Commercial Property Investment Returns Moderate in Q3

The latest SCSI/IPD Ireland Quarterly Property Index release shows investment returns from Irish commercial property to have moderated somewhat following a period of extremely strong growth which began in early 2014.

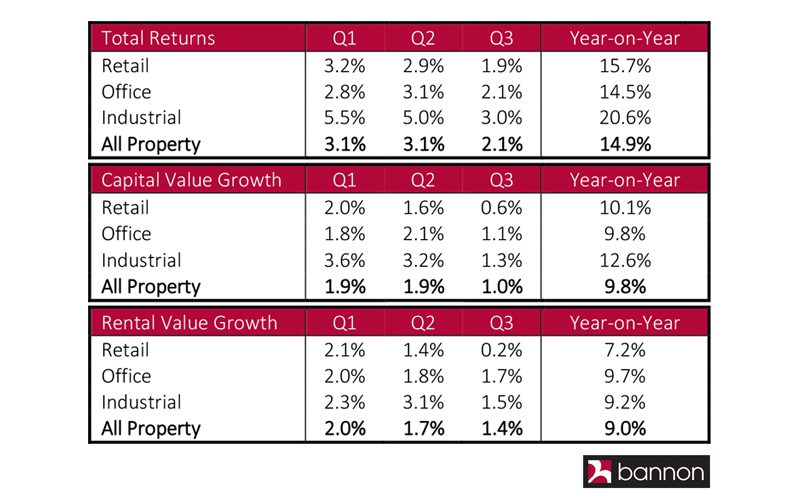

The total return of 2.1% in Q3 represents a slowdown compared with the 3.1% return recorded in Q2 and a significant drop compared with the 6.1% returned in the same period last year. Despite a cooling in headline performance in 2016, Irish commercial property remains the top performing investment asset class. A total annual return of 14.9% means that commercial property is still far outperforming Irish equities, which returned -1.0% in the 12 months to September 2016, and Irish bonds, which returned 8.3%.

Industrial property remains the strongest performing asset type, however growth in this sector also slowed in Q3 with returns up 3% following increases of over 5% in both Q1 and Q2, bringing overall returns to 20.6% over twelve months. Industrial property in South West Dublin was one of the top performers overall again this quarter, with returns up 3.2% over three months or 20% year-on-year.

Total returns from office investments closed at 2.1% in Q3, a decline compared with the 3.1% returned in Q2 and significantly lower than the 6.5% returned in the same period in 2015. Growth has now moderated in key Dublin 2 and 4 office markets, which saw quarterly returns of 1.8% and 2.5% respectively, while the Dublin 1, 3 & 7 office market emerged as one of the strongest performing segments this quarter registering a return of 3.2% driven by rental value growth of 2.1%. While it is difficult to envisage the long term effect of Brexit on the Irish property market we may see a positive impact on the Dublin office market. Many international companies will likely want to keep a presence in the EU and as the only English-speaking EU country Ireland could benefit greatly as demand increases. The challenge will be to provide adequate Grade A office space as well as residential accommodation to meet this potential demand.

Returns on retail property were slightly lower with 1.9% recorded in Q3, however stronger growth in the first half of the year and especially towards the end of 2015 means that the 12-month return stands at 15.7%, outperforming offices on an annual basis. Most importantly, the data suggest that the recovery continues to spread outside of Dublin with provincial retail emerging as the top performing retail segment following returns of 2.7% on quarter or 13.6% year-on-year. Retail property on Dublin’s two main high streets, Grafton Street and Henry/Mary Street, returned 2.6% and 2% on quarter to bring annual growth to 17.4% and 17.7% respectively.

Muted returns in Q3 could be a sign of uncertainties among Irish and overseas investors alike surrounding the Brexit result, the full consequences of which on the Irish economy are unclear as yet. Nevertheless, the Irish commercial property market remains buoyant with capital and rental values continuing to strengthen, albeit at a slower pace than has been seen in recent years. Stability will be crucial to maintaining confidence in the sector and ensuring the recovery continues to spread nationally.

Kate Ryan, Research Department