Quigleys Cafe opens in The Square

Bannon are delighted to welcome Quigleys Cafe, Bakery & Deli to The Square Tallaght.

The new cafe is now open for business just off the centre mall on Level 2.

Bannon are delighted to welcome Quigleys Cafe, Bakery & Deli to The Square Tallaght.

The new cafe is now open for business just off the centre mall on Level 2.

Angel Nails are now open at Manor Mills Shopping Centre, located at Kiosk 4 (bottom of travelator)

Urban Eyes are opening in Pavilions shopping centre, Swords!

New Local Independent Sunglasses Store looking to bring the classic and new brands to Ireland.

Hollister is set to become the latest retailer to join the line-up at the Blanchardstown Centre.

Hollister is set to become the latest retailer to join the line-up at the Blanchardstown Centre.

The American clothing brand has agreed a 10-year lease for a 582 sq.m (6,265 sq.ft) unit at the hugely-successful Dublin scheme.

Hollister will join JD Sports who signed up last year for a 1,100 sq.m (11,800 sq.ft) store within a 55,000 sq.ft extension that is under construction. Distributed across two levels adjoining Blanchardstown’s central mall, the development will comprise eight new retail units upon completion next year.

Commenting on Hollister’s decision to locate at Blanchardstown, Pat Nash, managing director of Multi Ireland & UK, said: “This signing underlines the growth of our offering and our ability to provide the broadest retailing choice in both our retail parks and our covered malls.”

Separately, Fingal County Council has granted planning permission for the development of an additional 3,200 sq.m (35,000 sq.ft) extension at Blanchardstown’s Blue Mall entrance.

Existing eateries

This space is being earmarked for the provision of a number of new restaurants ranging in size from 142 sq.m to 861 sq.m (1,528 sq.ft to 9,267 sq.ft). The extension will be located within close proximity to the Odeon cineplex and several of Blanchardstown’s existing eateries including Nando’s Milano and Eddie Rockets.

Developed originally by Stephen Vernon’s Green Property in 1996, the Blanchardstown Centre is acknowledged as one of Ireland’s foremost and most successful retail and leisure operations with more than 16.5 million visitors annually. The scheme includes more than 180 stores and is anchored by Dunnes Stores, Marks & Spencer, Penneys and Debenhams.

Bannon are delighted to be part of the Blue Mall extension with strong interest from both National & International F&B operators.

Carraig Donn are delighted to open their brand new store in The Square Tallaght today from 11am, where they are offering 20% off full price stock, goodie bags for the first 50 customers plus more exclusive opening offers!

Dublin’s largest menswear fashion Diffney is now open on Level 1 in The Square Tallaght.

Planning permission has been granted for a large new retail and residential development in south Dublin, despite strong opposition from the owners of the Dundrum Town Centre.

An Bord Pleanála has rejected an appeal by several parties including the Dundrum Retail Limited Partnership against the decision of Dún Laoghaire-Rathdown County Council to approve a €75 million project that will form part of the existing retail park and office development at The Park in Carrickmines.

The developer IPUT has plans for a neighbourhood shopping centre including two supermarkets, retail warehouses, restaurant, café, seven-screen cinema, crèche, offices, car showroom, medical centre and indoor skydiving facility as well as 130 apartments on a 10.5 hectare site close to the M50.

The overall development will extend to almost 84,000 sq m in four blocks extending in height from two to six storeys.

Commenting on the ruling, IPUT said it was “a major step forward in realising our ambition to reinforce Carrickmines Park as the leading out-of-town retail destination in Dublin”.

The development was also opposed by the owners of the cinema multiplex in the Dundrum Town Centre as well as Olivia Buckley, a Fianna Fáil candidate for the Dundrum area in the recent local elections.

DRLP, which is a joint venture between UK property group Hammerson and German insurer Allianz, said it was not opposed to the new development in Carrickmines in principle.

However, it claimed the proposed level of retail floor space was excessive for a neighbourhood centre particularly given there was no significant immediate residential catchment population to justify its scale.

DRLP said the proposed cinema and leisure uses would undermine the viability of existing town and district centres in south Dublin and represented a material contravention of the council’s development plan as well as running contrary to a range of regional and national planning policies.

Ms Buckley opposed the development claiming there was no requirement for another large retail centre or massive cinema complex in south Dublin and expressed concern it would impact on other nearby centres including Dundrum, Stillorgan and Dún Laoghaire.

Oversubscribed

She claimed retail warehousing was already oversubscribed in the capital, while the extension of The Park would also create serious traffic congestion on the M50.

Ms Buckley said it was disingenuous to call what was proposed a neighbourhood centre and branded such a description as “seriously misleading and inaccurate”.

Movies@Dundrum claimed the proposed multi-screen cinema would impact on its business when it relied on the planning system to protect its investment.

However, IPUT said there was a clear and long-standing need for a neighbourhood centre in Carrickmines as it was located in a significant growth area.

Dún Laoghaire-Rathdown County Council also said the development was an appropriate location for the centre as it would cater for new and emerging communities.

In its ruling, An Bord Pleanála said the centre would make a positive contribution to the urban character of the area.

The board said concerns relating to noise, vibration, dust and traffic could be satisfactorily mitigated by various measures and claimed the proposed development would have significant, direct, positive effects for the local population.

“Provision of neighbourhood centre facilities will reduce trips from the area to other locations,” it admitted.

IPUT successfully appealed a number of planning conditions imposed by the local authority that sought to deliver the project on a phased basis, which the developer claimed were overly prescriptive.

However, IPUT failed to overturn the condition which required it to construct a link road to Ballyogan Road before any other construction work began. IPUT claimed it was “unreasonable and unnecessary” and could impact on funding and the viability of the project.

It secured some minor concessions in its challenge to the scale of development contributions imposed by the local authority, which totalled almost €13 million.

Hammerson and Irish Life, joint owners of the Swords Pavilions Shopping Centre, have announced that luxury bath, body and home brand, Rituals Cosmetics will be opening its fourth stand-alone store in Ireland at Swords Pavilions, in the heart of North Dublin. Located close to the newly opened Superdry and JD Sports stores the 800 sq ft boutique will open on Wednesday 4th September 2019, enhancing the centre’s premium offer.

Founded in 2000 by Raymond Cloosterman, Rituals Cosmetics is the first brand in the world to combine home and body cosmetics, with an expansive product line including body care, scented candles, fragrance sticks, assorted teas, natural skin care and soulwear.

This latest announcement follows the opening of Swords Pavilions’ new dining quarter earlier this year with American burger chain Five Guys and well-loved pizza brand, Milano having already opened restaurants in the scheme. In July modern Persian kitchen Zaytoon also launched its new format restaurant at the centre.

This will be Rituals’ second stand-alone store opening in Ireland with Hammerson, having signed for a boutique in Dundrum Town Centre which launched in September 2018. The brand also has an outlet store in designer shopping destination, Kildare Village, owned by Hammerson through their partnership with Value Retail.

Simon Betty, Hammerson Director of Retail Ireland, said: “Rituals is a great addition to the brand offer at Swords Pavilions, demonstrating the continued demand from premium brands for high quality retail space in strong consumer catchments such as Swords Pavilions. Lettings such as this are a prime example of our strategy to ensure the centre remains the main retail and leisure destination in North Dublin.”

Rituals UK & Ireland Managing Director, Penny Grivea, said: “We are so excited to be opening another stand-alone store in Dublin at Swords Pavilions, allowing us to introduce the Rituals experience to as many customers as possible. Whether it is enjoying a hand massage at the water island or simply a cup of herbal tea upon arrival, the team can’t wait to help the Pavilions customers slow down and transform daily routines into meaningful rituals. This opening marks an exciting time for the brand, building upon our existing retail presence in Ireland.”

DANISH HOME RETAIL brand JYSK is planning to open 40 Irish stores within the next five years, effectively more than doubling its previous expansion plan for the country.

The 40-year-old Scandi retailer opened its first Irish store in Naas, Co Kildare in April and has since opened in three more locations. Earlier this year, JYSK – which is pronounced “yusk” – said it was planning 15 stores across the Republic.

The company has since revised these plans and said it now aims to open in 40 locations here over the next three to five years, which it says will help its Irish operation generate annual sales of up to €70 million.

To help source potential locations, JYSK – which sells a range of home furnishings and mattresses – is planning to meet with potential landlords at a showcase in Dublin in mid-September after encountering difficulties with its growth plan here.

Poul Erik Larsen, JYSK’s expansion director, said it has been more time-consuming and expensive to open new stores in Ireland compared to other European locations.

“We have noted that in other parts of Europe, we can issue and sign a lease contract within two to four weeks, whereas in Ireland, this is taking up to 16 weeks in some cases,” Larsen said.

“To achieve the volume of stores we want in the Irish market within two to three years, we need to secure a steady flow of new locations and that is something we’re actively pursuing right now.”

Hammerson and Irish Life, joint owners of the Ilac Centre, have announced that Dunnes Stores has opened its new, premium food hall in Dublin city’s Ilac Centre, bringing some of Ireland’s leading artisan food brands to the city centre.

The new 2,400 sq.m (25,800 sq.ft) food hall, located on the ground floor of the Ilac Central Mall near H&M and River Island, will offer Baxter & Greene’s freshly cooked stone-baked pizza and hot roast sandwiches, artisan cheeses from Sheridan’s Cheesemongers, health foods from Nourish, a premium Fishmonger and an array of other high-quality food options. In addition, Café Sol will deliver great tasting coffee and a selection of pastries to have in store or take-away. For customers wanting to add to their garden, Diarmuid Gavin’s Outdoor Spaces has a wide selection of house plants, trees, pots and gardening tools.

The hall will be open seven days a week, 8.30am to 8pm Monday, Tuesday, Wednesday, Friday, Saturday and until 9pm on Thursday. On Sunday it will be open from 10am until 7pm.

Simon Betty, Hammerson Director of Retail Ireland, said: “This is the latest step in our ongoing plans to enhance the dining and leisure experience at the Ilac Centre, as we continue to deliver new and exciting brand openings for our customers to enjoy. We’ve seen the success of Dunnes’ food halls all around the country, so we are pleased to showcase their best-in-class produce which will be the perfect fit for this popular destination.”

The new Dunnes Stores food hall follows the recent announcement of a major renovation of the Ilac Central Square which will deliver three new restaurants, a café, a new 3,000 sq.ft retail unit and other significant enhancements. The project will also reconfigure the unit at the Coles Lane entrance to facilitate late-night trading as well as new planting and paintwork around the lane.

(before and after)

We are very excited to announce that we have just completed stage 1 works to our existing car park as part of the Phase 2 development at Gateway Retail Park.

Scandinavian furniture and homeware chain JYSK opened their second Irish store this morning at Drogheda Retail Park as people queued up to get into the new JYSK store which was officially opened at 9.00 am.

Founded in Denmark in 1979, JYSK , (it’s pronounced “Yusk”), is a global retail chain with more than 2,700 stores worldwide selling everything for the home, it has a turnover of €3.6 billion a year and employs some 23,000 people.

The Drogheda JYSK store is the group’s second in Ireland, it opened its first branch in Naas in April and stores are also scheduled to open in Navan later this month and Portlaoise in August.

Intersport Elverys who proudly invested in Tipperary GAA, are delighted to announce they have officially opened their new store in Thurles Shopping Centre with the widest range of GAA, running and training gear for kids and adults.

Intersport Elverys, in partnership with Tipperary GAA invited fans young and old to meet the Inter County players and browse the new store. There was exclusive interviews, fun activities and exclusive discounts on the day.

They were joined by Tipperary players Seamie Callanan, Noel McGrath and Ronan Maher on the day who took pictures and signed autographs with fans.

Boots has become the latest major retailer to sign up at the landmark Gateway Retail Park in Galway.

The pharmacy-led health and beauty retailer has agreed to take a new 700 sq.m (7,500 sq.ft) premises at the scheme.

Boots are understood to be paying a rent in excess of €35 per sq.ft per annum for its new store which is under construction as part of the second phase of the retail park. Boots will be located immediately adjacent to the new branch of Harvey Norman.

Due for delivery in the first quarter of 2020, the second phase at Gateway will comprise an additional 11,148 sq.m (120,000 sq.ft) of retail space offering eight new retailers, three new food and beverage operators and a gym. Current tenants at the Gateway park include Dunnes Stores, Next, New Look, McSharry Pharmacy and B&Q.

Gateway’s asset manager, Paddy O’Connor of Sigma Retail Partners, believes Boots’ decision to locate at the scheme further underpins it as the destination of choice for retailers in Galway.

Darren Peavoy of Bannon who handled the letting on behalf of the landlord said the remaining units at the scheme are all under offer.

Costa Coffee will open a brand new store in Waterford Retail Park on the Outer Ring Road this summer. The new coffee pod will take up a floor area of approximately 2,600 sq. ft and will result in a bright and spacious high-spec coffee offering with outdoor seating. It joins other big-name retailers in the retail park including anchor tenant Harvey Norman, Homestore & More, Curry PC World, Halfords, Home Focus, EZ Living Interiors and Maxi Zoo.

Costa Coffee is a multinational coffee house company and is the second largest coffee house in the world. Costa Coffee is present in 31 countries across the globe and it opened its first store in Ireland in 2005. Its number of stores have been growing ever since and it has multiple stores all over Ireland.

The asset manager for Waterford Retail Park, Jenna Culligan from Sigma Retail Partners, said “We are delighted that Costa Coffee is joining our very strong tenant line-up in Waterford Retail Park. As part of our strategy for this park we identified that food and beverage was missing for the park and we sought to provide this for the retail park. As everyone knows Costa Coffee are one of the biggest coffee chains in the UK and Ireland and we are absolutely delighted to have them on board.”

Waterford Retail Park is easily accessed from Waterford City and is less than a 10 minutes’ drive away. The retail park is located along one of the main access routes to Waterford City from the M8 and N25 (Cork Road) and benefits from free customer parking. Waterford Retail Park is also located close to Waterford Greenway and the new Costa Coffee store will be a great pit-stop for visitors heading to and from the Greenway.

Bannon are the letting agents for Waterford Retail Park.

Bannon are delighted to have secured Petstop for the former Maplin unit in Limerick One Shopping Park.

At a rent of €24 per sq.ft for the 7,500 sq.ft unit, this letting further illustrates Limerick One’s regional importance as a premier retail trading destination.

A majority stake in Navan town Centre, which was on the market in 2016 for €62 million, has just been bought for about €43 million.

However, the off-market sale, which was handled by Rod Nowlan of Bannon and has just received clearance from competition authorities, did not include a residential element valued at less than €5 million that formed part of the 2016 offering.

The stake was sold to a fund controlled by Davy at an attractive yield of about 9-9.5%. This is undoubtedly a strong return for an asset of this scale in the Irish market at this time. However, the fall in value of the stake since 2016 is reflective of a softening market for provincial retail assets at a time when traditional retailing faces a significant challenge from eCommerce.

‘Stampede’

Declan Stone pointed to some notable retail transactions recently – principally Kilkenny, Carlow and Globe retail parks (all acquired by Friends First) – but suggested that retail as a sub-sector of the overall Irish investment market had its heyday in 2016 when retail transactions accounted for some 50% of a €4.4 billion market.

“In 2017 it fell to 28% of a €2.28 billion market and up to the third quarter of 2018 only accounted for about 11% of the total €2.53 billion spend,” says Stone.

“For me, the charge into retail in 2016 was somewhat surprising and seemed far more driven by the weight of capital than by underlying occupier demand. Put simply, retail yields tumbled – driving up capital values – but in the background there was little tenant demand to underpin this, and in fact in the intervening 24 months the occupational market has worsened.”

The 65% majority stake in Navan Town Centre came on the market in September 2016 through Savills and Cushman & Wakefield. CarVal Investors had bought loans underpinning the centre during the crash.

A number of deals were reportedly agreed for the stake at a price of about €54 million, but the major international investor concerned did not proceed with a transaction.

Driving force

The 65% shareholding was generating a rent roll of about €4.7 million as recently as 2017.

The balance of the shares in the centre are held by Irish Life.

Danish global home retail brand, JYSK, will open 15 stores across Ireland in the next two years, creating more than 200 jobs.

Founded in Denmark in 1979 by Lars Larsen, over the past four decades JYSK has expanded to 51 countries with more than 2,700 stores worldwide employing 23,000 people.

The first Irish store will open in Naas, Kildare in April, with two further stores opening in Drogheda, Louth and Navan, Meath in May, and a fourth store opening in Portlaoise, Laois opening during the summer.

Roni Tuominen, head of retail, said Ireland is a very important market for JYSK, given the prominent position the retail industry holds in the country for employment and the economy. “As a company, we focus on entering a new market each year, and we are excited that 2019 is the year we bring our brand to Ireland. We will open here with our latest concept stores and deliver exceptional quality products at great prices to Irish consumers,” he said.

JYSK offers a range of products for the home, from the bedroom to the garden. The brand has also enjoyed a world-wide reputation for expertise and knowledge in sleeping culture, which continues to this day, offering everything from mattresses to frames and bases.

Costa Coffee is the latest tenant to join the line-up at Malahide Road Retail Centre in north Dublin. Costa is trading out of a 2,000 sq.ft coffee pod that also has the use of outdoor seating. The letting comes just as the landlord, Irish Life, has resurfaced the car park and upgraded signage, lighting and landscaping.

The centre benefits from its location on the Malahide Road dual carriageway, attracting more than 25,000 customers most weeks. It is anchored by Woodies and Lidl, and other tenants include Halfords, Equipet, Right Price and Tiles.

Joint letting agents Bannon and Lisney are currently marketing two available units ranging in size from 4,950 to 9,895 sq.ft.

Canadian restaurant chain Pita Pit and Japanese eatery Musashi are to join Krispy Kreme in trading out of a newly redeveloped block at Ireland’s largest retail and leisure destination, the Blanchardstown Centre in north Dublin.

Both of the new units will extend to around 170 sq.m (1,829 sq.ft) and will include outdoor seating and dining areas, according to management company Multi Ireland. The expansion of the dining facilities comes after the recent opening of the first Krispy Kreme store in Ireland, which has attracted continuous queues for its own brand of doughnuts.

Pita Pit’s new outlet will be its first in Ireland. Founded in 1995 as a healthy alternative to fast food, the company has more than 500 outlets worldwide, mainly in the US and Canada.

The final unit in the block will be occupied by sushi and noodle bar Musashi, which already has five existing restaurants in Dublin. The new Blanchardstown outlet is the first in a shopping centre environment. Already open at the same block is Esquires, the international coffee house chain.

Multi Ireland has spent the past 12 months redeveloping the block, which had been vacant for several years. Putting this space back into productive use is expected to broaden the appeal of the Blanchardstown offering and add around €800,000 to the rent roll.

Simon Cooper, head of leasing, said Multi Ireland was particularly pleased that Krispy Kreme had selected Blanchardstown for their “debut Irish outlet”.

Businessman Eamon Watters, owner of Panda Waste, one of Ireland’s largest waste collection and recycling companies, has acquired a substantial stake in Charlestown Shopping Centre at junction five of the M50 in north Dublin. The acquisition was made through an investment vehicle called Garristown Venture Holdings.

The large-scale shopping centre and an adjoining site with planning permission for 247 apartments and further retail space have been sold for slightly over €42 million, well ahead of the €35.5 million quoted by selling agents.

David Carroll and Rod Nowlan of Bannon’s Capital Markets team handled the sale on behalf of the vendors.

Garristown Venture Holdings is owned and controlled by Ronan Barrett, a Dublin-based businessman who is originally from Co Tyrone. Mr Barrett confirmed that it is funding the acquisition through a combination of equity capital from Citadel’s institutional and private clients and senior and mezzanine debt funding from AIB and Cardinal Capital. Mr Watters is thought to be the primary client in the Citadel entity.

Charlestown is a well-established district shopping centre developed by brothers Michael and Tom Bailey and now under the control of the National Asset Management Agency.

Michael Bailey is a near neighbour of Mr Watters close to the village of Beauparc in Co Meath.

Panda is the largest exporter of recycled materials in Ireland and employs more than 650 people.

Garristown has confirmed that it is at an advanced stage of discussions with a number of prospective tenants for Charlestown, which will see the delivery of new letting and services including a TGI restaurant, a creche and a gym – which will bring the centre to 100% occupancy.

Planning permission

The centre has the benefit of a current grant of planning permission for 247 apartments on adjoining lands.

The new owners are in advanced discussions with John Paul Construction about the commencement of residential development on the site in the fourth quarter of this year.

Garristown says the adjoining land has the capacity to accommodation more than 400 apartments based on the revised density and height guidelines.

The shopping centre and leisure facilities – a rented nine-screen Omniplex cinema and Leisureplex facility – are producing a combined operational income of €2,835,738 – with the shopping centre accounting for €1,935,000 and the cinemas and Leisureplex block yielding €900,000.

More than 75% of the rental income comes from 10 tenants in a scheme which has an occupancy rate of 91%. Charlestown is anchored by Dunnes Stores, which owns its supermarket extending to 6,500 sq.m (70,000 sq.ft).

The other main tenants are Heatons, which pays a rent of €450,000 followed by Boots (€400,000), Leisureplex (€225,000), Carphone Warehouse (€105,000) and Lifestyle (€70,000).

A good proportion of the weekly average footfall of 54,000 is generated by the free access to a 1,350-space underground car park.

Currys PC World is coming to Waterford Retail Park. The 13,000 sq.ft. fit-out has commenced and it is due to open the end of August.

Waterford Retail Park is a premier retail park with a high profile location along one of the main access routes to Waterford City from the M8 and N25 (Cork Road). Anchored by Harvey Norman. The other retailers are Homestore & More, Halfords, Home Focus, EZ Living Interiors and Maxi Zoo. Waterford Retail Park celebrates its 10th year anniversary this year.

James Quinlan of Bannon, who is the letting agent for Waterford Retail Park, said “We are delighted that Currys PC World have decided to join the strong tenant line-up in the retail park. Costa have also agreed a deal in the park which will give customers the food and beverage offer that will improve the overall shopping experience at the park”

For further letting opportunities contact Bannon today on 01 647 7900

Manor Mills Shopping Centre has just opened a brand new Costa Coffee store and its arrival has generated a lot of excitement in the centre. Costa Coffee has invested heavily in its 1,600 sq. ft new store fit-out which has resulted in a bright, high spec coffee offering.

Costa Coffee is a multinational coffee house company and is the second largest coffee house in the world. Costa Coffee is present in 31 countries across the globe and it opened its first store in Ireland in 2005. Its number of stores have been growing ever since and it has multiple stores all over Ireland.

Sigma Retail Partners are the asset managers for Manor Mills Shopping Centre. Jenna Culligan from Sigma, said “We acquired Manor Mills just over a year ago and one of our asset management strategies from the outset was to bring in additional reputable brands and enhance the food and beverage offer to raise the profile and increase footfall and dwell time into the centre. We just had The Natural Bakery open last week and now we have Costa Coffee, and the feedback we have received from both customers and retailers alike have been very encouraging. We wish Costa Coffee all the best and we are delighted to welcome them into Manor Mills Shopping Centre.”

A significant amount has already been invested into the rebranding of Manor Mills Shopping Centre and plans for further investment are set to continue. The centre has recently installed free Wi-Fi throughout the mall adding further to its appeal to shoppers.

Manor Mills Shopping Centre is centrally located within Maynooth town itself and is located adjacent to Maynooth University. The shopping centre itself is home to 30 retailers including Dunnes Stores, Carraig Donn, Eason and Hickeys Pharmacy. There are over 500 free car parking spaces in a covered car park.

Manor Mills Shopping Centre in Maynooth has just opened a new store ‘The Natural Bakery’, an Irish company that offers a wide variety of breads, cakes, sandwiches, donuts and pastries, made fresh daily from scratch. They opened their first bakery in Kilmainham in 2013 when their owner Luke Ceighan realised there is a demand for more authentic, artisan baked goods. The concept was soon a success and by 2014, The Natural Bakery opened shops in Donnybrook, Rathmines, Ranelagh and Stillorgan. In 2015, Dun Laoghaire, Clarehall, Baggot Street, IFSC and Naas followed. They now have 13 stores in Ireland.

Jenna Culligan from Sigma Retail Partners, asset managers for Manor Mills Shopping Centre, said “We acquired Manor Mills just over a year ago and one of our asset management strategies from the outset was to bring in reputable brands and enhance the food and beverage offering to raise the profile and increase traffic, footfall and dwell time into the shopping centre. We identified the need for a popular bakery that offers a wide range of tasty pastries, cakes and treats for our shoppers. We wish The Natural Bakery all the best and we are delighted to have them added to our centre.”

A significant amount has already been invested in the rebranding of Manor Mills Shopping Centre and plans for further investment are set to continue. The centre has recently installed free Wi-Fi throughout the mall adding further to its appeal to shoppers.

Manor Mills Shopping Centre is centrally located within Maynooth town itself and is located adjacent to Maynooth University. The shopping centre itself is home to 30 retailers including Dunnes Stores, Carraig Donn, Eason and Hickeys Pharmacy. There are over 500 free car parking spaces in a covered car park.

For letting opportunities contact Bannon today on 01 647 7900.

One of the last large scale shopping centres to be offered for sale on the instructions of Nama – Charlestown Shopping Centre at Junction 5 of the M50 in north Dublin – is expected to be of interest mainly to US private equity funds and a mixture of Irish and overseas companies planning to strengthen their position in the private rental sector.

Agents Bannon and Savills are quoting €35.5 million for the complex, which has been made a great deal more appealing by the inclusion of an adjoining site with planning permission for 247 apartments and 7,000 sq.m (75,346 sq.ft) of shopping and other commercial space on the ground floor.

The agents said the planned addition of some 400 residential units in the immediate area – coming after the sale of 235 high-rise apartments to IRES and other buyers in recent years – would “add significantly to the sustainability and ultimate growth of the centre”.

Even as things stand, the shopping centre as well as the rented nine-screen Odeon cinema and Leisureplex facility are showing a return of 8% on the net operating income for the owners. The joint agents have been instructed to sell the entire investment in a single lot or, alternatively, in two parts: the shopping centre and leisure/cinema block as one lot and the mixed-use development site separately.

The shopping centre and leisure facilities produce a combined operational income of €2,835,738, with the shopping centre accounting for €1.935 million and the cinemas and Leisureplex block yielding €900,000.

The selling agents will be informing interested parties that more than 75% of the rental income comes from 10 tenants in a scheme that has an occupancy rate of 91%.

Charlestown is anchored by Dunnes Stores, which owns its supermarket extending to 6,500 sq.m (70,000 sq.ft).

The other main tenants are Heatons, which pays a rent of €450,000, followed by Boots (€400,000), Leisureplex (€225,000), Carphone Warehouse (€105,000) and Lifestyle (€70,040).

Apart from Dunnes, the centre has a lettable area of 8,638 sq.m (92,980 sq.ft) across 26 mall units, kiosks and external units. Much of the weekly average footfall of 54,000 is generated by free access to a 1,350-space underground car park.

In 2013, the Charlestown management developed fast food outlets for McDonald’s and KFC at the at the front of the shopping centre. These were sold to Hong Kong investors for €4.3 million – providing returns of 6.5%.

Rod Nowlan of Bannon and Domhnaill O’Sullivan of Savills, who are handling the sale, said they expect strong interest in the investment given the quality of the built scheme and the obvious potential derived from the lease-up opportunities and from the direct and indirect residential growth potential.

The US private equity giant Oaktree has made arrangements to complete the purchase of a controlling interest in The Square shopping centre in Tallaght, Co Dublin, tomorrow. The €250 million sale by Indego and Nama was one of the largest retail transactions in Ireland in 2017.

The 27-year-old shopping centre – Ireland’s largest when it first opened – registered some 22 million visitors in 2017 and currently produces an annual rental income of almost €14 million.

Marcus Wren of Sigma Retail Partners, advisers to Oaktree’s European Principal Group, yesterday commented that The Square had remained in “fractured ownership” since opening in 1990 and as a consequence it had not been possible until relatively recently to meaningfully adjust or manage the centre to reflect the needs of today’s shopper.

He said that Indego, with support from Nama, astutely established a strong platform to manage the asset by acquiring and amalgamating various borrowers interests in the scheme over the past number of years so as to be in a position to sell more than 90 per cent of the unit shops (118) and 100 per cent of the redevelopment potential.

Bernard Hamill, outgoing chief executive of the Indego Group, said that having laid down and implemented their strategic plan, together with the considerable support and assistance of Nama, to bring The Square to a market in a ready state he wished the new owners every success.

Rod Nowlan of Bannon Investment, who acted for Oaktree, commented that with rental levels less than half those prevailing at The Pavilions shopping centre in Swords, the Tallaght investment “represents a virtual sleeping giant”.

“The Square has immense potential for private residential schemes on its 19 acres of surface parking and a virtually untapped food and beverage opportunity on the sunny and picturesque southern side of the scheme,” he added.

The volume of retail sales increased by 2.6% in the month of November, with an annual increase of 6.8%. If Motor Trades are excluded, there was an increase of 1.9% in the volume of retail sales in November 2017 when compared with October 2017 and there was an increase of 7.6% in the annual figure.

The sectors with the largest monthly volume increases were Electrical Goods (14.5%), Department Stores (6.7%) and Other Retail Sales (5.7%). The sectors with the largest month on month volume decreases were Pharmaceuticals Medical & Cosmetic Articles (-11.2%), Bars (-1.5%) and Books, Newspapers and Stationery (-1.2%).

There was an increase of 2.6% in the value of retail sales in November 2017 when compared with October 2017 and there was an annual increase of 4.4% when compared with November 2016. If Motor Trades are excluded there was an increase of 1.2% on the month and an increase of 4.5% in the annual figure.

CSO reports

Planning permission for a €40m redevelopment and extension of the Red Mall at Blanchardstown Shopping Centre has been granted by the local authority.

It paves the way for the creation of up to 300 more jobs at the Dublin location, which is the country’s second-largest shopping centre.

Blanchardstown Shopping Centre – which is owned by US private-equity giant Blackstone – intends to add an additional 100,000 sq.ft of retail space.

It will see the construction of a single, 40,000 sq.ft unit, as well as 18 standard units.

Multi Corporation, Blackstone’s pan-European retail platform, manages the Blanchardstown Shopping Centre on behalf of the $9bn (€7.7bn) Blackstone fund that acquired the mall for €950m from Green Property last year.

When it acquired the property, Multi Corporation said there was scope for adding a total of about 150,000 sq.m (1.6 million sq.ft) of retail, residential, office and leisure space to the Blanchardstown site.

The shopping complex has about 12 million sq.ft (112,000 sq.m) of retail space. There are about 180 outlets at the centre and some tenants will be relocated in order to facilitate the new development.

When it first announced the planned extension to the shopping facility in September, Multi Corporation said the building work involved would support 250 construction jobs. The centre currently supports 5,500 jobs.

Dominic Deeny, the managing director of Multi Ireland, said in September that the new extension would be the second in a number of planned investments at Blanchardstown.

The Irish Independent recently revealed that US doughnut chain Krispy Kreme has selected Blanchardstown Shopping Centre as the location for its first-ever outlet in Ireland. The chain, now owned by Germany’s billionaire Reimann family, had been scouting for more than a year for a location in Ireland.

McDonald’s has also just secured planning permission to extend its drive-thru restaurant at Blanchardstown. It will add 462 sq.ft to boost the size of the outlet to 3,500 sq.ft.

Contact our Retail Letting Agents today for opportunities

Two neighbourhood centres at Rathbourne in Ashtown, Dublin 15, and another one at Stepaside in Dublin 18, are expected to attract a considerable interest when they are offered for sale in two separate lots through the Bannon agency.

David Carroll of Bannon is seeking €5.85 million for two shopping facilities at Rathbourne and €1.9 million for the Stepaside centre.

Castlethorn Development developed all three centres as part of large housing estates and is building a further homes in both locations.

The Village and River Centre are two separate retail schemes within the extensive Rathbourne housing development beside Ashtown train station and Phoenix Park. The Village is anchored by an owner-occupied SuperValu and includes 14 other retail and leisure units extending 1,905 sq.m (20,503 sq.ft). They are yielding a rental income of €373,000. Occupiers include Lloyds Pharmacy, Douglas and Kaldi, Bombay Pantry, Canal Bar and Geisha Asian Restaurant.

The River Centre, located about 400m from the Village, is considerably smaller with a Spar outlet and a Giraffe Childcare facility. A GP due to rent another unit in the coming weeks will bring the net operating income to €188,000.

The €5.85 million being sought for the two centres will show a return of 9.2%.

The third asset at Stepaside, known as Belarmine Plaza, is anchored by Fresh Supermarket and has a range of commercial units over three levels and an overall floor area of 3,398sq m (36,574sq ft). Bannon says the existing net income of €173,000 can be “significantly enhanced” when tenants are found for about 40% of the available space.

The €1.9 million being sought for the centre will show a net income yield of 8.71% after standard acquisition costs are deducted.

David Carroll and Alex Patterson said they are expecting good interest in the three centres given the opportunities to grow the income.

“Growth in sales during Q2 2017 outstrips growth in footfall”

Our last quarterly update (Q1 2017) showed a mix of footfall growth and sales contraction for the Bannon Shopping Centre Portfolio. The numbers for Q2 2017 were much more positive with growth in footfall and sales of +0.37% and +2.44% respectively.

Q2 2017 benefited from having the full boost of the Easter period, however it was the sales growth towards the end of the quarter which really made the difference. Sales in June 2017 were 4.46% ahead of June 2016, leaving the cumulative total for the first 6 months of 2017 +0.89% ahead of the first 6 months of 2016.

The opening of Inglot, Vila and Selected in Athlone Towncentre Shopping Centre during the quarter brought the mall occupancy rate in the centre to 100% for the first time since the centre opened In Nov 2007. The total occupancy rate for the Bannon portfolio improved slightly during Q2 to 98.8%.

Shirley Delahunt, Centre Manager at Athlone Towncentre said “the opening of Inglot, Vila and Selected within the last three months is hugely encouraging for the centre and reaffirms our position as the premier shopping destination in the Midlands”.

Jennifer Mulholland, Associate Director within the Retail Lettings Department at Bannon noted that “there is strong interest from international brands and finding good quality space has become the biggest issue facing retailers”.

At present Bannon manage over 6 million square feet of retail assets with a total annual rent and service charge income of €100 million and an annual footfall of 85 million. The portfolio is made up of a range of retail assets, from large regional shopping centres to small local neighbourhood schemes.

“strong interest from international brands and finding good quality space has become the biggest issue facing retailers”

Leading outdoor apparel retailer, Regatta Great Outdoors is to open a store in the newly-redeveloped Moore Mall South at the Ilac Centre.

The company signed an agreement in recent weeks for the final space in the refurbished €1.5 million wing of the centre which is owned jointly by UK shopping centre giant Hammerson and Irish Life. Regatta Great Outdoors is set to occupy 1,958 sq.ft at the Ilac. Fit-out of its new store will commence towards the end of this month in preparation for a September opening.

The Moore Mall South redevelopment has seen the arrival of four other new tenants at the Ilac Centre.

BB’s Coffee & Muffins has committed to 1,679 sq.ft, while book and toy retailer, The Works, has opened and occupies 1,958 sq.ft.

Sport supplement store, So Nutrition, and specialist catering equipment retailer, Nisbets. are due to occupy 560 sq.ft and 5,554 sq.ft respectively.

Check out further opportunities in the Ilac Centre

Article in independent.ie

Congratulations to our Quayside Shopping Centre manager Christine Dolan who was runner up for the Young Achiever of The Year 2017.

Bannon took over as managing and letting agents of Quayside in August 2016 and soon after it was clear that Christine was a key member of the management team, had great potential and she was quickly promoted to the role of Centre Manager & Head of Marketing. The centre has seen a significant resurgence since Bannon took over and this award is reflection of Christine’s hard work and dedication to the centre.

The Sceptre awards recognise the best practice and the best people in the shopping centre industry.

They are the pre-eminent accolades in the shopping centre industry, putting the spotlight on management teams, retailers and suppliers that demonstrate real excellence.

Fears about the future of global retail are permeating all markets, and no more so than the property sector. Foremost among concerns is the impact of the internet and autonomous private vehicles and drones and other autonomous delivery systems.

These issues have and will continue to have an impact on the role of the lowly shop in our society. However, like most fears this is largely derived from a lack of knowledge and understanding. It is much easier to keep away from what is perceived as a “scary and unpredictable” property sector than try to understand it. But through understanding comes rich rewards.

So why all the fear? By and large it is derived from the retail carnage that has unfolded in the US over the past number of years. High-profile store closures and job losses have been par for the course, but the only real surprise is that it didn’t all happen sooner. Little-known fact: the US has more than six times the retail floor space per capita than the UK and more than 10 times (yes, 10 times) the European average.

According to Forbes magazine, the number of American shopping centres has grown by more than 23%, and GLA (gross leasable area) by almost 30% since 1995. In that time the population has grown by less than 14%. Forbes says there is now close to 25 sq.ft of retail space per capita, and about 50 sq.ft if small shopping centres and independent retailers are added. In contrast, Europe has about 2.5 sq.ft per capita.

In addition, because of the maturity of the US market this is largely old and out-of-touch stock, such as generic strip malls and mass discount retail warehouses.

In this context, it is absolutely logical that the American retail sector is going through such a horrendous time. The internet impact was just the straw that broke the considerably overburdened camel’s back.

Another key feature distinguishing the “Irish situation” from that of the Americans, or even the British, is the impact of our planning system.

Despite the system’s many flaws, since 1999 the concept of sustainability has been at the heart of Irish planning, where proof of demand needs to be established and retail impact considered.

Now, there is no denying that there are multiple examples where competing city and county areas (or two adjoining counties) have granted excessive retail permissions in a clear attempt to secure “rates” for their district. By and large, however, the system has not gone down the UK route of hollowing out its town centres with mass satellite development, or the American route where brand new schemes are built, necessitating the closure of the neighbouring older “mall”.

As a consequence the Irish retail stock, which is largely situated within or close to existing historic town centres, is better placed to adapt to the additional pressures brought by demand for a more modern “experiential retail product”.

Unlike the relatively simplistic supply and demand dynamics that have driven the Irish office and residential sectors to uncomfortably high levels, “the fear factor” echoed at every property conference over the past 24 months has left the retail sector as the last remaining refuge of true value in the Irish property market.

Yes, there are examples of “over-enthusiastic purchases”, but most well-advised investors of retail portfolios over the past two years are enjoying double-digit capital growth as well as attractive ongoing cash-on-cash returns, and this is before things really start to “kick-off”.

A case in point is Sigma Retail Partners’ recent acquisition of the Manor Mills Shopping Centre in Maynooth, Co Kildare, which was acquired in 2004 for nearly €50 million. It was in turn acquired last January by Sigma on behalf of a private equity fund for €13.8 million, with a number of vacant units and a net operating income yield of 8.5%.

Less than six months later, Manor Mills is approaching full occupancy and producing a yield of 10.2%, with annual cash-on-cash return of more than 18% off predominantly market rents.

So were the new owners just lucky in a “scary and unpredictable sector”?

I believe there is more to it than that. Information is key. Turnovers, sales density, footfalls, click-and-collect sales and returns are key underwriting inputs. This is real-time factual data, not hypothesis or conjecture, based on data collected across the shopping centres and high streets across the country – not generic national statistics which hide the winners and losers.

When we overlay the demographic data along with its economic growth, there are (and will be) both seriously big winners and big losers in the retail property sector.

Knowing which to invest in is the key. Knowledge-based investment is not so scary and very lucrative.

Rod Nowlan is a director director of capital markets at Bannon Property Consultants.

Fears about the future of global retail are permeating all markets, and no more so than the property sector. Foremost among concerns is the impact of the internet and autonomous private vehicles and drones and other autonomous delivery systems.

These issues have and will continue to have an impact on the role of the lowly shop in our society. However, like most fears this is largely derived from a lack of knowledge and understanding. It is much easier to keep away from what is perceived as a “scary and unpredictable” property sector than try to understand it. But through understanding comes rich rewards.

So why all the fear? By and large it is derived from the retail carnage that has unfolded in the US over the past number of years. High-profile store closures and job losses have been par for the course, but the only real surprise is that it didn’t all happen sooner. Little-known fact: the US has more than six times the retail floor space per capita than the UK and more than 10 times (yes, 10 times) the European average.

According to Forbes magazine, the number of American shopping centres has grown by more than 23%, and GLA (gross leasable area) by almost 30% since 1995. In that time the population has grown by less than 14%. Forbes says there is now close to 25 sq.ft of retail space per capita, and about 50 sq.ft if small shopping centres and independent retailers are added. In contrast, Europe has about 2.5 sq.ft per capita.

In addition, because of the maturity of the US market this is largely old and out-of-touch stock, such as generic strip malls and mass discount retail warehouses.

In this context, it is absolutely logical that the American retail sector is going through such a horrendous time. The internet impact was just the straw that broke the considerably overburdened camel’s back.

Another key feature distinguishing the “Irish situation” from that of the Americans, or even the British, is the impact of our planning system.

Despite the system’s many flaws, since 1999 the concept of sustainability has been at the heart of Irish planning, where proof of demand needs to be established and retail impact considered.

Now, there is no denying that there are multiple examples where competing city and county areas (or two adjoining counties) have granted excessive retail permissions in a clear attempt to secure “rates” for their district. By and large, however, the system has not gone down the UK route of hollowing out its town centres with mass satellite development, or the American route where brand new schemes are built, necessitating the closure of the neighbouring older “mall”.

As a consequence the Irish retail stock, which is largely situated within or close to existing historic town centres, is better placed to adapt to the additional pressures brought by demand for a more modern “experiential retail product”.

Unlike the relatively simplistic supply and demand dynamics that have driven the Irish office and residential sectors to uncomfortably high levels, “the fear factor” echoed at every property conference over the past 24 months has left the retail sector as the last remaining refuge of true value in the Irish property market.

Yes, there are examples of “over-enthusiastic purchases”, but most well-advised investors of retail portfolios over the past two years are enjoying double-digit capital growth as well as attractive ongoing cash-on-cash returns, and this is before things really start to “kick-off”.

A case in point is Sigma Retail Partners’ recent acquisition of the Manor Mills Shopping Centre in Maynooth, Co Kildare, which was acquired in 2004 for nearly €50 million. It was in turn acquired last January by Sigma on behalf of a private equity fund for €13.8 million, with a number of vacant units and a net operating income yield of 8.5%.

Less than six months later, Manor Mills is approaching full occupancy and producing a yield of 10.2%, with annual cash-on-cash return of more than 18% off predominantly market rents.

So were the new owners just lucky in a “scary and unpredictable sector”?

I believe there is more to it than that. Information is key. Turnovers, sales density, footfalls, click-and-collect sales and returns are key underwriting inputs. This is real-time factual data, not hypothesis or conjecture, based on data collected across the shopping centres and high streets across the country – not generic national statistics which hide the winners and losers.

When we overlay the demographic data along with its economic growth, there are (and will be) both seriously big winners and big losers in the retail property sector.

Knowing which to invest in is the key. Knowledge-based investment is not so scary and very lucrative.

Rod Nowlan is a director director of capital markets at Bannon Property Consultants.

“Footfall across the Bannon portfolio was +0.65% in Q1 2017”

Our last quarterly update (Q4 2016) showed a strong close to 2016 for the Bannon Shopping Centre Portfolio with total footfall growth of 0.85% and total turnover growth of 3.45%. The portfolio consists of regional shopping centres in various locations across the country.

The first quarter of 2017 saw footfall growth of 0.65% but sales were back by 2.95% versus the same period in 2016. The trend improved in April with a month on month increase in sales of 3.54% bringing the yearly running total (Jan – Apr) back to -1.19%.

The annual movement of Easter each year can have quite an impact on monthly totals and this was certainly the case during the first quarter of 2017. Easter Sunday fell on the 16th April 2017 versus 27th March 2016, thus April sales (Q2 2017) benefited significantly from this year’s Easter break.

Vacancy rates across the portfolio continued to fall during Q1 2017 and this is expected to continue with several very significant deals in the pipeline for Q2 and Q3 2017.

Ray Geraghty, Divisional Director within the Property Management Department at Bannon noted that despite a string of strong national economic indicators that consumers were cautious during Q1 2017 and this impacted on sales across the board. Ray believes that the outlook for 2017 remains positive, particularly from a letting perspective and that the occupancy rate across the portfolio is nearing the holy grail of 100%.

At present Bannon manage over 6 million square feet of retail assets with a total annual rent and service charge income of €100 million and an annual footfall of 85 million. The portfolio is made up of a range of retail assets, from large regional shopping centres to small local neighbourhood schemes.

“Tentativeness during Q1 2017 not impacting on retailer enquiries and vacancy rates continue to drop”

The Blanchardstown Centre in west Dublin has announced four new retail lettings which will lead to the creation of 50 full-time positions. The 120,000 sq.m shopping centre has only one 68 sq.m unit currently available to let. The new lettings will add more than €1.25 million per annum to the rent roll ranging from just under €100,000 for the smallest unit to almost €700,000 for the most prominent outlet.

The sports and fashion retailer Lifestyle Sports is to add to its portfolio in Blanchardstown by opening a new 500 sq.m (5,382 sq.ft) flagship store. Lifestyle will continue to trade from its 2,000 sq.m (21,527 sq.ft) outlet in the adjoining retail park.

Lingerie retailer Ann Summers will trade from a new 240 sq.m (2,583 sq.m) store on level 2 close to H&M, L’Occitane and Easons. This will be the third Irish outlet for the UK multiple which has more than 150 stores worldwide.

Virgin Mobile is also opening a new 30 sq.m (323 sq.ft) unit while the Australian retailer Smiggle will be launching its new stationery brands in a 100 sq.m (1,076 sq.ft) store on Level 1.

Dominic Deeney, managing director of owners Multi Ireland (part of the Blackstone group) said Blanchardstown was continuing to attract high-profile international retailers. Ann Summers, Smiggle and Virgin all had strong retail propositions which would add to the high quality retail experience offered to shoppers. Lifestyle was also expanding its portfolio, adding a new flagship store.

Huge queues at Grand Opening of new superstore, The Range, in Liffey Valley on Friday.

After months of anticipation the day finally arrived for Liffey Valley’s newest superstore, The Range, to open its doors. The launch took place at 9am Friday 19th of May at The Retail Park, Liffey Valley in front of a huge queue of eager customers. The store was officially opened by the Mayor of South Dublin, Guss O’Connell. He was joined for the celebrations by owner and founder of The Range, Chris Dawson. The crowd was overflowing with excitement and the ribbon cutting was met with smiles and applause.

Enthusiastic customers queued from 7pm the day before to secure their star prize of a Lay-Z-Spa Paris hot tub with others joining them to receive a runner up prize. They all could not wait to enter the store and discover the great variety of products that The Range has to offer.

Friendly staff were joined by Captain Range, the company’s own mascot and Livvie the Bear from The Retail Park, to welcome customers to the store. Once open, shoppers packed inside their new store to find themselves some fantastic bargains.

Friendly staff were joined by Captain Range, the company’s own mascot and Livvie the Bear from The Retail Park, to welcome customers to the store. Once open, shoppers packed inside their new store to find themselves some fantastic bargains.

The Liffey Valley store has an extensive Homewares department, as well as large DIY, Arts & Crafts and a spacious outdoor garden centre. There is also a large seasonal area offering a vast selection of luxury garden furniture, barbeques and solar lighting. There are some fantastic opening offers running across all departments until 4th June with many exclusive bargains available.

Dublin’s 98 FM promo team, the Thunder, were in-store to entertain the crowds in their fun zone with goody bags and face painting. The celebrations are set to continue over the weekend with free face painting by Snazaroo taking place at the new store on Saturday 20th May and a free Trimcraft demo in-store on Sunday 21st May.

Devon-based entrepreneur, Chris Dawson commented on the opening: “Opening a new store is always a proud moment for the company and it is great to continue with our overseas expansion so close to Dublin. It was great to have so many people turn up to celebrate our opening this morning and we hope all our customers managed to find themselves some fantastic bargains. We would like to thank the council and The Retail Park for all of their support in welcoming us to Liffey Valley”.

Some 15 jobs are expected to be created in Athlone Towncentre later this month with the opening of two new clothing outlets.

This follows on from the creation of 14 jobs with the recent opening of the new Inglot cosmetics store.

Leading clothing brands Vila and Selected Homme will officially open in two adjoining units in the Towncentre on May 25 next and will further enhance the reputation of Athlone as being the fashion capital of the Midlands.

Shirley Delahunt, Manager and Head of Marketing at Athlone Towncentre, said the new store openings are “a huge vote of confidence in the centre and in Athlone as a shopping destination” and she confirmed that all internal units in the 176,000 sq.ft Centre are now fully occupied.

Vila and Selected Homme are part of the Danish-owned clothing company, Bestseller, which employs over 41,000 people across Europe, the Middle East, Canada and China. Their clothing ranges are aimed at fashion-conscious young men and women and are sure to be extremely popular with young shoppers from right across the Midlands.

The opening of Vila Clothing and Selected Homme will bring to five the number of units occupied over the last number of months, with the opening of Quiz Clothing and The Works in the run-up to the busy Christmas period.

Reported in the Westmeath Independent

With 1 day to go until the Grand Opening of value superstore The Range in Liffey Valley, staff have been busy adding the finishing touches to the store ahead of Friday’s 9am opening.

The new Range outlet will be the third home, leisure and garden superstore to open from the retail chain in the Republic of Ireland and is located at The Retail Park Liffey Valley near Dublin.

Special guest Mayor of South Dublin, Guss O’Connell will be there to officially open the new store.

The Liffey Valley store will have an extensive Homewares department, offering kitchen appliances to tableware and hoovers to home storage, as well as large DIY, Arts & Crafts and Patio sections and a spacious outdoor garden centre. There will be some fantastic opening offers across all departments until 4th June with many exclusive bargains available.

To celebrate the opening, Dublin’s 98 FM radio will be running promotions all week on the 12-4pm show for the listeners to win a share of €1,000 in vouchers for The Range. There is a whole selection of activities planned for the opening day, starting with amazing giveaways for the first 50 people in the queue including a Lay-Z-Spa Paris worth €700 for the first in line! Dublin’s 98 FM radio will be in-store on the day with their fun zone, goody bags and face painting.

The company’s own mascot, Captain Range will also be attending the opening to provide balloons and entertainment for the young and young at heart! There will be free face painting for children by Snazaroo on Saturday and a free craft demo by Trimcraft on Sunday.

The new store is bringing around 80 new jobs to the area, which is a tremendous boost for the economy and is sure to be a welcome addition to the already busy retail park.

Chris Dawson commented: “We are really looking forward to opening our store in Liffey Valley at the end of this week. We are confident that the jobs we are providing with the launch of the new store should help to boost the local economy. We would like to invite the people of Liffey Valley and beyond, to come and join us on Friday to celebrate the grand opening.”

THE NEW STORE WILL BE LOCATED AT:

The Retail Park Liffey Valley, Coldcut Road, Quarryvale, County Dublin

Well done to the Bannon retail team for their recent letting. Check out Inglot this weekend at Athlone Towncentre

EZ Living Interiors will open a new store in Navan Retail Park in the upcoming weeks, with fit out work scheduled early April. EZ Living will join the strong line up of retailers already in the park including TK Maxx, Smyths Toys, Homebase, Halford, Petmania and DID Electrical. The store will have a total floor area of 18,000 sq. ft and has successfully secured planning permission for a mezzanine level. EZ Living Interiors is known to their customers for good design and quality and will offer a vast range of high quality furniture.

Now operating in Ireland for over 28 years, EZ Living Interiors have become front runners in the furniture market offering superb customer service, excellent quality and amazing value across Ireland with stores in Cork, Waterford, Naas, Dublin and more recently in the UK with the opening of their first flagship store in Belfast. This will be EZ Living’s first store in Navan and it will offer furniture and home accessories.

Gavin White of EZ Living Interiors said, “Ireland’s residential property market is alive again and the demand for furniture has increased significantly in the last couple of years. We have seen success in our stores as we provide good quality furniture with great customer service and opening our new shop in Navan Retail Park made sense to our plans for expansion due to its location and current retailers trading there.”

Navan Retail Park has had success with several planning applications in recent times with a significant planning permission being approved for the development of a petrol filling station and associated food and beverage offer.

Freda O’Donnell, of Sigma Retail Partners, asset managers of Navan Retail Park, said, “Ireland has seen a surge of home buyers in the recent years and we have noted that retailers offering home-related products are doing well. We have been receiving high levels of interest from retailers in this sector for the retail parks and shopping centres we manage throughout Ireland. More announcements of additional retailers opening at Navan Retail Park will be made soon.”

Adam Merriman from Bannon, Property Manager for Navan Retail Park, said, “We are delighted that EZ Living has joined Navan Retail Park, it complements the current retail line-up nicely. Also there are a number of new tenants that will open in the coming months which will be announced shortly, so we are excited about the future for this retail park and its customers.”

Hammerson and Irish Life have started the works – which will see the creation of five new units – at the well known shopping centre.

The centre is adjacent to Henry Street, Ireland’s busiest shopping street and is home to 85 retail and catering units, including H&M, River Island, and Argos. New brands introduced to the centre in recent months include Tiger, Paese Cosmetics and Chopped.

The development, expected to be completed by this summer, involves an investment of some €1.5m – and forms part of a wider plan by the Ilac’s owners to improve the centre’s tenant mix.

The Ilac Centre currently comprises 291,808 sq.ft of retail accommodation and in the 12 months to December 31 last year had footfall of 17.8m people.

Agreements have already been exchanged for four of the five new units and these will see BB’s Coffee & Muffins, book retailer The Works, So Nutrition, and specialist catering equipment retailer, Nisbets join the Ilac Centre’s present compliment of 85 retail and food units.

Hammerson acquired 50% stakes in Dundrum, the Ilac, and the Pavilions after paying Nama €1.85bn for €2.6bn worth of loans connected to the developments.

Hammerson and German insurer Allianz acquired the so-called ‘Project Jewel’ loans from Nama, with all of the loans associated with developer Joe O’Reilly and his firm, Chartered Land.

Irish Life owns the other 50% of the Ilac. It also owns 25% of the Pavilions, with IPUT owning another 25%.

Hammerson also secured sole ownership of a prime Dublin city centre development area, and development land beside the Pavilions.

Simon Betty, Hammerson’s Director of Retail, Ireland, commented: “Investing in the retail experience and improving the tenant mix at the Ilac Centre will be a major priority over the course of 2017, and we look forward to working with Irish Life to achieve this. The centre is well located in the centre of Dublin, benefitting from high footfall and sales, and through this refurbishment and other asset management initiatives we will ensure that the centre continues to offer our customers the right mix of retail and food & beverage.”

Deirdre Hayes, Head of Property Asset Management at Irish Life, added: “The start of the Moore Mall South refurbishment underpins Irish Life’s commitment to retail in Dublin city centre and marks an important milestone for the Ilac Centre by enhancing the quality and mix of retail and leisure for the city’s considerable catchment area. We look forward to working with Hammerson on this and future projects.”

The Charlesland Neighbourhood Centre, which comprises a Supervalu store and eight adjoining retail units over 1,579 sq.m (17,000 sq.ft), is producing a rent roll of €510,000 but this could increase when a standalone pub/leisure block in the centre is let.

Almost half of the rent flows from anchor tenant Supervalu, which has more than 13 years left on its lease, while other occupiers include Health Express Pharmacy, Boyle Sports, Charlesland Medical Centre and Pizza Hut.

Terms are also agreed on the last remaining retail units with a takeaway restaurant and a letting agreed with a dentist to take 320 sq.m (3,440 sq.ft) on the first floor.

When these lettings are finalised, the entire centre will have a weighted average unexpired lease term of about 10.17 years.

The standalone three-storey pub/leisure block extends to 1,394 sq.m (15,000 sq.ft) and comes with full vacant possession. “This block could be adapted to a wide variety of uses subject to planning permission,” according to Bannon.

Greystones has seen substantial residential growth over the past decade with most of this in the Charlesland and adjoining Eden Gate areas. Developer Cairn is expected to start work shortly on 450 new homes in Charlesland having got the green light from Wicklow County Council.

The neighbourhood centre, which extends to 3,716 sq.m (40,000 sq.ft), has an adjoining car park accessed via a lift and travellator and benefits from a further basement “overflow” car park to give 250 spaces in total.

Should you require further information or would like to discuss the opportunity in more detail, please feel free to contact Alexandra Patterson or Rod Nowlan on +353 1 6477900.

Article in the Irish Times

Approx. 20% of Ireland’s shopping centre stock has changed hands since 2013 and this includes six of the country’s top 10 centres in terms of size with a seventh, Blanchardstown, expected to transact shortly.

This is according to the latest report on the sector from DTZ Sherry FitzGerald, which reports that 40 shopping centres have transacted in recent years. Seventeen of these were in Dublin, with Cork and Tipperary accounting for a further 20%.

However, while the investment market has been busy buying shopping centres, there has been very little new shopping centre added since the crash. Any new space was typically extensions to existing centres, and most of this extra 27,900 sq.m of space is accounted for by the growth of Liffey Valley, Charlestown in Dublin 11 and Chare Hall in Dublin 17.

“The development pipeline of extra shopping centre space will continue to focus predominantly on extensions but new-builds will complete by the end of the decade” according to DTZM

The quantum of shopping centre space in the capital stands at 820,000 sq.m. A further 229,800 sq.m is in the pipeline for completion between 2017 and 2019 at six centres including Stillorgan Village Centre, Frascati Shopping Centre, The Square Tallaght, Crumlin Shopping Centre, Dublin Central and Cherrywood.

Dublin Central, at the former Carlton cinema site on O’Connell Street, and Cherrywood in south Co Dublin are the only two new-builds in the pipeline, and are expected to be completed in 2019. These will be the first new centres in the State since the Millfield Shopping Centre in Balbriggan was completed in 2011.

Report by the Irish Times

The off-beat Beechmount shopping centre in Navan has been sold to an Irish investor for €4.1 million in a deal that will show an immediate income yield of 10%.

The sale included a 3.9 acre development site which was originally the location of Beechmount ballroom and handball alley.

David Carroll of Bannon handled the sale of the complex which includes Birds SuperValu supermarket, eight retail units and two office suites which are producing a rental income of €420,000 per annum.

Davy Real Estate has bought a modern shopping centre and adjoining petrol filling station in Cashel, Co Tipperary, for one of its property funds.

The Dublin fund manager paid slightly over €6 million for the investment which is expected to show a return of around 12.3%. The centre is the only purpose-built shopping complex in the town with an overall floor area of 6,537 sq.m (70,363 sq.ft) and 342 surface car-parking spaces.

Anchor tenant Tesco is paying rent of €565,000 per annum under a long term lease with a weighted average unexpired lease term of over 11 years. Other tenants include O’Dwyer’s Pharmacy and Cordis Cashel Ltd – a subsidiary of Johnson & Johnson – providing an additional rent roll of €92,896.

The centre opened in 2008 and has 2,500 sq.m (26,910 sq.ft) of vacant retail space which when let should considerably enhance the rent roll. The overall rent at this stage is €657,570 with a weighted average unexpired lease of over 10 years. Tesco is also paying €163,570 for a standalone Tesco petrol filling station located between the centre and junction 9 of the M8. The lease has another eight years to run.

The joint selling agents were Lisney and Bannon.

Report by the Irish Times

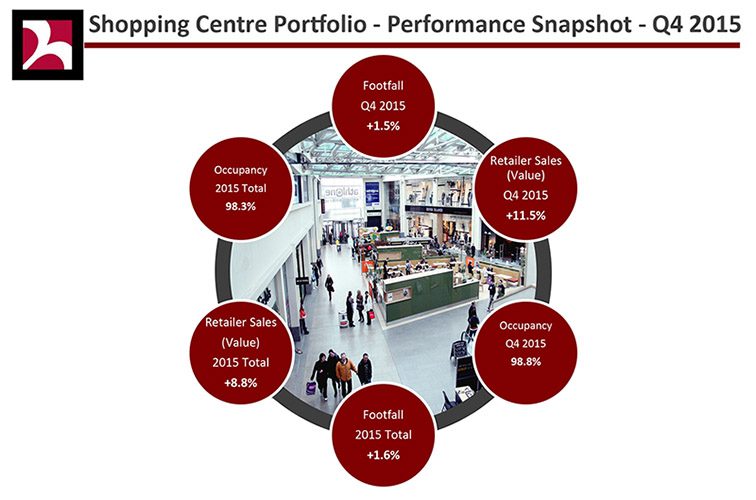

“Growth in Footfall and Retail Sales during Q4 despite Inclement Weather”

Our last quarterly update (Q3 2015) noted that the prospects in the run up to Christmas 2015 were very positive and now looking back we can report that the year finished out even better than expected.

The Bannon Shopping Centre Portfolio continued to perform strongly during Q4 2015 with footfall growth of 1.5%. As a result footfall for the entire year finished up 1.6%. This is despite some extreme weather conditions during November and December which had an impact on footfall, particularly in our regional locations.

Despite the prevailing weather conditions retail sales for Q4 grew by 11.5%. This is off the back of growth in Q1, Q2 & Q3, leading to total growth for the year of 8.8%. The star performers in Q4 2015 were ladies fashion and footwear.

A number of retailers experienced year on year growth of 20%-30% during the month of December.

Ray Geraghty, Associate Director within the Property Management Department at Bannon noted that the comparison between the growth in footfall and the growth in retail sales is very interesting. The fact of the matter is that consumer sentiment is at its highest level since mid-2008 and this is impacting positively on people’s propensity to spend. In summary, 2015 finished on a very positive note and the outlook for 2016 is no different.

At present Bannon manage over 4 million square feet of retail assets with a total annual footfall of over 70 million people. The portfolio is made up of a range of retail assets, from large regional shopping centres to small local neighbourhood schemes.

“2015 started with cautious optimism but finished with a bang”

“Growth in Retail Sales is gathering pace with a notable improvement in spend per customer”

With the Christmas rush only around the corner the prospects from now until the end of the year are very positive.

The Bannon Shopping Centre Portfolio has continued to perform very strongly during Q3 2015 with footfall growth of 1.6%. Footfall growth during 2015 has been consistent and sustained, however growth in retailer sales is gathering pace. The total growth in retailer sales during Q3 was 9.4%, versus a growth of 7.3% in Q2. The year to date growth in retailer sales is running at 8.1%

The best performing retailer categories during Q3 2015 were ladies fashion and jewellery which underscores the dramatic shift in disposable income and consumer sentiment. In some cases tenants had experienced growth of 20 – 30% during Q3 2015 versus Q3 2014.

All of the above bodes well for the final and most important quarter of the year.

Ray Geraghty, Associate Director within the Property Management Department at Bannon noted tenants are now competing for space. Some recent notable deals include; Skechers and Sixth Sense at Whitewater Shopping Centre, TK Maxx, Starbucks and Tiger at Athlone Towncentre Shopping Centre and Name-It at Swords Pavilions.

Jennifer Mulholland, Associate Director within the Retail Agency Department at Bannon noted that the prospects for 2016 are very good. She expects the vacancy rate to continue to fall across the portfolio with a number of schemes on target to become fully occupied by the middle of next year.

At present Bannon manage over 3 million square feet of retail assets with a total annual footfall of over 60 million people. The portfolio is made up of a range of retail assets, from large regional shopping centres to small local neighbourhood schemes.

“Occupancy levels expected to continue improving during 2016”

A modern shopping centre in Cashel, Co Tipperary, along with an adjoining petrol filling station are to be offered for sale by private treaty at €6.5 million.

Joint agents Lisney and Bannon are handling the sale of the complex which will show an initial yield of 12.1% and offer opportunities to strengthen that figure even further.

The shopping centre is the only purpose built retail complex in the town with an overall floor area of 6,537 sq.m (70,362 sq.ft) and 342 surface car parking spaces. Anchor tenant Tesco is paying a rent of €565,000 per annum under a long-term lease with a weighted average unexpired lease term of 11.83 years.

Other tenants include O’Dwyer’s Pharmacy and Cordis Cashel Ltd (a subsidiary of Johnson & Johnson) providing an addition rent roll of €92,896.

The centre opened in 2008 and has 2,500 sq.m (26,910 sq.ft) of vacant retail space which when let will enhance the returns from the investment.

The overall rent at this stage from the shopping centre is €657,896 with a weighted average unexpired lease term of 10.74 years. Tesco is also paying €163,570 for a stand alone Tesco petrol filling station located between the shopping centre and junction 9 on the M8 motorway. This lease has another eight years to run.

Offers for the shopping centre and the petrol filling station will be considered individually.

Contact Rod Nowlan or Alex Patterson today on 01 6477900.

Article in the Irish Times

Agents Bannon are delighted to present to the market the sale of Hazel Portfolio, comprising of two provincial shopping centres and one retail park. Geographically diverse collection of retail assets which benefit from their position as dominant retail centres in their respective catchments. High profile tenants include Pennys, TK Maxx, Next, New Look, Homebase, B&Q and Harvey Norman.

1. Wilton Shopping Centre is located in the suburb of Bishopstown approximately 3 kms south west of the city centre and opposite Cork University Hospital.