A big welcome to this year’s Interns 2023

Bannon is pleased to welcome this year’s interns. We are delighted to have you join the team and hope you have a fantastic time working with us.

Stephan Van Breda, Troy Ryan, Kate Wolfe, Emily King

Bannon is pleased to welcome this year’s interns. We are delighted to have you join the team and hope you have a fantastic time working with us.

Stephan Van Breda, Troy Ryan, Kate Wolfe, Emily King

One of the main attractions in Melbourne, Australia is undeniably its City Centre laneways. Once existing as purely functional areas, in the 1990’s the Government introduced policies to reimagine Melbourne’s laneways. The aim was to create exciting cultural and retail destinations in the Central Business District (CBD) to draw activity back into the city from suburban shopping centres.

The local policy promotes the inclusion of art, landscaping, street furniture and activity space to bring vibrancy with al fresco dining adding to this atmosphere. New developments are encouraged to provide small-scale tenancies at ground level to support a unique trading environment. The laneways are characterised by an abundance of local independent operators. These operators benefit from a city centre location without the cost of main street rents, adding diversity to the city’s retail core.

The policy in Melbourne recognises four core values that support the laneways’ success in attracting pedestrian movement and activating underutilised space.

So what can we learn from these policies for our cities in Ireland? Laneways are a common feature within Irish cities and towns. They are generally associated with servicing, bins, and anti-social behaviour, causing them to deflect rather than attract activity. We can see from policies introduced in Melbourne, that there is an opportunity to enhance our laneways while supporting our cities. They could act as extensions of retail streets, encouraging the circulation of shoppers, dwell zones and a destination for unique retail and food and beverage offers.

Led by policy, we can create vibrant and exciting spaces in Irish city centres. The Bannon Consultancy Team highlighted these opportunities in a Retail Study carried out for the Dublin City Council Development Plan 2022 – 2028. The private sector can play a role. Property owners with significant frontage to a laneway could activate and provide an exciting new space for the public to enjoy, creating rental value from previously underutilised space. We need to think creatively to develop our cities.

Author: George Colyer, Surveyor, Bannon

Date: 31st January 2023

For the property sector, while one of strongest capital market years on record (second only to 2019), 2022 will be best remembered as the “year of reckoning”. A year where a mixture of macro-economic and geopolitical issues combined to commence rebasing the market following almost a decade of effectively zero interest rates, low inflation, and expansive monetary policies.

For the property sector, while one of strongest capital market years on record (second only to 2019), 2022 will be best remembered as the “year of reckoning”. A year where a mixture of macro-economic and geopolitical issues combined to commence rebasing the market following almost a decade of effectively zero interest rates, low inflation, and expansive monetary policies.

To view the full report, please click here.

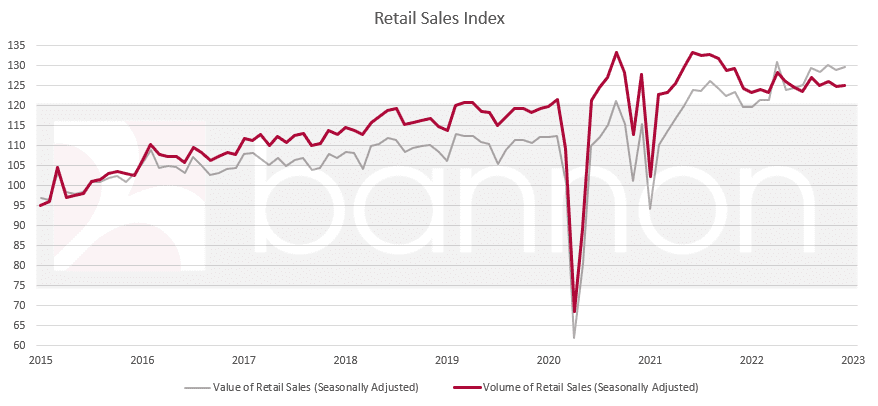

Changing spending patterns saw retail sales in December 2022 fall marginally from November figures indicating the traditional Christmas rush has turned into more of a marathon than a sprint. Annualised figures (excl. motors) show a strong increase in sales values of 7.88% albeit a nominal increase in volumes of 0.16%. This reflects the ongoing price inflation which saw the cross over in the value and volume indexes last year. The data also shows a strong shift away from household and electrical which enjoyed a stellar performance during periods when other retail outlets were closed due to COVID restrictions.

What a wonderful treat this morning!

What a wonderful treat this morning!

Bannon’s Social Committee is delighted to introduce Coffee and Pastry Mornings, the first of many, to boost morale and welcome new colleagues.

The first Bannon Pulse of 2023 is now live. We look back at the strong level of activity in 2022, highlighted by the large number of lettings and new market entrants. Our occupancy trackers finished 2022 in positive form, as did our trading analysis across the retail categories. Neil Bannon gives his take on the market concluding that, ‘The opportunity for informed investors is to acquire retail assets with robust performance but priced to reflect a negative narrative’.

The first Bannon Pulse of 2023 is now live. We look back at the strong level of activity in 2022, highlighted by the large number of lettings and new market entrants. Our occupancy trackers finished 2022 in positive form, as did our trading analysis across the retail categories. Neil Bannon gives his take on the market concluding that, ‘The opportunity for informed investors is to acquire retail assets with robust performance but priced to reflect a negative narrative’.

To view the full report, please click here.

For the property sector, while one of strongest capital market years on record (second only to 2019), 2022 will be best remembered as the “year of reckoning”. A year where a mixture of macro-economic and geopolitical issues combined to commence rebasing the market following almost a decade of effectively zero interest rates, low inflation, and expansive monetary policies.

See the high-level Bannon summary of 2022 in Bannon’s first Investment Pulse of 2023!

Dublin Office market take up for 2022 exceeded the ten year moving average figure and surpassed 2,600,000 sq.ft. by year end. This figure was boosted by a busy Q4 with over 804,000 sq.ft. transacting in the final quarter of the year. This was largely attributable to the two largest transactions of the year, Citigroup’s acquisition of 300,000 sq.ft. at Waterfront South Central and SMBC Aviation Capital’s leasing of 135,000 sq.ft. at Fitzwilliam 28.

Whilst not back to pre-covid levels, take up has increased by 53% on 2021 figures and we are seeing further stability in the market with an upsurge in activity from the Professional services and financial sectors.

Our final Retail Pulse of 2022 has just gone live. All in all, an exceptionally busy year for the team at Bannon. 2023 is looking very promising for Retail.

Our final Retail Pulse of 2022 has just gone live. All in all, an exceptionally busy year for the team at Bannon. 2023 is looking very promising for Retail.

Neil Bannon concludes this Retail Pulse with 10 Reasons to be Cheerful about the Retail Landscape in Ireland (page 4).

To view the full report, please click here.

The new Dublin City Development Plan for the period 2022-2028 came into effect on 14th December 2022. The Plan establishes the planning framework for the evolution of the City over a six-year period. One of the most notable changes brought about in this Plan are the restrictions placed on the potential future development of lands zoned ‘Z15 – Institutional and Community’. The Plan states that any residential or commercial development on such lands would only be considered in “highly exceptional circumstances”.

It is estimated that some 1,800 acres of land throughout the City Council administrative area are zoned Z15. While a significant portion of this total comprises existing educational and healthcare facilities, a significant proportion comprises lands privately owned by religious organisations including the Archdiocese of Dublin. In an era where consolidation of parishes is likely to become more prevalent, these properties, which are typically centrally located within local communities, could offer the potential for repurposing as social or private housing and go some way towards the addition of much needed residential stock across the capital. It appears contradictory that the new Development Plan has limited the future development potential of these lands in a time of chronic need and when creative solutions are required most.

Niall Brereton BSc MRICS MSCSI is a Registered Valuer and Director of Professional Services at Bannon.

Hambleden House

19-26 Pembroke Street Lower

Dublin 2

D02 WV96

Ireland

»Map

Phone: +353 (1) 6477900

Fax: +353 (1) 6477901

Email: info@bannon.ie