Dublin Office Market Q2 2024

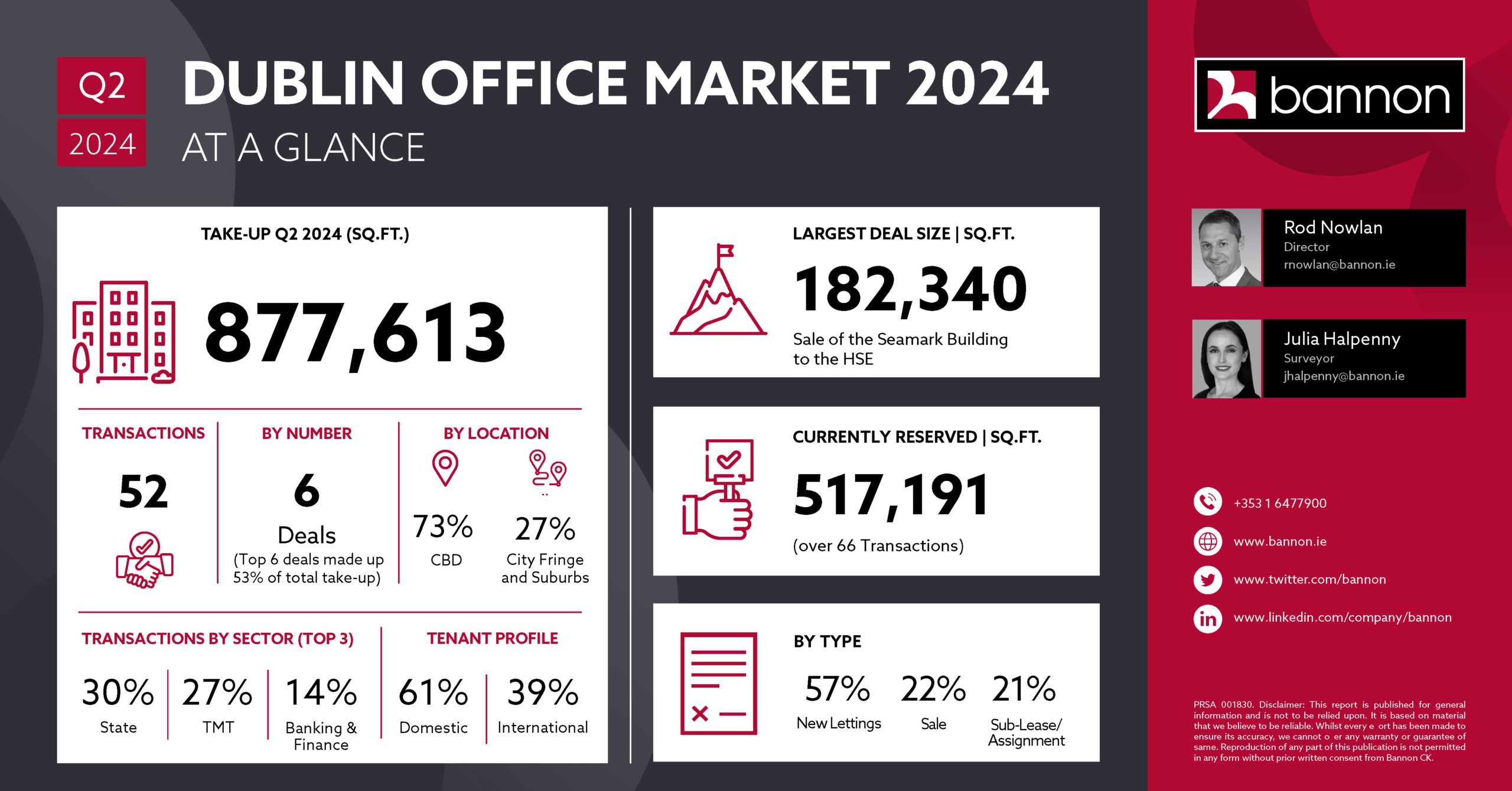

Q2 saw a very positive pick-up in office activity with take-up reaching over 870,000 sq.ft., a material increase on the mere 197,000 sq.ft. transacting in Q1. These figures were boosted by the inclusion of the sale of the 182,340 Sq.Ft. long vacant Seamark office Building in Elm Park which we understand was bought by the HSE for a step-down facility. In addition, in excess of 150,000 Sq.ft. of space was assigned to Stripe at Wilton Park, representing the first sign of large scale prime ESG take-up since covid. More importantly it is the first sign of the TMT sector beginning to become active again. This currently dormant sector usually represents approx. 50% of take-up Dublin figures as opposed to just 27% this quarter.

The average deal size in Q2 was 16,877 sq.ft. increasing from 5,640 Sq.ft. in Q1 and 7,774 Sq.ft. in the same quarter of 2023. As seen in previous quarters, small floorplates continue to dominate deal numbers with 22 transactions (out of 52) occurring in the <5,000 Sq.ft. bracket. This part of the market has actually remained relatively stable since the return to the office post-pandemic. Heading into Q3, there is still in excess of 500,000 Sq.ft. of space reserved, which creates some momentum for the second half of the year.