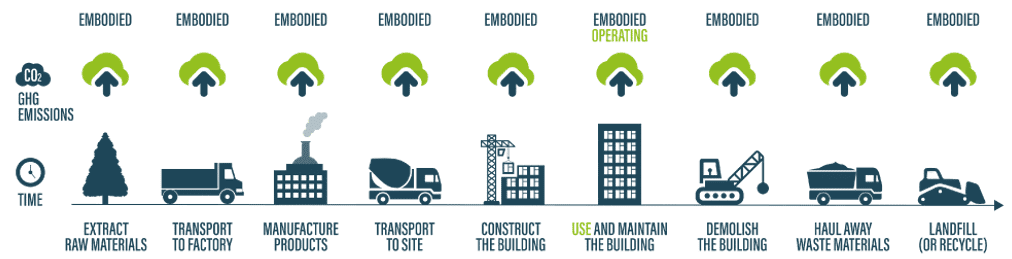

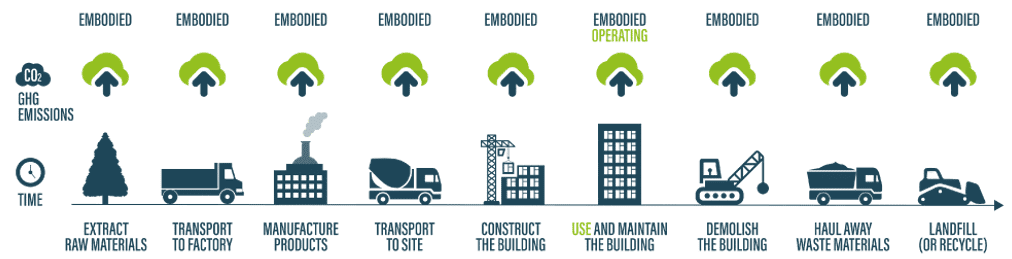

Embodied carbon refers to the emissions associated with all the activities of procuring, mining and harvesting raw materials. It includes transforming these materials into construction products, transporting them to site and incorporating them into a building. Subsequently, it includes maintaining, replacing, removing and disposing at the end of their life. Essentially embodied carbon is built into the fabric of a building.

Eleven percent of global emissions are associated with embodied carbon emissions from new construction. With the introduction of the revised Nearly Zero Energy standard, NZEB, through Part L of the building regulations in 2019 for both residential and commercial buildings, the upfront embodied carbon now represents a much greater part of the whole life cycle carbon of the building.

Over the last 6 years development of Grade A office schemes has accelerated in the capital, with 7.8 million sq.ft of Grade A offices delivered to date. The majority of these buildings have been world class in terms of their sustainable and environmental credentials. This has attracted international blue-chip tenants and commanded prime rents. Importantly, these assets have performed particularly well when transacted and have appealed to numerous investors, with several new entrants emerging into the Dublin capital markets sector over the period. Prime top-tier office investment yields have continued to perform well with yield levels being sustained through the covid 19 pandemic, highlighting the demand for this type of product.

Companies are setting ambitious ESG goals with increasing pressure to report on activity. The onus will be on fund managers, financial advisors, asset managers and all participants within the financial markets to disclose all information on ESG issues. There will be additional requirements for products that promote ESG characteristics and have sustainable investment objectives. Therefore, the emphasis on portfolio performance will be key for these stakeholders. The quality of the assets held will continue to be critical.

Whilst new Grade A schemes grab the headlines, there is over 45m sq.ft. of office stock in the Dublin market across various asset classes. Older stock continues to perform, particularly in the CBD where the reduced rent payable in parallel with prime location appeals to some occupiers. There is, however, a lifespan to these schemes, particularly in light of new regulations. Therefore, the owner must consider the proposition in terms of future decreasing value, occupier appeal, performance and the asset becoming environmentally stranded.

A ‘stranded asset’ relates to a building where the cost of bringing it into line with current and future environmental standards is not justified in the context of the value once the works are completed. Embodied carbon may create an opportunity for environmentally stranded assets. As the cost of carbon and consequently new building increases, the value of the embodied carbon within existing assets may rescue the value of some assets currently perceived to be stranded.

There will be huge opportunity for those with the skills to efficiently transition these buildings back to the institutional mainstream. In this regard valuing and selling these assets will require an in-depth analysis of the true costs associated with bringing them up to standard. Bannon is actively carrying out these exercises for a number of clients through our sustainability business Evia – Sustainable Facility Services.

Authors: Cillian O’Reilly, Surveyor, Sustainability Manager, Bannon / Lucy Connolly, Divisional Director, Bannon

The Bannon Property Management team is expanding with a growth of 20% in the last 12 months.

The Bannon Property Management team is expanding with a growth of 20% in the last 12 months.