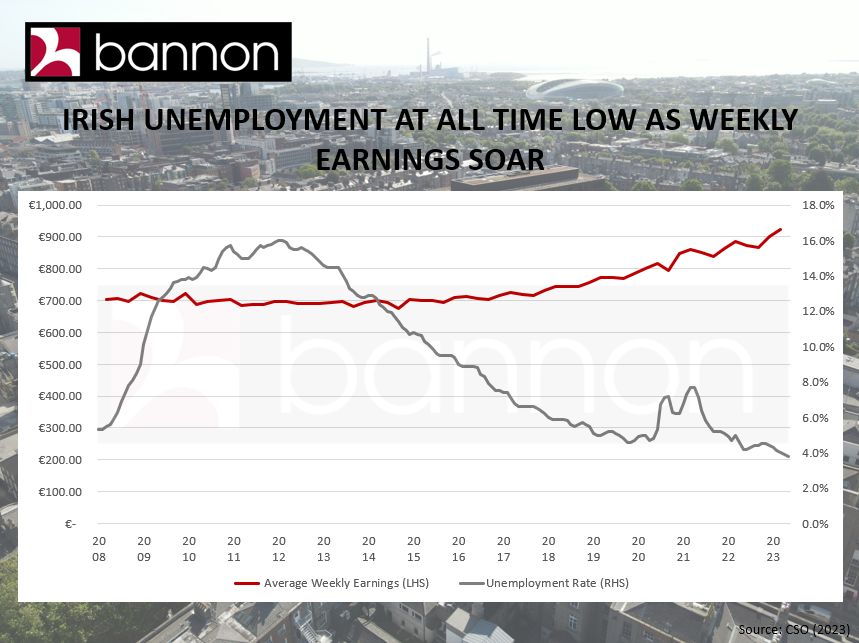

The Irish consumer market continues to showcase its strength and resilience. According to the latest report by CSO unemployment has hit a record low of 3.8%, while weekly earnings have reached a new high of €923.48.

This remarkable achievement is even more significant when considering that seasonally adjusted unemployment is now 50% lower than its peak during the Covid pandemic two years ago. Furthermore, the Irish labour force has surpassed 2.7 million for the first time in recorded history, and average weekly earnings are 20% higher than pre-Covid levels. With such positive indicators, the outlook for the Irish retail market is incredibly promising.

The Covid-19 Pandemic has led to a paradigm shift in the traditional approach to office-based work. Following the initial ‘work from home’ requirements during the Pandemic, many businesses have since adopted alternative working models away from the traditional ‘in the office at your desk’ to models such as shifting staff to full work from home, flexible working options and hybrid working models.

The widespread shift to more flexible and agile working models has moved the concept of ‘work’ from a physical place to an activity. The net effect of this does not mitigate the need for a physical office, rather it changes the role and function the office plays in the business and how the space is utilised to meet staff working habits and models and drive business goals. While the full effect of Covid-19 on working models is yet to be seen, the consensus of many businesses and organisations has been to adopt a form of hybrid working to give staff more flexibility and that this is required in order to maintain and attract talent.

Hybrid working models will not necessarily impact an office development’s occupational capacity, rather it allows the building to attract occupiers with larger workforces. For example, if a development with a capacity for 1,000 workers is occupied by a business that implements a 50/50 split between WFH and office, the scheme can, in theory support an occupier with a 2,000 strong workforce. In practice this may be less as businesses will require full attendance by teams at different times and we have already seen the TWT (Tuesday, Wednesday and Thursday) phenomenon at play as workers prefer to work from home on Mondays & Fridays. Despite this, the classic rule of thumb of allocating 10-15 sq.m. of space per employee to gauge an occupier’s spatial requirement is clearly being challenged. Paradoxically, there may be a positive spin off for the locations where these offices are located as the total number of distinct visitors during the week increases.

There is still uncertainty around the long-term effect of Covid-19 on long term office working models. This is manifesting itself in the leasing environment through shifting occupier space requirements, greater lease flexibility and increased demand for fitted-out spaces. Businesses will use lease events such as expiries and break options to rationalise their workplaces to reflect their adopted work models. As workplaces continue to adapt and adopt modern working practises it is important for occupiers to be cognisant of the spatial requirements needed to accommodate and attract the modern workforce and for investors and owners to be cognisant of the effect these work models will affect demand levels and lease events.

If you wish to discuss developments in the office markets further, please contact offices@bannon.ie.

Author: George Colyer, Surveyor, Bannon

Date: 2nd June 2023

Bannon’s latest Office Pulse is now live.

Bannon’s latest Office Pulse is now live.

Take up for the first quarter of the year reached 278,000 sq.ft. across 45 transactions, representing a 45% decrease on Q1 2022. Deal sizes have decreased this quarter with 76% of transactions falling into the sub 5,000 sq.ft. bracket resulting in an average deal size of 6,300 sq.ft. Lease flexibility continues to be the dominant driver in demand. There is over 600,000 sq.ft. currently reserved (71 Transactions) which should boost Q2 figures.

See full details below together with expert insight from Lucy Connolly and Cillian O’Reilly.

To view the full report, please click here.

HMV reopening in their original Henry Street store is great news for the Street! More new store openings to follow…

The Dublin office market is experiencing a game of musical chairs as environmental, social and governance (ESG) goals and policies drive office occupiers to relocate to more sustainable, greener buildings. This has been further accelerated by changing occupier demands. It has created a redevelopment and refurbishment opportunity that attracts occupiers from older, so-called brown buildings.

Many owners and occupiers recognise the opportunity to achieve their ESG goals and policies while reducing occupational costs. Moreover, the ability to attract high-quality occupiers is only possible with a green building. The game of musical chairs provides vacant possession to allow the redevelopment or refurbishment of brown buildings, thus enhancing the value of the asset.

One example of this trend is AIB’s decision to vacate Irish Life’s 1 Adelaide Road base and consolidate to 10 Molesworth Street. This move allowed Deloitte, which occupies Deloitte & Touche House on Earlsfort Terrace, to commit to the redeveloped 1 Adelaide Road. As a result, the Earlsfort Terrace property will become available to Iput for its proposed redevelopment.

[ Older office buildings can be as good as new. They’re often even better ]

Another example is the relocation of An Garda Siochana from its Harcourt Street headquarters to the recently completed Walter Scott House on Military Road. Hibernia Real Estate Group swiftly demolished the building, paving the way for the construction of Harcourt Square, which will become KPMG’s new Dublin office upon completion. This shift will result in Kennedy Wilson achieving vacant possession of KPMG’s office on Stokes Place, which received the green light from An Bord Pleanála earlier this year.

Waterfront South Central in Dublin’s north docklands is set to become the new European headquarters of Citi Group. The deal was made with Ronan Group Real Estate (RGRE), which acquired Citi Group’s premises at 1 North Wall Quay. The current premises will no doubt be redeveloped or refurbished and reintroduced to the market as a green building.

Aside from the discussed redevelopment opportunities, there are significant quantities of grey space available, including Fibonacci Square, which is being leased by Meta; 1 Cumberland Place, leased by Twitter; and 2 and 3 Wilton Park, leased by LinkedIn. This Grade A ESG-compliant space will undoubtedly be involved in the next round of musical chairs in the Dublin office market. As occupiers of older buildings take up this space, it will free up further development opportunities. The attractiveness of these options to developers will depend on the specifics of the building, location, floor-to-ceiling heights, and the practicality and cost of upgrading them to either new offices or alternative uses.

The game of musical chairs has created opportunities for owners and occupiers to achieve their ESG goals and policies while simultaneously reducing occupational costs. This trend also presents an exciting opportunity for the redevelopment and refurbishment of brown buildings and the enhancement of asset value.

Lucy Connolly is divisional director and head of offices at Bannon

Bannon’s latest monthly Retail Pulse has now gone live.

Bannon’s latest monthly Retail Pulse has now gone live.

In this publication Neil Bannon discusses the up to date retail sales figures recently published by the CSO and how Irish consumers continue to confound predictions.looks at the stark decrease in the household debt to income ratio and what this might mean for the retail sector

To view the full report, please click here.

The Bannon Property Management Team has continued its growth from 2022 with a number of new instructions across the island. Q1 of 2023 has started off on the same footing with a number of new hires across the surveying and accounts team. Bannon now manages more than 1 in 4 of Irelands Shopping Centres & Retail Parks welcoming over 100 million customers every year. While the majority of our instructions are retail (Shopping Centres or Retail Parks), we also manage an increasing number of office buildings, most particularly in Dublin. This has required the team to focus on the sustainability aims of our clients and putting in place projects to achieve the goals.

The department has a 40-strong team of surveyors and accountants from 10 counties across Ireland. This is representative of the portfolio as we manage assets across all 4 provinces as we continue to grow our presence as a nationwide business.

The Bannon Head Office is based in Dublin, however, the firm adopts a hybrid working model for the Property Management Team. In several cases our surveyors live and work in the locality of the assets they manage.

The geographical spread of the Bannon portfolio and the surveyors who work with them, give us unique insights into the locality in which assets are located. Local knowledge is essential to ensure that the needs of local customers are met.

With recent instructions in Cork City and Cork County Bannon now has a major presence in the Cork market. This is in addition to new shopping centre management instructions in Waterford and Kilkenny.

If you want to talk to the Bannon team about managing a commercial property asset or are interested in joining Ireland’s fastest growing property management team, please check out www.bannon.ie.

Author: William Lambe, Divisional Director, Bannon

Date: 4th May 2023

When the team at Bannon decided last year to organise a fundraiser for Cancer Trials Ireland in memory of their colleague Louise Creevy (née Doherty) who had sadly passed away, they thought it would be a one-off event. Such was the success of the Property Picnic, however, more than 650 guests from across the industry turned up for the gathering at 1WML in the Windmill Quarter and raised €170,087 in the process.

Given the picnic’s popularity, and with the funding raised contributing to trials in which 144 cancer patients in Ireland got to avail of cutting-edge treatments that they could not otherwise have accessed, and at no cost to themselves or the State, it’s hardly surprising that the event is back on this year. Keystone sponsorship for this year’s Property Picnic is being provided by Hibernia Real Estate Group, MCR, Core Capital, Matheson, Mastertech, and Glass Bottle (RGRE and Lioncor). Tickets for the event, which takes place on May 18th at 1WML in the Windmill Quarter, Dublin 2, cost €55 with an additional booking fee of €5.

Commenting on the importance of events such as Property Picnic to her organisation’s work, Cancer Trials Ireland chief executive Eibhlín Mulroe said: “Cancer Trials offer treatment options to patients. First and foremost, that is why many doctors working in cancer in Ireland seek to get patients on to trials.

“Within that, fundraisers like the Property Picnic help Cancer Trials Ireland to open a very important category of cancer clinical trials known as ‘investigator-led’ – read ‘doctor-led’ – trials. These trials are non-commercial. The research questions they ask are driven by patient need rather than commercial reasons.

“Last year, Property Picnic funds went towards four such investigator-led trials. Two of the trials were breast cancer trials, one in HER2-positive breast cancer, affecting one in five women in Ireland with breast cancer, the other in triple-negative breast cancer, affecting one in eight women, and is more common in younger women. The other two trials were in prostate cancer – one trial for previously untreated high-risk, localised prostate cancer, and the other for progressive, metastatic (ie cancer that has spread from where it first formed) prostate cancer.

“With the Property Picnic’s help, Cancer Trials Ireland was able to close out three of these trials, and in one case (the high-risk, localised prostate cancer study) present findings at a prestigious international cancer conference earlier this year, which showed the trial did achieve its primary objective of reducing prostate gland volume.”

Local authorities across the country have been historically dependent on commercial rates for a significant proportion of their yearly income. It is estimated that commercial rates are worth approximately €1.5 billion annually to the local government sector. As of 2019 the Department of Housing, Local Government and Heritage reported that rates income typically represents between 20% to 30% of local authority income. The highest proportion was derived in Fingal County Council with rates revenue representing 52% of total income for that year. The proportion of rates income to total revenue is likely to increase further with the move by some local authorities to substantially reduce the vacancy credit available to owners of unoccupied commercial properties.

Since 2017 the vacancy refund allowable by Dublin City Council has been reduced from 50% to nil, meaning an owner is obliged to pay the entire commercial rates bill attached to a property regardless of whether it is occupied or not. The corresponding vacancy relief available from the other Dublin Local Authorities for the current year are as follows; Fingal 30%, Dun Laoghaire-Rathdown 35% and South Dublin 50%.

For properties situated outside the main urban local authority areas landlords typically had no commercial rates liability for vacant properties. However, with Carlow County Council opting to reduce the maximum level of vacancy credit available to 50% for 2023, other local authorities across the country may follow suit. This changing landscape should cause owners and investors to closely consider the financial liabilities associated with holding vacant commercial properties. Depending on the nature of the property in question, options which may be open to owners to reduce their liability could include undertaking works to put the property beyond beneficial use or seek a change of planning to residential use.

For more information and advice regarding reducing your commercial rates liability contact Niall Brereton, Director of Professional Services.

Author: Niall Brereton, Director, Bannon

Date: 3rd May 2023

Neil Bannon comments ‘Another confirmation that the retail sector is defying gloomy predictions this time from Dublin MasterCard Spending Pulse. Sales are up YoY in all categories from Necessities to Entertainment. The data accords with results from the Bannon retail portfolio and indicates strong growth across the Country. Particularly interesting to see Household Goods holding onto and adding to the gains made in the pandemic with sales in the sector now 25% above where they were in Q 1 2020’.

Full Irish Times Article available here.

At Bannon we analyse two types of sustainability, environmental sustainability attributes and the sustainability of an asset’s income. Sustainability of income is important as this considers the ability of the Occupier of the asset to pay rent to the Owner based upon the business they carry out in the building. Gaining an insight into this allows an Owner to understand whether they will maintain or improve income on the occurrence of lease events such as break clauses and expiries and also assess how solid or otherwise their income is in the context of market conditions and the implementation of asset strategy. The asset class that gives an Owner the greatest opportunity to use this analysis is retail where the performance of the business within the shop is directly relevant to the stability of income the Owner receives.

Understanding the strength of the rental income by analysing the trading and commercial performance of the rent paying occupiers puts the Investor in the strongest position to negotiate and regear lease terms, react to market requirements and devise and implement strategic asset goals. Bannon carry out rental sustainability analysis for schemes utilising our depth of retail asset and occupier specific data. The occupier’s current position will be further validated by their wider commercial performance and the effect both macro and micro economic conditions may have on the occupiers and their ability to perform.

The sustainable performance of an occupier is a key consideration for maintaining and forecasting income over the period of ownership. This gives our clients a clear advantage is assessing the value of an asset and looking at acquisition opportunities. The value of retail assets, especially shopping centres, has been depressed for some time despite their proven track record of producing strong predictable cashflows. Adopting sustainable rental analysis allows our client to see past the negative sentiment and acquire income producing assets at low cost when compared to other real estate investments.

A comprehensive understanding on a schemes rental sustainability can inform decision making when devising and asset strategy and inform cashflow forecasting. This can aide in de-risking cash flow line items for owners over their ownership period. Understanding rental sustainability can serve as a means of curating the schemes occupier mix and planning strategic initiatives. Overall, the ability to enhance the knowledge and understanding of income for the owner serves as a means to promote good asset management and to improve income over the term of ownership.

If you would like to know more about Bannon’s approach to rental sustainability analysis and how it can strengthen your asset strategy, please get in touch @ Consutancy@bannon.ie.

Author: George Colyer, Surveyor, Bannon

Date: 17th April 2023

A Green Lease is a commercial lease, containing additional clauses that the building must be occupied, operated and managed in an environmentally sustainable manner. The concept of a Green Lease was first developed in Australia where its use has been mandatory since 2006 in all government-owned and occupied buildings. In France, Green Lease legislation has been mandatory since 2013. Globally, 42% of investors have Green Lease clauses in place with an additional 37% looking to adopt them by 2025. On the occupational side, 34% of occupiers are currently committed to Green Leases.

Green Lease clauses can range from ‘light green’ to ‘dark green’ depending on the nature of the property, and energy performance certifications. The essential elements of a Green Lease include:

For both Owners and Occupiers, a Green Lease encourages a relationship of collaboration and meets corporate social responsibility objectives.

What are the benefits of a Green Lease?

For the Owner

For the Occupier

Green leasing provides an effective framework for both Owners and Occupiers to work together to achieve a common objective and comply with future legislative requirements. A sustainable building with lower running costs is more marketable for Owners and more cost-effective for Occupiers to occupy. Given the evolving nature of Green Leases, it is prudent to take legal and professional advice before entering such leases to ensure that the provisions are suitable for your organisation.

If you want to discuss the sustainability dynamics of the Irish Commercial property market further contact the Consultancy Team @ Bannon.

Author: Cillian O’Reilly, Surveyor, Sustainability Manager, Bannon

Date: 11th April 2023

The Q1 2023 Bannon Investment Pulse is now available providing a succinct summary of the Capital Markets transactions starting off the year.

With the Residential sector a surprising resilient highlight the total turnover of €625m is reflective of the current subdued sentiment in the market.

For more information or to talk on the opportunities available please get in touch; Roderick Nowlan, Alex Patterson, George Colyer, Cillian O’Reilly

One doesn’t have to go back too far into the archives to find headlines relating to markets in Dublin. Recent headlines include the uses of the Fruit & Veg Markets in the north inner city, the future (or fate) of the Iveagh Markets in The Liberties and plans for a market use at CHQ alongside EPIC, Europe’s leading tourist attraction (World Travel Awards). With the concept such a visited topic one looks to examples, both here and abroad, of where markets exist in cities as major attractions, creating hubs of activity that provide a platform to promote local, independent businesses, producers and suppliers and exhibit the tastes and cuisines of the area.

In Ireland, the most prominent example is of course Cork’s famous English Markets. Developed and owned by the Council, this traditional food market first opened in 1788 and remains as a hub of retail activity, with independent, local stallholders (some generations old, others local start-ups) selling a variety of fresh food and artisanal goods. While the dominance of a grocery offer suggests the target clientele are largely locals, a combination of atmosphere and architecture makes the market a major attraction for the City.

The Time Out Market in Lisbon is considered as a must-do when visiting the Portuguese capital. The market was founded by the publishing company with a vision to showcase the best business ideas and projects in Lisbon. The market now contains restaurants, shops, bars and a music venue alongside fruit & veg, meat, fish and flower vendors. London’s Camden Market has developed into a retail, food & drink destination in London, comprising over 1,000 shops, stalls and stands with an array of unique independent offers. Other examples include Mercado in London and Mercado de San Miguel in Madrid.

A common theme of these markets is the presence of independent, local operators. These operators allow the markets offer something unique and different from the traditional high street or shopping centre mix. The artisan nature of these vendors can serve to promote the markets as a tourist destination where visitors can experience local cuisine and support local producers. The planning submitted for the proposed market offer at CHQ is an opportunity for an exciting market offer to break into Dublin and the recent pop-up, Me Auld Flower market in the Fruit & Veg Market in Smithfield as part of the St Patrick’s Day Festival may indicate that more exciting development lies ahead.

If you want to discuss the retail dynamics of City & Town Centre further you can contact us @consultancy@bannon.ie

Author: George Colyer, Surveyor, Bannon

Date: 3rd April 2023

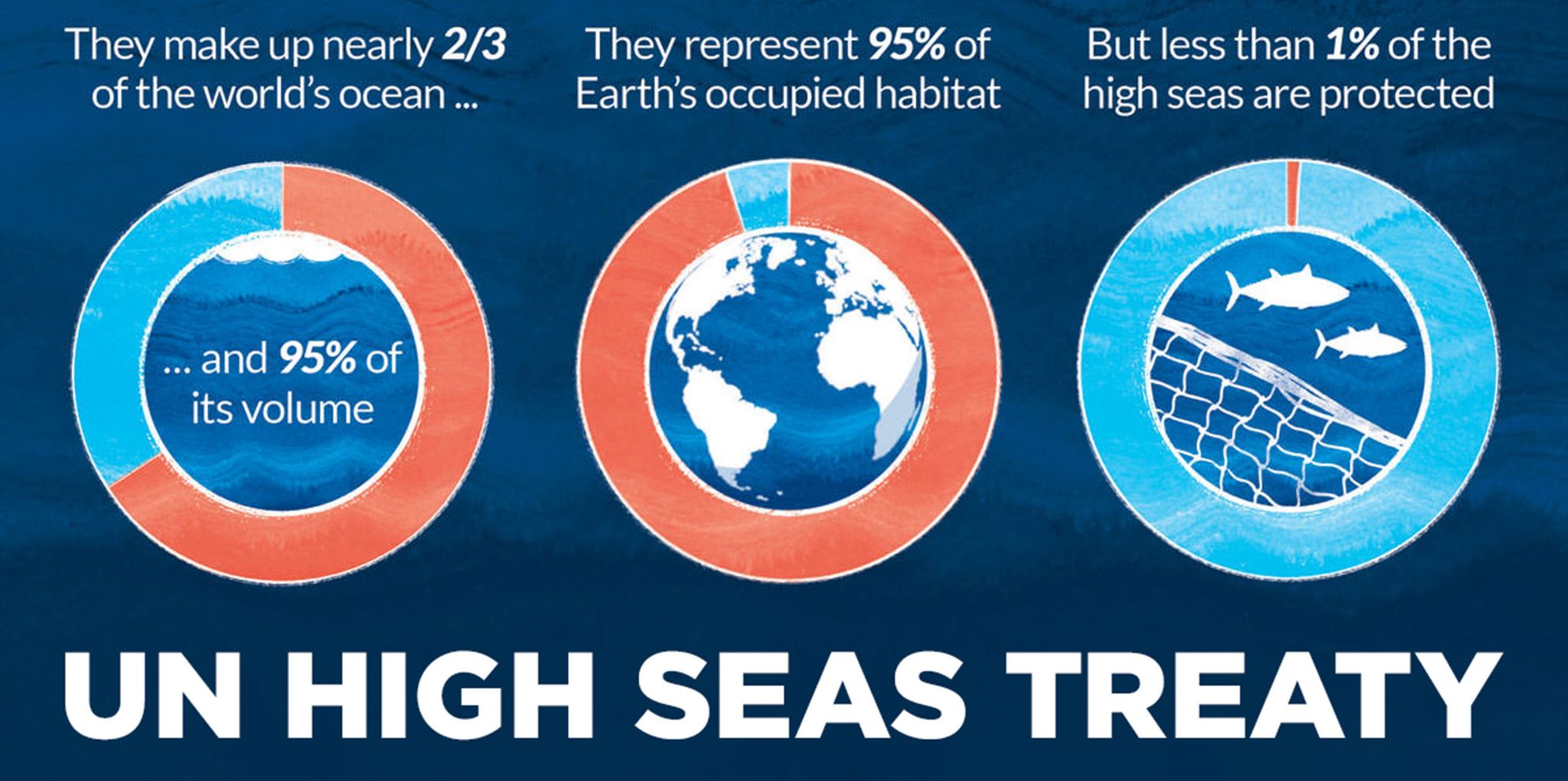

“The ship has reached the shore,” United Nations conference president Rena Lee announced after a marathon final day of talks between negotiators from more than 100 countries.

Ocean ecosystems keep our planet in balance by producing nearly half of the earth’s oxygen and absorbing much of its carbon dioxide but they are under threat from pollution, exploitation and global warming. After 15 years of negotiations, the UN High Seas Treaty which will help to protect vast swathes of the planet’s oceans was agreed in New York on Saturday. The high seas, or the parts of the ocean that are not territorial waters, do not technically belong to anyone and account for 60% of the earths oceans. Only a mere 1% of the high seas are currently protected. The treaty places 30% of the world’s land and sea under protection by the end of 2030, a target known as “30 by 30”.

The next step for the treaty is signing by UN member states and formal adoption after which countries will have to look at practically how these measures would be implemented and managed. This phase may take some time, however, the agreement of the High Seas Treaty is a major milestone as we look towards a greener future.

Bannon’s latest Office Pulse is now live!

Bannon’s latest Office Pulse is now live!

This month’s Office Pulse includes expert market insights from Lucy Connolly and Cillian O’Reilly. In this edition we ask; As tech sector expansion slows down, is this the end of the super deal? We also look at the data behind a two-tier occupational office letting market.

To view the full report, please click here.

Bannon’s latest monthly Retail Pulse has now gone live.

Bannon’s latest monthly Retail Pulse has now gone live.