Retail Healthcheck with Neil Bannon

Neil Bannon joined Newstalk Bobby Kerr on Down to Business on Saturday to discuss what we might do to attract the investment our towns and cities need right now.

Neil Bannon joined Newstalk Bobby Kerr on Down to Business on Saturday to discuss what we might do to attract the investment our towns and cities need right now.

To listen to the full podcast, click here.

Neil Bannon joined Newstalk Bobby Kerr on Down to Business on Saturday to discuss what we might do to attract the investment our towns and cities need right now.

Neil Bannon joined Newstalk Bobby Kerr on Down to Business on Saturday to discuss what we might do to attract the investment our towns and cities need right now.

To listen to the full podcast, click here.

The first Bannon Dublin Office Market Pulse of 2023 is now live. Dublin office market take up exceeded 2,650,000 sq.ft. in 2022, boosted by a busy Q4 with over 804,000 sq.ft. transacting in the final quarter. See full details below together with expert insight from Lucy Connolly.

The first Bannon Dublin Office Market Pulse of 2023 is now live. Dublin office market take up exceeded 2,650,000 sq.ft. in 2022, boosted by a busy Q4 with over 804,000 sq.ft. transacting in the final quarter. See full details below together with expert insight from Lucy Connolly.

To view the full report, please click here.

Davy Real Estate has appointed Ireland’s largest, domestically owned commercial property consultancy firm Bannon, to manage Harbour Place Shopping Centre in Mullingar. The shopping centre which was opened in the mid-1990s comprises in excess of 100,000 sq. ft. of retail floor space and is anchored by Dunnes Stores. Other notable occupiers include Boots, Paul Byron Shoes, C.R. Tormey Butchers, Carraig Donn, Claire’s Accessories, Peter Mark, Holland and Barrett & Esquires.

Bannon manages over 55 retail shopping centres and retail parks across the country, covering seven million sq. ft. of commercial real estate worth c. €2 billion. As the market leader, Bannon has advised and managed the country’s most notable retail spaces in the last thirty years such as Dundrum Town Centre, Blanchardstown S.C., Swords Pavilions and The Square.

Commenting on the appointment, Director of the Bannon Property Management team, Ray Geraghty said “We are extremely proud to be working with Davy Real Estate on this important asset, and we look forward to working closely with the centre management team and occupiers. This instruction has particular significance for me given that Mullingar is my hometown. The midlands is going from strength to strength and we are proud to be supporting this growth. The appointment further validates the position we in Bannon hold as market leaders of retail property management in Ireland.”

One of the main attractions in Melbourne, Australia is undeniably its City Centre laneways. Once existing as purely functional areas, in the 1990’s the Government introduced policies to reimagine Melbourne’s laneways. The aim was to create exciting cultural and retail destinations in the Central Business District (CBD) to draw activity back into the city from suburban shopping centres.

The local policy promotes the inclusion of art, landscaping, street furniture and activity space to bring vibrancy with al fresco dining adding to this atmosphere. New developments are encouraged to provide small-scale tenancies at ground level to support a unique trading environment. The laneways are characterised by an abundance of local independent operators. These operators benefit from a city centre location without the cost of main street rents, adding diversity to the city’s retail core.

The policy in Melbourne recognises four core values that support the laneways’ success in attracting pedestrian movement and activating underutilised space.

So what can we learn from these policies for our cities in Ireland? Laneways are a common feature within Irish cities and towns. They are generally associated with servicing, bins, and anti-social behaviour, causing them to deflect rather than attract activity. We can see from policies introduced in Melbourne, that there is an opportunity to enhance our laneways while supporting our cities. They could act as extensions of retail streets, encouraging the circulation of shoppers, dwell zones and a destination for unique retail and food and beverage offers.

Led by policy, we can create vibrant and exciting spaces in Irish city centres. The Bannon Consultancy Team highlighted these opportunities in a Retail Study carried out for the Dublin City Council Development Plan 2022 – 2028. The private sector can play a role. Property owners with significant frontage to a laneway could activate and provide an exciting new space for the public to enjoy, creating rental value from previously underutilised space. We need to think creatively to develop our cities.

Author: George Colyer, Surveyor, Bannon

Date: 31st January 2023

For the property sector, while one of strongest capital market years on record (second only to 2019), 2022 will be best remembered as the “year of reckoning”. A year where a mixture of macro-economic and geopolitical issues combined to commence rebasing the market following almost a decade of effectively zero interest rates, low inflation, and expansive monetary policies.

For the property sector, while one of strongest capital market years on record (second only to 2019), 2022 will be best remembered as the “year of reckoning”. A year where a mixture of macro-economic and geopolitical issues combined to commence rebasing the market following almost a decade of effectively zero interest rates, low inflation, and expansive monetary policies.

To view the full report, please click here.

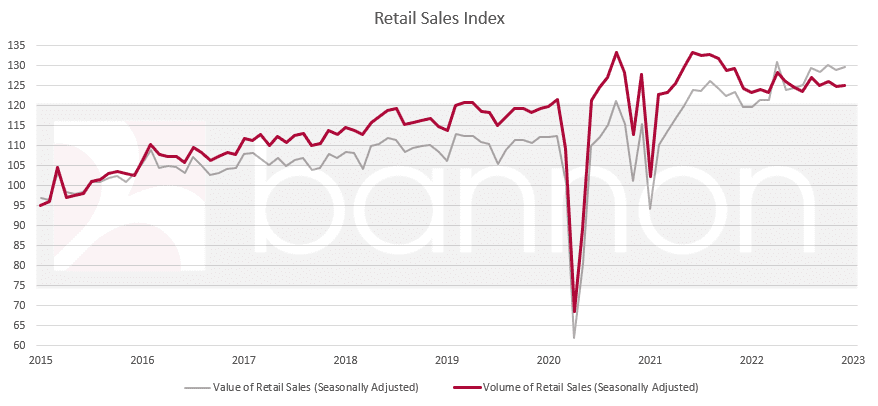

Changing spending patterns saw retail sales in December 2022 fall marginally from November figures indicating the traditional Christmas rush has turned into more of a marathon than a sprint. Annualised figures (excl. motors) show a strong increase in sales values of 7.88% albeit a nominal increase in volumes of 0.16%. This reflects the ongoing price inflation which saw the cross over in the value and volume indexes last year. The data also shows a strong shift away from household and electrical which enjoyed a stellar performance during periods when other retail outlets were closed due to COVID restrictions.

The first Bannon Pulse of 2023 is now live. We look back at the strong level of activity in 2022, highlighted by the large number of lettings and new market entrants. Our occupancy trackers finished 2022 in positive form, as did our trading analysis across the retail categories. Neil Bannon gives his take on the market concluding that, ‘The opportunity for informed investors is to acquire retail assets with robust performance but priced to reflect a negative narrative’.

The first Bannon Pulse of 2023 is now live. We look back at the strong level of activity in 2022, highlighted by the large number of lettings and new market entrants. Our occupancy trackers finished 2022 in positive form, as did our trading analysis across the retail categories. Neil Bannon gives his take on the market concluding that, ‘The opportunity for informed investors is to acquire retail assets with robust performance but priced to reflect a negative narrative’.

To view the full report, please click here.

For the property sector, while one of strongest capital market years on record (second only to 2019), 2022 will be best remembered as the “year of reckoning”. A year where a mixture of macro-economic and geopolitical issues combined to commence rebasing the market following almost a decade of effectively zero interest rates, low inflation, and expansive monetary policies.

See the high-level Bannon summary of 2022 in Bannon’s first Investment Pulse of 2023!

Dublin Office market take up for 2022 exceeded the ten year moving average figure and surpassed 2,600,000 sq.ft. by year end. This figure was boosted by a busy Q4 with over 804,000 sq.ft. transacting in the final quarter of the year. This was largely attributable to the two largest transactions of the year, Citigroup’s acquisition of 300,000 sq.ft. at Waterfront South Central and SMBC Aviation Capital’s leasing of 135,000 sq.ft. at Fitzwilliam 28.

Whilst not back to pre-covid levels, take up has increased by 53% on 2021 figures and we are seeing further stability in the market with an upsurge in activity from the Professional services and financial sectors.

Our final Retail Pulse of 2022 has just gone live. All in all, an exceptionally busy year for the team at Bannon. 2023 is looking very promising for Retail.

Our final Retail Pulse of 2022 has just gone live. All in all, an exceptionally busy year for the team at Bannon. 2023 is looking very promising for Retail.

Neil Bannon concludes this Retail Pulse with 10 Reasons to be Cheerful about the Retail Landscape in Ireland (page 4).

To view the full report, please click here.

Bannon’s latest monthly Retail Pulse has now gone live. Neil Bannon looks at recent retail sales data to demonstrate how the negative narrative continues to clash with reality.

Bannon’s latest monthly Retail Pulse has now gone live. Neil Bannon looks at recent retail sales data to demonstrate how the negative narrative continues to clash with reality.

To view the full report, please click here.

The environment and climate change were once again the centre of attention for world leaders and delegates last month at the UN Climate Change Conference, COP27. Taking place in the Egyptian coastal city of Sharm el-Sheikh, the conference welcomed more than 100 Heads of State and Governments and over 35,000 participants.

One of the major talking points of COP27 was greenwashing. Greenwashing is the process of conveying a false impression or misleading information about how a company’s actions and/or products are environmentally sound. The UN High-Level Expert Group on Net-Zero Emissions Commitments of Non-State Entities evaluated climate commitments and action plans of large multinational institutions finding one-third of the world’s 2,000 largest firms, by revenue, have publicly stated net zero goals. A staggering 93% of them have no chance of hitting their self-elected targets without drastically ramping up their current initiatives.

Coinciding with COP27 and in contrast to the greenwashing mentioned above, retailers including H&M, Kering and Inditex committed to purchasing over half a million tonnes of low-carbon alternative fibres for clothing and packaging to help reduce global emissions. It is reported that every tonne of clothing produced using alternative fibres will save between 4 and 15 tonnes of carbon emission. This commitment may provide the market pull required to attract investment to scale the alternative fibre sector which currently accounts for a tiny fraction (7.5 million tonnes) of man-made fibres produced each year.

The big question remains, can countries and institutions step up their efforts in tackling climate change?

Blog post written by Cillian O’Reilly, our Sustainability Manager. You can contact Cillian by email on coreilly@bannon.ie

The impact of macroeconomic changes on the property sector being discussed at The National Property Summit 2022 today.

Our Chairman Neil Bannon will be discussing the commercial property sector with Suzie Nolan from Aviva, Vincent Harney and Carol Tallon from Property District.

The Bannon Dublin Office Market report is available now. Take up for the third quarter reached 819,000 sq.ft. representing a 60% increase on Q2 and a 77% increase in the same period last year. Lease flexibility continues to be sought in the short term as companies continue to assess their office requirements as remote and hybrid models are fully determined.

The Bannon Dublin Office Market report is available now. Take up for the third quarter reached 819,000 sq.ft. representing a 60% increase on Q2 and a 77% increase in the same period last year. Lease flexibility continues to be sought in the short term as companies continue to assess their office requirements as remote and hybrid models are fully determined.

We are seeing an increase in activity from the financial and professional services sectors, many of whom are seeking to satisfy their ESG policies in terms of their real estate decisions.

To view the full report, please click here.

A contentious and topical issue for some time now, the Residential Zoned Land Tax (RZLT) will impact a range of stakeholders across the development land sector. The RZLT, which was introduced in the Finance Act 2021 effectively replaces the Vacant Site Levy, with a similar objective of increasing the supply of residential accommodation.

As an annual tax charge, it will be calculated at 3% of the market value of land zoned suitable for residential development which is or can be readily serviced. Each local authority is obliged to generate a residential zoned land tax map, with draft maps published from the start of November 2022.

Land suitable for residential development from the 1st of January 2022 and development not commenced prior to the 1st of February 2024 will be liable for taxation. Landowners seeking to be omitted from the tax have until the 1st of January 2023 to make an appeal to their Local Authority. Impacted landowners will be expected to self-assess or engage with a registered valuer to conclude the market value of their land in anticipation of the 23rd of May 2024 tax return date.

The limited circumstances under which the RZLT may be deferred include the following:

– Planning permission has been granted in respect of the residential land and a commencement notice, in respect of the residential development, has been lodged with the relevant Local Authority.

– If an appeal relating to the inclusion of the site on the register has not yet been determined.

– Judicial review or appeal to An Bord Pleanála is brought by a third party in relation to the planning permission that was granted.

For more information on the potential implications of RZLT contact nbrereton@bannon.ie.

There is a puzzle which involves moving the one empty space around a collection of tiles to make the correct image and it comes to mind when looking at the near-term future of the Dublin Office market.

The headline stats on the office market will tell you that there is 5.6m sq.ft. under construction but that 2.2m of it is pre-let. What these stats hide is that some of that pre-let space is actually available. Take 2 & 3 Wilton Place which are currently being built by IPUT for LinkedIn who have advised the market that they no longer want to occupy these buildings. IPUT’s investment is secure as the buildings are effectively let to a Microsoft business who are legally committed but from the market perspective 330,000 sq.ft. has just moved from the pre-let column to the available to let column and it’s not just buildings that are under construction. As agents on the redevelopment of the ESB headquarters we pre-let 28 Fitzwilliam Place to the tech company Slack subsequently selling the investment to the large European Investors Amundi. Slack were subsequently bought by Salesforce and 28 Fitzwilliam although fully complete since 2021 has never been occupied. To these examples can be added the buildings in the Facebook / Meta HQ in Ballsbridge which they have decided not to occupy although it is not clear that they will be bringing these to the leasing market or just mothball them for the time being.

What this adds up to is a much greater availability of brand-new top-grade office stock than the headline stats would suggest. We have no doubt that all this brand new ESG compliant stock will be occupied. They are good quality buildings in good locations that comply with the sustainability needs of large corporate occupiers. What it will do however is speed up the movement of the tiles around the board. It accelerates the ability of large corporate occupiers currently residing in non ESG compliant buildings to move to the buildings they need. When the image is complete the empty tiles will correspond to the older non ESG compliant buildings which will need to be upgraded, converted to alternative uses or generate a much lower rent than they have achieved heretofore.

At Bannon the Office & Consultancy teams are actively working with clients to solve the more complex problem, how to generate the best return from well located office stock that fails the sustainability test.

Author: Neil Bannon, Executive Chairman, Bannon

Date: 14th November 2022

Join Neil Bannon at the upcoming National Property Summit 2022 on 1st December discussing the latest challenges and opportunities facing Irish commercial property with this expert panel.

Whatever the short balance of the year has in store, there is little doubt that in 2022 a rubicon was crossed for assets that are not scoring well with their ESG credentials. The RICS made sure valuers took the step to acknowledge the importance of ESG credentials on buildings and their impact on values with the publication of a new guidance note effective from January this year. Also in 2022, more than ever, both occupiers and owners made known their absolute preference for ESG compliant buildings. In the office sector in Q3 over 85% of city take-up related to ESG compliant offices.

Whatever the short balance of the year has in store, there is little doubt that in 2022 a rubicon was crossed for assets that are not scoring well with their ESG credentials. The RICS made sure valuers took the step to acknowledge the importance of ESG credentials on buildings and their impact on values with the publication of a new guidance note effective from January this year. Also in 2022, more than ever, both occupiers and owners made known their absolute preference for ESG compliant buildings. In the office sector in Q3 over 85% of city take-up related to ESG compliant offices.

The Bannon Professional Services team has embraced the RICS Valuation Practice Guidance Note titled ‘Sustainability and ESG in Commercial Property Valuation and Strategic Advice’ in undertaking our valuations. In doing so we demonstrate how we have considered sustainability and ESG credentials in our valuation approach, calculations and commentary.

Our experience in 2022 is that the majority of owners have come to realise the importance of ESG credentials in terms of how they influence value. For some owners, mainly outside of the more professional participants, there is still the ‘unknown’ in terms of the actual cost to rectify their asset where there is a deficiency. In relation to older assets where there is a shortfall in data it has been necessary for us to ask for specialist third party inputs, primarily in relation to the cost of bringing the asset up to an acceptable ESG standard. On some of those occasions we have been challenged with the findings as, often is the case, the cost of the upgrade is not supported by a corresponding uplift in value. This is more typical where the asset is in a secondary location. In those circumstances we have then also looked at alternative uses or otherwise materially adjusted the carrying value.

All said, valuing properties which have a shortfall in terms of being a credible ESG asset requires an in-depth understanding of a myriad of factors. They include market variables, competition from compliant buildings, and costs.

We have learned a lot in the past 24 months, but with much more to learn as the focus on ESG continues with pace. The benchmark that buildings must reach in terms of a new rating post being redeveloped is still unclear. Also, whilst valuers will request a lot from owners as part of their due diligence, in many cases definitive answers are not yet available. What we do now know is that the value gap will continue to widen between those that do offer enhanced ESG credentials and those that don’t.

Author: Paul Doyle, Managing Director, Bannon

Date: 10th November 2022

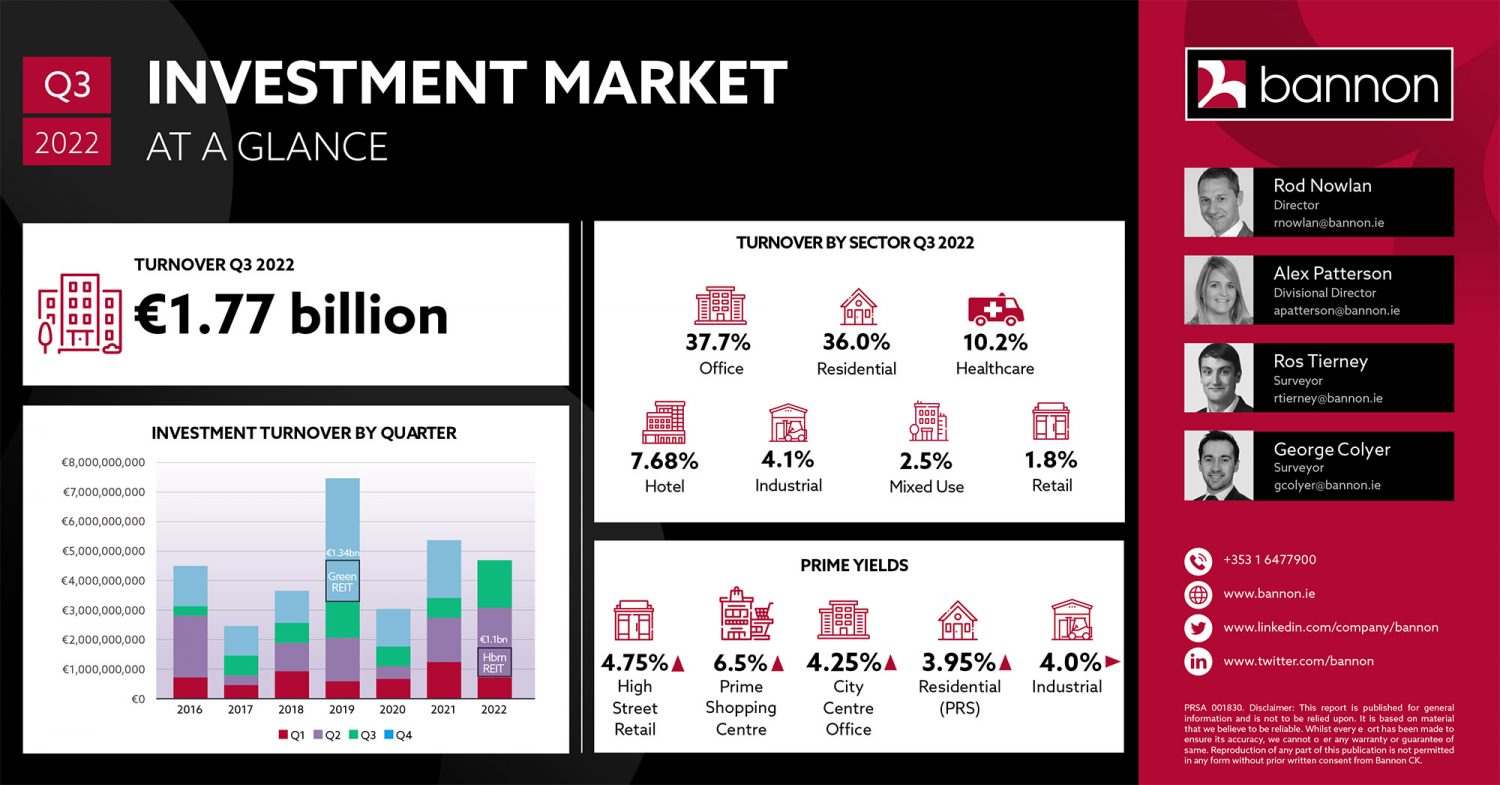

A cursory look at both the third quarter and year-to-date property investment volume data would indicate that it’s a case of “steady as she goes” in the market but as always, the proverbial devil is in the detail. When you pull back the curtain on the statistics, the current institutional investment mantra of “beds, sheds and meds” is reflected in the true underlying trends.

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/irishtimes/RD72OWG6Z5BTFCE3SO7DUQKALI.jpg)

At first glance, investment volumes for the third quarter show that offices hold the lead at 37.7 per cent closely followed by residential at 36 per cent. Year to date shows an even stronger position for offices at 43.5 per cent and residential at 29.9 per cent. However, two key transactions shroud a huge shift in the market and highlight the importance of both the residential sector and the movement in non-office investments.

If we exclude the €1.089 billion Hibernia Reit (Hibernia Real Estate Group) transaction from the second quarter (which arguably should not have been included as it was a corporate acquisition) and the one-off €500 million Salesforce headquarter deal from the third quarter, the lay of the land changes dramatically. The result is that the residential sector exceeds 50 per cent of third-quarter volumes and 44.4 per cent of the year-to-date volumes. Conversely, the office sector falls to a mere 17.7 per cent of the quarter and 17.6 per cent for the year-to-date.

This is a dramatic transition for the offices sector, which accounted for 39 per cent of market transactions in 2020 and 28 per cent in 2021. A number of factors are likely contributing to this shift. Among them is the depleting availability of developer-led schemes for trade, concern attaching to the occupational impact of the working-from-home (WFH) phenomenon, and the unknown impact of required ESG retrofitting to standing stock.

As a consequence of the decline in the office sector’s relative importance we are seeing a number of alternative sectors come to the fore. The industrial sector has seen the reverse trend as the desire for sheds from institutions is unabated and the supply side is relatively elastic. It has grown from a mere 4 per cent in 2019 and 8.8 per cent in 2020 to 13.1 per cent currently, almost on a par with office. Similarly, the healthcare sector, from near obscurity, comes to represent almost 8 per cent of investment volumes.

When you add all this up, excluding the Hibernia and Salesforce deals, “beds, sheds and meds” made up over 65 per cent of investment-transaction volume in the year to date. When you consider that sheds and medss collectively amounted to mere rounding errors in the investment statistics 10 years ago, it demonstrates just how much the real-estate landscape has shifted and reinforces the sheer naivety of assuming that the market today is a clear indicator of future trends

The increased availability of so-called “grey space” and sublet opportunities, eg LinkedIn in Wilton Place, may further reduce speculative office development and consequent supply. The roll-out of primary healthcare centres across the country will support continued growth in investment the healthcare sector. These trends point to the future of the investment market and are the current focus of our research and consultancy team.

Occupancy rates continue to improve and retail sales reach an inflection point.

To view the full report, please click here.

The Irish Commercial Real Estate (CRE) sector performed strongly in Quarter 3 with over €1.77 billion invested in Irish commercial property across 47 transactions. This figure was underpinned by the Ronan Group’s sale of the Salesforce HQ on Spencer Place and a 204-bedroom hotel for €500 million, the largest transaction by some margin. Annual turnover will significantly exceed €5bn for 2022 and establish the second strongest year on record after 2019.

To view the full report, click here.

The Dublin office market performed strongly in Q3 with take up reaching 819,337 sq.ft. across 60 transactions, bringing the year-to-date figure to just over 1,820,000 sq.ft. To put this figure in context, it represents a 77% increase on Q3 2021, a 256% increase on Q3 2020 and 134% increase on Q3 2019 levels (pre covid).

As we move forward into the final quarter, there is over 770,000 sq.ft. of office accommodation reserved and active requirements of c. 3 million sq.ft. which bodes well for the remainder of the year.

Following an extended period of “head burying”, most property fund managers are bracing themselves for material negative valuer adjustments across their portfolios (with the potential exception of retail which has already been massively discounted). This trepidation is clearly derived from the escalating impacts of the war in Ukraine, spiralling inflation, rising interest rates, looming recession in both the US and across the EU, and now the calamitous UK economic situation. However, there is one area of the property market where the impact of these issues will be magnified and, to add to its woes, systemic shortfalls exposed which have been historically overlooked. This is the area of non-ESG (environmental, social and governance) compliant offices, many of which are already on their way to becoming “stranded assets”.

If a building does not meet ESG requirements and the cost of improving it to satisfy these exceeds the required market return, the building in question can be considered a stranded asset. In the valuers’ defence, the office occupational market has been very slow in adjusting to the environmental agenda

Until relatively recently very few valuers were appropriately differentiating between offices that could satisfy occupier ESG requirements and those that could not. This is especially the case for those perceived “modern schemes” constructed in the past 10 years but whose energy conservation specification does not satisfy the 2017 Part L building guidelines — the effective start of the nZEB (nearly zero energy building) standards. Even if ESG upgrades were accounted for, the costs being applied were often only a fraction of the reality. These costs, which include the likes of glass/facade replacement, plant enhancement/replacement, electrical hardware upgrades, new BMS (building management systems), PV (photovoltaic) installation, rainwater harvesting and general water conservation initiatives are now materially higher and rising.

A scarcity of materials and competition for labour and expertise is unlikely to see these costs abate in the next few years as the scale of the issue becomes apparent. The Bannon office team estimates than less than 15 per cent of Dublin’s current office stock is actually ESG compliant.

In the valuers’ defence, the office occupational market has been very slow in adjusting to the environmental agenda, and rent is ultimately the primary driver of value. However, since the ramifications of the EU’s sustainable finance directive (adopted in April 2021) and the UK’s escalating Minimum Energy Efficiency Standards (MEES) have become clearer, and with various recent high-profile climate events driving public (and corporate) opinion, a sea change in attitudes has swept over the occupational market.

If we look back at this quarter’s office lettings, the transition in the market’s thinking is clear. There was almost 400,000sq ft of take-up in Dublin’s core central business district (Dublin 1, 2 and 4) with 86 per cent of this accounted for by ESG-compliant space. Clearly there is now a firmly established two-tier office occupational market in the city centre, namely ESG-compliant offices and the rest. Interestingly, from a further review of this quarter’s take-up, it is clear that ESG is still not a priority in the more “value-focused” suburban locations with a mere 15 per cent of the 275,000sq ft of take-up outside of Dublin 1,2 and 4 being ESG-compliant. However, the pressure on all occupiers is likely to intensify further in January 2023 when the rest of the taxonomy regulations — technical screening criteria (TSC) and regulatory technical standards (RTS) — and the second phases of financial services sector regulation and the FCA climate-related disclosure regime come into effect.

This will be particularly difficult for suburban assets to react to as the rent available in these locations is unlikely to be sufficient to support ESG retrofits.

The extent of this micro-sector’s woes doesn’t stop there either. The “latent carbon” movement is also upon us meaning that it will become increasingly difficult to knock down existing buildings. Increased density and height can support the economics of ESG which is often maximised by demolition. The increasing focus on preserving latent carbon will mean the best that will be on offer for these buildings is to be extended vertically and horizontally, which will have both structural and planning limitations. As a consequence, valuers are finally consulting their quantity-surveyor colleagues to determine the true scale of the issue. The “tic-tic” of the rollercoaster looks to be falling silent for this part of the market, and I’m not sure the current non-ESG compliant office owners will enjoy the ride to come.

There will however be a huge opportunity for those with the skills to efficiently transition these buildings back towards the institutional mainstream. In this regard, valuing and selling these assets will require an in-depth analysis of the true costs associated with bringing them up to standard. For some, the maths just will not work, while for others pursuing an alternate use may be the only avenue open to them.

The Croí Cónaithe scheme, which has had €450m earmarked for it over the next three years, is designed for the State to plug the gap between the cost of construction and the market value of apartments. It relates to certain areas where the sales price achievable is less than the costs of development.

The Croí Cónaithe scheme, which has had €450m earmarked for it over the next three years, is designed for the State to plug the gap between the cost of construction and the market value of apartments. It relates to certain areas where the sales price achievable is less than the costs of development.

Funding will be provided solely for build-to-sell developments with apartments to be sold to individual owner-occupiers rather than build-to-rent schemes. It is hoped that the initiative will kick-start apartment developments in unviable locations particularly for first-time buyers, single people etc.

A report titled ‘The Real Costs of New Apartment Delivery’ by the Society of Chartered Surveyors in January 2021 found that a typical urban apartment block of between five to eight storeys, could cost between €380,000 and €451,000 to build. The variance should largely consist of site value depending on location. Build costs at these levels are generally above the sales prices achievable for most locations throughout Ireland outside of prime Dublin residential addresses. These construction costs will have also risen significantly in the intervening period.

Such a scheme which would invariably increase supply and the mix of new residential units being supplied to the market should be welcomed by all stakeholders. However, the perception that developers will somehow benefit from the public purse will be a key criticism to counteract. An open book analysis of input costs for each participating scheme and a cap on developers’ profit may be one way to ensure a satisfactory outcome for the return on investment by the State.

Niall Brereton BSc MRCIS MSCI is a Registered Valuer and Director of Professional Services at Bannon

We asked our leading experts for their views on achieving a sustainable future for the Irish commercial real estate sector:

General Commentary from Executive Chairman Neil Bannon

Sustainability impacts everybody, whether it is investors securing the long-term value of their assets, corporate occupiers demonstrating their environmental credentials to clients and staff, retailers reacting to shifts in consumer demand or funding institutions protecting the security of their loan books. There is no part of the property market that is and will not be increasingly impacted by the move to a zero-carbon future. This realisation was the reason Bannon established EVIA 3 years ago; a consultancy business whose sole focus is the delivery of sustainable solutions to stakeholders in the commercial real estate sector. Since its inception EVIA, working hand in hand with the Bannon Management, Investment and Consultancy teams, has delivered dozens of sustainability projects including LED lighting projects, smart metres and energy monitoring, solar power installation and increasingly we are seeing demand from clients to provide an overarching strategy to put their entire relationship with real estate on a long-term sustainable footing.

Sustainability impacts everybody, whether it is investors securing the long-term value of their assets, corporate occupiers demonstrating their environmental credentials to clients and staff, retailers reacting to shifts in consumer demand or funding institutions protecting the security of their loan books. There is no part of the property market that is and will not be increasingly impacted by the move to a zero-carbon future. This realisation was the reason Bannon established EVIA 3 years ago; a consultancy business whose sole focus is the delivery of sustainable solutions to stakeholders in the commercial real estate sector. Since its inception EVIA, working hand in hand with the Bannon Management, Investment and Consultancy teams, has delivered dozens of sustainability projects including LED lighting projects, smart metres and energy monitoring, solar power installation and increasingly we are seeing demand from clients to provide an overarching strategy to put their entire relationship with real estate on a long-term sustainable footing.

The route to sustainability is both challenging and exciting. It can be costly and yet the alternative is much more expensive for stakeholders in the industry. By pursuing a sustainable strategy that coordinates zero-carbon delivery with valuation and asset management expertise, the journey can be efficient and ultimately profitable.

Retail from Directors James Quinlan and Darren Peavoy

Institutional owners have very much embraced the ESG agenda, retailers have been slower to embrace from a property occupancy perspective, but this is changing. There is a trend in Institutional owners delivering ESG improvements via refurbishment works in advance of new lettings in prime high street locations. We are now seeing this being followed by some of the major international brands that are taking leases on these properties where they are committing to BREEAM GOOD (and higher) fitouts. Retailers have been proactive in retrofitting energy efficient initiatives including new LED lighting to reduce energy usage and benefit from reduced air conditioning requirements due to the reduced heat generation.

Institutional owners have very much embraced the ESG agenda, retailers have been slower to embrace from a property occupancy perspective, but this is changing. There is a trend in Institutional owners delivering ESG improvements via refurbishment works in advance of new lettings in prime high street locations. We are now seeing this being followed by some of the major international brands that are taking leases on these properties where they are committing to BREEAM GOOD (and higher) fitouts. Retailers have been proactive in retrofitting energy efficient initiatives including new LED lighting to reduce energy usage and benefit from reduced air conditioning requirements due to the reduced heat generation.

Valuations from Managing Director Paul Doyle and Director Niall Brereton

The Bannon Professional Services team actively embraces and adheres to the latest RICS Valuation Practice Guidance Note titled ‘Sustainability and ESG in Commercial Property Valuation and Strategic Advice’ when undertaking valuation instructions. This Guidance Note requires the valuer to demonstrate how they have considered sustainability and ESG credentials in their valuation approach, calculations and commentary. It may be necessary, depending on the nature of the instruction, for the valuer to seek specialist investigations by a third party advising as to the ability and estimated cost to bring an asset up to modern standards. Valuing assets of this nature requires an in-depth analysis of the true costs associated with bringing them up to standard.

The Bannon Professional Services team actively embraces and adheres to the latest RICS Valuation Practice Guidance Note titled ‘Sustainability and ESG in Commercial Property Valuation and Strategic Advice’ when undertaking valuation instructions. This Guidance Note requires the valuer to demonstrate how they have considered sustainability and ESG credentials in their valuation approach, calculations and commentary. It may be necessary, depending on the nature of the instruction, for the valuer to seek specialist investigations by a third party advising as to the ability and estimated cost to bring an asset up to modern standards. Valuing assets of this nature requires an in-depth analysis of the true costs associated with bringing them up to standard.

Property Management from Director Ray Geraghty

Sustainability is a key focus of the Bannon Property Management team. The extent of our portfolio (150 assets) gives Bannon a unique position in the Irish marketplace to be leaders of change. At present there are a variety of ongoing projects across the portfolio which are focused on reducing energy consumption, reducing water consumption and reducing waste.

Sustainability is a key focus of the Bannon Property Management team. The extent of our portfolio (150 assets) gives Bannon a unique position in the Irish marketplace to be leaders of change. At present there are a variety of ongoing projects across the portfolio which are focused on reducing energy consumption, reducing water consumption and reducing waste.

Office from Divisional Director Lucy Connolly

Sustainability in terms of office design and construction has become a fundamental and determining factor for companies when acquiring office space. With corporate ESG agendas now firmly in place, what was once a consideration, is now a key component in the acquisition process, which in turn is leading to increased demand for prime grade A office accommodation.

Sustainability in terms of office design and construction has become a fundamental and determining factor for companies when acquiring office space. With corporate ESG agendas now firmly in place, what was once a consideration, is now a key component in the acquisition process, which in turn is leading to increased demand for prime grade A office accommodation.

Investment from Executive Director Rod Nowlan

ESG has permeated every aspect of real estate, but in many ways has been led by the Capital Markets sector. Well before the adoption in April 2021 of EU’s Sustainable Finance Directive, major real estate players were readying themselves for the impact of ESG in terms of putting in place procedures for collating information and assessing and adjusting their assets and portfolios. These institutions have either been acquiring or developing compliant assets while simultaneously selling assets which would fall foul of ESG regulations. Most smaller fund managers and private offices have now followed suite. Now that ESG goes to the heart of any asset due diligence, non-complaint assets have a difficult future ahead of them! There will however be huge opportunity for those with the skills to efficiently transition these buildings back to the institutional mainstream. In this regard, valuing and selling these assets will require an in-depth analysis of the true costs associated with bringing them up to standard.

ESG has permeated every aspect of real estate, but in many ways has been led by the Capital Markets sector. Well before the adoption in April 2021 of EU’s Sustainable Finance Directive, major real estate players were readying themselves for the impact of ESG in terms of putting in place procedures for collating information and assessing and adjusting their assets and portfolios. These institutions have either been acquiring or developing compliant assets while simultaneously selling assets which would fall foul of ESG regulations. Most smaller fund managers and private offices have now followed suite. Now that ESG goes to the heart of any asset due diligence, non-complaint assets have a difficult future ahead of them! There will however be huge opportunity for those with the skills to efficiently transition these buildings back to the institutional mainstream. In this regard, valuing and selling these assets will require an in-depth analysis of the true costs associated with bringing them up to standard.

Why is the real estate sector being targeted to improve its environmental sustainability? The big numbers speak for themselves. It is the industry’s responsibility to improve these statistics. At Bannon we are proactively working to improve the environmental performance of Ireland’s Commercial Real Estate Sector.

As per the SCSI / RICS Code of Practice definitions, service charges in commercial property enable an owner to recover the costs of servicing and operating a property. This is for the benefit of the occupiers and users of the services and facilities provided within the property.

The service charge arrangement is dictated by the lease of the property and presents what responsibilities fall to the service charge regime and what responsibilities fall to the occupier.

One of the key roles of the Bannon Property Management team is compiling the annual service charge budgets for the assets under our management. When doing this work, we are conscious of the impact service charge regimes have on occupiers and owners. If the budget is set too low, cashflow issues arise that affect the smooth operation of the asset. This can lead to a deterioration of the asset which will have numerous implications for users, occupiers and owners. Alternatively set the budget too high and this impacts on the viability of occupiers to pay and ability to let units.

Having a high service charge per square foot also has an impact on the rental rates the owner can achieve. This in turn negatively impacts the asset value. Therefore, it is paramount that property managers are constantly reviewing, and tracking service charge spend. This is easier said than done.

When setting the 2022 service charge budgets in Q4 2021 no surveyor could have predicted the war in Ukraine and the subsequent disruption this would create in the world economy. It is hard to believe that the Russian invasion of Ukraine has resulted in the increase occupational costs for occupiers in Irish commercial assets!

Given the increase in operational costs worldwide since January 2022, most Irish commercial assets with service charge liabilities are looking at a balancing charge at the end of the year. This is when annual service charge expenditure has exceeded the annual budgeted figure. This is due to service charge budgets being set before an escalation of the War and subsequent impact on the global economy.

The current landscape is substantially different to when we were setting 2022 service charge budgets. With the ongoing energy crisis and global economic conditions, setting 2023 service charge budgets will be more challenging than ever. Significant increases in energy costs coupled with construction costs increasing by 14% over the past 12 months according to the SCSI’s construction cost index (July 21-June 22) have created these challenges. The addition of ERO (Employment Regulation Order) increased hourly rates for cleaning and security professionals, combined with these challenges, means that we are dealing with a perfect storm.

it is imperative that the property manager strikes a balance between having a sustainable and affordable service charge budget, but to also ensure there are funds to maintain the common areas.

This is a fine balance and Bannon predicts service charge regimes will increase significantly in 2023. This will lead to hard choices for asset managers and owners. As market leaders, Irish-owned Bannon manages multiple commercial assets including shopping centres, retail parks and offices throughout Ireland. We have significant experience in setting and managing service charge budgets, helping our clients find this balance.

Author: William Lambe, Divisional Director, Bannon

Date: 5th October 2022

Transport is the number one contributor to the Bannon carbon footprint. The scale of our extensive nationwide portfolio means that staff accumulate a significant number of kilometres traveling to meetings, site visits and commuting to the office.

Our Sustainability Subcommittee actively promotes the use of sustainable transport options. Dublin City Council bikes, electric scooters, the bike to work scheme and tax saver public transport tickets are all made available to the Bannon team. And it starts at the top! Managing Director Paul Doyle and Executive Chairman Neil Bannon are regularly spotted leading the charge around Dublin city.

Bannon’s latest monthly Retail Pulse has now gone live. In this publication Neil Bannon shares some insights into the ongoing decline of online fast fashion retailers and Darren Peavoy focuses on the rebound in footfall levels which has been seen in Dublin City Centre.

Bannon’s latest monthly Retail Pulse has now gone live. In this publication Neil Bannon shares some insights into the ongoing decline of online fast fashion retailers and Darren Peavoy focuses on the rebound in footfall levels which has been seen in Dublin City Centre.

To view the full report, please click here.

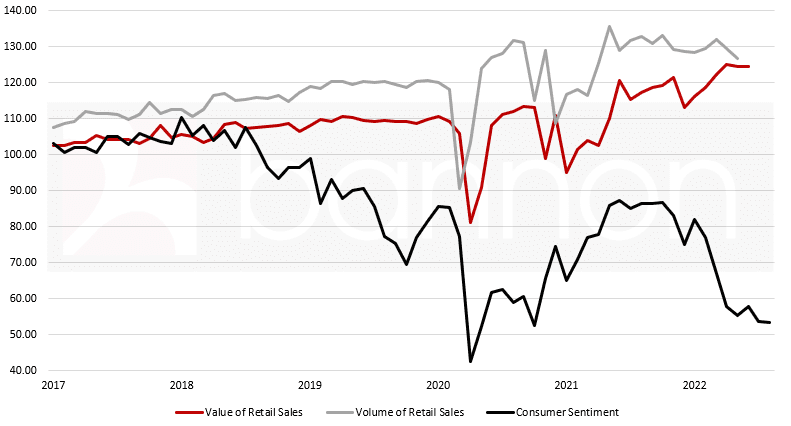

Predictably Irish Consumer Sentiment has dropped significantly in the face of an onslaught bad news; interest rates up, cost of living crisis, energy bills and the ongoing War in Ukraine. What will be interesting to watch is how this drop in sentiment manifests itself in retail sales.

Predictably Irish Consumer Sentiment has dropped significantly in the face of an onslaught bad news; interest rates up, cost of living crisis, energy bills and the ongoing War in Ukraine. What will be interesting to watch is how this drop in sentiment manifests itself in retail sales.

To date year on year retail sales have held up well. Expect to see a divergence in performance across the retail sector as consumers prioritise certain spend categories over others. Sectors which are particularly sensitive to energy costs and and are in the highly discretionary spend segments will likely suffer the greatest squeeze whilst need based spending should hold up well based on strong demographics.

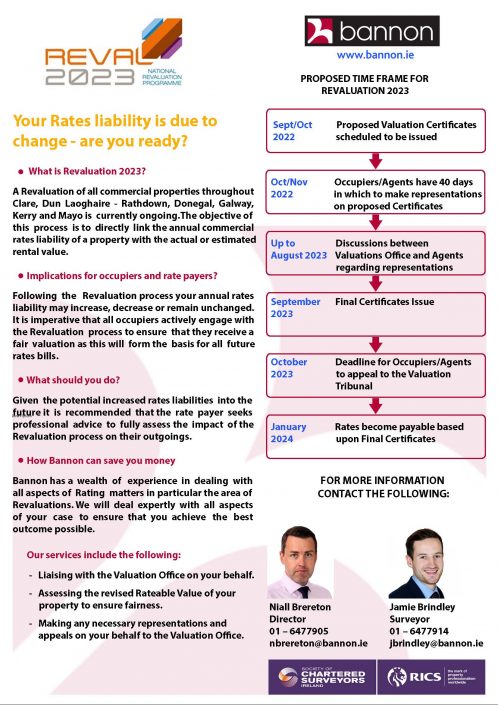

Revaluation 2023 is about to get underway in earnest with Proposed Valuation Certificates due to issue to ratepayers in the coming days.

Revaluation 2023 is about to get underway in earnest with Proposed Valuation Certificates due to issue to ratepayers in the coming days.

Bannon has significant expertise in achieving substantial savings on behalf of ratepayers across the full spectrum of commercial real estate.

What is a Community Shopping Centre?

What is a Community Shopping Centre?

Community Shopping Centres are characterised by a large supermarket anchor usually occupying over 50% of the scheme’s floor area. The balance of occupiers is typically complimentary or ancillary to the grocery offer, providing daily and weekly convenience needs to serve the local catchment such as butcher, pharmacy, coffee shop etc. These offers typically include local services, food & beverage, and high-frequency of purchase, low-cost retail products. While fashion offers may be included, these will generally be dependent on the catchment and competitive environment. Community Shopping Centres do not have the quantum of space compared to larger schemes to support a destination comparison or fashion led retail experience.

How did COVID impact on these centres?

The impact of COVID retail trading restrictions had different effects on footfall levels between shopping centre categories. The prevalence of essential retail uses within Community Shopping Centres meant the impact was relatively minor. Footfall levels stayed at 80% of pre COVID levels in 2019 and turnover, in many cases, increased as physical retail spend was funnelled into essential services and products only. Comparison led schemes by contrast saw a drop of 40% of footfall during the same period. While the dominance of essential retail in Community Shopping Centres served to preserve footfall during trading restrictions, there has been a significant recovery of footfall over the last twelve months. Footfall levels in Community Shopping Centres are now back to 93% of 2019 levels.

How will the increase in the cost-of-living impact these centres?

During periods of recession and high rates of inflation, households still require essential goods and services. An increase in the cost of goods or a decrease in available income will see a larger portion of household expenditure directed towards the purchases of these goods. The net effect is that there is less available spend for want and luxury type goods. As the retail offer in Community Shopping Centres is generally need-focused, these centres are well positioned to perform relatively well and maintain occupier sustainability in difficult market conditions. The reliance on local catchments with short journey times also bodes well for these centres as the increased cost of fuel feeds into decision making for shoppers.

The need-focused nature of many typical Community Shopping Centre occupiers positions this category of centre to hedge against inflationary or recessionary shifts in the retail property market.

Author: George Colyer, Surveyor, Bannon

Date: 14th September 2022

Bannon’s latest monthly Retail Pulse has now gone live. Our focus in this publication is on New Developments, where we identify a number of new retail schemes due for completion in the next 24 months. On our footfall monitor more positive trends feature with High Street footfall, by example, showing a 25% increase year on year.

Bannon’s latest monthly Retail Pulse has now gone live. Our focus in this publication is on New Developments, where we identify a number of new retail schemes due for completion in the next 24 months. On our footfall monitor more positive trends feature with High Street footfall, by example, showing a 25% increase year on year.

To view the full report, please click here.

August recorded a small but continuing drop in consumer confidence, to a 22-month low, as households prepare themselves for further price pressures according to KBC Bank Ireland. What is interesting is the mismatch between what Irish consumers are saying and what they are doing.

Retail sales which traditionally track consumer confidence with a short lag period, have remained robust and in recent times even grown whilst confidence has dropped.

The Bannon Dublin Office Market report is available now. Take up for the second quarter of the year reached 511,549 sq.ft. across 61 transactions, bringing the year to date figure to just over 1,000,000 sq.ft. A substantial increase on the same period last year, when just 232,523 sq.ft. of take up was recorded.

Market sentiment is improving quarter on quarter as demonstrated by an increase in take up and occupier demand, with over 1,300,000 sq.ft. currently reserved.

To view the full report, please click here.

Bannon welcomes The Warehouse Gym to Gateway Shopping Park, Knocknacarra, Co Galway.

The Warehouse Gym is a great addition to the shopping park and no expense was spared in its development.

The Bannon Retail Pulse July 2022 issue is now available. This month, our Executive Chairman Neil Bannon focuses on the juxtaposition between robust economic statistics and a persistently negative narrative. Read Neil’s commentary ‘The Most Depressing Boom’ on page 4.

The Bannon Retail Pulse July 2022 issue is now available. This month, our Executive Chairman Neil Bannon focuses on the juxtaposition between robust economic statistics and a persistently negative narrative. Read Neil’s commentary ‘The Most Depressing Boom’ on page 4.

To view the full report, please click here.

The H1 Bannon capital markets report is out now and worth a read as Roderick Nowlan feels certain sectors are passing an inflection point….

The H1 Bannon capital markets report is out now and worth a read as Roderick Nowlan feels certain sectors are passing an inflection point….

To view the full report, please click

Take up for Q2 was largely on par with Q1 of this year with 511,549 sq.ft. of office accommodation transacting across 61 deals, bringing the YTD take up figure to just over 1 million sq.ft. Whilst not back to pre-covid levels, demand in the marketplace continues with over 1.3 million sq.ft. currently reserved.

2nd Floor, IFSC House, Dublin 1 – IFSC House is a high-profile landmark building with stunning river views, offering a prominent corporate HQ opportunity in the centre of Dublin’s International Financial Services Centre. Extending to over 22,200 sq.ft. the 2nd floor office is available now by way of Sub-Lease or Assignment.

For further information contact Lucy Connolly or Ros Tierney on 01-6477900.

The combination of current and expected future demand for housing in Dublin’s commuter belt counties should see strong interest from investors and developers in the sale of a 12-acre land holding in Mullingar, Co Westmeath.

The lands, on the Dublin Road and just 700m from Mullingar town centre, are being offered to the market by joint agents Bannon and James L Murtagh & Sons on behalf of St Finian’s Diocesan Trust at a guide price of €2.75 million.

The subject holding surrounds the diocesan office, which the trust is retaining for its continued use, and is distributed across two parcels of land extending to a combined area of about 4.85 hectares (12 acres). The entire holding is zoned “Proposed Residential” in the Mullingar Local Area Plan 2014–2020 (as extended). An architectural feasibility study prepared by Altu Architects indicates potential (subject to planning consent) for the development of a housing scheme of about 116 units, comprising 27 two-bedroom houses, 35 three-bedroom houses and 54 four-bedroom houses.

While the lands have a sylvan setting adjoining St Paul’s Catholic Church, St Colman’s National School and Clonard House, they are near all the amenities of Mullingar.

Mullingar is a well-established commuter town and sits about 80km or a one-hour drive from Dublin via the N4 and M4 motorway. The town is also served by mainline rail services.

Niall Brereton of Bannon says: “This is a rare opportunity to acquire a development site in one of the most desirable residential locations within the Dublin commuter belt. Mullingar is a highly accessible town given its proximity to the N4 as well as Mullingar train station offering daily services to and from Dublin city centre. The subject land has terrific development potential, subject to planning permission, and will appeal to developers seeking opportunities to deliver new housing units in an area of high demand.”

Our June 2022 Bannon Retail Pulse is now available. This month, as well as keeping track on our indicators which continue to improve, we focus on Grafton Street. We forecast that current vacancy is likely to drop significantly as 2022 progresses with a further enhancement of the mix and offerings on our premier retail street.

Our June 2022 Bannon Retail Pulse is now available. This month, as well as keeping track on our indicators which continue to improve, we focus on Grafton Street. We forecast that current vacancy is likely to drop significantly as 2022 progresses with a further enhancement of the mix and offerings on our premier retail street.

To view the full report, please click here.

Managing 25% of Ireland’s Shopping Centres, our Property Management team is very proud of the scale and reach of our growing portfolio. On an ongoing basis, Bannon engages with various contractors to optimise user experience and maintain the appearance and accessibility across our retail portfolio. One such example is Gorey Shopping Centre.

A big thank you to everyone involved in recent projects, namely Arkomax (Refurbishment of Public Toilets & Installation of Parent & Child Facilities) and Breffni Group (Car Park Works). Also, a big thank you to the ever committed Niamh O’Byrne (Gorey Shopping Centre – Centre Manager).

TEAM – Together Everyone Achieves More!

The challenges faced by retail and the effects on performance metrics against the various Covid trading restrictions, have triggered the need to reconsider how retail assets should be categorised and considered. ‘Retail asset’ is a broad, all-encompassing term used to capture Shopping Centres, Retail Parks and High Street/Main Street Shopping. At Bannon, we have extensive data and performance metrics across these retail asset types. This information demands a rethink on how we talk about the sector. While property is inherently heterogenous, with each asset having its own idiosyncrasies, we can refine asset types based on shared and similar characteristics, which overall, relate to the role and function these assets play in their local catchment and community.

How various retail assets have reacted to and been affected by the restricted retail trading conditions that began in early 2020, have driven the need to re-categorise these assets. Areas considered include their ability to perform their function, the extent to which they remain functional against changes in market conditions and the characteristics of each scheme. This has provided a more focused approach that can be used to better inform sustainable tenant mixes and pricing analysis. It is through our ability to combine analysis with Bannon’s unique data insights, that we endeavour to display thought leadership in the commercial property market. Based on this, Bannon will release articles on Community Shopping Centres, Retail Parks and Shopping Parks and High Streets that discuss the drivers that shape and influence key areas. They include their footfall, the opportunities and challenges their occupier mix face against emerging market trends and the role and function of these asset types within the market.

Watch out for this series of articles over the summer.

Author: George Colyer, Surveyor, Bannon

Date: 20th June 2022

The Bannon Retail team is acquiring stores on behalf of national and international retailers with a variety of use categories including Card Factory, Lush, Pret A Manager, Eason, Jump Juice Bars, Matt Britton, McCabes Pharmacy, Tuthills, Gino’s and L’Ombre Hair & Beauty. As part of our work, we advise them on their rollout strategy across Ireland.

On meeting a potential acquisition client, we study the retailer to understand their brand placement and their customer profile. This together with other research allows us to accurately assess where best to locate them.

We secured the acquisition instruction for Smiggle (the Australian go to brand for school, lifestyle and stationery products) and by way of a sample case study we set out below the service provided and our contribution to a successful store roll out.

The Brief:

On successfully pitching our acquisition services, our brief from Smiggle was to provide a full service in identifying new store locations and negotiating lease terms on their behalf.

Stage 1:

Smiggle was a new entrant to Ireland. We began by educating them on the current economic climate, the retail market within Ireland and the retail hierarchy across the country. Leasing structures in Australia are quite different to those commonly used in Ireland. We prepared a detailed presentation on the standard leasing terms in Ireland to include lease length, owner and occupier renewal rights, upwards downwards rent reviews, break options and sub-letting terms. We also assisted them in securing a legal team to represent the company in Ireland.

Stage 2:

Understanding the retailer’s model, we used our expertise to advise where their initial focus should be placed for unit acquisition. We completed a table of target locations and collated an individual pack on each detailing footfall, scheme size, current retailers, available units and sample costs. We toured the Country with them and agreed the target towns and cities where they wished to secure representation.

Stage 3:

We began searching for suitable available units within the agreed target locations. We commenced negotiations and proceeded to agree rental terms, tenant incentives, lease structure, break options and additional tenant specific requirements. On finalising terms, we assisted the legal team in bringing the lettings to lease signing. We assisted them in appointing a fit-out contractor and liaised with the team to provide unit plans and the technical information required to prepare fit out drawings for owner approval.

Outcome

Smiggle saw a stronger opening in Ireland than in any other territory they trade in. The conclusion to the roll out strategy saw the opening of stores in Dundrum Town Centre, Blanchardstown Town Centre, Swords Pavilions, Ilac Centre, Mahon Point Shopping Centre, Crescent Shopping Centre and Winthrop Street in Cork.

Based on our understanding of the market and the Smiggle brand, our advice was an initial roll out of 5-10 store openings. We achieved this target, and the occupier was extremely pleased with our seamless acquisition strategy and the stores secured.

The Bannon Retail team specialises in both owner and occupier representation nationwide. We complete on average c. 170 retail transactions per year. Understanding the market is key whilst advising both owners and occupiers across their portfolio. We collect over 250 pieces of turnover data weekly/monthly, and we use this data and experience to maintain insight as the leading advisors to the retail market across the country.

Author: Jennifer Mulholland, Divisional Director, Bannon

Date: 15th June 2022

While the traditional retail sector continues to evolve in response to the challenges presented by the rise in online shopping and the questions posed by the Covid-19 pandemic, the presence of two of Ireland’s most successful and resilient brands as anchors coupled with significant rental income from a strong tenant line-up is expected to attract interest from both domestic and international investors in the sale of the Marshes Shopping Centre.

The Dundalk scheme — acquired by its current owners, American real estate firm Kennedy Wilson, for €44.5 million in 2014 — is being offered to the market by joint agents CBRE and Bannon at a guide price of €33.5 million.

Anchored by a 71,600sq ft Penneys and a 116,500sq ft Dunnes Stores (grocery and drapery), the Marshes Shopping Centre has consistently delivered robust trading and occupancy levels and proved resilient through the Covid-19 pandemic. The scheme is approaching a 100 per cent occupancy rate with its two remaining vacant units currently the subject of negotiations with prospective occupiers. Outside of its anchor tenants, the centre is generating a net operational income of about €3.4 million per annum from leading retailers including Boots, H&M, Eason and JD Sports. Some €400,000 of this income is being derived from the scheme’s surface car park, which also offers development potential according to the selling agents. The guide price of €33.5 million reflects a net initial yield of 9.2 per cent and a capital value of €233 per square foot.

Built originally in 2005 at a cost of €120 million, the Marshes Shopping Centre boasts a diverse national and international tenant mix including grocery, necessity retail, fashion, and food and beverage distributed across a lettable area (excluding anchors Penneys and Dunnes Stores) of 13,366sq m (144,000sq ft) on a site of 27.6 acres. The scheme has a prime location in Dundalk town and is widely regarded as one of the foremost retail centres for the wider northeast region.

In the short term, the investment offers the purchaser strong and sustainable rental income with multiple asset-management and income-growth opportunities including leasing up the remaining vacant space (last two units). There are a number of redevelopment options available also subject to planning permission, according to the selling agents.

Commenting on the sale, Roderick Nowlan, director at Bannon’s capital markets division said: “The acceleration of change within the retail sector, driven by Covid, has highlighted the strength of strong regional centres, especially those with robust grocery and necessity retail anchors as well as internet-resilient occupiers such as Penneys and Dunnes. The strong rent and service charge collection performance of this asset reflects this position.”

Kyle Rothwell, executive director at CBRE’s capital markets division, added: “We anticipate strong interest for Marshes Shopping Centre. The centre is performing exceptionally well and is supported by two very strong anchors and a complementary tenant mix. This scheme will appeal to those who are looking to complete short-term asset management and subsequently benefit from a fully let scheme.”

One of our recent Retail Pulse reports was referenced by David McWilliams in his article in Saturday’s Irish Times. The article suggests that one of the reasons for vacancy in the city centre is that Owners are demanding rental levels “priced to a pre COVID world” hoarding vacant property. The reality is very different, from a position of relative stability through 2018 & 2019 High Street rents dropped sharply, i.e. 40% by Q4 2020. They started to recover some of this loss in 2021 but are still down about 30% from 2019 levels. Current values on Grafton Street are just over half the level they were at the Celtic Tiger peak whereas values in every other real estate sector are now above their 2007 level. These are not my figures but are sourced from the MSCI Index.

One of our recent Retail Pulse reports was referenced by David McWilliams in his article in Saturday’s Irish Times. The article suggests that one of the reasons for vacancy in the city centre is that Owners are demanding rental levels “priced to a pre COVID world” hoarding vacant property. The reality is very different, from a position of relative stability through 2018 & 2019 High Street rents dropped sharply, i.e. 40% by Q4 2020. They started to recover some of this loss in 2021 but are still down about 30% from 2019 levels. Current values on Grafton Street are just over half the level they were at the Celtic Tiger peak whereas values in every other real estate sector are now above their 2007 level. These are not my figures but are sourced from the MSCI Index.

From the Bannon perspective we have recently concluded 3 deals on Grafton Street and are in active discussions on many more. I don’t share David’s pessimism on Dublin City Centre and expect to see a more diverse and cosmopolitan retail mix emerge over the next year as these deals come to fruition, perhaps even a “vivacious metropolitan centre”.

If you want access to data on the retail and other sectors, click here.

The new Large-Scale Residential Development (LRD) Process came into effect on the 17th December 2021 bringing to an end its much-debated predecessor the Strategic Housing Development (SHD) scheme which commenced in 2016. The primary aim of the SHD process was to fast-track planning applications for developments of over 100 residential units or 200 student bed spaces. While the primary aim of the LRD process remains the same as the SHD process, the major difference is that such applications will now be considered by the relevant Local Authority first rather than SHD applications which were lodged directly to An Bord Pleanála.

The LRD process can be broken into four distinct steps as follows:

I. Pre-Application (Section 247) Consultation with Planning Authority

8-week period of consultation with the relevant council.

II. LRD meeting with the Planning Authority and LRD Opinion

After the pre-application consultation, an LRD Meeting which is required to obtain an “LRD Opinion” concludes if “the proposal constitutes a reasonable basis for submitting an LRD planning application”.

III. LRD Application is Lodged

This must be done within 6 months of receiving the LRD Opinion.

IV. Decision

After the application is lodged the relevant Local Authority has 8 weeks to make a decision.

Following the decision of the Local Authority a right of appeal to An Bord Pleanála is available.

It is hoped that the reintroduction of the initial observation to the Local Authority and the subsequent appeal stage to An Bord Pleanála will help to reduce the large number of Judicial Review cases which have become prevalent in recent years. Furthermore, the initial consultations at local level should tease out contentious issues early in the application process. However, it remains to be seen at this early stage of the LRD scheme whether or not the revised process will result in lower levels of Judicial Reviews and assist with the delivery of much needed residential developments.

Author: Ronan Lavelle, Surveyor, Bannon

Date: 13th June 2022

The commercial rental market is on the cusp of significant change. The true impact of Section 132 of the Land Conveyancing Reform Act 2009 is now impacting all reviews. Learn how our highly experienced team can help you with your rent review.

The commercial rental market is on the cusp of significant change. The true impact of Section 132 of the Land Conveyancing Reform Act 2009 is now impacting all reviews. Learn how our highly experienced team can help you with your rent review.

To view the full report, please click here.

Hambleden House

19-26 Pembroke Street Lower

Dublin 2

D02 WV96

Ireland

»Map

Phone: +353 (1) 6477900

Fax: +353 (1) 6477901

Email: info@bannon.ie

| Title | Price | Status | Type | Area | Purpose | Bedrooms | Bathrooms |

|---|