Industrial property continues to drive growth Q2

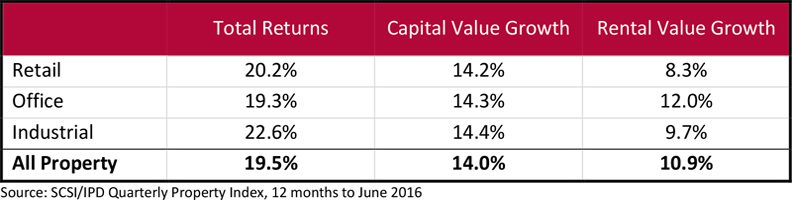

Industrial property remains the strongest performing asset class with Q2 returns up 5% driven by strong growth in capital and rental values of 3.2% and 3.1% respectively.

Industrial property in South West Dublin performed particularly well in Q2, with returns up 6.7% in Q2 or 21.1% year-on-year.

Total returns from office investments closed at 3.1% in Q2, an improvement compared to the 2.8% returned in Q1, but substantially lower than the 7.6% returned in the same period in 2015. Unsurprisingly, the Dublin 4 office market was the strongest performer, registering total returns of 5.2% in Q2 driven by strong capital value appreciation of 4.6%. The expectation that the office sector may benefit from Brexit has meant that demand for office investments is holding up. This is reflected in the current stability of both Hibernia and Green REIT’s share price, both heavily weighted to this sector and a stark comparison to their UK counterparts who have suffered heavy losses.

Retail property is now seeing sustained growth, with returns up 2.9% in Q2, slightly below the 3.3% seen in Q1, bringing the 12-month return to 20.2%. Performance remains steady on Dublin’s two main high streets; Grafton Street returns were up 2.5% on quarter, or 26% year-on-year, while Henry Street saw stronger quarterly growth of 3.4%, bringing 12-month returns to 21.7%. Most importantly, the data suggest that the recovery is now gaining momentum outside of Dublin, with total returns from retail property in provincial locations closing at 5.4% in Q2, or 15.9% year-on-year. This has been driven by impressive provincial rental value growth of 5.5% in Q2.

While continued growth in the commercial property sector in the first half of 2016 is welcomed, the 6.3% return for the first six months of the year does represent a slowdown when compared to the 11.2% return recorded during the same period in 2015. Muted returns could be a sign of uncertainties among Irish and overseas investors alike surrounding the Brexit referendum, the consequences of which on the Irish economy are unclear as yet. Indeed, we are now seeing the postponement of a number of sales that were due to come on-stream as the situation is assessed. Stability will be crucial to maintaining confidence in the sector and ensuring the recovery continues to spread nationally.