Buoyed by a long spell of fine weather, sales in the Irish retail sector grew by 3.4% in the second quarter of 2018, according to a new report from Retail Ireland, the Ibec group that represents the sector.

In its latest Retail Monitor, published today (see attached), the group said sales in the first half of the year have grown steadily with some categories such as grocery, DIY and hardware, and fuel benefiting strongly from the sustained spell of warm weather during June. Following disruptions to trade and loses which ran into the tens of millions arising from Storm Emma earlier this year, this boost will be welcomed by the sector.

Retail Ireland Director Thomas Burke said: “From the prolonged cold snap and heavy snow of March, to the drought conditions of June, weather has had a huge impact on Irish retailers in the first half of this year. With the recent fine spell of weather, our members have reported strong demand for seasonal products such a fans, ice cream, BBQs and patio furniture, amongst other things. This spike in demand pushed retailers supply chains to the limit during June particularly.

“Other once-off events such as the football World Cup and the royal wedding in the UK provided a welcome boost to trade for retailers in the period, with sales of soft drinks, alcohol, and magazines benefiting most. This trend reflects a broader move towards event led retail in recent years as retailers seek to leverage such events to help promote consumer spend.”

Retail Ireland noted however that the fine weather was not good news for all sectors of retail, with some reporting declining footfall and falling sales in the period.

Mr. Burke said: “While many retail categories have been boosted by the long dry spell, other sectors such as department stores, fashion and footwear and hairdressing have reported lower than normal footfall and declining sales in the period, with consumers opting for a trip to the beach or park rather than a day’s shopping or pampering in the warm weather.”

Key retail trends set out in the Retail Ireland Monitor include:

Supermarkets and convenience stores:

Strong figures in June for supermarkets and convenience stores shows that retail sales in this area are finally establishing a sustained pattern of growth. Volume and value are moving together in recent months and the positive impact of June’s good weather on treats and ‘little and often’ shopping is also coming through. Off trade alcohol sales and soft drinks consumption grew as a result of the good weather and the keen interest in the World Cup.

Department stores:

The busy pre-Easter week fell into Q1 this year, making comparatives with the same quarter last year difficult. Nevertheless, total sales values increased by 0.7% compared to Q2-2017, and total sales volumes increased by 4.1%, when compared to the same period last year. Consistently cold weather during April and May weighed on women’s summer clothing sales, whilst record high temperatures at the end of the quarter adversely impacted footfall. Despite these challenges online continues to deliver strong growth within this category of retail.

Fuel stations:

Consumption remained strong in quarter two despite the sharp increases in oil prices from late March 2018. Total sales values grew by 5.9% in Q2-2018, with sales volumes increasing by 1.5% versus Q2-2017. In the non-fuel business, Q2-2018 was very positive. Favourable weather conditions disrupted normal consumer buying patterns in fuel stations. Convenience and ‘food-to-go’ offerings performed well in May and June, with a slight impact on anticipated hot beverage sales. The most significant year-on-year increase was in car wash sales, as improvements in weather conditions drove strong demand for car wash services.

Pharmacies:

Warm weather drove strong seasonal healthcare (hay fever) and sun care performance, coupled with a healthy performance on core toiletries in the second quarter of the year. Beauty related categories performance slowed during the quarter due to the exceptional hot weather in June. On an annualised basis, total sales values increased by 1.9% and total sales volumes grew by 6.8% compared to June 2017.

Fashion, footwear and textile stores:

There was no growth in total sales values in the first six months of 2018, while total sales volumes posted growth of 2.5% during the same period. Fashion retailers report that accessories and menswear were the strongest performers during the quarter. Regardless of the bad start to 2018, in the past 18 months there has been an increased focus on retail development across Dublin and the regions. Larger retail units, redevelopments and extensions have attracted new quality fashion brands to the country’s well know shopping streets and centres.

DIY and hardware stores:

Performance in the DIY and hardware category was dominated by the fine weather conditions with a significant increase in demand for gardening and outdoor categories reported. Initial strong demand for garden furniture, wood care and BBQ products were further augmented in the quarter by a surge in watering related categories, as it became clear that the fine weather would persist. Outside of gardening, the sector saw steady growth in interior, DIY and home products categories, reflective of ongoing positive consumer sentiment and a willingness to invest in home projects.

Books, News & Stationery:

Overall, the category was up 7.0% in value terms and up 5.9% in volume terms, versus Q2 last year. April’s sales were boosted by an initial clawback from the widespread weather disruption in March. Throughout the quarter, the book market continued its positive performance trend year-to-date, while the British royal wedding and the FIFA World Cup provided a temporary relief to the long-term decline in magazine sales performance. Stationery sales were more challenged, particularly in June, with a slow start to the key back to school season, due to the hot weather.

Retail Ireland Monitor Q2 2018.pdf

Blanchardstown, one of the country’s largest shopping and leisure facilities, is to get a €16.5m interior design makeover.

Blanchardstown, one of the country’s largest shopping and leisure facilities, is to get a €16.5m interior design makeover.

IRISH diner Shake Dog is set to open its first Dublin restaurant in the Ilac Centre on Henry Street in March 2020.

IRISH diner Shake Dog is set to open its first Dublin restaurant in the Ilac Centre on Henry Street in March 2020.

MacDonagh Junction is the larges shopping centre in the South East. But that is a massive under-statement for the Kilkenny centre is so much more.

MacDonagh Junction is the larges shopping centre in the South East. But that is a massive under-statement for the Kilkenny centre is so much more.

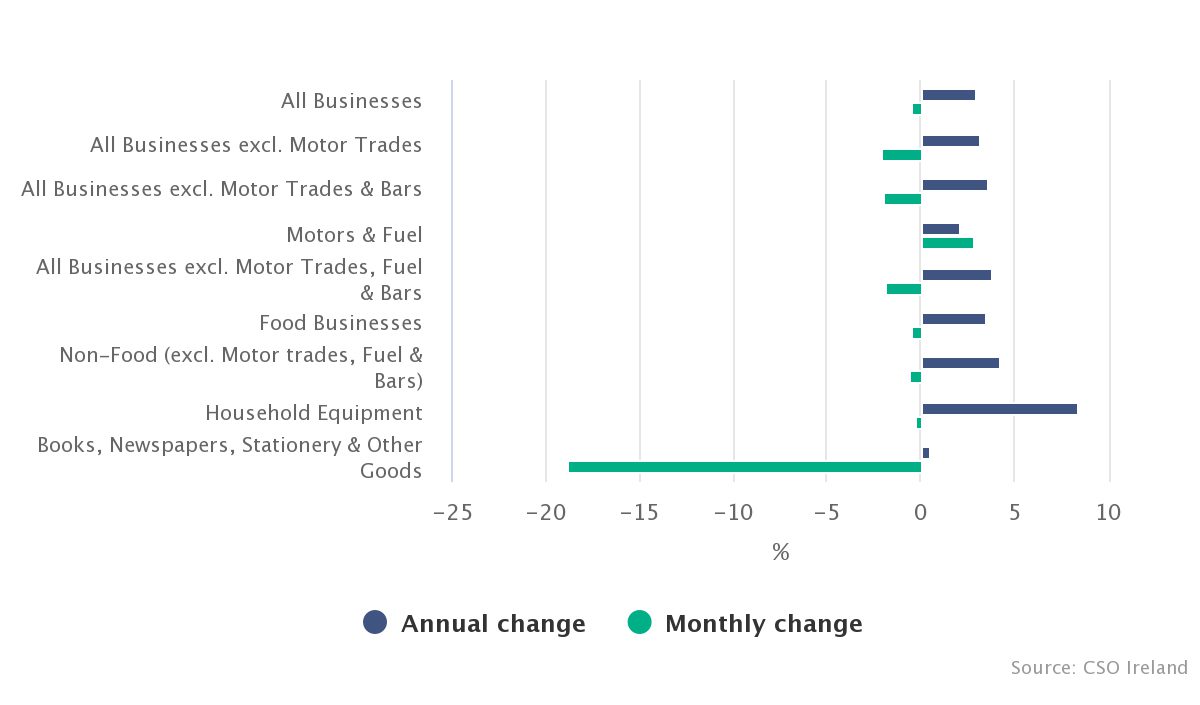

The volume of retail sales decreased 0.5% in October when compared to September on a seasonally adjusted basis and increased by 3.0% on an annual basis. When Motor Trades are excluded, the volume of retail sales decreased by 2.1% in October 2019 and rose by 3.2% when compared with October 2018.

The volume of retail sales decreased 0.5% in October when compared to September on a seasonally adjusted basis and increased by 3.0% on an annual basis. When Motor Trades are excluded, the volume of retail sales decreased by 2.1% in October 2019 and rose by 3.2% when compared with October 2018.

Hollister is set to become the latest retailer to join the line-up at the Blanchardstown Centre.

Hollister is set to become the latest retailer to join the line-up at the Blanchardstown Centre.

The volume of retail sales increased 4.3% in September when compared to August on a seasonally adjusted basis and increased by 4.2% on an annual basis. When Motor Trades are excluded, the volume of retail sales increased by 2.3% in September 2019 and rose by 4.7% when compared with September 2018.

The volume of retail sales increased 4.3% in September when compared to August on a seasonally adjusted basis and increased by 4.2% on an annual basis. When Motor Trades are excluded, the volume of retail sales increased by 2.3% in September 2019 and rose by 4.7% when compared with September 2018.

Smyths, meanwhile, has completely conquered the British market, opening more than 100 large retail outlets there in a little over a decade, vanquishing its specialist rivals. Its UK sales are now about €675 million.

Smyths, meanwhile, has completely conquered the British market, opening more than 100 large retail outlets there in a little over a decade, vanquishing its specialist rivals. Its UK sales are now about €675 million.

Brexit and the recent wet weather failed to dampen consumer confidence here over the last few weeks as grocery sales grew by 3.3% in the 12 weeks to October 6.

Brexit and the recent wet weather failed to dampen consumer confidence here over the last few weeks as grocery sales grew by 3.3% in the 12 weeks to October 6.