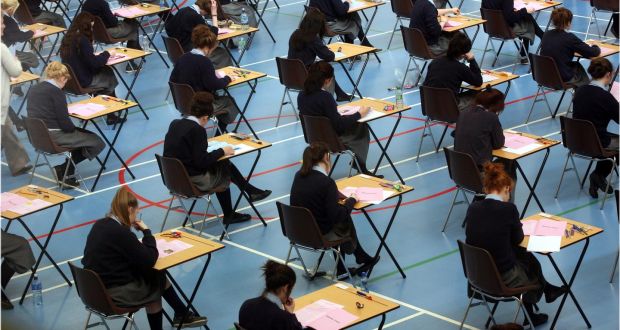

Major reform of the Leaving Cert is being planned from 2024 onwards which will include spreading project work and exams over fifth and sixth year.

The move aims to reduce student stress levels around the traditional written exams and introduce teacher-based assessment for projects and other course components.

Minister for Education Norma Foley is keen to proceed with reforms which would see students entering senior cycle in September 2023 sitting Paper One in English and Irish at the end of fifth year.

Over several years, 60 per cent of marks for all Leaving Cert subjects will be based on written exams and 40 per cent on additional assessment components such as project work, orals or practicals.

Teacher-based assessment of these additional components will be externally moderated by the State Examinations Commission.

The announcement on Tuesday follows a four-year review of the senior cycle by the National Council for Curriculum and Assessment (NCCA), based on consultations with students, teachers, parents and industry.

The review found while there was broad agreement exams should remain, it proposed giving greater weight to continual assessment, projects or other course components over a two- or three-year period.

On foot of Tuesday’s announcement, a selection of schools will shortly be invited to become pilot schools and participate at an early stage in revised curriculum and assessment arrangements.

Among the changes announced are:

* The introduction of two new subjects – drama, film and theatre studies; and climate action and sustainable development – which will be ready for students in pilot schools starting fifth year in 2024;

* An initial tranche of new and revised subjects will be available in pilot schools from September 2024, when students entering fifth year will study updated subject curricula, with updated assessment models in chemistry, physics, biology and business;

* Future oral exams and the music practical performance will take place during the first week of the Easter break of sixth year, as is the case this year;

* Leaving Certificate Applied (LCA) students will have improved access to maths and foreign languages from September 2022;

* A new qualification will be introduced at level one and two on the National Qualification framework to provide an appropriate level of assessment to some students with special educational needs, building on the equivalent programme at Junior Cycle level;

* Access for all students to a revised transition year programme will be encouraged.

Under Ms Foley’s plans, the NCCA and the State Examinations Commission will develop, in consultation with education partners, how an externally moderated, school-based form of assessment would operate.

However, teachers’ unions on Tuesday moved quickly to voice their opposition to any plan that involves members assessing their own students.

Teachers’ Union of Ireland (TUI) general secretary Michael Gillespie said: “Our members are fundamentally opposed to assessing their own students for State certificate purposes and therefore external assessment and State certification – which retain significant public trust – are essential for all written examinations and all additional components of assessment.”

Association of Secondary Teachers’ Ireland (ASTI) president Eamon Dennehy said certification in State exams must be “entirely externally assessed”.

“This must be retained in all aspects of the development of the Leaving Cert. It is vital that the integrity of the state exams system is maintained,” he said.

Ms Foley said the redeveloped senior cycle aims to deliver “equity and excellence for all”.

“This programme is timely and ambitious – we must not rush, but cannot delay. The timing I have set out will ensure that students will feel the benefits at the earliest possible time, with notice of these in advance.”

She said the reforms will reduce the pressure on students that comes from final assessments based primarily on exams.

“We will move to a model that uses other forms of assessment, over a less concentrated time period, in line with international best practice,” she said.

Ms Foley said these changes will enable the education system to maintain its high standards.

“Our current system has many strengths. But we know that it can be improved, to better support our students, to reduce pressure while maintaining standards, to keep pace with the changes in practices internationally and to meet the needs and expectations of our students and of our society in preparing our young people for the world ahead,” she added.

Article by The Irish Times.

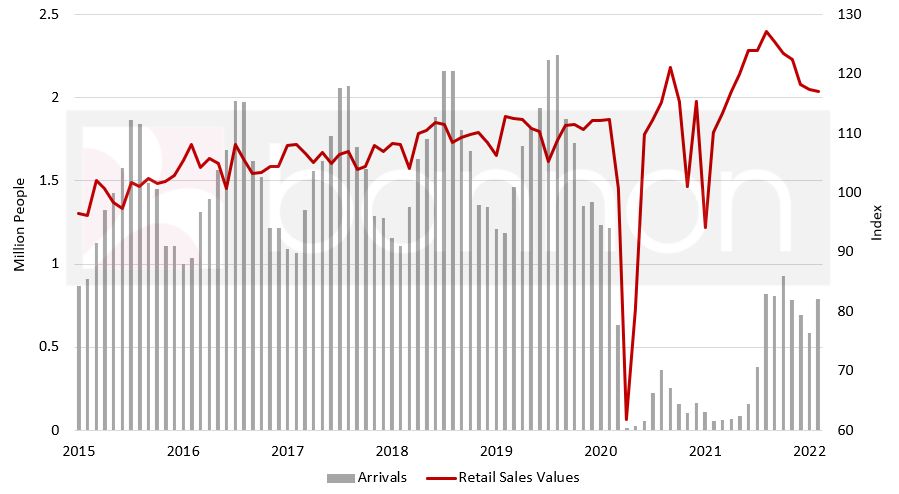

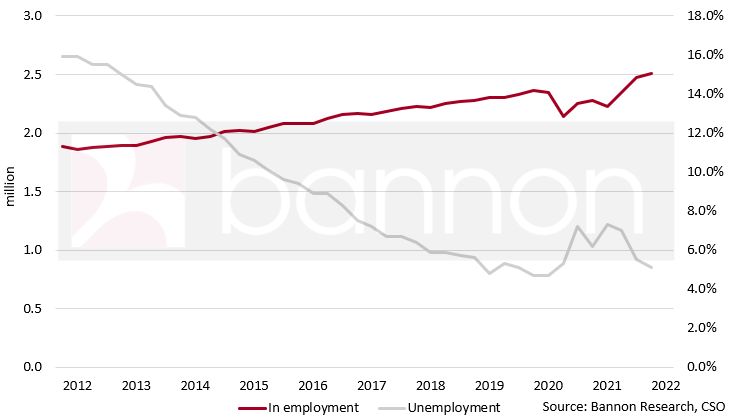

Neil Bannon joined Newstalk Bobby Kerr on Down to Business on Saturday to discuss the medias negative perception of the Irish retail market.

Neil Bannon joined Newstalk Bobby Kerr on Down to Business on Saturday to discuss the medias negative perception of the Irish retail market.

The Bannon KeepCups and Chilly’s water bottles arrived today for all staff. As a firm we are strongly committed to reducing waste and promoting wellbeing. No more plastic coffee cups for the Bannon team!

The Bannon KeepCups and Chilly’s water bottles arrived today for all staff. As a firm we are strongly committed to reducing waste and promoting wellbeing. No more plastic coffee cups for the Bannon team!

We are delighted to share our latest Bannon Retail Pulse. This month we focus on the Food & Beverage Sector where we report on strong take-up and low vacancy across the sector. Our Retail Pulse is updated monthly and all are available on our website

We are delighted to share our latest Bannon Retail Pulse. This month we focus on the Food & Beverage Sector where we report on strong take-up and low vacancy across the sector. Our Retail Pulse is updated monthly and all are available on our website

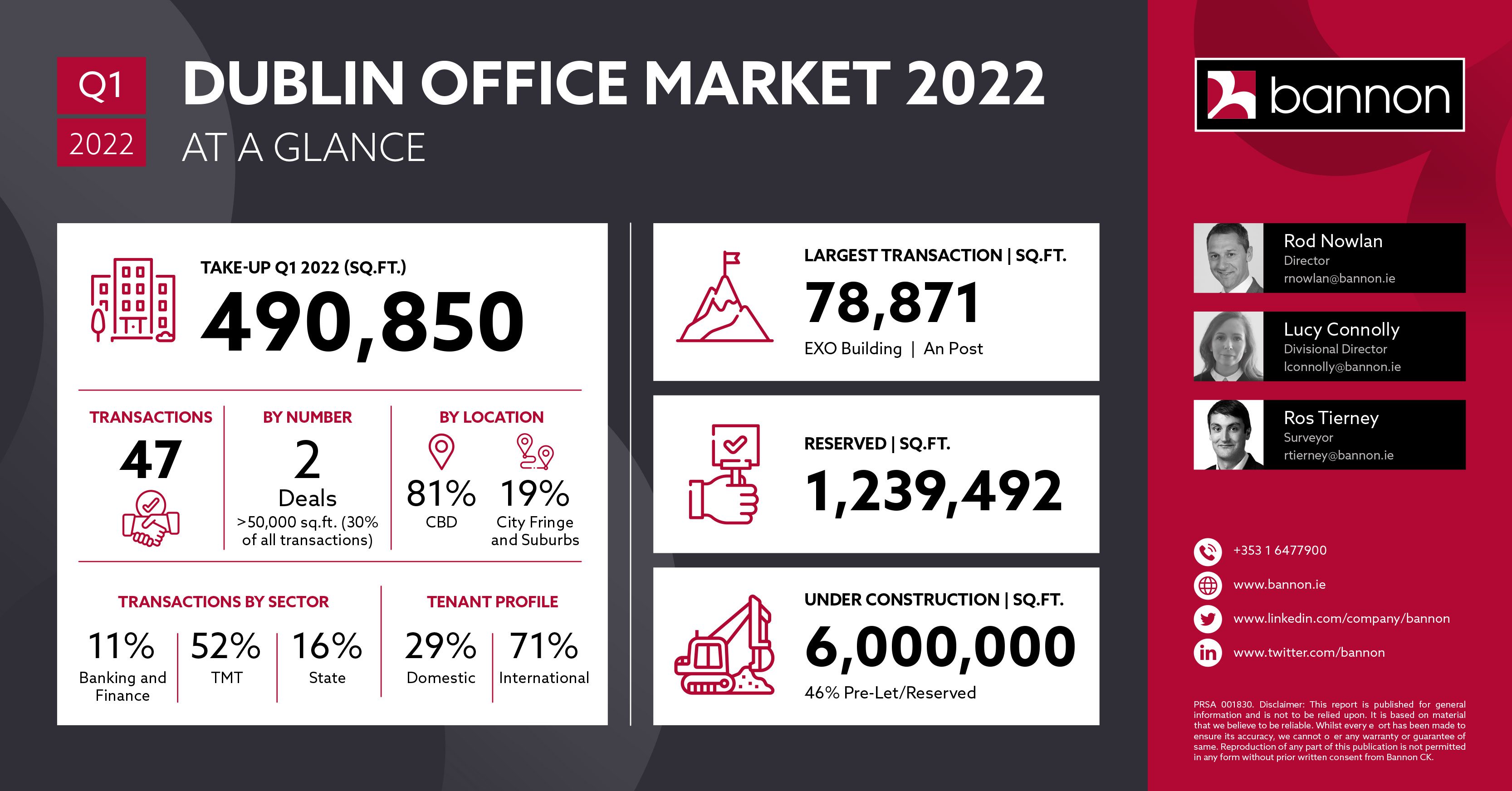

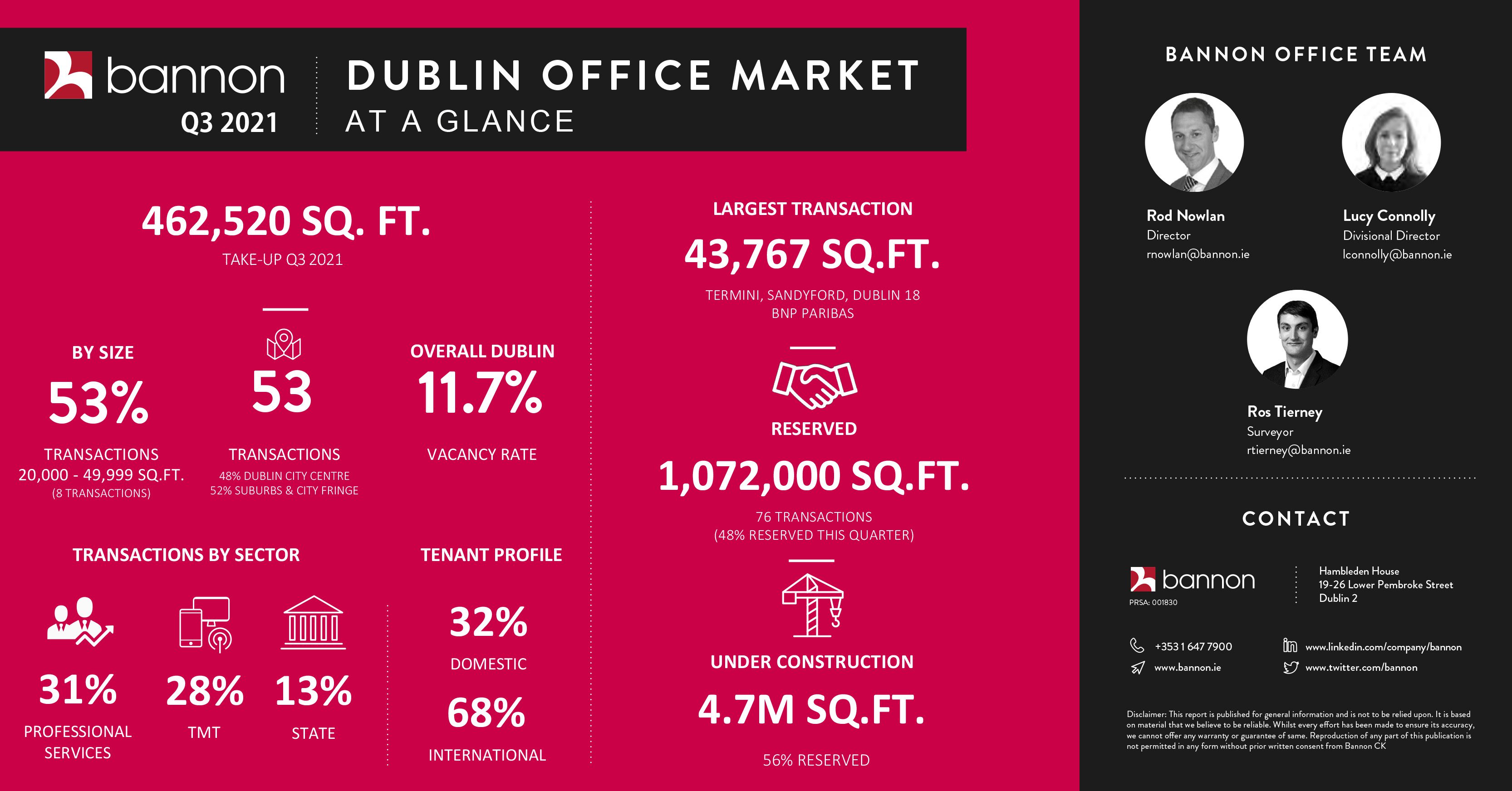

At Bannon we manage over 75 individual commercial assets including Shopping Centres, Retail Parks, Neighbourhood Schemes, Multi Let and Single Let Offices. This represents over 7 million sq.ft of commercial real estate in Ireland, with an estimated value of €2 billion.

At Bannon we manage over 75 individual commercial assets including Shopping Centres, Retail Parks, Neighbourhood Schemes, Multi Let and Single Let Offices. This represents over 7 million sq.ft of commercial real estate in Ireland, with an estimated value of €2 billion.

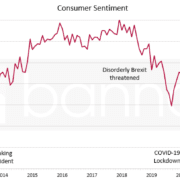

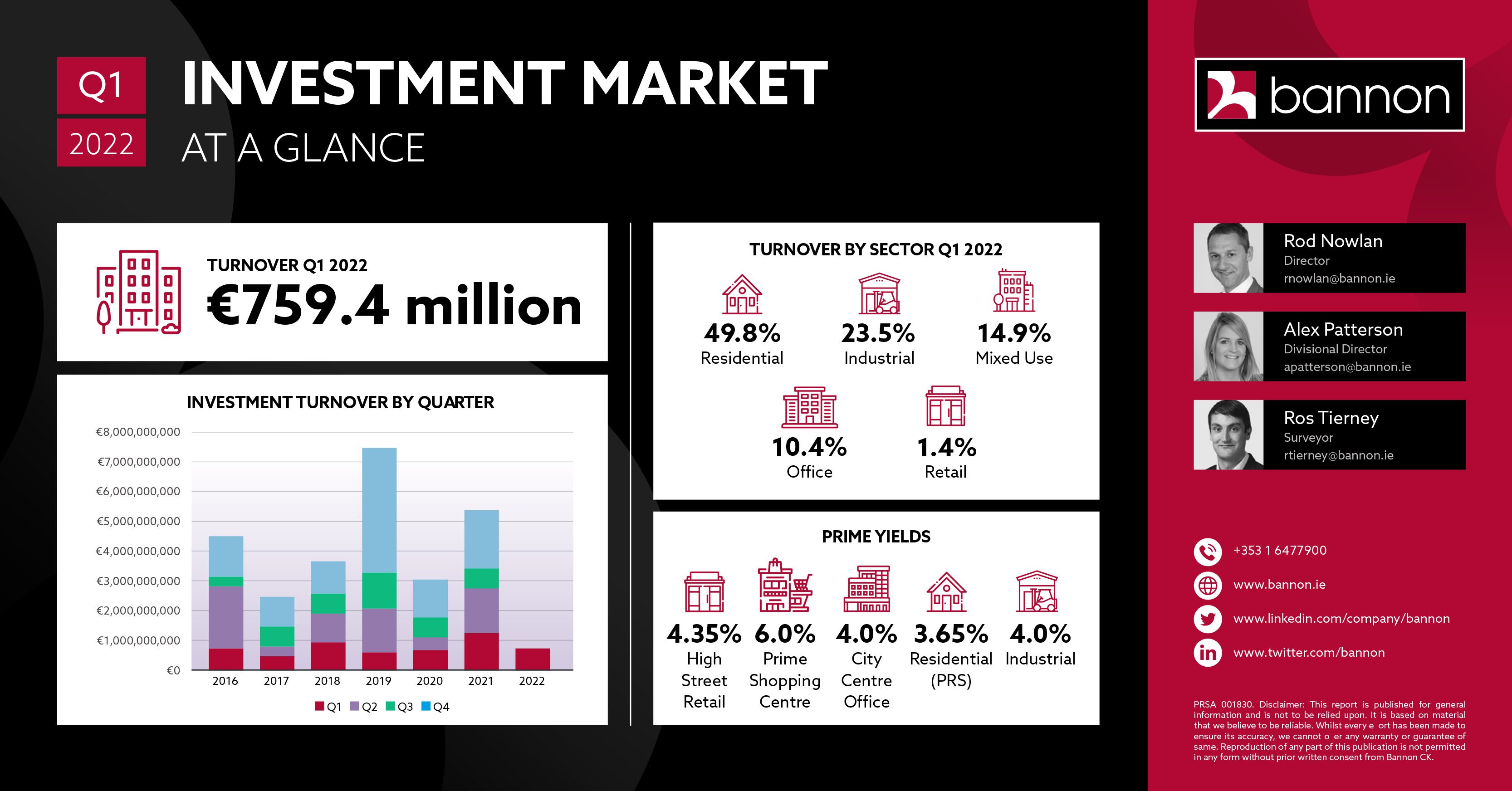

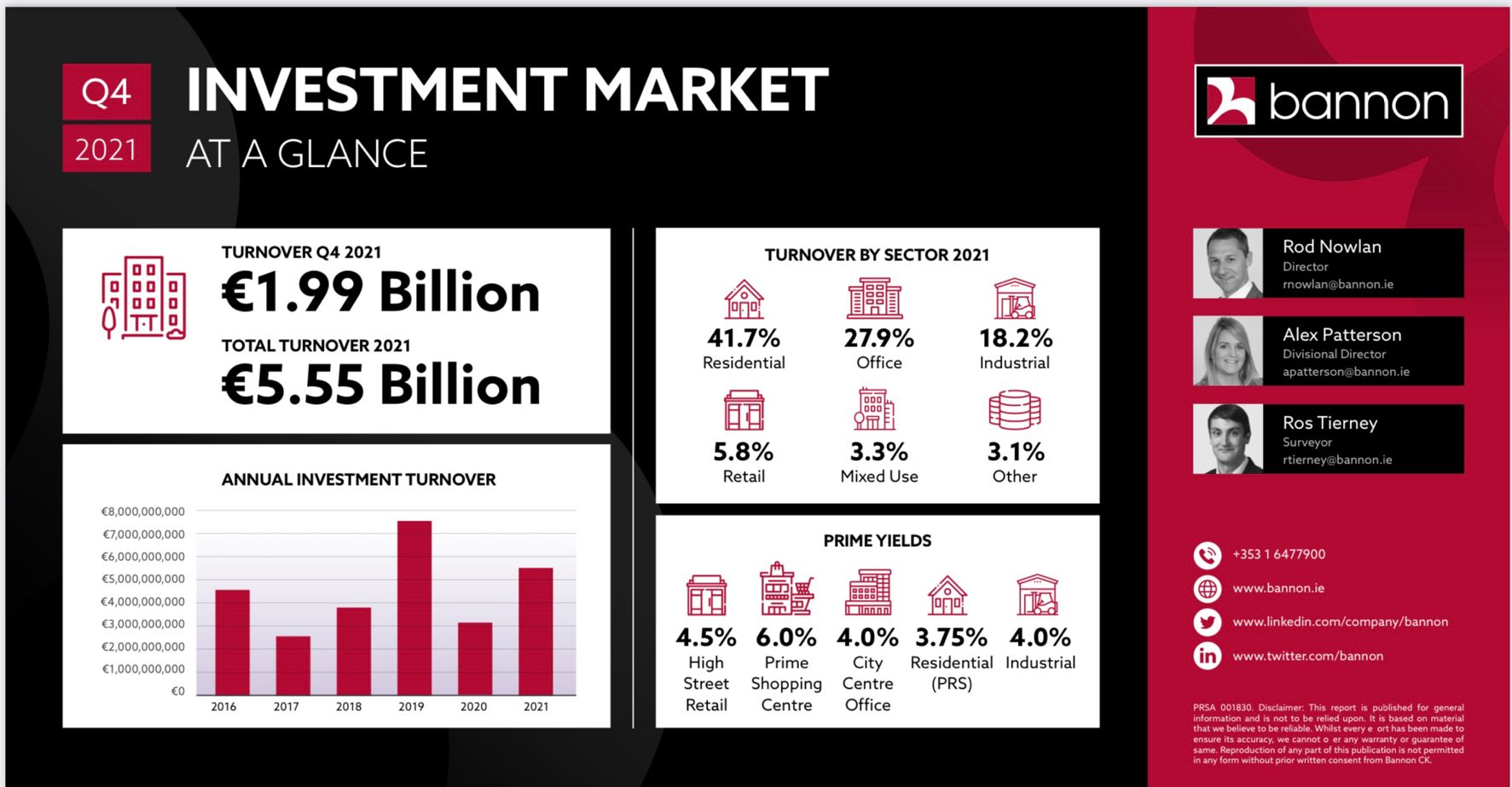

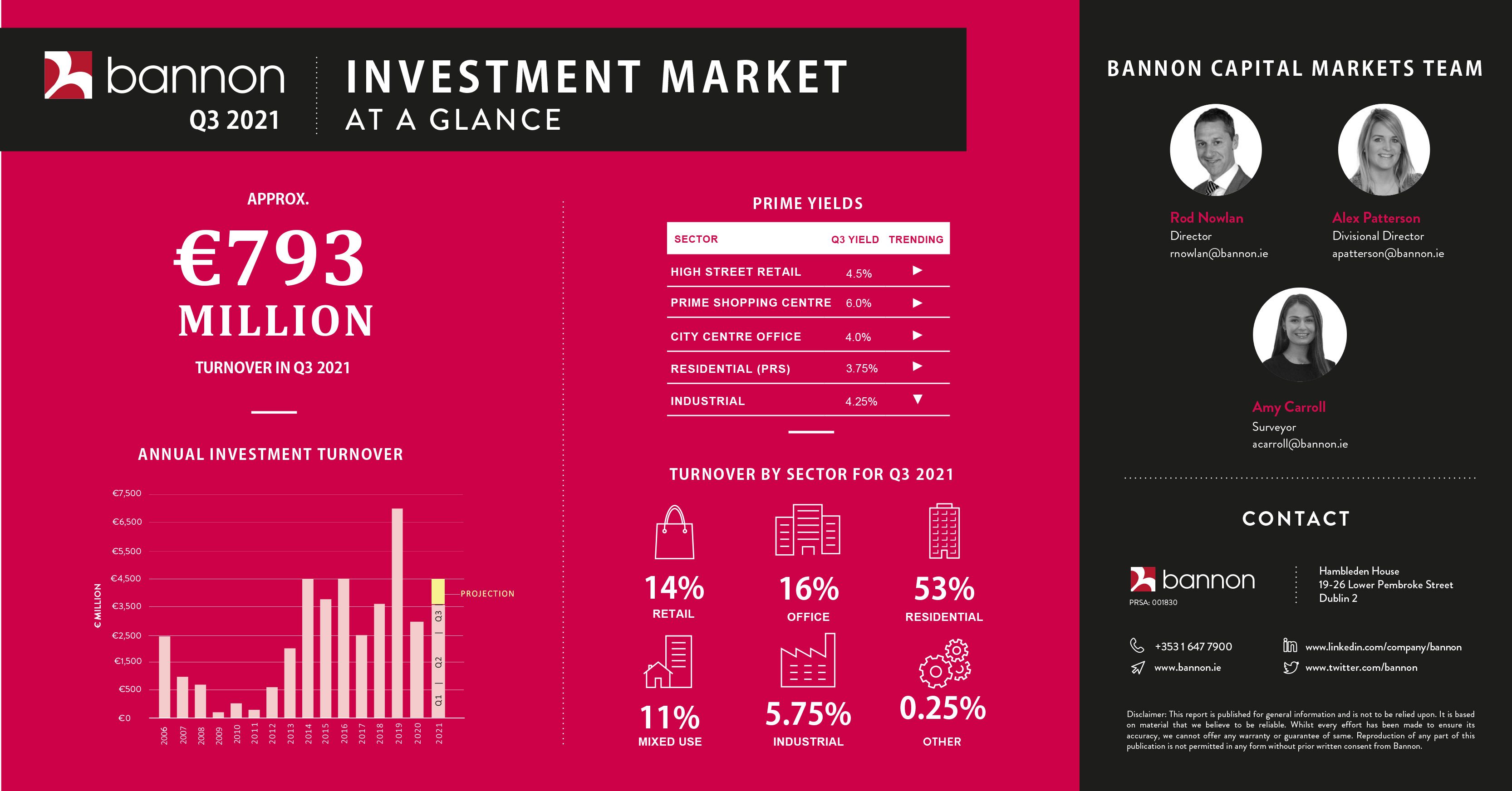

While it is still too soon to quantify the impact of the geo-political and macroeconomic backdrop on the Irish commercial property market, based on the Q1 figures and advanced pipeline transactions we anticipate that 2022 will still become one of only three years to record a turnover in excess of €5bn.

While it is still too soon to quantify the impact of the geo-political and macroeconomic backdrop on the Irish commercial property market, based on the Q1 figures and advanced pipeline transactions we anticipate that 2022 will still become one of only three years to record a turnover in excess of €5bn.

We have pleasure in enclosing The Bannon Retail Pulse Report for March 2022. March witnessed further improvement in footfall trends, reflecting the lifting of restrictions earlier in the year. This will improve further as we can now look forward to an increase in tourist numbers in the months ahead. Transactional activity was extremely busy in Q1 and will continue into Q2.

We have pleasure in enclosing The Bannon Retail Pulse Report for March 2022. March witnessed further improvement in footfall trends, reflecting the lifting of restrictions earlier in the year. This will improve further as we can now look forward to an increase in tourist numbers in the months ahead. Transactional activity was extremely busy in Q1 and will continue into Q2.

CGI of Proposed Scheme (Model Works)

CGI of Proposed Scheme (Model Works)

The function of all forms of real estate and the specific requirements of its users continues to change at pace. The most significant factors driving this evolution are non-financial – Environmental, Social and Governance (ESG) requirements.

The function of all forms of real estate and the specific requirements of its users continues to change at pace. The most significant factors driving this evolution are non-financial – Environmental, Social and Governance (ESG) requirements.