Residential Property Price Index July 2016

The CSO launched a new Residential Property Price Index (RPPI) for Ireland. The new model incorporates significant methodological improvements and will replace the existing series. The original model was based on mortgage data from credit institutions and, as such, its coverage of the market was less complete. For example, between 2011 and 2015, about half of household property transactions were funded by a mortgage; the percentage was as low as 44.4% in 2013. The new model records sale prices based on Stamp Duty returns (the same data source as the Residential Property Price Register), which means it will now cover all market purchases, both cash and mortgage-based. This will provide a clearer and more accurate picture of real property price growth than is available through mortgage data alone.

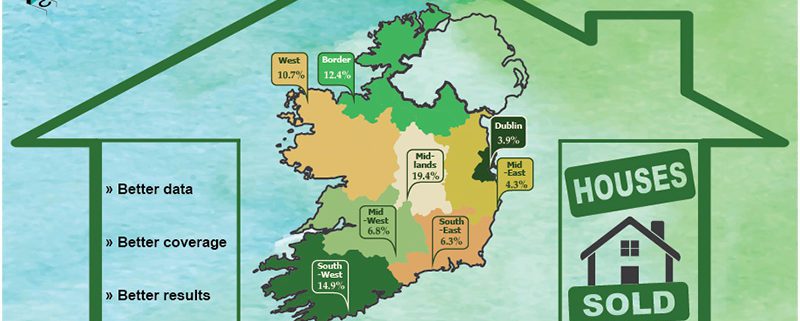

Eircode routing keys are used in the new index to better account for locational differences between dwellings meaning that while prices were previously broken down into three categories (Dublin, National, National Excluding Dublin), there are now four new house price indices in the Dublin Region (Dublin City, Dun Laoghaire Rathdown, Fingal, South Dublin) and seven in the rest of Ireland (Border, Midland, West, Mid-East, Mid-West, South-East, South-West).

Key findings:

- The new RPPI indicates that the peak to trough fall in residential property prices nationwide was 54.4%, not 50.9% as recorded previously. The price increase from the trough to the latest month (July 2016) is 43.2% using the new RPPI, whereas it was estimated as 37.4% using the original RPPI.

- Dublin house prices are 60.4% higher than their trough in February 2012. However, Dublin house prices are 32.8% lower than their peak in April 2007. The recovery was initially led by price increases in Dún Laoghaire-Rathdown in 2012 and 2013. However, since late 2014 onwards, Dublin City has led the growth in house prices. House prices in the Fingal area have been slowest to recover.

- The new model indicates that cash buyers generally paid less for residential property than mortgage buyers, all other things being equal, over the period 2010 to 2016. This differential was most pronounced when the market was at its lowest and outside of Dublin.

- First-time buyers’ share of the market fell from 53.1% in 2010 to 24.4% in 2015.

Report by the Central Statistics Office