Consumers prefer real-life shopping experiences, says leading Irish retailer

Retail is back and it’s here to stay, says Christine Dolan of Quayside Shopping centre in Sligo Town.

The centre manager believes that the majority of Irish consumers prefer the social experience of a trip to the shops over the convenience of e-tail.

She told the All-Ireland Business Times that Quayside is busier than ever.

“I think people have missed coming into the shops”, she said. “It’s a totally different experience to shopping online.”

“People love the social aspect of a day out shopping and I think most people are sick of the virtual experiences – there are a lot of people who have been quite lonely through the pandemic and you can’t beat meeting up with friends for a lunch date while having a browse through the shops.”

“There’s a great buzz around at the moment and people are starting to mix again and enjoy themselves.”

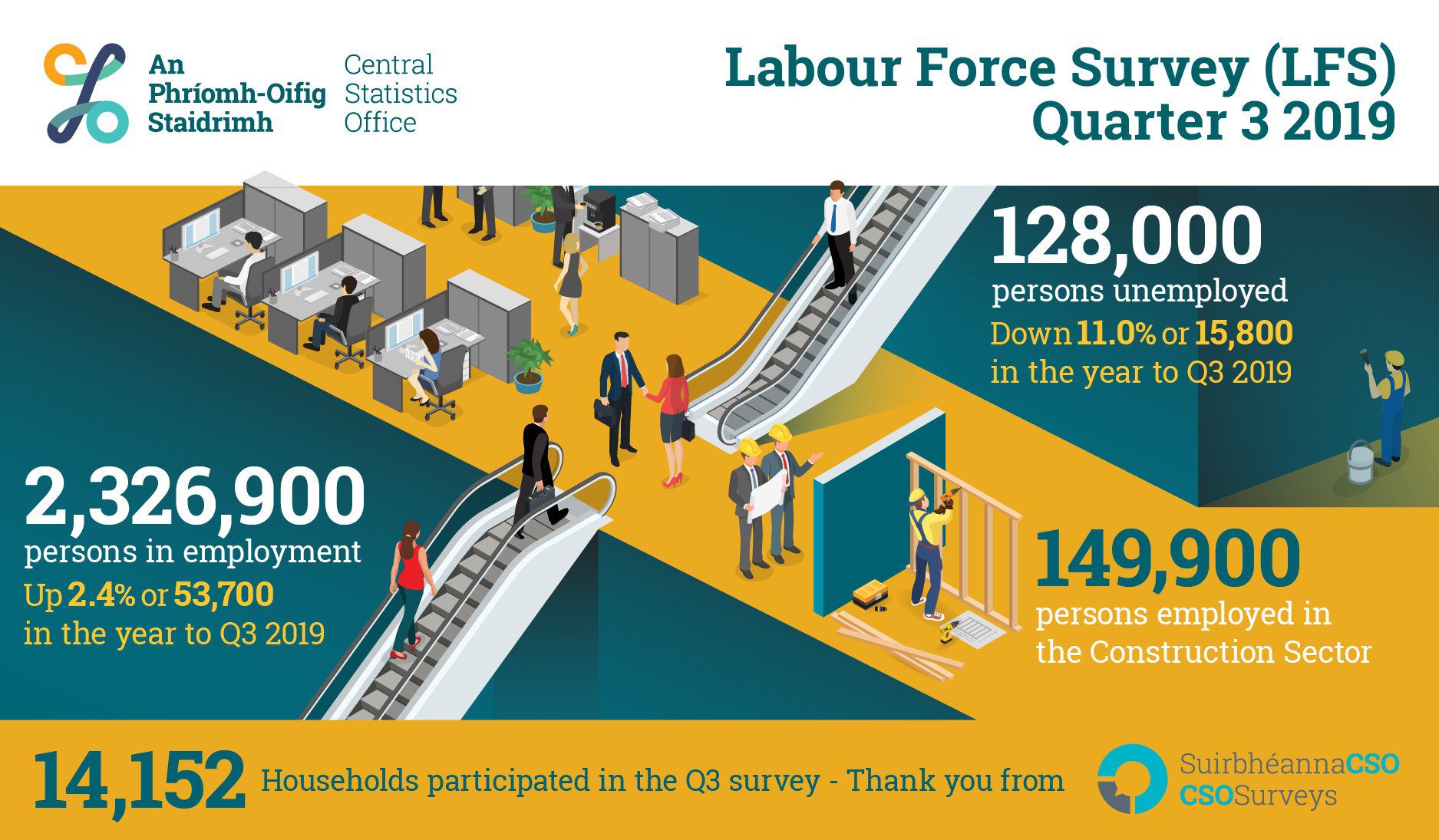

A 2020 report by Deloitte found that retail is Ireland’s largest industry and the largest private sector employer, employing almost 300,000 workers – with three in four of those employed based outside of Dublin.

Quayside Shopping Centre opened its doors in 2005 as the largest shopping centre in the northwest of Ireland.

With 130,000 feet of floor space the centre boasts 43 retailers including TK Maxx, Lifestyle Sports and Next.

Quayside lost two retailers over the pandemic, one of them was a Carphone Warehouse store which was a casualty of the Group’s decision to close 80 stores in Ireland last year.

Christine revealed that units have since been filled by two new tenants with more set to come on board.

While Christine admits that competing against online retailers will be a tough challenge in the years to come, she is not worried about the long term future of her industry.

“What we’ve proven here time and time again is that we are resilient.”

“We’ve been through a recession and we’ve come out stronger on the other end so I have no doubt that we will get back to where we were pre-pandemic.”

“In fact, I think we’ll be in a better place.”

According to the Central Statistics Office’s Retail Sales Index retail sales increased by 3.3% in June this year compared to May on a seasonally adjusted basis. On an annual basis, retail volumes were 10.6 per cent higher than in June last year.

Interestingly the retail sales figure for June this year was 13.4% higher when compared to two years earlier, before the Covid-19 pandemic.

Quayside Shopping Centre recently landed its third Business All-Star Accreditation in recognition of its contribution to retail in Ireland.

Reacting to the news, Christine said: “I am delighted to be part of an ambitious All-Star Business. To be accredited for the third year in a row is a huge honour and I see it as recognition of the hard work that goes on behind the scenes.”

Quayside’s focus over the next few months is to promote the “shopping centre experience” and Christine revealed that the centre will be introducing an initiative to help local craftspeople and creators.

She said: “We have plans to relaunch our very successful Christmas markets and hope to do this a little bit early this year. The markets provide a wonderful opportunity for local traders who may have been out of work the last while and want the chance to set up a pop up shop or trading stall.”

“We really want to celebrate with our customers and give something back to the local community this year.”

To learn more about Quayside Shopping Centre Sligo, visit their All-Star showcase page here.

culture of the market and understand the importance of real estate delivering long term returns for our clients. However, we believe this can be done in a way that simultaneously creates better places to work and reduces the impact on the environment.

culture of the market and understand the importance of real estate delivering long term returns for our clients. However, we believe this can be done in a way that simultaneously creates better places to work and reduces the impact on the environment.

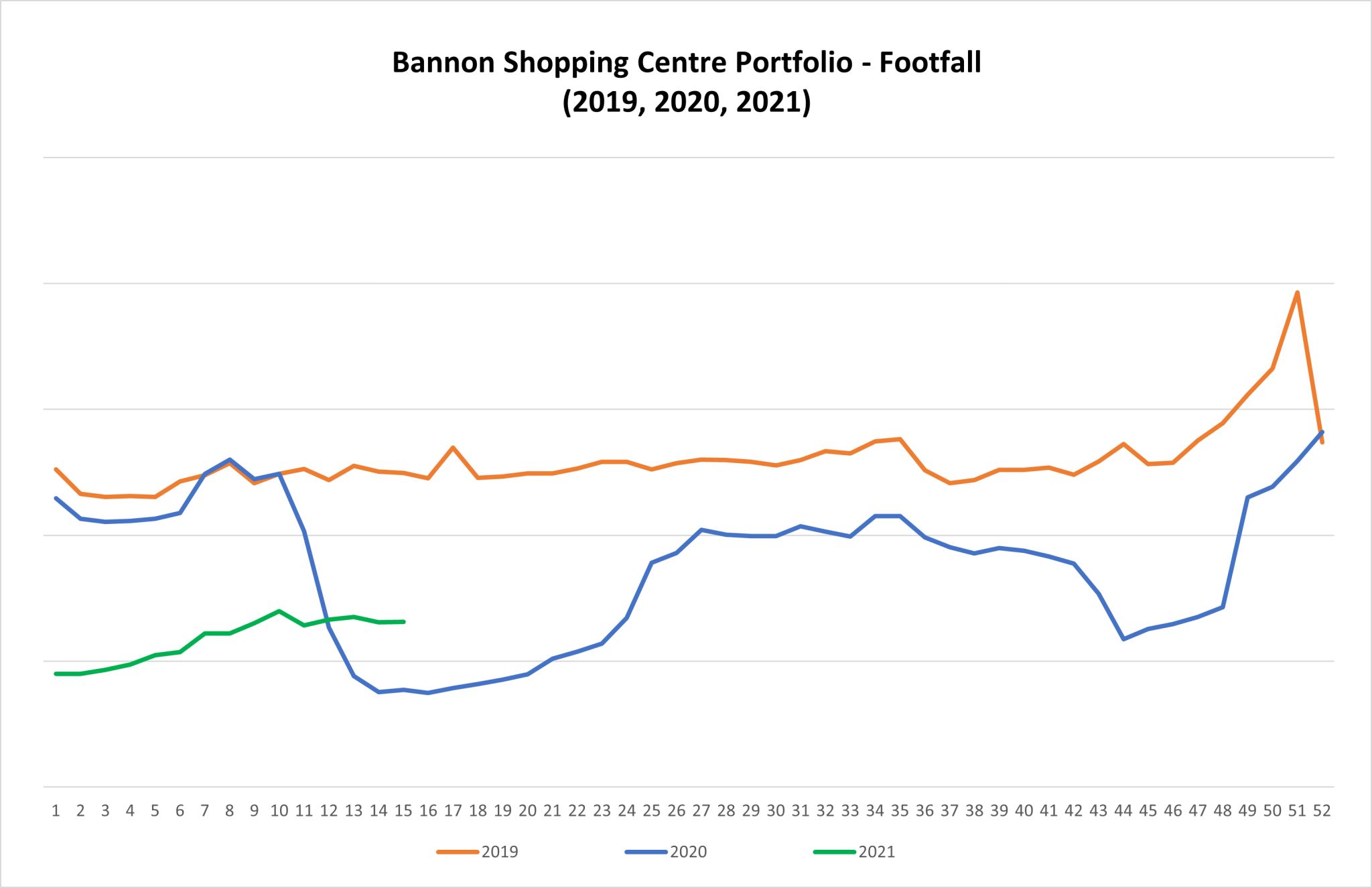

Dublin Town reporting footfall in the City Centre at 87% of 2019 levels last Saturday, given the lack of Tourists that’s a very encouraging recovery. It will be interesting to see which retailers benefit most from the return of the consumer.

Dublin Town reporting footfall in the City Centre at 87% of 2019 levels last Saturday, given the lack of Tourists that’s a very encouraging recovery. It will be interesting to see which retailers benefit most from the return of the consumer.

Following the government’s transposition of IORP II, any new One Member Arrangements (OMA) will now be largely prevented from borrowing for their investments and be required to hold at least 50% of their investment in regulated markets e.g. listed shared and/or bonds.

Following the government’s transposition of IORP II, any new One Member Arrangements (OMA) will now be largely prevented from borrowing for their investments and be required to hold at least 50% of their investment in regulated markets e.g. listed shared and/or bonds.

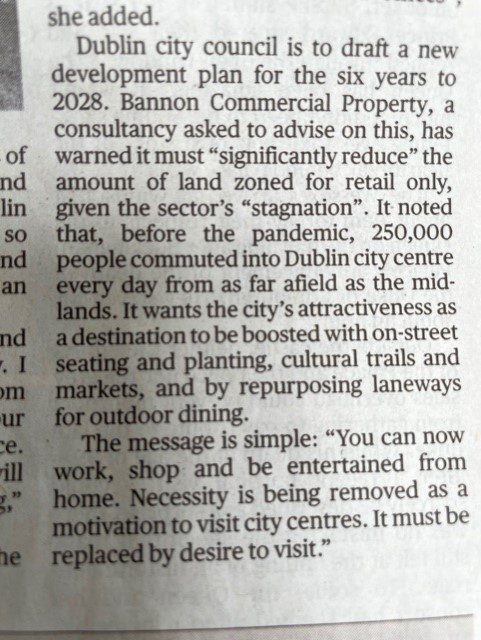

After the pandemic: in Dublin’s bare city. Our streets must be reimagined to entice visitors rather than cater to workers. Bannon advises on this in

After the pandemic: in Dublin’s bare city. Our streets must be reimagined to entice visitors rather than cater to workers. Bannon advises on this in

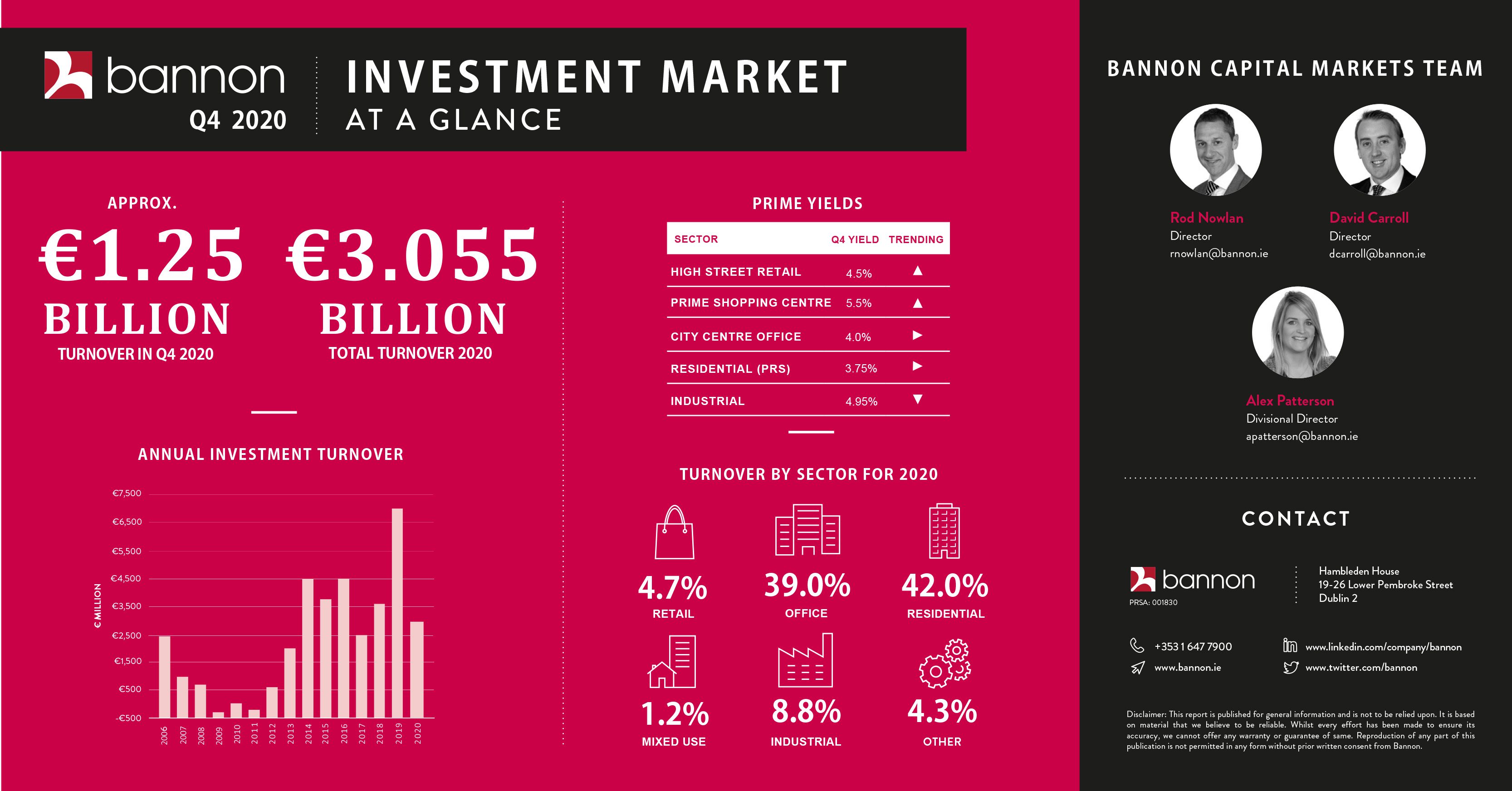

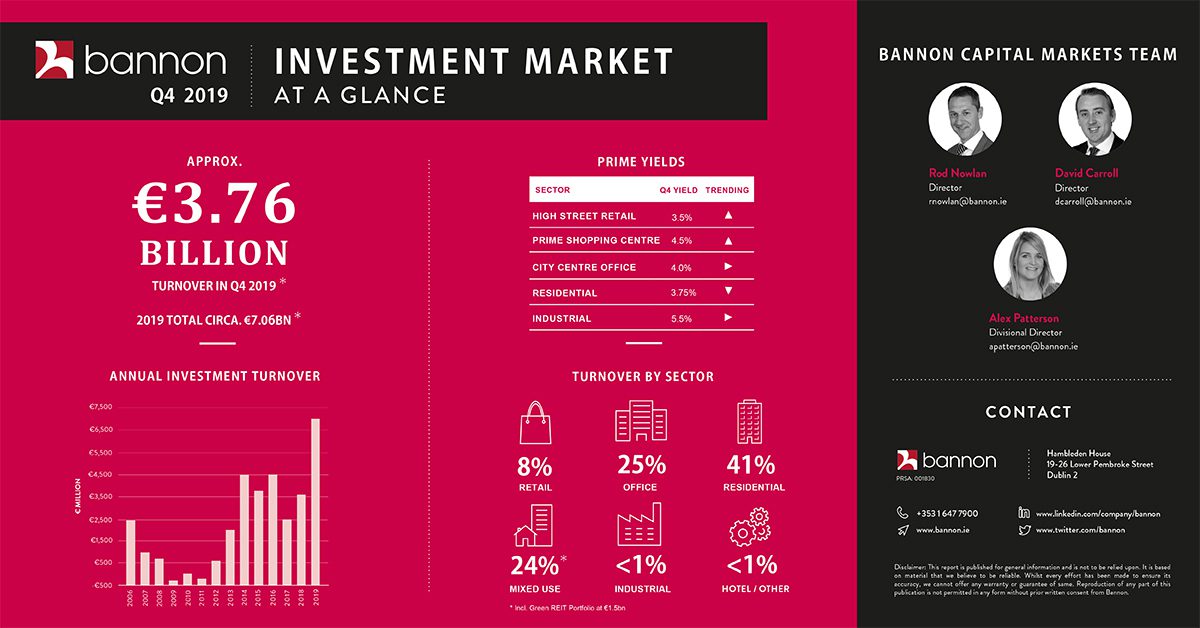

Last minute residential deal tips market over €3bn.

Last minute residential deal tips market over €3bn.

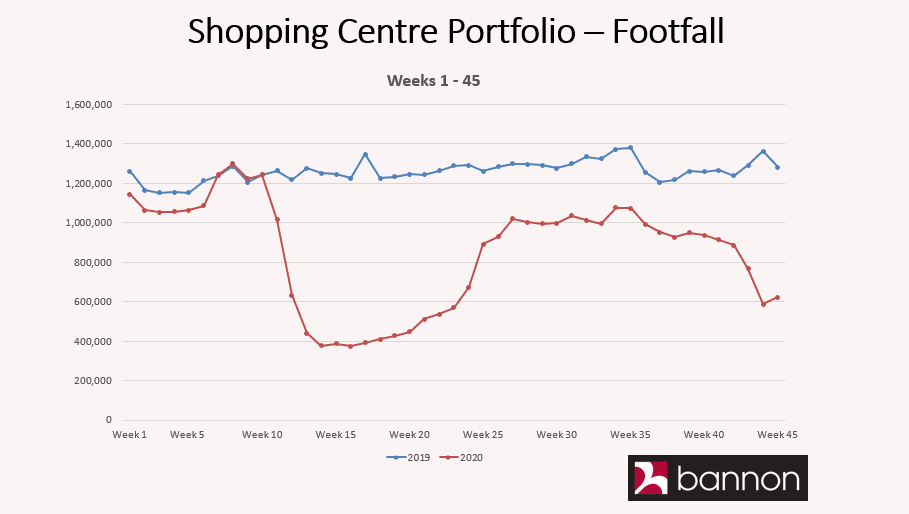

In general the footfall across our portfolio is remarkably consistent every year, however 2020 is very different. We remain hopeful that people will shop with purpose when the restrictions are eased at the start of December.

In general the footfall across our portfolio is remarkably consistent every year, however 2020 is very different. We remain hopeful that people will shop with purpose when the restrictions are eased at the start of December. The inconsistent and illogical nature of the imposition of essential goods only sales in retail across the country is causing serious damage to the sector.

The inconsistent and illogical nature of the imposition of essential goods only sales in retail across the country is causing serious damage to the sector.

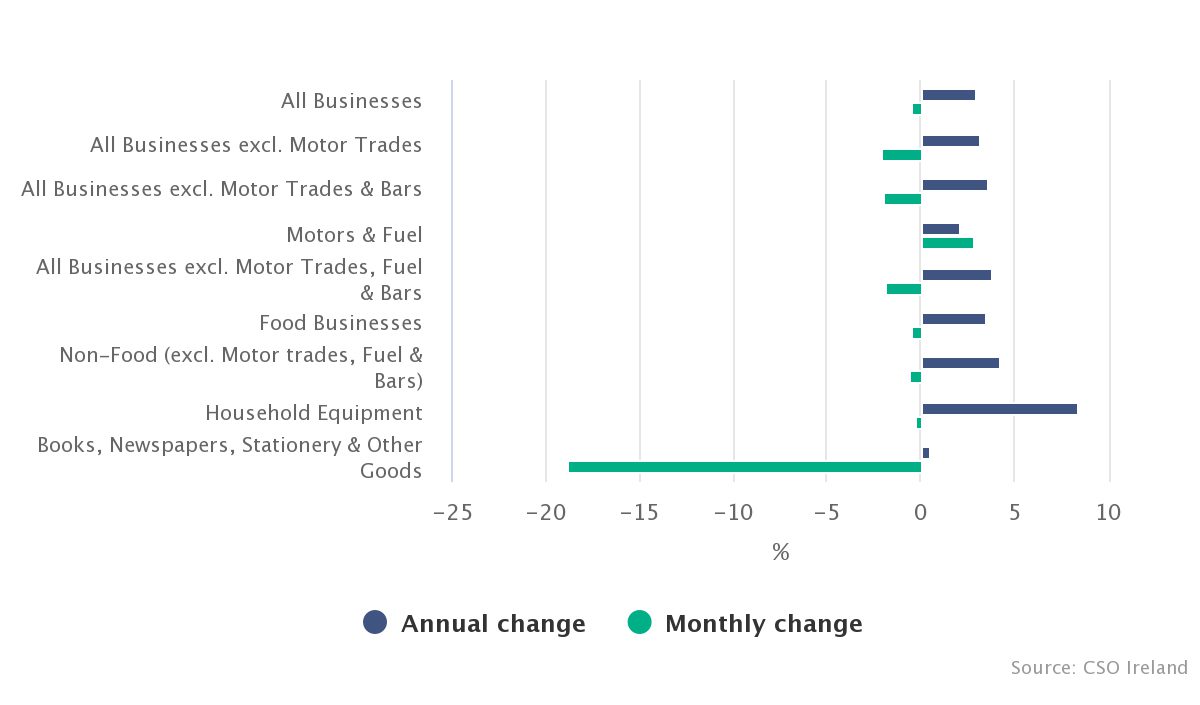

The volume of retail sales decreased 0.5% in October when compared to September on a seasonally adjusted basis and increased by 3.0% on an annual basis. When Motor Trades are excluded, the volume of retail sales decreased by 2.1% in October 2019 and rose by 3.2% when compared with October 2018.

The volume of retail sales decreased 0.5% in October when compared to September on a seasonally adjusted basis and increased by 3.0% on an annual basis. When Motor Trades are excluded, the volume of retail sales decreased by 2.1% in October 2019 and rose by 3.2% when compared with October 2018.

The volume of retail sales increased 4.3% in September when compared to August on a seasonally adjusted basis and increased by 4.2% on an annual basis. When Motor Trades are excluded, the volume of retail sales increased by 2.3% in September 2019 and rose by 4.7% when compared with September 2018.

The volume of retail sales increased 4.3% in September when compared to August on a seasonally adjusted basis and increased by 4.2% on an annual basis. When Motor Trades are excluded, the volume of retail sales increased by 2.3% in September 2019 and rose by 4.7% when compared with September 2018.

Smyths, meanwhile, has completely conquered the British market, opening more than 100 large retail outlets there in a little over a decade, vanquishing its specialist rivals. Its UK sales are now about €675 million.

Smyths, meanwhile, has completely conquered the British market, opening more than 100 large retail outlets there in a little over a decade, vanquishing its specialist rivals. Its UK sales are now about €675 million.