Amid reports of a post-Covid hollowing out of city centres like San Francisco, and to a lesser extent New York and Los Angeles, as retailers suffer the effects of working from home, Ireland’s recovery is gathering pace, and by most measures is now stronger than it was pre-pandemic.

But Ireland too has a high reliance on technology workers, who may also be adopting hybrid working practices, so why is the Irish market performing better than the US, the UK, and many other markets?

I asked retail expert Neil Bannon, Executive Chairman at Bannon, and the first reason is that the US, for example, has six times more retail space per capita, than Ireland.

“Just imagine that we had another six Dundrum Town Centres, Liffey Valley’s, Blanchardstown Town Centres and six times every other shop in Dublin, and that is the scale of the over-supply in America,” he said.

In Ireland there has been no new shopping centre built since 2010 and no new retail park developed since 2007.

While our construction of new homes has been too slow, it has recently hit record levels, and this too, is driving demand.

There are just over two million households in Ireland, he told me, and the Housing for All Plan aims to produce another 300,000 new homes by the end of the decade.

‘In Ireland there has been no new shopping centre built since 2010‘

But there seems to be consensus that we need 500,000 new homes, which represents one new home for every four existing homes, “a staggering increase”, he added.

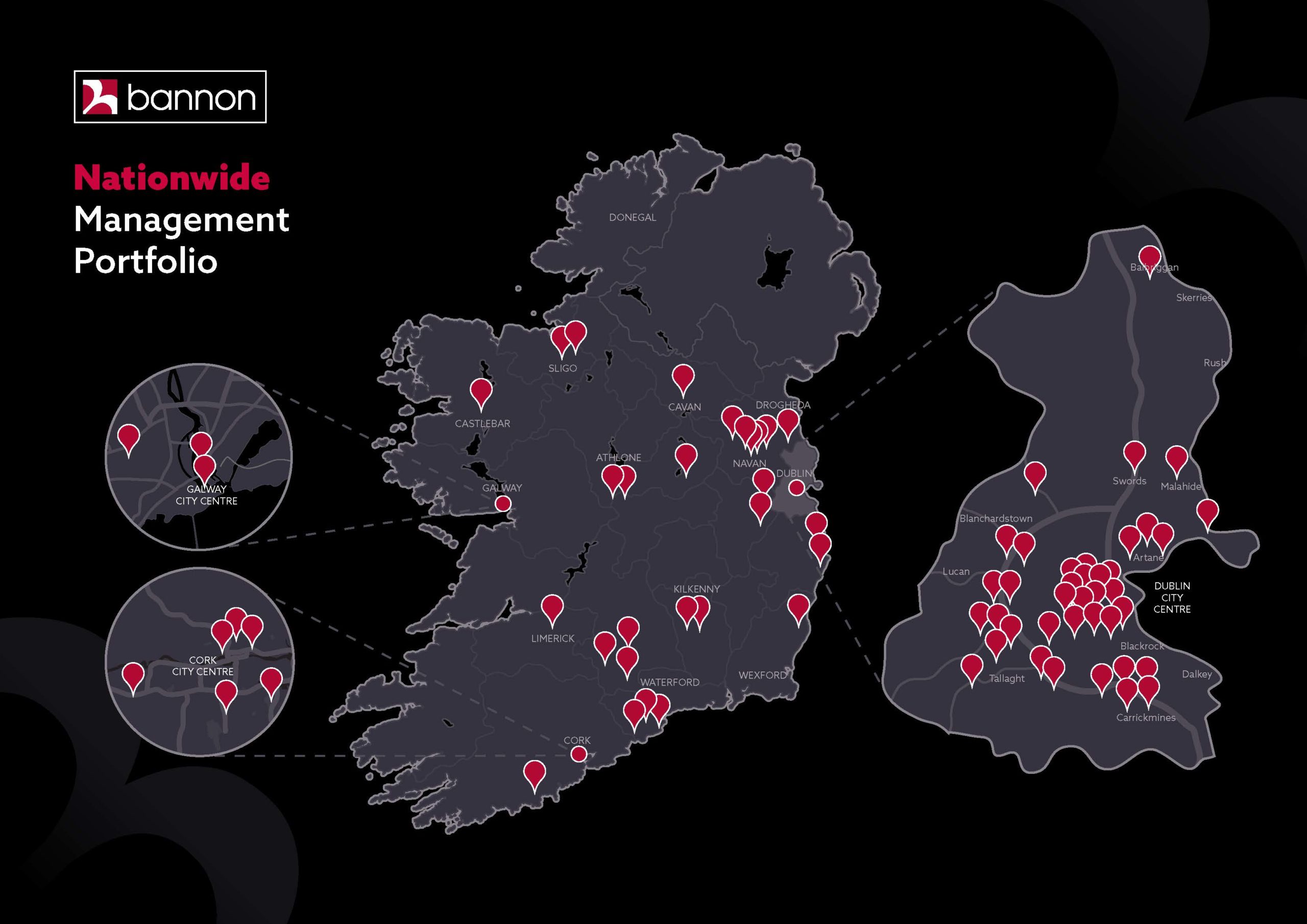

The impact of this growth is already being seen on Ireland’s 73 retail parks, 20pc of which are managed by Bannon.

Retail parks are the conduit for the overwhelming majority of spending associated with housing, Mr Bannon said – for example couches, TVs, white goods and floor coverings – with 85pc of sales taking place in store, according to Central Statistics Office figures.

“If every house in Ireland spends €2,500 annually on household goods, that’s up to €12.5bn of spend. If 500,000 new homes are built, and the average cost of kitting them out is €25,000, that’s another €5bn of expenditure,” he said.

One result is that Ireland’s retail parks are largely at full occupancy and rents are rising.

“We had expected some fall-off from the post-Covid DIY boom, but in fact, footfall and spending levels are stronger than pre-pandemic,” Mr Bannon said.

‘Ireland’s retail parks are largely at full occupancy and rents are rising.’

The most valuable retail park units were always those few with an ‘open user’ planning consent, permitting, for example, fashion retailers and not one that is just restricted to bulky goods.

However, a shift in the market is that furniture retailers are now out-bidding even open user retailers as evidenced by a deal just signed at Liffey Valley Retail Park where Danish brand JYSK has taken a 10,000 sqft unit plus mezzanine at a rent of approximately €25 per sqft.

That is, Mr Bannon notes, “a 40pc higher rent than pre-Covid”.

JYSK have taken half a dozen 10,000-15,000 sqft units in Ireland and continues to expand.

Another expanding brand that is already operating on several retail parks is EZ Living Furniture which also recently rented a 10,000 sqft unit plus mezzanine at Liffey Valley Shopping Centre.

It is not just the Dublin area as Limerick One Shopping Park has also seen new outdoor clothing and equipment retailer Mountain Warehouse recently lease a 7,000 sqft unit at approximately €28 per sqft.

The theme for the year ahead is “competition for space among brands and rising rents”, Mr Bannon concluded.

Article by The Independent

Bannon

Bannon

Bannon’s latest monthly Retail Pulse has now gone live.

Bannon’s latest monthly Retail Pulse has now gone live.

Bannon’s latest monthly Retail Pulse has now gone live.

Bannon’s latest monthly Retail Pulse has now gone live.

The first Bannon Pulse of 2023 is now live. We look back at the strong level of activity in 2022, highlighted by the large number of lettings and new market entrants. Our occupancy trackers finished 2022 in positive form, as did our trading analysis across the retail categories.

The first Bannon Pulse of 2023 is now live. We look back at the strong level of activity in 2022, highlighted by the large number of lettings and new market entrants. Our occupancy trackers finished 2022 in positive form, as did our trading analysis across the retail categories.

Our final Retail Pulse of 2022 has just gone live. All in all, an exceptionally busy year for the team at Bannon. 2023 is looking very promising for Retail.

Our final Retail Pulse of 2022 has just gone live. All in all, an exceptionally busy year for the team at Bannon. 2023 is looking very promising for Retail.

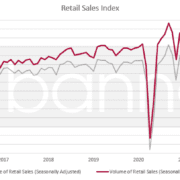

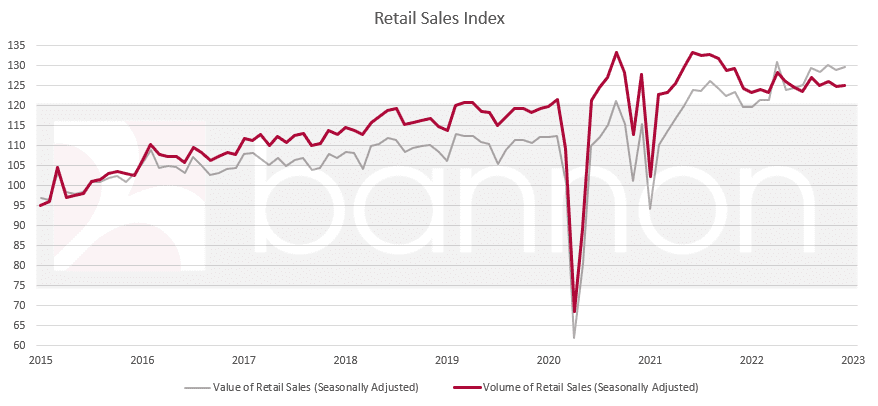

Bannon’s latest monthly Retail Pulse has now gone live. Neil Bannon looks at recent retail sales data to demonstrate how the negative narrative continues to clash with reality.

Bannon’s latest monthly Retail Pulse has now gone live. Neil Bannon looks at recent retail sales data to demonstrate how the negative narrative continues to clash with reality.

Great news for the Citywest community. The nationwide restaurant chain, Camile Thai Kitchen has chosen Citywest Shopping Centre for its latest location.

Great news for the Citywest community. The nationwide restaurant chain, Camile Thai Kitchen has chosen Citywest Shopping Centre for its latest location.

EZ Living Interiors have opened their fifteenth Irish store at The Retail Park Liffey Valley. The store, which adds to an already impressive retailer line up in the park, is home to over 100 sofa collections, 50 dining sets, 50 bedroom ranges and a divine collection of home accessories, with everything from the timeless to the trendy. With an array of furniture designed and manufactured locally in Ireland, the Irish-owned family business is passionate about supporting Irish jobs, skill and craftmanship.

EZ Living Interiors have opened their fifteenth Irish store at The Retail Park Liffey Valley. The store, which adds to an already impressive retailer line up in the park, is home to over 100 sofa collections, 50 dining sets, 50 bedroom ranges and a divine collection of home accessories, with everything from the timeless to the trendy. With an array of furniture designed and manufactured locally in Ireland, the Irish-owned family business is passionate about supporting Irish jobs, skill and craftmanship.

Bannon’s latest monthly Retail Pulse has now gone live. In this publication Neil Bannon shares some insights into the ongoing decline of online fast fashion retailers and Darren Peavoy focuses on the rebound in footfall levels which has been seen in Dublin City Centre.

Bannon’s latest monthly Retail Pulse has now gone live. In this publication Neil Bannon shares some insights into the ongoing decline of online fast fashion retailers and Darren Peavoy focuses on the rebound in footfall levels which has been seen in Dublin City Centre.

Super day meeting with international retailers at Completely Retail Marketplace in London for our retail team, James Quinlan, Jennifer Mulholland and Darren Peavoy.

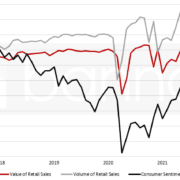

Super day meeting with international retailers at Completely Retail Marketplace in London for our retail team, James Quinlan, Jennifer Mulholland and Darren Peavoy. Predictably Irish Consumer Sentiment has dropped significantly in the face of an onslaught bad news; interest rates up, cost of living crisis, energy bills and the ongoing War in Ukraine. What will be interesting to watch is how this drop in sentiment manifests itself in retail sales.

Predictably Irish Consumer Sentiment has dropped significantly in the face of an onslaught bad news; interest rates up, cost of living crisis, energy bills and the ongoing War in Ukraine. What will be interesting to watch is how this drop in sentiment manifests itself in retail sales.

It is our pleasure to welcome Penneys to

It is our pleasure to welcome Penneys to

What is a Community Shopping Centre?

What is a Community Shopping Centre?

Bannon’s latest monthly Retail Pulse has now gone live. Our focus in this publication is on New Developments, where we identify a number of new retail schemes due for completion in the next 24 months. On our footfall monitor more positive trends feature with High Street footfall, by example, showing a 25% increase year on year.

Bannon’s latest monthly Retail Pulse has now gone live. Our focus in this publication is on New Developments, where we identify a number of new retail schemes due for completion in the next 24 months. On our footfall monitor more positive trends feature with High Street footfall, by example, showing a 25% increase year on year.

Bannon is delighted to welcome Babydoll Vintage Clothing to Stephens Green Shopping Centre.

Bannon is delighted to welcome Babydoll Vintage Clothing to Stephens Green Shopping Centre.

Another fantastic addition to the Tenant mix at

Another fantastic addition to the Tenant mix at

The Bannon Retail Pulse July 2022 issue is now available. This month, our Executive Chairman Neil Bannon focuses on the juxtaposition between robust economic statistics and a persistently negative narrative. Read Neil’s commentary ‘The Most Depressing Boom’ on page 4.

The Bannon Retail Pulse July 2022 issue is now available. This month, our Executive Chairman Neil Bannon focuses on the juxtaposition between robust economic statistics and a persistently negative narrative. Read Neil’s commentary ‘The Most Depressing Boom’ on page 4.

Wildflowers in full bloom at Thurles Shopping Centre ahead of the centre celebrating it’s 25th Anniversary this weekend, Saturday 25th June.

Wildflowers in full bloom at Thurles Shopping Centre ahead of the centre celebrating it’s 25th Anniversary this weekend, Saturday 25th June.

Our June 2022 Bannon Retail Pulse is now available. This month, as well as keeping track on our indicators which continue to improve, we focus on Grafton Street. We forecast that current vacancy is likely to drop significantly as 2022 progresses with a further enhancement of the mix and offerings on our premier retail street.

Our June 2022 Bannon Retail Pulse is now available. This month, as well as keeping track on our indicators which continue to improve, we focus on Grafton Street. We forecast that current vacancy is likely to drop significantly as 2022 progresses with a further enhancement of the mix and offerings on our premier retail street.