Unlocking Infrastructure Deadlocks – PANCR, Drogheda

The well documented log-jams associated with infrastructure delivery across the country, and the Greater Dublin Area in particular, have been the subject of much political discourse over the past number of months. Delays in delivering key pieces of infrastructure such as roads, waste-water treatment plants, electricity supplies etc. have stymied the construction of housing schemes which are required to address the country’s chronic housing shortage.

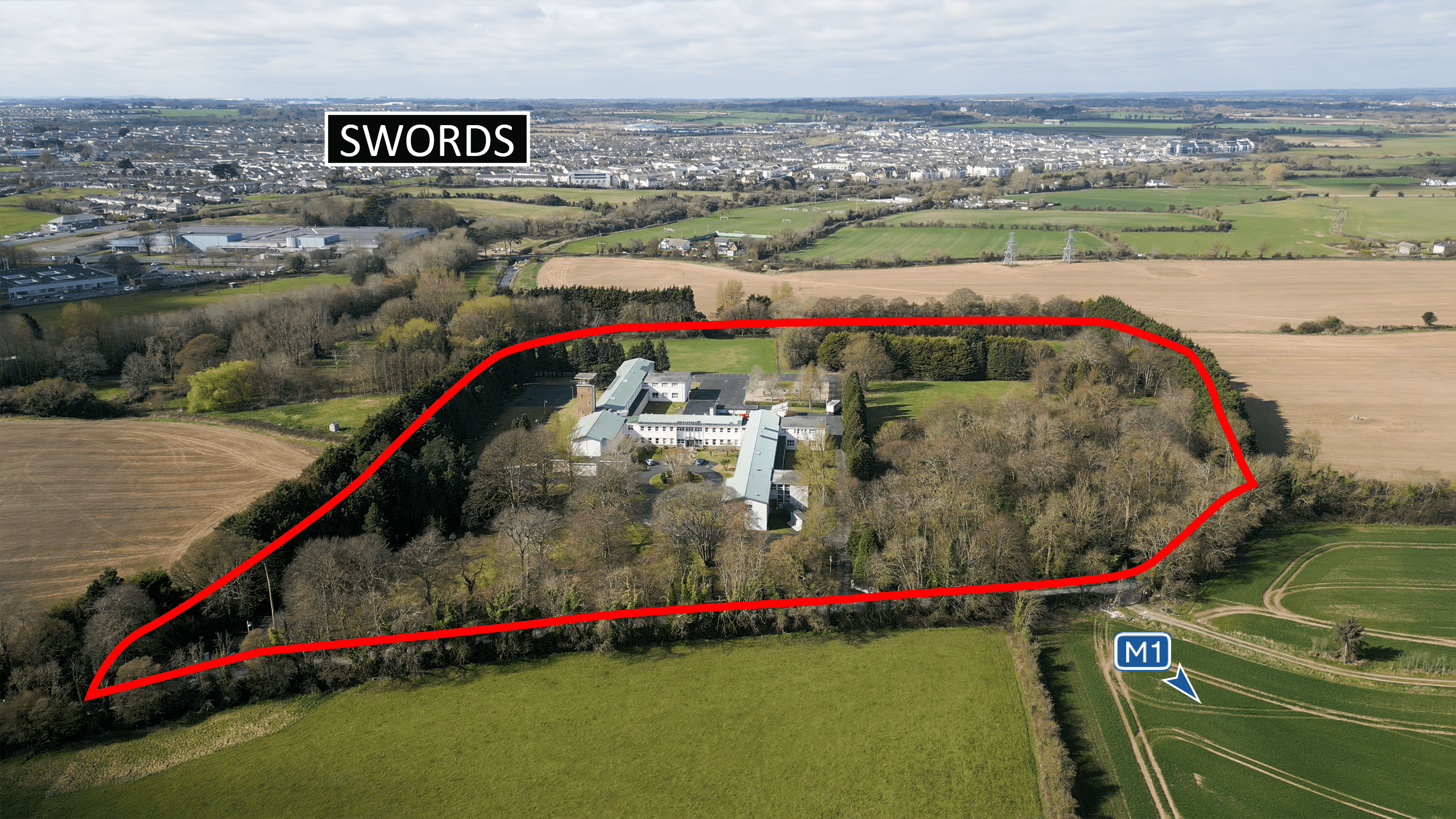

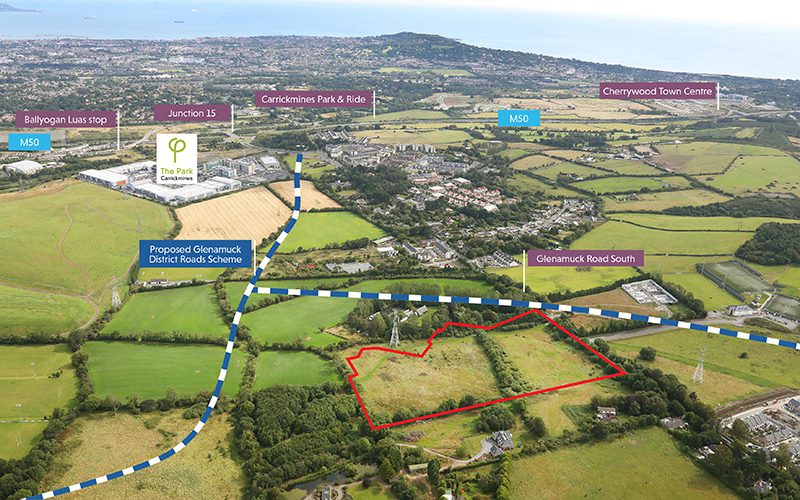

A notable example of where key infrastructure delivery can provide the catalyst for new housing delivery is the Ballymakenny area to the north-east of Drogheda, Co. Louth. In 2007, North Drogheda Development Partnership submitted a planning application to Louth County Council, seeking permission to develop 1,056 residential units across an 80-acre site at Ballymakenny, Drogheda, featuring a mix of houses, duplexes, and apartments.

While the global financial crash of 2008 stalled new housing delivery for a number of years, it was not until the completion of the first two phases of the Port Access Northern Cross Route (PANCR) in March 2024 that new housing developments on a substantial scale were enabled in this part of Drogheda. The PANCR, which had been approved but stalled for over a decade due to funding difficulties, was finally constructed by means of a public-private partnership through collaboration between Castlethorn, Louth County Council and HISCo (backed by the Ireland Strategic Investment Fund (ISIF).

Several developers are on-site delivering new residential units in the area with some 5,000 new homes earmarked for the locality, largely enabled by the completion of this long-awaited orbital road. Castlethorn alone is in the process of delivering approximately 1,250 new homes in the area with over 800 units completed to date at Ballymakenny Park and Ushers Mill. Bannon has provided ongoing valuation advice to Castlethorn as part of the Part V requirements throughout the various phases of this scheme of development.

The Bannon Professional Services Team has considerable experience in providing Part V Submissions and Valuations to Local Authorities on behalf of developers of residential projects. Contact Niall Brereton, Director – Professional Services & Land, for an initial consultation.

Photo courtesy of Castlethorn