World Green Building Week 2025

![]() Following World Green Building Week, we’re proud to highlight some of the sustainable efforts taking place across our office portfolio and the positive impact they continue to have.

Following World Green Building Week, we’re proud to highlight some of the sustainable efforts taking place across our office portfolio and the positive impact they continue to have.

![]() Following World Green Building Week, we’re proud to highlight some of the sustainable efforts taking place across our office portfolio and the positive impact they continue to have.

Following World Green Building Week, we’re proud to highlight some of the sustainable efforts taking place across our office portfolio and the positive impact they continue to have.

From sustainability to community, we’re proud to highlight the positive change happening across our retail portfolio this World Green Building Week!

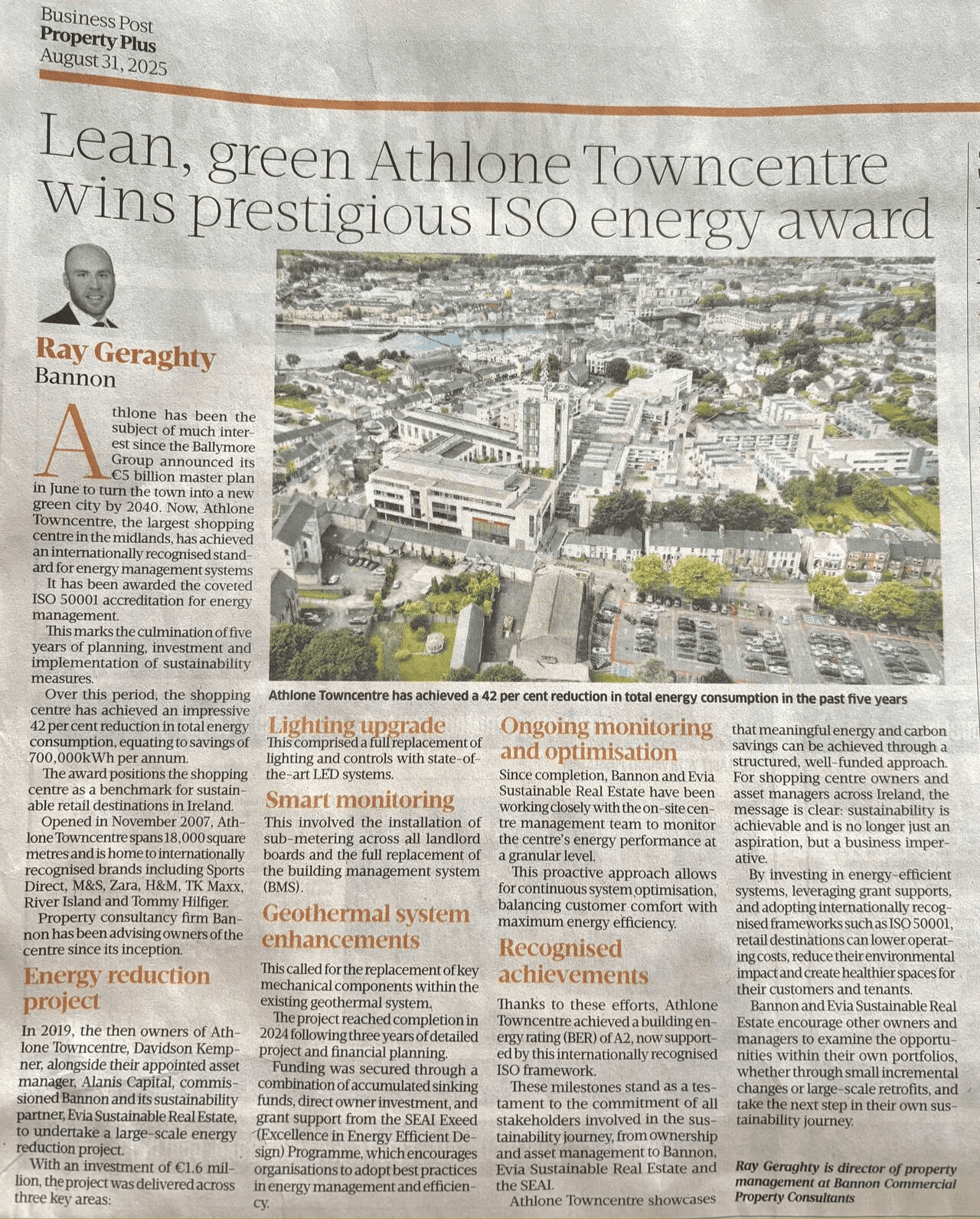

A big thank you to Tina-Marie O’Neill at the Business Post for covering this story in Sunday’s edition, with Ray Geraghty explaining that ‘this marks the culmination of five years of planning, investment and implementation of sustainability measures’.

We are excited to showcase the Cadenza building in Dublin, part of Bannon’s office portfolio, where sustainable design meets urban biodiversity. 🌿

Designed by Henry J Lyons Architects and LEED Platinum certified, this thoughtfully renovated space features a lush courtyard with a living wall by Living Walls, a tranquil water feature by Fountainworks, and landscaping maintained by SAP Landscapes.

Bannon is proud to collaborate with these expert partners in creating a vibrant, eco-conscious workspace. With over 35% of the outdoor area dedicated to planting, accessible paths, and serene seating, Cadenza exemplifies how modern offices can promote wellbeing while supporting nature in the heart of the city.

We’re excited to share that our Sustainability Committee has brought some fresh life into the office with a lovely selection of indoor plants!🌷

Beyond just brightening up our workspace, they will serve as a daily reminder of our commitment to sustainability.

Even better — the plants were sourced from Enable Ireland’s Garden Centre in Sandymount, supporting a fantastic charity that provides services to children and adults with disabilities across Ireland🤝

The awards keep on coming for the Team in Swords Pavilions. The team had an extremely busy Friday last week collecting a number of awards. These include:

Sustainable Energy Authority of Ireland (SEAI) Energy Team of the Year

Fingal Chamber Business Award for Best in Climate Action

Fingal Chamber Business Award for Business of the Year (large / corporate)

The awards are in addition several others won this year by the team. Congrats to the team in Pavilions. The awards are testament to the fantastic work being carried out in the centre.

Photo taken from Swords Pavilions

Our Executive Chairman Neil Bannon is delighted to have the opportunity to address delegates at today’s SCSI PMFM conference. Neil’s presentation focuses on the longer term trends which impact the commercial real estate sector.

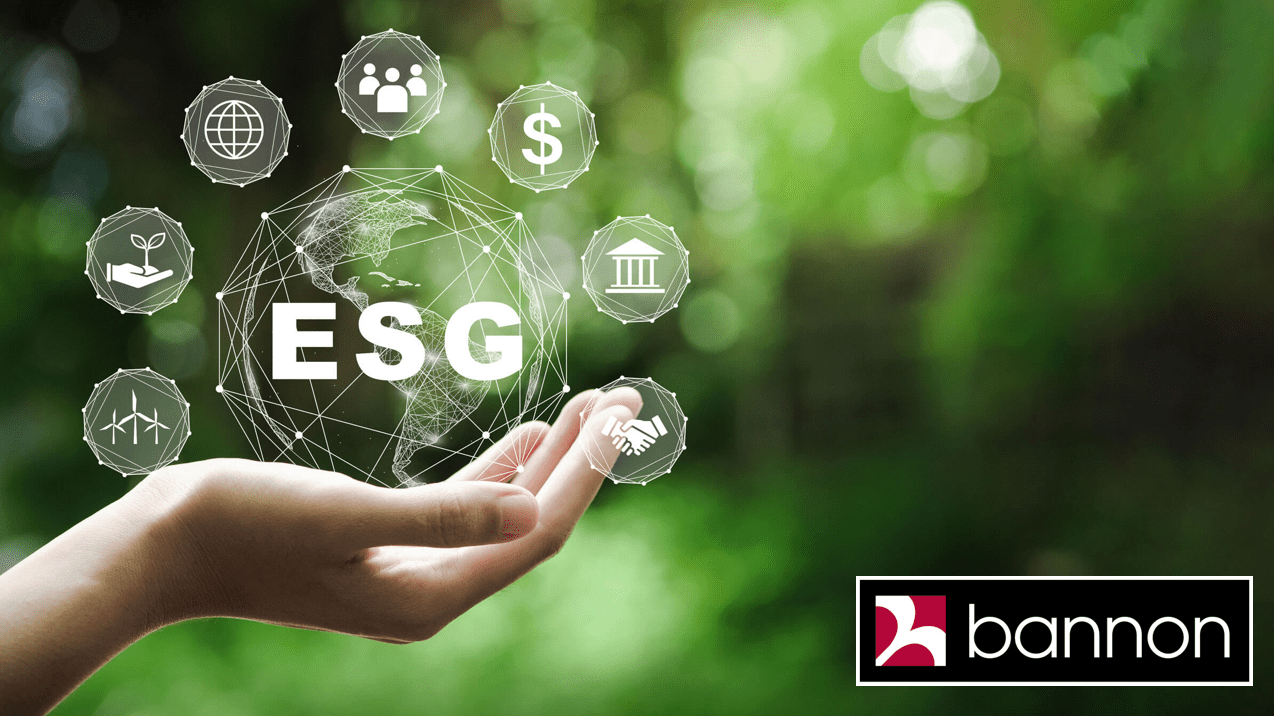

In recent years, some in the property industry have dismissed ESG as a buzzword or see it as a form of greenwashing. However, ESG has steadily emerged as a critical consideration globally in real estate. Now, Ireland is aligning with this global shift by implementing new legal frameworks aimed at reducing carbon emissions and fostering healthier, more sustainable buildings.

In recent years, some in the property industry have dismissed ESG as a buzzword or see it as a form of greenwashing. However, ESG has steadily emerged as a critical consideration globally in real estate. Now, Ireland is aligning with this global shift by implementing new legal frameworks aimed at reducing carbon emissions and fostering healthier, more sustainable buildings.

This shift is timely: according to the United Nations Environment Programme, buildings account for a staggering 39% of global greenhouse gas emissions annually. Reducing the carbon footprint of the built environment is vital, and there is growing demand across all sectors for corporate entities to take proactive steps in ESG reporting.

Voluntary sustainability certifications have gained significant traction among investors and asset managers seeking to enhance portfolio performance, particularly in terms of carbon reduction and sustainability. Leading organizations such as GRESB, BREEAM, and Fitwell provide frameworks that standardise and validate sustainability reporting across the real estate sector. Fitwell’s research revealed that nearly half (49%) of building owners are willing to pay a premium for properties that are accredited or demonstrate tangible environmental benefits. Similarly, GRESB’s annual ESG benchmark survey now has over 1,000 participating companies and funds. The U.S. Green Building Council found that LEED-certified buildings generate 34% lower CO2 emissions compared to non-certified properties. For both owners and occupiers, investing in these improvements is essential for futureproofing their assets and leases.

While many companies have voluntarily embraced ESG reporting, this landscape is rapidly changing. The European Union has introduced laws that make ESG reporting mandatory for businesses, asset managers, and property owners. The European Commission’s ‘European Climate Law,’ also referred to as the ‘European Green Deal,’ aims to make the continent climate-neutral by 2050. In support of this, the Corporate Sustainability Reporting Directive (CSRD) mandates sustainability reporting, starting with companies of 500+ employees and eventually extending to smaller enterprises.

At Bannon, in partnership with Evia Sustainable Real Estate, we leverage the power of data to help our clients navigate this evolving ESG landscape and achieve their sustainability goals. Our tailored approach begins with a comprehensive analysis of energy, waste, and water consumption across real estate assets. We specialise in delivering bespoke solutions for the collection and analysis of environmental data, designed to meet the specific needs of commercial real estate portfolios.

As ESG continues to reshape the real estate industry, those who embrace sustainable practices and reporting not only align with new regulations but also gain a competitive edge in an increasingly climate-conscious market.

Authors: Cillian O’Reilly, Chartered Surveyor, Bannon & Alison Manning, Graduate Surveyor, Bannon

Date: 9th September 2024

Our Chairman, Neil Bannon participated in an engaging panel discussion this morning at the Bank of Ireland Commercial Real Estate Breakfast Briefing on how sustainability will impact commercial real estate.

A thought provoking morning focusing on what needs to be done to address the challenge and how Bannon and Evia Sustainable Real Estate are here to help create more sustainable and resilient real estate assets.

A big thank you to Bank of Ireland Corporate and Commercial for hosting the event and for driving these essential conversations.

We at Bannon would like to congratulate Ian Hunter and the team at Swords Pavilions who have been shortlisted in the upcoming Sceptre Awards for Sustainability Initiative of the Year and Manager of the Year showcasing all the ongoing hard work in the centre.

Such a great achievement and we wish the team the very best of luck!

A 6.8% reduction in Ireland’s greenhouse gas emissions in 2023 marks another vital step towards a sustainable future. However, there is still a long way to go to achieve Ireland’s climate ambition of a 51% reduction by 2030. At Bannon, we are proud to contribute to this effort, reducing our carbon footprint by 29% in 2022 and achieving an additional 5% reduction in 2023.

Insightful discussions at this morning’s sustainability talk hosted by AIB. Alex Patterson got to hear from Goodbody Clearstream and Sustainable Energy Authority of Ireland (SEAI) on the importance of the 2030 targets and the crucial steps businesses should take to start their sustainability journey. This was followed by a panel discussion with owners of Brennan & Co. and Magee & Co. on where their businesses are on their sustainability journey.

Insightful discussions at this morning’s sustainability talk hosted by AIB. Alex Patterson got to hear from Goodbody Clearstream and Sustainable Energy Authority of Ireland (SEAI) on the importance of the 2030 targets and the crucial steps businesses should take to start their sustainability journey. This was followed by a panel discussion with owners of Brennan & Co. and Magee & Co. on where their businesses are on their sustainability journey.

We are proud at Bannon to share that since we embarked on our sustainable journey, we have reduced our carbon footprint by 78.7 tonnes.

Congratulations to Alison Manning on achieving her certification as a Fitwel Ambassador for Bannon. Joining the movement towards healthier, more sustainable spaces. Fitwel, a leading certification system promotes wellness in buildings and communities, fostering environments that enhance health and productivity. Alison is committed to applying this newfound knowledge in her role to contribute to creating a more sustainable environment.

Your Hour, Your Power! Staff at Bannon and properties across our nationwide management portfolio of shopping centres, retail parks and offices will be taking part in Earth Hour tomorrow, Saturday 23rd March, from 8.30pm until 9.30pm.

Earth Hour is a global awareness movement in which involves lights, appliances, plant, and other items being turned off for an hour.

Biodiversity is not only a cornerstone of healthy ecosystems but also plays a crucial role in enhancing the quality of life for local communities. As urbanisation and the built environment continue to reshape landscapes, integrating biodiversity into commercial assets can result in numerous benefits that extend far beyond environmental considerations.

In commercial assets biodiversity has a positive impact on local wildlife. Urbanisation tends to displace many species, but well-planned green spaces can serve as valuable habitats. Chirping birds, the buzzing of bees and the presence of butterflies contribute to a richer and more dynamic environment. This not only enhances the overall ecological balance but also fosters a sense of connection with nature among users. We in Bannon have seen this first hand where we have numerous assets involved in the All-Ireland Pollinator plan. We create a landscape in our assets where pollinators can thrive and restore pollinators populations to healthy levels. Pollinators are integral to all local ecosystems as they help fertilise flowers, crops and wild plants.

One of the primary advantages of promoting and integrating biodiversity in commercial assets is the positive impact on the overall well-being of the users. Green spaces with diverse flora and fauna provide recreational opportunities, offering users an alternative to the built-up environment many are now surrounded by. Access to natural environments has been linked to improved mental health, reduced stress levels, and increased overall happiness. Integrating biodiversity into retail and office spaces contributes to creating a more enjoyable user experience.

Adding greenery into commercial spaces enhances the aesthetic appeal of the area. Landscaping with a variety of plants, trees and flowers not only beautifies the surroundings but also creates a welcoming atmosphere. This visual appeal can attract more visitors to the commercial area, boosting footfall for occupying businesses.

In addition to the aesthetic and recreational benefits, biodiversity in commercial assets has tangible economic advantages. Green roofs not only provide habitat for plants and animals but also offer insulation, reducing energy consumption for heating and cooling within buildings. This, in turn leads to cost savings for the service charge and creates a more sustainable and economically efficient asset.

The promotion of biodiversity aligns with growing consumer preferences for sustainable and eco-friendly practices. Businesses that actively engage in biodiversity programmes and showcase their commitment to environmental responsibility are likely to attract environmentally conscious consumers. This creates a positive feedback loop where businesses, customers and the environment all benefit from a shared commitment to biodiversity.

Integrating biodiversity into commercial assets requires a multifaceted approach that yields numerous benefits for local communities, owners, and users alike. The importance of promoting biodiversity is undeniable. By recognising the interconnectedness of ecological health and prosperity, Property Managers can work together to create vibrant and sustainable commercial assets that benefit owners, users, and the environment.

The Bannon Property Management team manage a large portfolio of assets including Offices, Shopping Centres and Retail Parks in Ireland. We are actively implementing this multifaceted approach to biodiversity across our portfolio.

Author: William Lambe, Divisional Director, Bannon

Date: 6th March 2024

Today, 1st February 2024, marks the launch of Ireland’s Deposit Return Scheme.

Over recent months, retailers throughout our nationwide retail management portfolio have been installing reverse vending machines in anticipation of this momentous occasion.

The DRS represents a substantial step toward achieving a more sustainable future. In line with the Single Use Plastics Directive, Ireland must ensure the separate collection of 77% of plastic beverage bottles placed on the market by 2025, with a further increase to 90% by 2029.

We invite you to join us in championing a sustainable future.

The United Nations (UN) annual climate change conference, also known as the ‘Conference of the Parties’ or ‘COP’, brings together world leaders, ministers, and negotiators to agree on how to address climate change.

Since 1995, almost every member nation on Earth has come together in a different country each year, except for 2020.

The UN describes the COP as “the supreme decision-making body” of the United Nations Framework Convention on Climate Change (UNFCCC). It includes representatives of all the countries that are signatories, known as parties, to the UNFCCC. During each COP, the parties review the progress towards the overall goal of the UNFCCC: to tackle climate change.

The negotiating parties include governments that have signed the UN Framework Convention on Climate Change (UNFCCC), the Kyoto Protocol and/or the Paris Agreement. The COPs are also attended by thousands of representatives from civil society, the private sector, international organisations, and the media.

Why is this conference called COP28?

COP28 stands for the 28th Conference of the Parties to the United Nations Framework Convention on Climate Change

Where will COP28 be hosted?

The COP is hosted by a different country each year. COP28 will be hosted by the United Arab Emirates (UAE) and will take place between 30 November–12 December 2023 in Dubai.

Why is COP28 important?

It is hoped COP28 will help keep alive the goal of limiting long-term global temperature rises to 1.5C. This was agreed by nearly 200 countries in Paris in 2015. The 1.5C target is crucial to avoid the most damaging impacts of climate change, according to the UN’s climate body, the Intergovernmental Panel on Climate Change (IPCC).

Long-term warming currently stands at about 1.1C or 1.2C compared with pre-industrial times – the period before humans started burning fossil fuels at scale. However, the world is on track for about 2.5C of warming by 2100 even with current pledges to tackle emissions. The window for keeping the 1.5C limit in reach “rapidly narrowing”, the UN says.

UN Secretary-General Antonio Guterres called for the COP28 talks and agendas to close the climate ambition gap. He also stated that “Leaders can’t kick the can any further. We’re out of road,” condemning a “failure of leadership, a betrayal of the vulnerable, and a massive, missed opportunity. As the reality of climate chaos pounds communities around the world – with ever fiercer floods, fires, and droughts – the chasm between need and action is more menacing than ever.”

What are the key issues to watch at COP28?

For more information on COP28

https://news.un.org/en/story/2023/11/1143567

The Government aims to have 80% of Irish electricity come from renewable energy. As part of Budget 2024 a €380 million fund has been announced to help households with the green transition and reduce greenhouse gas emissions and energy bills. The doubling of the tax disregard in respect of personal income received by households who sell residual electricity from micro-generation back to the national grid will also promote the greening of the housing stock nationwide.

Bannon is proud influencing the greening of the Irish Commercial Real Estate Sector through the procurement 100% Green Renewable Energy across their Property Management Portfolio. In addition to this, Bannon works closely with our partner Evia – Sustainable Real Estate to implement green initiatives to reduce the carbon and improve the sustainability initiatives of commercial real estate assets across Ireland.

It is crucial to prioritise and establish a comprehensive water conservation strategy for any asset. Some factors to consider include:

The primary water conservation objective of an asset is to conserve a natural commodity. It is based on efficiencies like reduced flows, leak detection and the introduction of rainwater harvesting systems for non-potable use (e.g., toilets, general cleaning). Conserving water reduces the need for costly infrastructure expansion and maintenance, providing a positive impact on the environment and service charges.

Once you have developed and integrated water conservation, there is a secondary sustainable measure that can explored.

When we think about sustainability measures, several projects typically come to mind. Solar PV Panels, EV Charging Stations, LED Lighting, Rainwater Harvesting – the list goes on. Asset Managed Water Wells are one of the least utilised sustainability initiatives explored in Ireland. What a missed opportunity given the wet summer we just experienced!

Asset Managed Water Wells are renewable sources that have the potential to provide water to common area facilities such as toilets and tap water (not for consumption) in public spaces. Take shopping centres for example. There are a small number of shopping centres in Ireland that have implemented Asset Managed Water Wells, but why are more centres not doing the same? One barrier is that the drilling process on-site is not a simple option. The site must meet many conditions and most importantly, the drilling must find a water source.

Exploring the eligibility of your site is worthwhile. In line with a decision by the Commission for Regulation of Utilities (CRU) on non-domestic tariffs, a new set of national water and wastewater business charges came into effect on the 1st of October 2021. There has been no change to charges since 2014. Historically, customers would have paid charges based on their local authority. The newer system introduced four bands based on the level of usage. Having an Asset Managed Water Well on site would remove the need for public water which in turn would reduce water rates.

A well-developed and integrated strategy can be used in line with public water systems. This is a visionary objective that should be embraced to protect the long-term vulnerability of this natural resource. From a commercial perspective, the savings are significant.

Be a visionary! Talk to Evia Sustainable Real Estate or Bannon Property Management team in advance of your next budget year to discuss potential savings and projected payback.

Author: Aoife McGovern, Surveyor, Bannon

Date: 13th October 2023

Many thanks to Brian Leavy and the team in Thorntons Recycling for hosting some of the Bannon Property Management Team yesterday.

The Bannon team were given a tour of the Thorntons Recycling MDR (Mixed Dry Recycling) and SRF (Solid Recovery Fuel) facilities in Ballyfermot.

Thorntons Recycling operate on a zero to landfill basis which is in line with the Bannon sustainability aims and ethos. It was great for the Bannon team to see first hand, the process of how zero to landfill is being achieved.

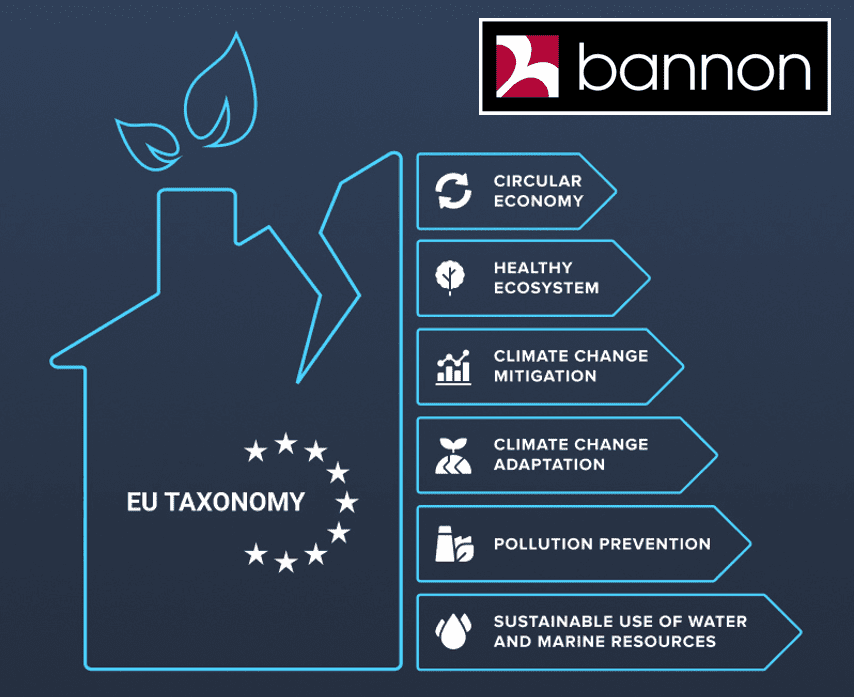

The European Union has taken a significant step towards promoting sustainability by introducing the EU Taxonomy Regulation. This ground-breaking initiative aims to provide a standardized framework for identifying environmentally sustainable economic activities. This article explores the EU Taxonomy, its significance, and the implications it holds for businesses and investors.

What is the EU Taxonomy?

The EU Taxonomy is a system that categorizes environmentally sustainable economic activities, offering clear and consistent guidance for sustainable investments. It helps investors and businesses align their financial choices with environmental goals and encompasses various sectors like energy, real estate, and agriculture.

Key Components of the EU Taxonomy

The Taxonomy focuses on six environmental objectives:

Each objective is accompanied by specific criteria that economic activities must meet to be classified as environmentally sustainable.

One of the core principles of the EU Taxonomy is the Do No Significant Harm principle, which ensures that an economic activity must not cause significant harm to any of the environmental objectives. This means that businesses seeking to be classified as environmentally sustainable must meet stringent criteria to avoid adverse impacts on the environment

Companies are required to disclose the extent to which their activities align with the Taxonomy’s criteria in their financial reporting. This transparency allows investors to make informed decisions about their investments based on environmental considerations.

Significance for Businesses:

Businesses that follow the EU Taxonomy can tap into a growing pool of sustainable finance opportunities, like green bonds and loans that are gaining popularity with investors. Compliance with the Taxonomy can help businesses secure funding from these sources. Moreover, adhering to Taxonomy standards showcases a commitment to environmental sustainability, boosting their reputation and attracting socially responsible investors and customers. It also helps businesses identify and minimize environmental risks, reducing their exposure to regulatory and operational challenges in a world that places a high value on sustainability.

Significance for Investors

Investors can make smarter choices by checking a company’s sustainability disclosures through the Taxonomy. This allows them to match their portfolios with their environmental, social, and governance objectives. Investing in Taxonomy-compliant companies can lower the risk tied to environmental issues and changing regulations. It also helps investors steer clear of investments that might become obsolete as the world moves toward a greener economy.

The EU Taxonomy is a crucial step in promoting environmental sustainability in finance and real estate. It offers a consistent way to identify eco-friendly activities, benefiting businesses and investors. As sustainability becomes more important, the Taxonomy will play a key role in changing how we invest and allocate capital, ultimately helping the environment. Using this framework can bring financial benefits and help create a more sustainable and resilient future for everyone.

Author: Cillian O’Reilly, Surveyor, Sustainability Manager, Bannon

Date: 14th September 2023

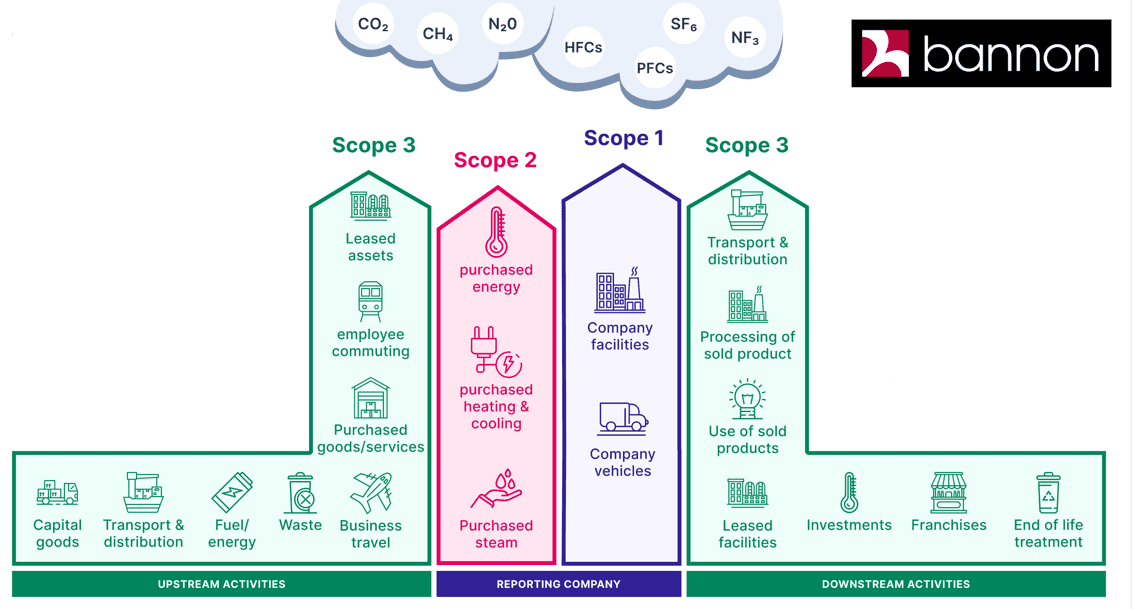

In the ever-evolving landscape of commercial real estate, sustainability is a paramount consideration. As we strive to reduce our carbon footprint and address climate change, understanding and managing greenhouse gas emissions is crucial for the industry’s future. In this article, we’ll explore how Scope 1, 2, and 3 emissions apply specifically to the commercial real estate sector and why they should be at the forefront of our strategies.

Scope 1 Emissions: The Building Blocks

Scope 1 emissions in commercial real estate pertain to direct greenhouse gas emissions resulting from sources owned or controlled by a property owner or occupier. These emissions are produced within the boundaries of the property and are directly tied to its operations. Common examples include emissions from on-site heating, cooling, and electricity generation systems, as well as emissions from owned or leased vehicles used for property maintenance and management. For the commercial real estate sector, tackling Scope 1 emissions can involve upgrading building systems for greater efficiency, transitioning to renewable energy sources, and implementing eco-friendly transportation options for maintenance and management teams. Reducing Scope 1 emissions demonstrates a commitment to environmental stewardship and can improve the marketability of properties.

Scope 2 Emissions: The Energy Equation

Scope 2 emissions are indirect emissions associated with the generation of purchased electricity, heat, or steam consumed by a commercial property. These emissions are linked to energy sources outside the property boundaries, such as the local power grid. In the real estate context, Scope 2 emissions mainly comprise the carbon intensity of the electricity used to power the building and its operations. To address Scope 2 emissions, property owners and occupiers can consider procuring green energy or renewable energy certificates. Transitioning to cleaner energy sources not only reduces the carbon footprint of a property but can also enhance its appeal to environmentally conscious tenants.

Scope 3 Emissions: The Ripple Effect

Scope 3 emissions are the broadest and often the most challenging to quantify in commercial real estate. These encompass all other indirect emissions along the value chain of the property but outside the control of the owner or occupier. For the commercial real estate sector, Scope 3 emissions can include emissions associated activities such as commuting and business travel, as well as emissions embedded in the products and services used in the building. Addressing Scope 3 emissions requires collaboration between property owners, occupiers, and suppliers. Encouraging sustainable commuting options, supporting telecommuting, and sourcing eco-friendly products and services within the building can make a significant impact on reducing the overall carbon footprint.

In summary, understanding and managing Scope 1, 2, and 3 emissions are pivotal for the future of commercial real estate. These three scopes provide a holistic view of your environmental impact, from the direct emissions under your control to the broader, indirect emissions associated with your operations. It’s not only about reducing environmental impact but also about meeting the increasing demand for sustainable and eco-conscious properties. By embracing green building practices, optimizing energy usage, and engaging in sustainable supply chain management, the commercial real estate sector can lead the way toward a more environmentally responsible and resilient future.

Author: Cillian O’Reilly, Surveyor, Sustainability Manager, Bannon

Date: 13th September 2023

As we begin World Green Building Week, Bannon is proud to launch its 2022 ESG Report. Through numerous initiatives, Bannon far exceeded its ESG goals, achieving a carbon footprint reduction of 34%. Bannon looks forward to working with Owners, Occupiers and all interested parties in the real estate sector to curate a more sustainable future.

To view the full report, please click here.

Sustainability is a defining issue in the modern world. Its importance reaches across various sectors, including commercial property management. For the Bannon Property Management team, the prioritisation of sustainability in its approach to managing commercial properties is not just a choice, but a necessity.

One of the most pressing reasons for prioritising sustainability is the urgent need to address environmental challenges. Ireland, like the rest of the world, is grappling with the consequences of climate change, resource depletion, and biodiversity loss. Commercial properties are known to consume significant amounts of energy and resources. By embracing sustainable property management practices, such as energy-efficient technologies, waste reduction, and sustainable landscaping, Bannon property managers have significantly reduced the carbon footprint of the assets we manage. Our approach aligns with our clients’ sustainability commitments and serves as a model for responsible resource utilisation and environmental stewardship.

Economic resilience is another key component for prioritising sustainability in commercial property management. In an era of fluctuating energy costs, regulatory changes, and evolving consumer preferences, sustainable properties are better poised to navigate uncertainties. Energy-efficient buildings, for example, have lower operational costs due to reduced energy consumption. Over time, these cost savings translate into tangible financial benefits for property owners and occupiers. Additionally, sustainable properties are likely to attract a growing segment of environmentally conscious occupiers and investors who prioritise properties that align with their values. This increased demand can lead to higher occupancy rates, longer lease durations, and enhanced property values, bolstering the economic viability of sustainable property management.

Sustainability in commercial property management is closely intertwined with broader societal trends and global expectations. The rise of environmental, social, and governance (ESG) considerations has reshaped investor and occupier preferences. Increasingly, investors are factoring in sustainability metrics when evaluating real estate opportunities, and occupiers are seeking spaces that align with their values and contribute to their well-being.

It is often said the S (Social) in ESG is the hardest to measure. The social dimension of sustainability reinforces its significance in commercial property management approaches. A sustainable property is more than just an energy-efficient structure; it’s a place that fosters human well-being and enhances the quality of life for occupants. Green buildings are associated with improved indoor air quality, ample natural light, and thoughtful design that promotes occupant comfort and productivity. Employees working in such environments are likely to experience better health, higher job satisfaction, and increased productivity.

By embracing sustainability, property managers not only tap into a growing market but also enhance their reputations as ethical and forward-thinking industry leaders. It would be remiss, however, not to acknowledge the challenges that accompany the integration of sustainability into commercial property management.

Initial investments in sustainable technologies and building upgrades can be daunting, especially for older properties that require retrofitting. Property managers must navigate financial considerations while also demonstrating the long-term benefits of these investments, including energy savings and enhanced property values. Collaborative efforts involving property managers, owners, financial institutions, and stakeholders are essential to encourage sustainable property development and management. Together with Bannon’s sister company, Evia, we offer tailored solutions to our clients. This enables Bannon to provide clients with an interdisciplinary service that offers both property management and technical solutions to sustainable practices.

Bannon has been at the forefront of implementing and actioning sustainable property management across our asset portfolio. This has ranged from the installation of PV panels for electricity generation, replacement of lights with energy-efficient alternatives, and putting in place online portals for building occupiers to ensuring that contractors we use in our assets are in line with our values regarding sustainability objectives.

Bannon has prioritised sustainability in our property management approach for a multitude of reasons. From mitigating environmental impact to enhancing economic resilience and promoting societal well-being, the benefits of sustainability are undeniable. By embracing sustainable practices, Bannon property managers help clients achieve environmental targets, position properties for long-term financial success and create spaces that promote occupant health and productivity. The alignment of sustainable property management practices with evolving market demands, and global expectations underscores the strategic importance of sustainability.

Author: William Lambe, Divisional Director, Bannon

Date: 4th September 2023

Environmental, Sustainable & Governance (ESG) requirements for buildings are becoming of increasing importance to both investors and occupiers for buildings. There is no doubt that ESG will become an increasingly prevalent element within the commercial real estate (CRE) landscape, becoming an important driver of asset value. This means current owners will be facing important considerations. How do you attract good quality occupiers, achieve strong rents and ensure a competitive market of buyers for your asset at exit. ESG-led objectives are becoming increasingly commonplace in investment and fund criteria for institutional real estate owners. As these owners are significant sources of capital in CRE markets a likely result will be a somewhat forced divestment from ‘brown’ assets (non-ESG compliant assets) and a channelling of capital towards ‘green’ (ESG compliant) assets.

The market is not balanced, green assets in Ireland are typically buildings constructed or extensively refurbished after the 2014 Building Regulations came into play. We estimate that the green market comprises less than 15% of Dublin’s office stock, with the majority of this space located in Dublin 2 and Sandyford, the prime office locations. With multiple players competing for a limited supply of stock and available capital being funnelled into this small sector an expectation is prices will be driven up by competitive bidding in both the investor and occupier markets. The net effect of these events will be an increase in asset value through growth income complimented by strong occupier covenants and yield compression.

By contrast, we expect a shift in the brown asset market. Company mandates or client requirements will oblige some occupiers to occupy green buildings, seeing the demand for brown space shrink and the market becoming increasingly oversupplied. The pressures resulting from falling demand and increased void costs, will create a lower rent environment. An exit of institutional grade investors will see the demand drop for these buildings with ESG rules preventing purchase. The remaining investors will have to consider the cost and value associated with bringing an asset into the green market. While the market for this in prime locations may be viable, there are greater challenges for suburban/out of centre locations where the end rental value that can be achieved may not support viability of refurbishment.

Rescuing these potentially stranded buildings represents an opportunity for investors and developers and Bannon working with our sustainability business Evia are available to provide technical insights to ESG building upgrades. Feel free to reach out to discuss.

Author: George Colyer, Surveyor, Bannon

Date: 9th June 2023

At Bannon we analyse two types of sustainability, environmental sustainability attributes and the sustainability of an asset’s income. Sustainability of income is important as this considers the ability of the Occupier of the asset to pay rent to the Owner based upon the business they carry out in the building. Gaining an insight into this allows an Owner to understand whether they will maintain or improve income on the occurrence of lease events such as break clauses and expiries and also assess how solid or otherwise their income is in the context of market conditions and the implementation of asset strategy. The asset class that gives an Owner the greatest opportunity to use this analysis is retail where the performance of the business within the shop is directly relevant to the stability of income the Owner receives.

Understanding the strength of the rental income by analysing the trading and commercial performance of the rent paying occupiers puts the Investor in the strongest position to negotiate and regear lease terms, react to market requirements and devise and implement strategic asset goals. Bannon carry out rental sustainability analysis for schemes utilising our depth of retail asset and occupier specific data. The occupier’s current position will be further validated by their wider commercial performance and the effect both macro and micro economic conditions may have on the occupiers and their ability to perform.

The sustainable performance of an occupier is a key consideration for maintaining and forecasting income over the period of ownership. This gives our clients a clear advantage is assessing the value of an asset and looking at acquisition opportunities. The value of retail assets, especially shopping centres, has been depressed for some time despite their proven track record of producing strong predictable cashflows. Adopting sustainable rental analysis allows our client to see past the negative sentiment and acquire income producing assets at low cost when compared to other real estate investments.

A comprehensive understanding on a schemes rental sustainability can inform decision making when devising and asset strategy and inform cashflow forecasting. This can aide in de-risking cash flow line items for owners over their ownership period. Understanding rental sustainability can serve as a means of curating the schemes occupier mix and planning strategic initiatives. Overall, the ability to enhance the knowledge and understanding of income for the owner serves as a means to promote good asset management and to improve income over the term of ownership.

If you would like to know more about Bannon’s approach to rental sustainability analysis and how it can strengthen your asset strategy, please get in touch @ Consutancy@bannon.ie.

Author: George Colyer, Surveyor, Bannon

Date: 17th April 2023

A Green Lease is a commercial lease, containing additional clauses that the building must be occupied, operated and managed in an environmentally sustainable manner. The concept of a Green Lease was first developed in Australia where its use has been mandatory since 2006 in all government-owned and occupied buildings. In France, Green Lease legislation has been mandatory since 2013. Globally, 42% of investors have Green Lease clauses in place with an additional 37% looking to adopt them by 2025. On the occupational side, 34% of occupiers are currently committed to Green Leases.

Green Lease clauses can range from ‘light green’ to ‘dark green’ depending on the nature of the property, and energy performance certifications. The essential elements of a Green Lease include:

For both Owners and Occupiers, a Green Lease encourages a relationship of collaboration and meets corporate social responsibility objectives.

What are the benefits of a Green Lease?

For the Owner

For the Occupier

Green leasing provides an effective framework for both Owners and Occupiers to work together to achieve a common objective and comply with future legislative requirements. A sustainable building with lower running costs is more marketable for Owners and more cost-effective for Occupiers to occupy. Given the evolving nature of Green Leases, it is prudent to take legal and professional advice before entering such leases to ensure that the provisions are suitable for your organisation.

If you want to discuss the sustainability dynamics of the Irish Commercial property market further contact the Consultancy Team @ Bannon.

Author: Cillian O’Reilly, Surveyor, Sustainability Manager, Bannon

Date: 11th April 2023

Sustainability is a critical issue in modern property management, with more and more owners and occupiers seeking to adopt eco-friendly practices and reduce their carbon footprint. From a commercial property management perspective, there are several key strategies and best practices that can be used to promote sustainability and reduce environmental impact.

One important strategy is to focus on energy efficiency. Commercial buildings by their nature are some of the largest consumers of energy, and reducing energy usage can have a significant impact on both the environment and the bottom line. This can be achieved through a range of measures, such as improving insulation, installing energy-efficient lighting and appliances, installing solar photovoltaic arrays and implementing a smart building system that monitors and controls energy usage.

Another area of focus is water conservation. Many commercial properties use vast amounts of water, from landscaping and irrigation to bathroom facilities and kitchenettes. To reduce water consumption, property managers can implement low-flow fixtures, such as toilets and showerheads, as well as drought-resistant landscaping and rainwater harvesting systems.

Sustainable property management also involves waste reduction and recycling efforts. Property managers can encourage occupiers to reduce waste by providing recycling facilities and implementing composting programs. They can also work with contractors and suppliers to ensure that materials and products are sourced sustainably, and that waste is disposed of responsibly.

Environmental assessment method and rating system for buildings programs, such as BREEAM (Building Research Establishment Environmental Assessment Methodology), provide a framework for sustainable property management and can help property owners and managers to evaluate and improve their environmental performance, build more sustainable environment as a whole. By achieving BREEAM certification or other green building certifications, property managers can demonstrate their commitment to sustainability and attract environmentally conscious occupiers.

Finally, sustainable property management involves engaging and educating occupiers about sustainability and environmental issues. Property managers can provide educational materials and resources, host events and workshops, and encourage occupiers to adopt sustainable practices in their daily operations.

Overall, sustainability is a critical issue in commercial property management, and there are many strategies and best practices that can be used to promote sustainability and reduce environmental impact. By focusing on energy efficiency, water conservation, waste reduction and recycling, green building certification, and occupier engagement, property managers can help to create more sustainable, eco-friendly commercial properties that meet the needs of both businesses and the planet.

Author: Alex Staskunas, Property Manager, Bannon

Date: 23rd March 2023

“The ship has reached the shore,” United Nations conference president Rena Lee announced after a marathon final day of talks between negotiators from more than 100 countries.

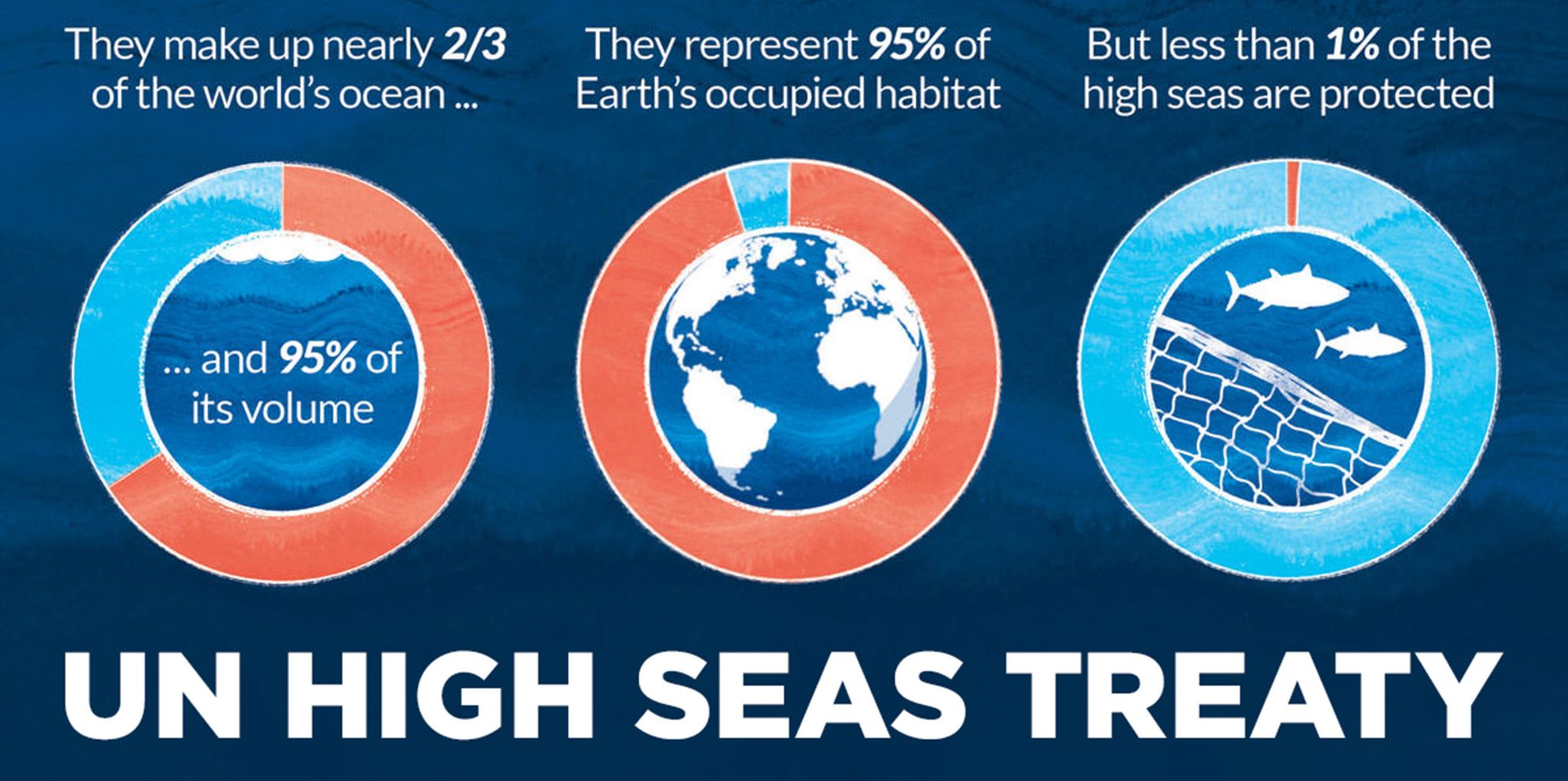

Ocean ecosystems keep our planet in balance by producing nearly half of the earth’s oxygen and absorbing much of its carbon dioxide but they are under threat from pollution, exploitation and global warming. After 15 years of negotiations, the UN High Seas Treaty which will help to protect vast swathes of the planet’s oceans was agreed in New York on Saturday. The high seas, or the parts of the ocean that are not territorial waters, do not technically belong to anyone and account for 60% of the earths oceans. Only a mere 1% of the high seas are currently protected. The treaty places 30% of the world’s land and sea under protection by the end of 2030, a target known as “30 by 30”.

The next step for the treaty is signing by UN member states and formal adoption after which countries will have to look at practically how these measures would be implemented and managed. This phase may take some time, however, the agreement of the High Seas Treaty is a major milestone as we look towards a greener future.

Bannon is delighted to receive ISO 14001:2015 Environmental Management Systems certification which will function alongside our existing ISO 9001:2015 Quality Management System for all services provided by Bannon.

This certification is validation of Bannon’s commitment to Environmental Sustainability in the delivery of our property consultancy services that span across retail agency, office agency, professional services, investment, consultancy and property management.

Many thanks to all involved, in particular the newly formed Sustainability Subcommittee, who embraced the challenges of designing and implementing the system. All eyes now turn to the future and the implementation of a range of innovative initiatives.

Very positive news from the Department of Transport with the publication of Ireland’s first EV Charging Infrastructure Strategy 2022-2025.

We have been swamped with noise around EV charging over the last number of years. Bannon has installed charging units at a number of retail centres across the country, with more in the pipeline. Whilst there is clearly a need nationwide for a charging infrastructure to accompany the push to electrify the national fleet, the planning and installation of this infrastructure needs to be informed by the rational analysis of reliable data.

At Bannon we have access to an enormous database of nationwide data about how people use cars to access shopping destinations and where they come from, with over 100 million customer visits generated by the portfolio annually. This data can be used to establish which retail schemes need more charging points to satisfy their customer requirements, which schemes can be used as charging stop over points for people on longer journeys and which journeys could be redirected to public transport, cycling or walking. Using data to ensure that resources are deployed where they will be of most benefit is at the core of sustainability.

The Department of Transport is inviting input on the draft strategy to be sent to evinfrastructure@transport.gov.ie

Electric Vehicle Charging Infrastructure Strategy 2022-2025 PDF

Bannon is delighted to announce that it has entered into a partnership with Site Passport to establish the Bannon Verified Supplier platform. Site Passport transforms the way companies access, evaluate, monitor and analyse their supply chain. They do this by providing smarter, integrated and automated solutions that deliver increased competitiveness, enhanced reputation and reduced risk.

The Bannon Verified Supplier platform is a bespoke online resource designed in conjunction with Site Passport to ensure that all contractors working on Bannon managed sites meet the highest levels of standards. In order to qualify as a Bannon Verified Supplier, our partners must meet the following minimum criteria:

To date we have verified over 80 contractors through the process. The verifying process ensures that only the most proactive and efficient contractors are engaged on Bannon managed sites. We insist that all our contractors are committed to meeting sustainability and environmental goals in line with our company ethos. All contractors must demonstrate that they have a proactive sustainability policy that is being adhered to and actively monitored We also encourage contractors to use the most efficient and environmentally friendly products available to the market.

As market leaders, Bannon manages over 75 commercial assets including Shopping Centres, Retail Parks and Offices with a combined footfall of over 100 million visitors per annum. Therefore, we put a premium on ensuring that all contractors who work on Bannon managed sites are industry leaders who like us, strive to meet the highest of standards. This is imperative to our role as managing agents. Bannon is committed to ensuring that all assets under our management are safe, clean and a welcoming environment for all users. This is achieved by partnering with contractors who share our values and are committed to our best-in-class approach. The Bannon Verified Supplier platform is another tool to help Bannon achieve this.

Author: William Lambe, Divisional Director, Bannon

Date: 1st April 2022

Urban Transportation Hubs. A snazzy name for a car park or a way of rethinking how we move about our cities and towns?

There is an opportunity to reimagine the role of car parks. Giving over space within the facilities to accommodate secure bike parking, charging stations for electric bikes and scooters, dedicated spaces for car share schemes and a range of EV charging options for those that need rapid charging, to the owner who just needs a slow charge overnight can turn these buildings into true transport hubs.

They can form a central part of a transport interchange where customers pivot from one form of transport to another pre-booking their required option on a dedicated app. Arrive on your bike, park it securely for the day and take out pre-booked EV charge appropriately to make a trip to Galway. Arrive on a shared scooter and rent out an electric bike.

Reusing and refocussing existing infrastructure intelligently is ultimately the key to sustainability, why not start with car parks?

Blog post written by Cillian O’Reilly, our Sustainability Manager. You can contact Cillian by email on coreilly@bannon.ie

Achieving progress in the move to greater sustainability in any organisation requires fundamental changes in how we manage and direct our businesses. This requires the buy in of all the stakeholders, the internal team, our clients and our suppliers. Our experience with change management is that it is only truly successful if you change culture.

That’s why, when Bannon started on its sustainability journey a number of years ago, we stopped using plastic bottled water and switched to chilled tap water, provided keep cups for the team’s caffeine obsession and started using electric scooters, thankfully now legal, and Dublin City Council bikes to get to local meetings.

Simple changes like this accompanied the more significant changes such as moving our entire Property Management portfolio to renewable energy sources. Making the big moves required for a sustainable future is easier to achieve when the simple changes are clear and evident.

Blog post written by Cillian O’Reilly, our Sustainability Manager. You can contact Cillian by email on coreilly@bannon.ie

The function of all forms of real estate and the specific requirements of its users continues to change at pace. The most significant factors driving this evolution are non-financial – Environmental, Social and Governance (ESG) requirements.

The function of all forms of real estate and the specific requirements of its users continues to change at pace. The most significant factors driving this evolution are non-financial – Environmental, Social and Governance (ESG) requirements.

At Bannon, we are seeing a profound shift from clients towards more sustainable practices. With environmental issues coming to the fore globally and a particular focus of the impact on the real estate sector, Bannon has been proactive in applying innovative and market leading initiatives across assets within our portfolio.

In simple terms sustainability means meeting our own current needs without compromising the ability of future generations to meet their own needs. This encompasses the economy, society and the environment and is often referred to as profits, planet and people.

We know that ESG and sustainability related innovations need to be adopted into every aspect of the management of real estate. Given the scale and variety of assets under our management we are acutely aware of the positive impact changes we implement will have on, the environment and the users of our clients’ buildings.

In partnership with our clients, we have implemented over 40 specific sustainability initiatives in the last 5 years. These initiatives will remove a cumulative 500,000 kg of carbon dioxide annually.

A small sample of the sustainability innovations implemented across our portfolio include:

The focus on sustainability has numerous benefits to all stakeholders and wider society. This ranges from lowering carbon emissions into the atmosphere to a reduction in costs for users of assets. Simultaneously sustainability initiatives provide added value to the assets for investors.

It is very easy to pay lip service to the latest trends in the industry and not take action to back these up. In order to achieve meaningful change, sustainability has to now be at the fore of real estate management. Bannon has recognised this and will continue to work in partnership with all stakeholders to make sure we continue the progress already made.

William Lambe is a Divisional Director with the Property Management team at Bannon.

The Property Management team in Bannon oversees a portfolio of 75 assets for a range of institutional, private equity and private clients.

Hambleden House

19-26 Pembroke Street Lower

Dublin 2

D02 WV96

Ireland

»Map

Phone: +353 (1) 6477900

Fax: +353 (1) 6477901

Email: info@bannon.ie

| Title | Price | Status | Type | Area | Purpose | Bedrooms | Bathrooms |

|---|