With online shopping having come into its own following the unwelcome arrival of Covid-19, the sale by New York-headquartered Marathon Asset Management of three of Ireland’s best-known retail parks is set to test the post-pandemic appetite of investors for traditional bricks-and-mortar retail.

The Parks Collection is being offered to the market individually or as one lot by joint agents Cushman & Wakefield and Savills at a guide price of €78 million. The portfolio comprises Belgard Retail Park in Tallaght, Dublin 24, the M1 Retail Park in Drogheda, Co Louth, and Poppyfield Retail Park in Clonmel, Co Tipperary.

While the sale of the entire offers the prospective purchaser the opportunity to secure a collection of strongly-performing retail parks and an attractive net initial yield of 8.43 per cent, the portfolio’s assets are expected to see interest on an individual basis also.

Belgard Retail Park, for its part, is regarded as one of the foremost retail parks in the capital. Located on the Belgard Road in Tallaght and 11km from Dublin city centre, the scheme comes for sale fully-occupied and anchored by B&Q, the largest home improvement and garden centre retailer in the UK and Ireland. Other occupiers include Homestore & More, Dealz, Carpet Right, Halfords, Right Style Furniture, Burger King and Starbucks.

While the scheme currently extends to 12,728sq m (137,000sq ft) with 482 car parking spaces, it has planning permission for an additional retail warehouse unit of 2,404sq m (25,877 sq ft) over two levels with 1,409 sq m (15,166 sq ft) of ground-floor space and 995sq m (10,710sq ft) of retail warehouse/storage space at mezzanine level.

The total current rent is about €3.13 million per annum with a weighted average unexpired lease term of 7.3 years. B&Q contributes around 67 per cent of the income on a lease until 2028 with an upward-only rent review clause.

The M1 Retail Park is located 3km west of Drogheda town centre and just off the M1 motorway connecting Dublin and Belfast. It comprises a mix of retail, office and leisure accommodation extending to a total of 24,805sq m (267,000sq ft), along with 600 car-parking spaces. The majority of the development is taken up by retail and leisure (89 per cent) and is anchored by Woodie’s DIY who occupy 4,885sq m (52,585sq ft). The park’s other tenants include Smyths Toys, Sports Direct /Brand Max, Dealz, Equipet and EZ Living amongst others.

The total current rent is €2.44 million per annum with a weighted average unexpired lease term of 8.4 years. Woodies (with lease guarantees from Grafton Group plc) contributes around 40 per cent of the income on a lease until September 2030 with upward-only rent reviews.

The scheme also includes Mellview House, a four-storey building comprising 25,048sq ft of office space, a 30,483sq ft gym at ground floor, basement and mezzanine levels operated by Gym Plus and a number of other smaller retail units. Another building known as the Pavilion is home to Costa Coffee and TC Matthews with a recent new letting to Lanu Medi Spa.

An additional site adjacent to M1 Retail Park also forms part of the Parks Collection sale. The land extends to 27 acres and comprises three adjoining plots with proposed zoning under the Draft Louth County Development Plan 2021-2027 for three uses, namely ‘A2 New Residential’, ‘ C1 Mixed Use’ and ‘ B4 District Centre’.

99% occupied

Poppyfield Retail Park is located 2.5km from Clonmel town centre at the junction of the Cahir Road and the N24. Developed in 2004, the scheme extends to 12,821sq m (138,000sq ft) and comprises a mix of 14 retail warehousing units, a neighbourhood centre and 393 car-parking spaces. The park is 99 per cent occupied and anchored by Woodie’s DIY (with a lease guarantee from Grafton Group plc) and SuperValu. Other high-profile tenants include Harry Corry, Maxi Zoo, EZ Living, World of Wonder and DID Electrical. The neighbourhood centre is occupied by Costa Coffee, Sam McCauley, along with a hair and beauty studio and fish-and-chips operator. KFC also have a drive-through at the entrance to the park which does not form part of the sale.

The total current rental income is €1.43 million per annum and the weighted average unexpired lease term is seven years. Woodie’s and SuperValu contribute around 52 per cent of the income, and have seven and eight years remaining on their respective leases.

Marathon Asset Management acquired the M1 and Poppyfield parks originally as part of a larger portfolio in 2014, which also included The Park, Carrickmines; Lakepoint Retail Park, Mullingar; and the Four Lakes Retail Park in Carlow. Belgard Retail Park was acquired separately.

Marathon has undertaken significant asset management and phased disposal of these assets since then. The latest sale from its Irish retail portfolio was completed only this week and saw a private high net worth investor paying close to €7 million to secure ownership of Lakepoint Retail Park in Mullingar.

The scheme, which is anchored by Woodie’s DIY, is generating total rent of €516,000 per annum giving the purchaser an initial return of just under 7 per cent. The deal was brokered on Marathon’s behalf by Rod Nowlan of Bannon while Declan Bagnall of Bagnall Doyle McMahon represented the purchaser.

Article by The Irish Times

A disappointing quarter but our Capital Markets director

A disappointing quarter but our Capital Markets director

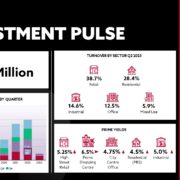

2023 was very much “annus horribilis” in terms of capital market’s activity. Concluding with a total turnover of €1.85 billion it represents the lowest level of activity since 2012. Clearly the pricing uncertainty brought about by the ending of the free money era, driven by a multitude of geopolitical and economic factors, has had the biggest effect.

2023 was very much “annus horribilis” in terms of capital market’s activity. Concluding with a total turnover of €1.85 billion it represents the lowest level of activity since 2012. Clearly the pricing uncertainty brought about by the ending of the free money era, driven by a multitude of geopolitical and economic factors, has had the biggest effect.

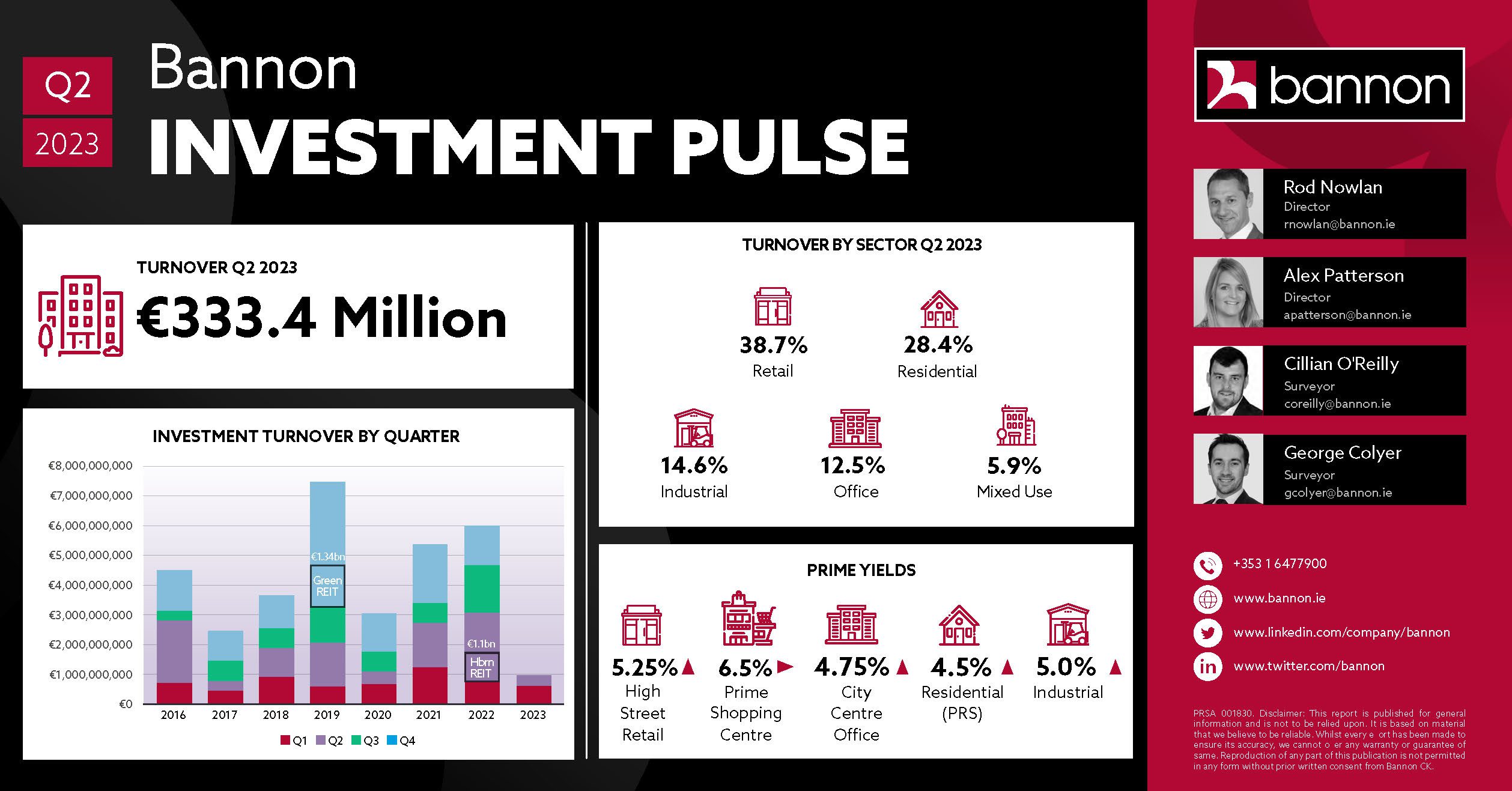

There were two key takeaways from this quarter’s Capital Markets figures. First and foremost, for the first time in almost a decade there were no material PRS transactions. The second was that two purchasers, specifically Davys and French Fund Corum, accounted for almost 50% of the entire quarter’s market turnover with the acquisition of 10 separate assets.

There were two key takeaways from this quarter’s Capital Markets figures. First and foremost, for the first time in almost a decade there were no material PRS transactions. The second was that two purchasers, specifically Davys and French Fund Corum, accounted for almost 50% of the entire quarter’s market turnover with the acquisition of 10 separate assets.

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/irishtimes/RD72OWG6Z5BTFCE3SO7DUQKALI.jpg)

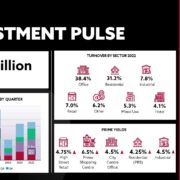

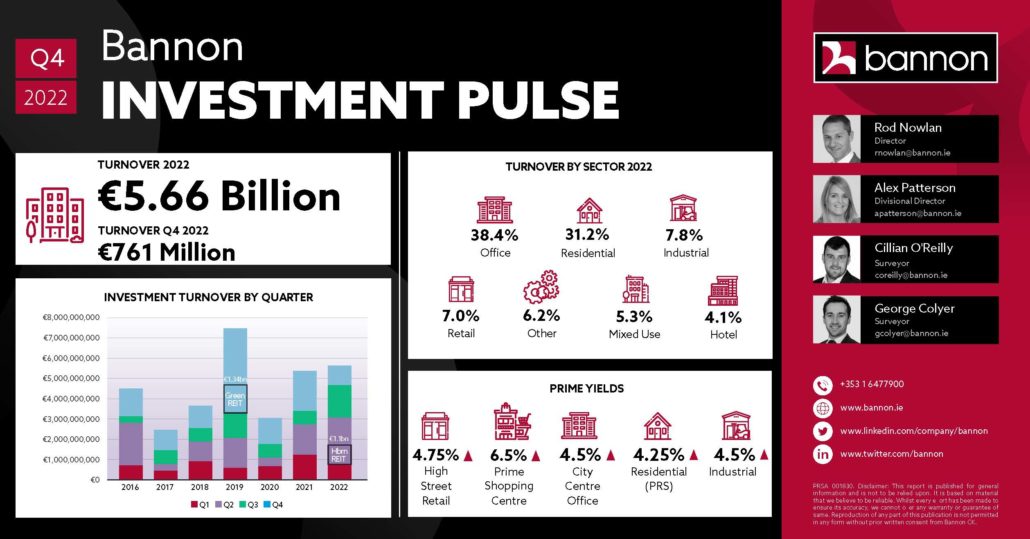

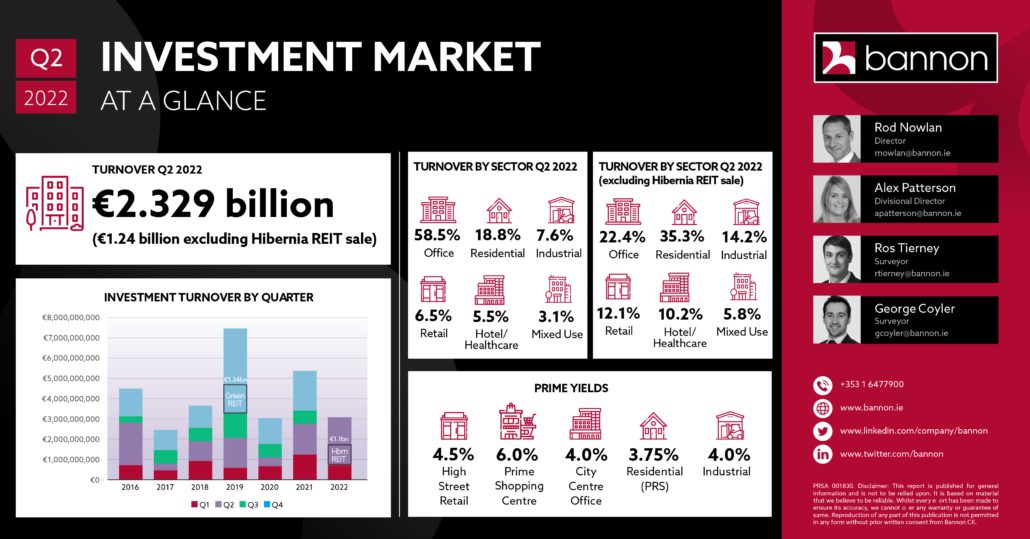

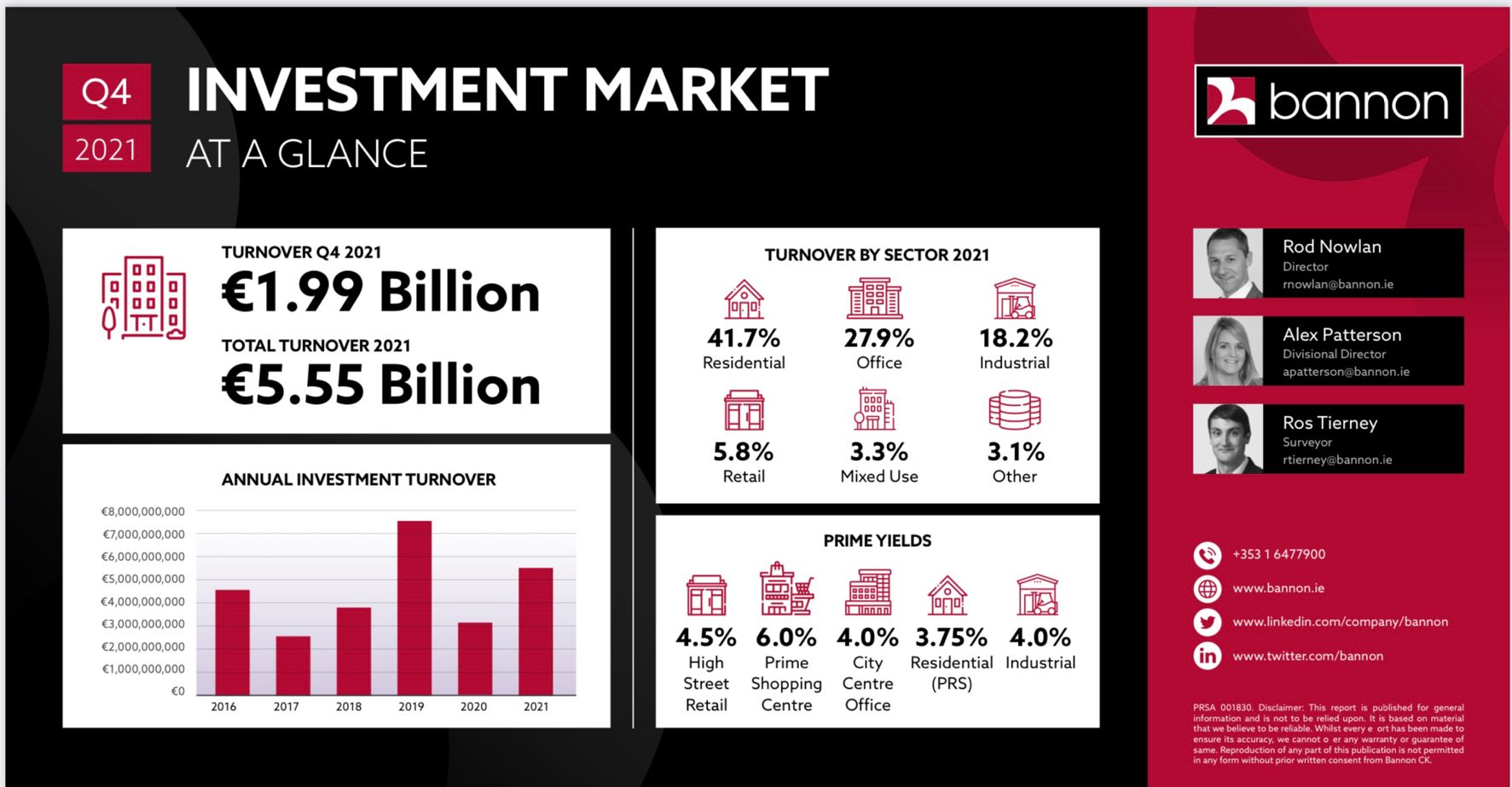

For the property sector, while one of strongest capital market years on record (second only to 2019), 2022 will be best remembered as the “year of reckoning”. A year where a mixture of macro-economic and geopolitical issues combined to commence rebasing the market following almost a decade of effectively zero interest rates, low inflation, and expansive monetary policies.

For the property sector, while one of strongest capital market years on record (second only to 2019), 2022 will be best remembered as the “year of reckoning”. A year where a mixture of macro-economic and geopolitical issues combined to commence rebasing the market following almost a decade of effectively zero interest rates, low inflation, and expansive monetary policies.

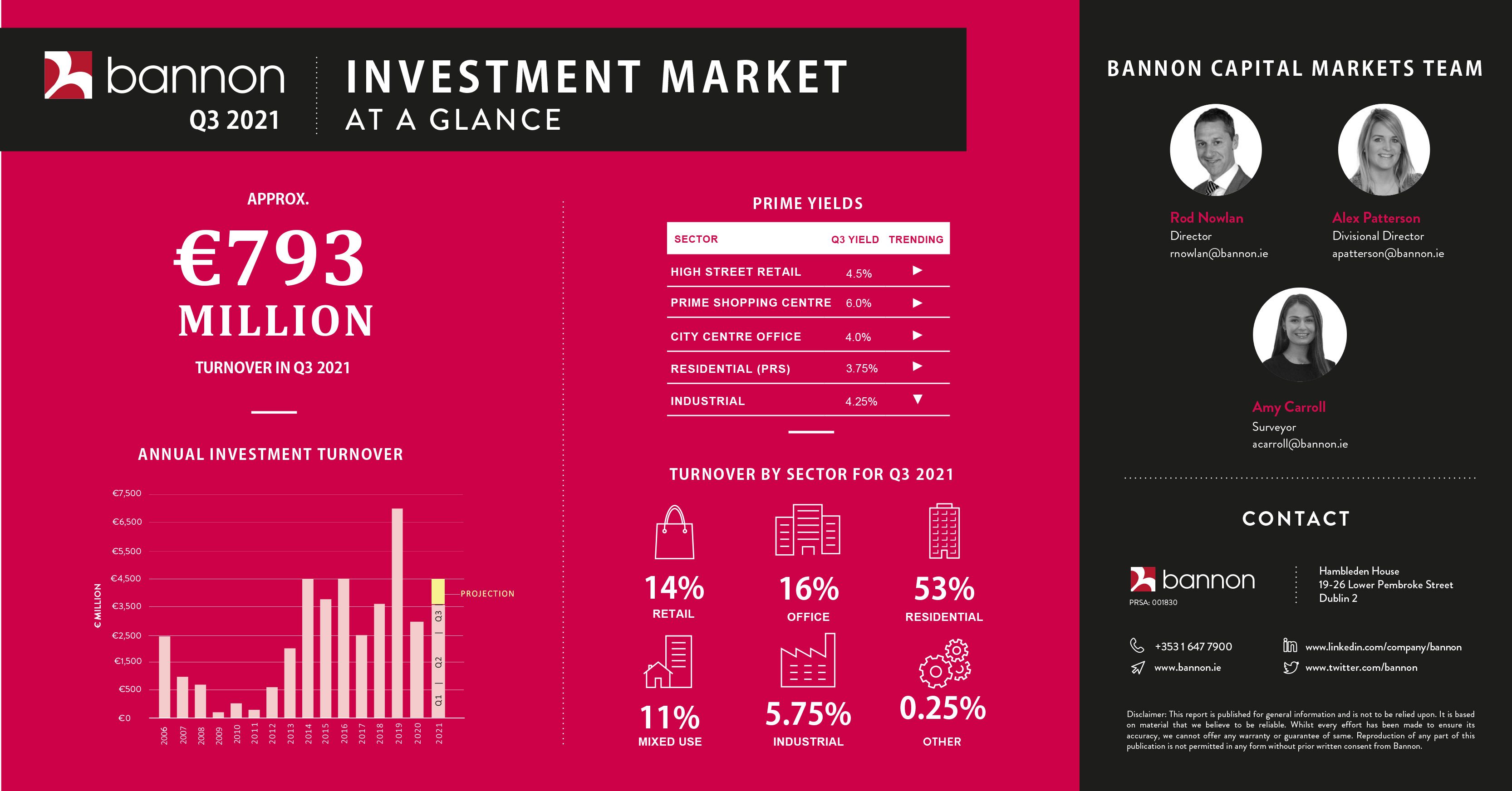

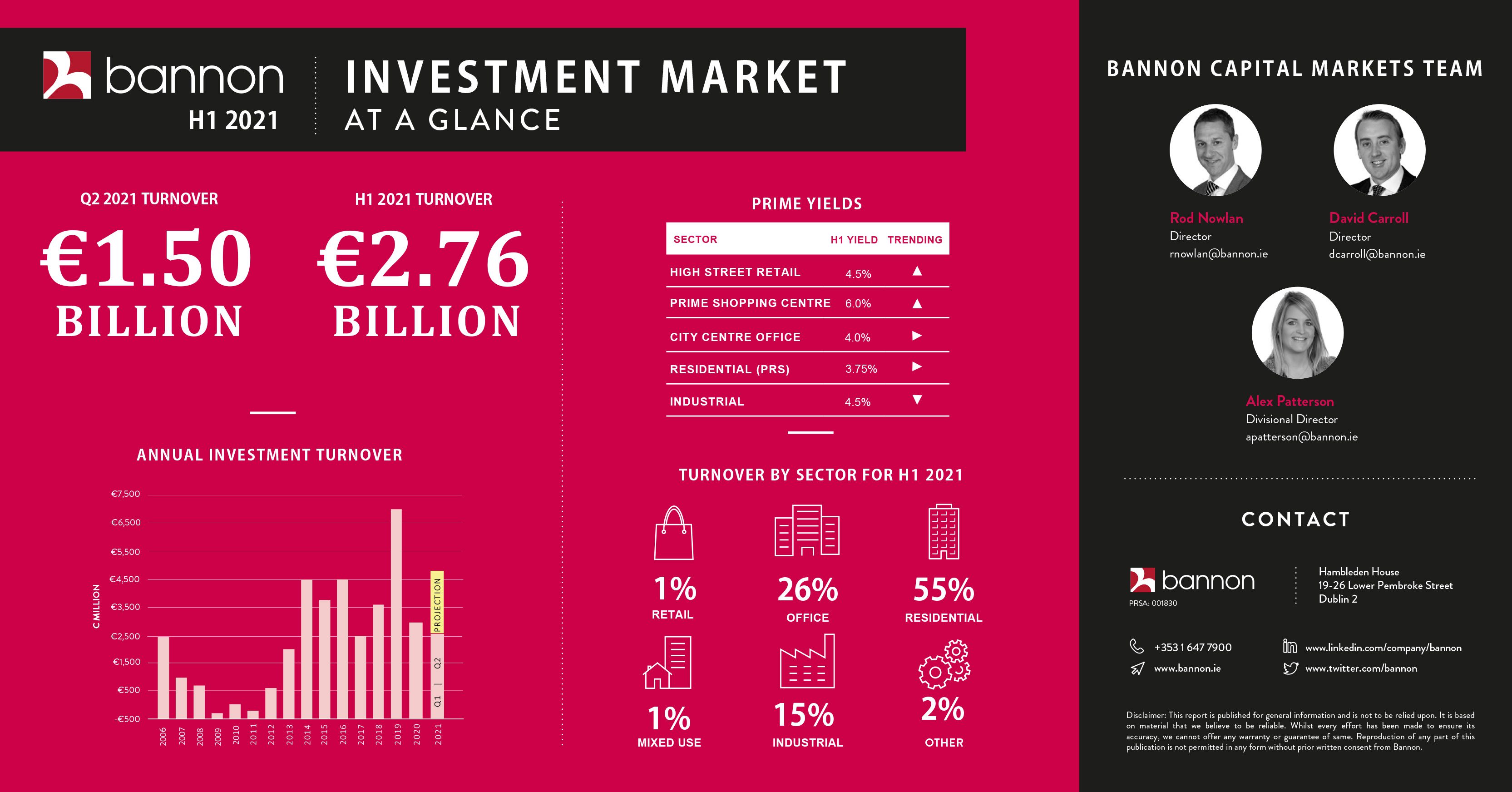

The H1 Bannon capital markets report is out now and worth a read as Roderick Nowlan feels certain sectors are passing an inflection point….

The H1 Bannon capital markets report is out now and worth a read as Roderick Nowlan feels certain sectors are passing an inflection point….

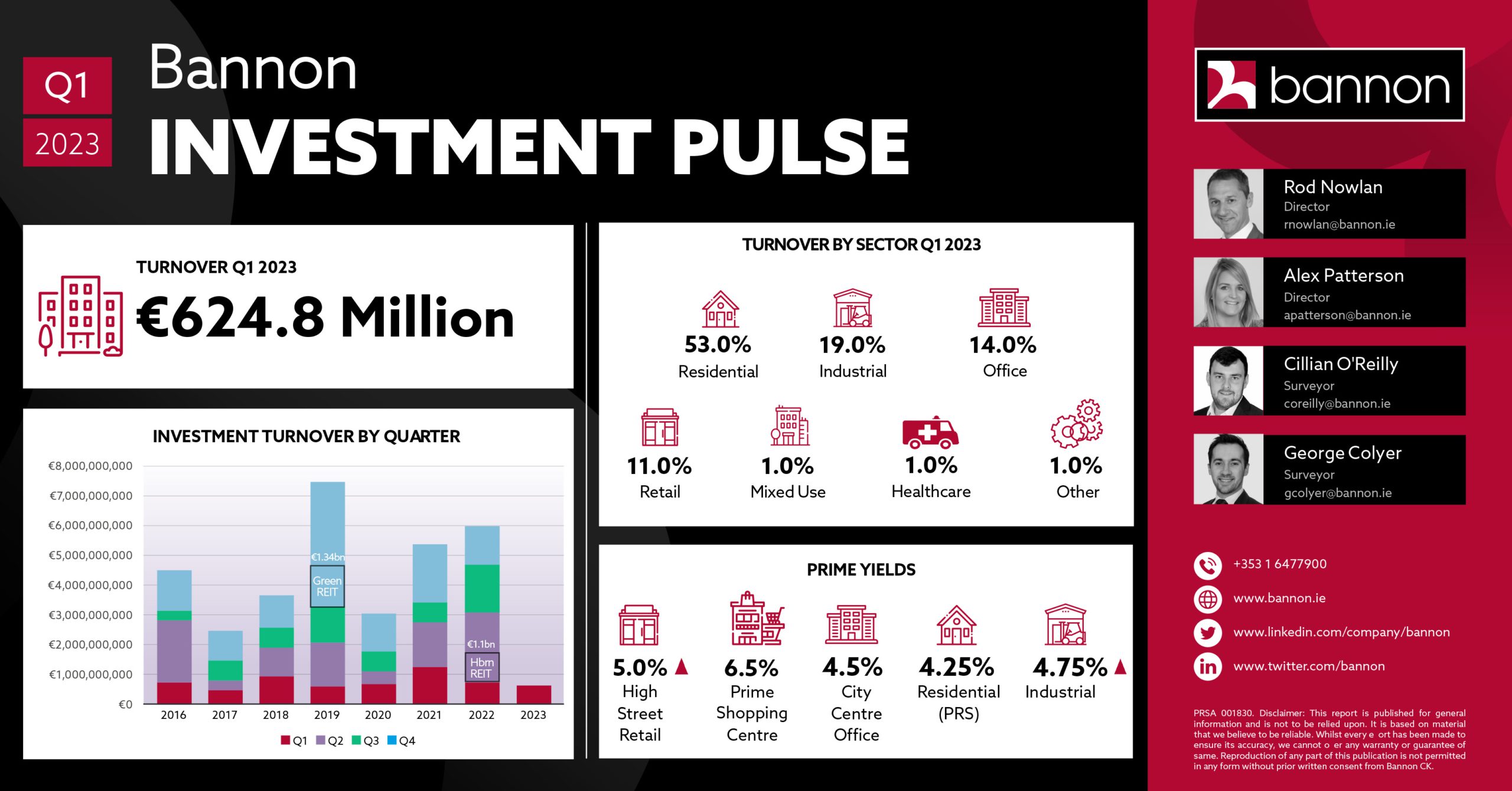

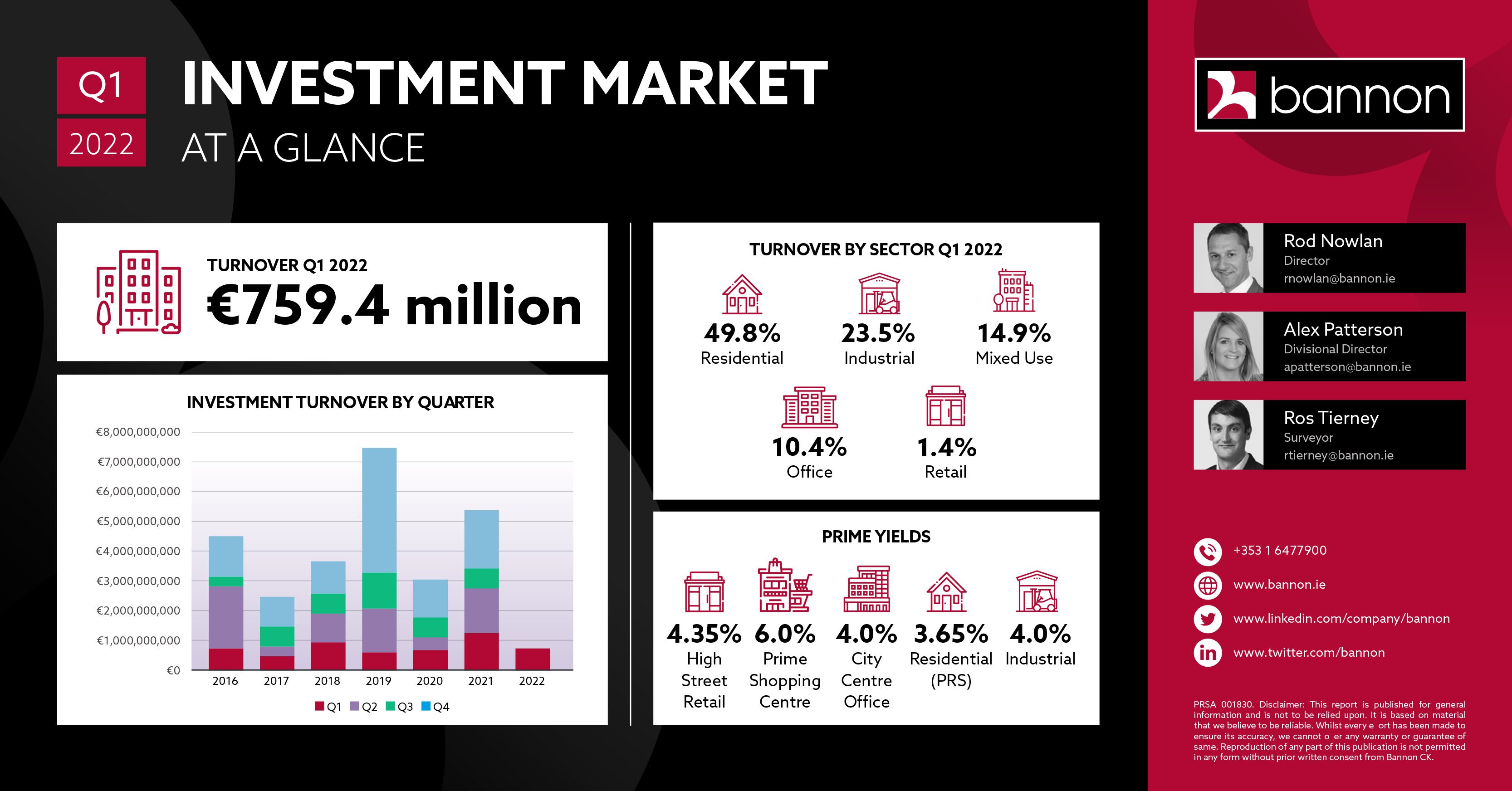

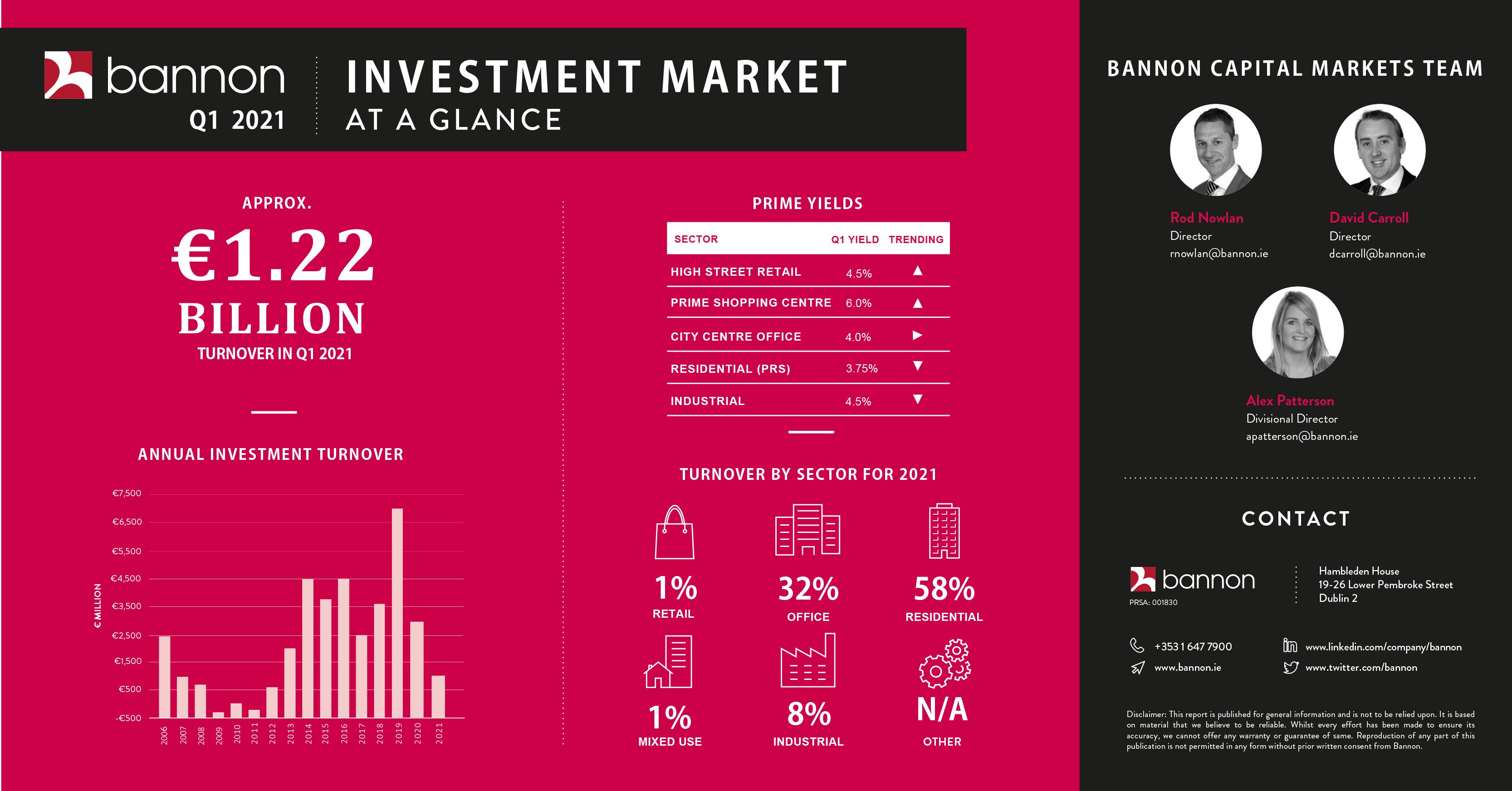

While it is still too soon to quantify the impact of the geo-political and macroeconomic backdrop on the Irish commercial property market, based on the Q1 figures and advanced pipeline transactions we anticipate that 2022 will still become one of only three years to record a turnover in excess of €5bn.

While it is still too soon to quantify the impact of the geo-political and macroeconomic backdrop on the Irish commercial property market, based on the Q1 figures and advanced pipeline transactions we anticipate that 2022 will still become one of only three years to record a turnover in excess of €5bn.

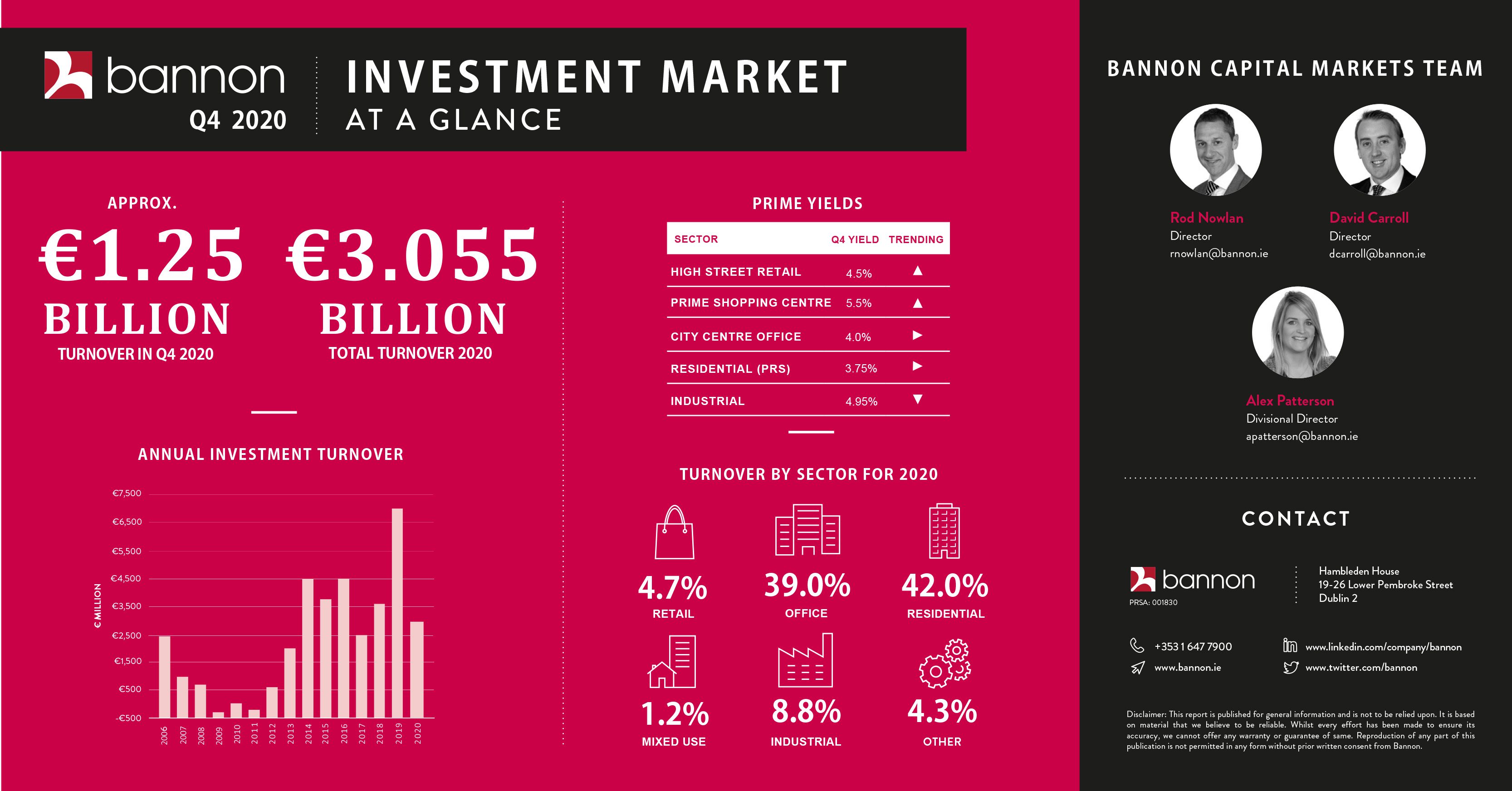

Last minute residential deal tips market over €3bn.

Last minute residential deal tips market over €3bn.

One of only a handful of independently-owned retail units at the highly successful Blanchardstown Centre has been brought to the market by agent Bannon at a guide price of €16 million.

One of only a handful of independently-owned retail units at the highly successful Blanchardstown Centre has been brought to the market by agent Bannon at a guide price of €16 million.