Building a Greener Future: How ESG is Reshaping Real Estate

In recent years, some in the property industry have dismissed ESG as a buzzword or see it as a form of greenwashing. However, ESG has steadily emerged as a critical consideration globally in real estate. Now, Ireland is aligning with this global shift by implementing new legal frameworks aimed at reducing carbon emissions and fostering healthier, more sustainable buildings.

In recent years, some in the property industry have dismissed ESG as a buzzword or see it as a form of greenwashing. However, ESG has steadily emerged as a critical consideration globally in real estate. Now, Ireland is aligning with this global shift by implementing new legal frameworks aimed at reducing carbon emissions and fostering healthier, more sustainable buildings.

This shift is timely: according to the United Nations Environment Programme, buildings account for a staggering 39% of global greenhouse gas emissions annually. Reducing the carbon footprint of the built environment is vital, and there is growing demand across all sectors for corporate entities to take proactive steps in ESG reporting.

Voluntary sustainability certifications have gained significant traction among investors and asset managers seeking to enhance portfolio performance, particularly in terms of carbon reduction and sustainability. Leading organizations such as GRESB, BREEAM, and Fitwell provide frameworks that standardise and validate sustainability reporting across the real estate sector. Fitwell’s research revealed that nearly half (49%) of building owners are willing to pay a premium for properties that are accredited or demonstrate tangible environmental benefits. Similarly, GRESB’s annual ESG benchmark survey now has over 1,000 participating companies and funds. The U.S. Green Building Council found that LEED-certified buildings generate 34% lower CO2 emissions compared to non-certified properties. For both owners and occupiers, investing in these improvements is essential for futureproofing their assets and leases.

While many companies have voluntarily embraced ESG reporting, this landscape is rapidly changing. The European Union has introduced laws that make ESG reporting mandatory for businesses, asset managers, and property owners. The European Commission’s ‘European Climate Law,’ also referred to as the ‘European Green Deal,’ aims to make the continent climate-neutral by 2050. In support of this, the Corporate Sustainability Reporting Directive (CSRD) mandates sustainability reporting, starting with companies of 500+ employees and eventually extending to smaller enterprises.

At Bannon, in partnership with Evia Sustainable Real Estate, we leverage the power of data to help our clients navigate this evolving ESG landscape and achieve their sustainability goals. Our tailored approach begins with a comprehensive analysis of energy, waste, and water consumption across real estate assets. We specialise in delivering bespoke solutions for the collection and analysis of environmental data, designed to meet the specific needs of commercial real estate portfolios.

As ESG continues to reshape the real estate industry, those who embrace sustainable practices and reporting not only align with new regulations but also gain a competitive edge in an increasingly climate-conscious market.

Authors: Cillian O’Reilly, Chartered Surveyor, Bannon & Alison Manning, Graduate Surveyor, Bannon

Date: 9th September 2024

A busy few days for the Bannon Retail team touring Liverpool, Manchester and Birmingham looking at new retail and leisure openings and getting a handle on new market trends!

A busy few days for the Bannon Retail team touring Liverpool, Manchester and Birmingham looking at new retail and leisure openings and getting a handle on new market trends!

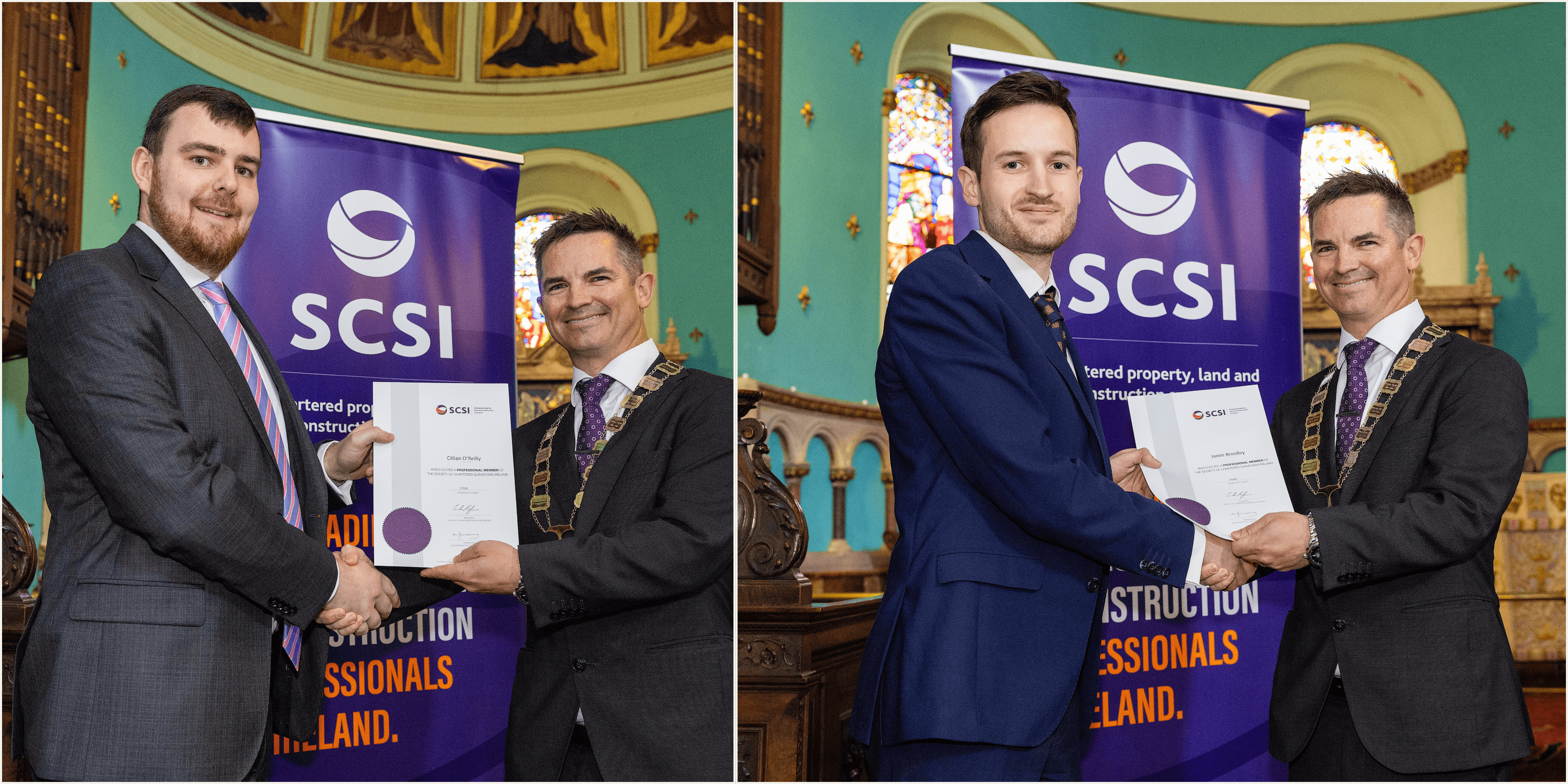

Delighted to see

Delighted to see

Insightful discussions at this morning’s sustainability talk hosted by

Insightful discussions at this morning’s sustainability talk hosted by

Our latest monthly Retail Pulse has now gone live. In this publication our retail leasing team highlight Irish occupiers and franchisees with ongoing expansion requirements.

Our latest monthly Retail Pulse has now gone live. In this publication our retail leasing team highlight Irish occupiers and franchisees with ongoing expansion requirements.

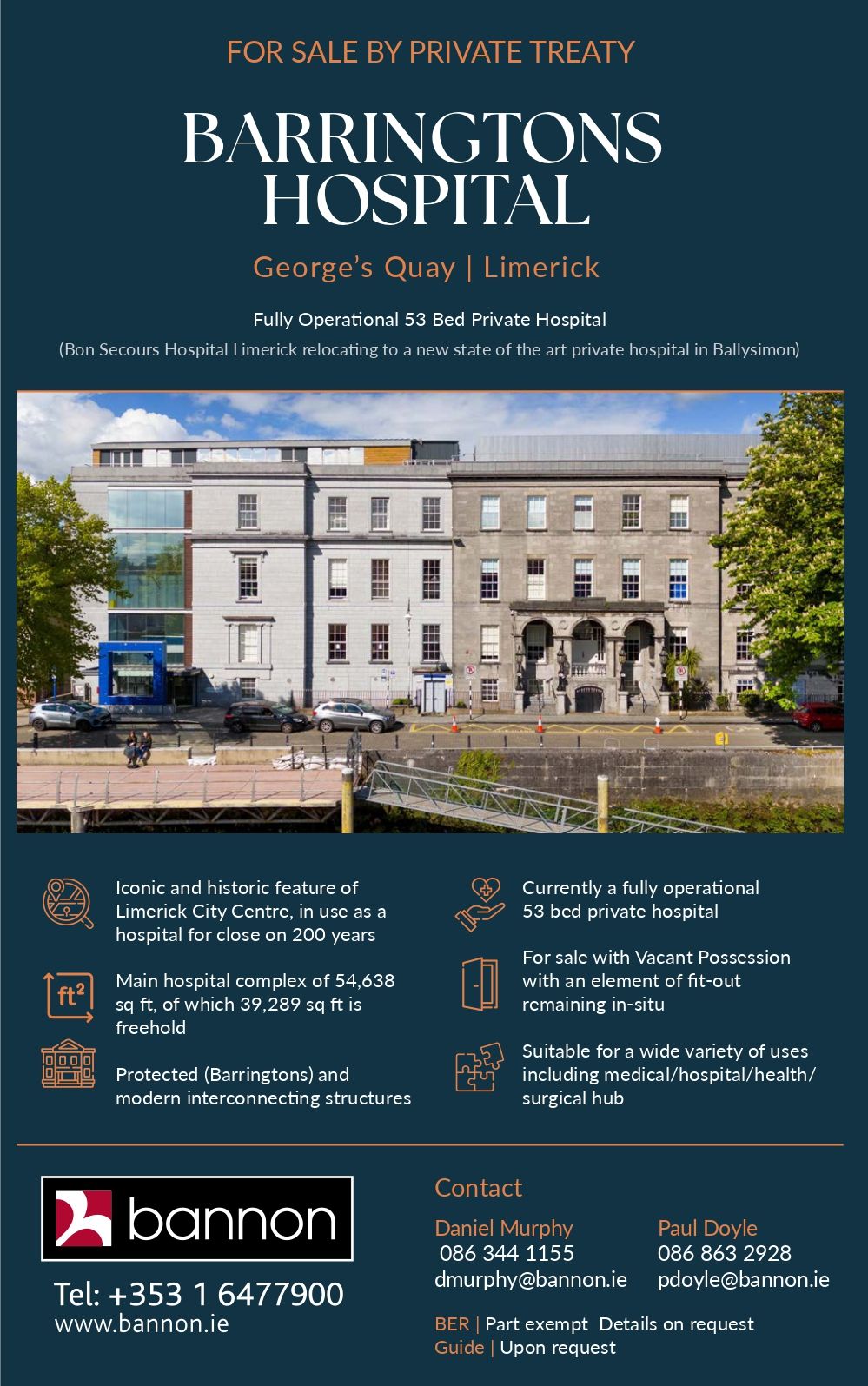

“Barringtons Hospital is an iconic and historic feature of Limerick City Centre, in use as a hospital for close on 200 years”

“Barringtons Hospital is an iconic and historic feature of Limerick City Centre, in use as a hospital for close on 200 years”