Returns on Irish Commercial Property Increase 25% in 2015

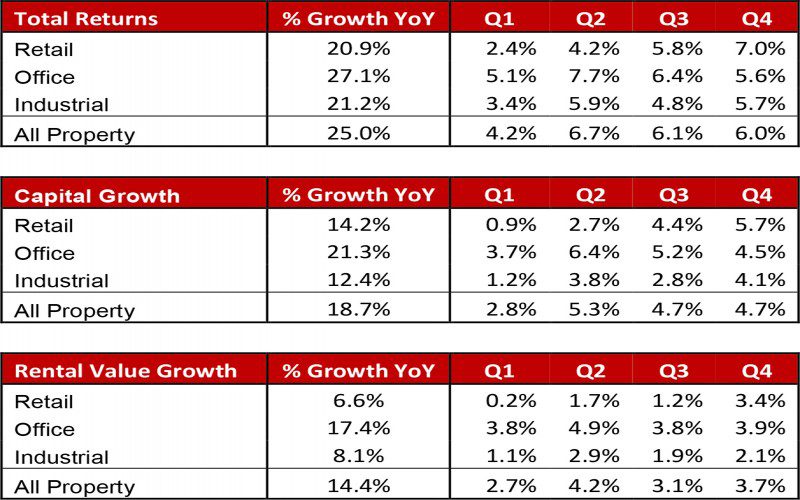

Strong performance in Ireland’s commercial property sector continued throughout 2015, albeit at a slightly slower pace than the record levels of growth seen in 2014. Total returns increased by 6% in Q4 bringing the 12-month return for 2015 to 25% – almost double that of the UK over the same period (13.8% according to the IPD UK Monthly Property Index).

Growth is notably more balanced now than it was in 2014. Retail and industrial property outperformed offices in Q4, returning 7% and 5.7% respectively compared with 5.6% for office properties. Retail capital values also grew at a faster rate than offices in Q4 for the first time since 2012, increasing by 5.7% compared with 4.5% for offices and 4.1% for industrial property.

Nevertheless, strong rental growth of 17.4% throughout the year driven by a strong occupier market and low levels of stock meant that offices continued to lead the market overall in 2015, returning 27.1% year-on-year, compared with 21.2% growth for industrial property and 20.9% growth for retail.

The success of the property market in Ireland is further emphasised by the fact that it far outperformed both Irish bonds, which returned 4.4% in the 12 months to December 2015 (JP Morgan 7 – 10 year), and Irish equities, which returned 6.4% (ISEQ Equity Index).