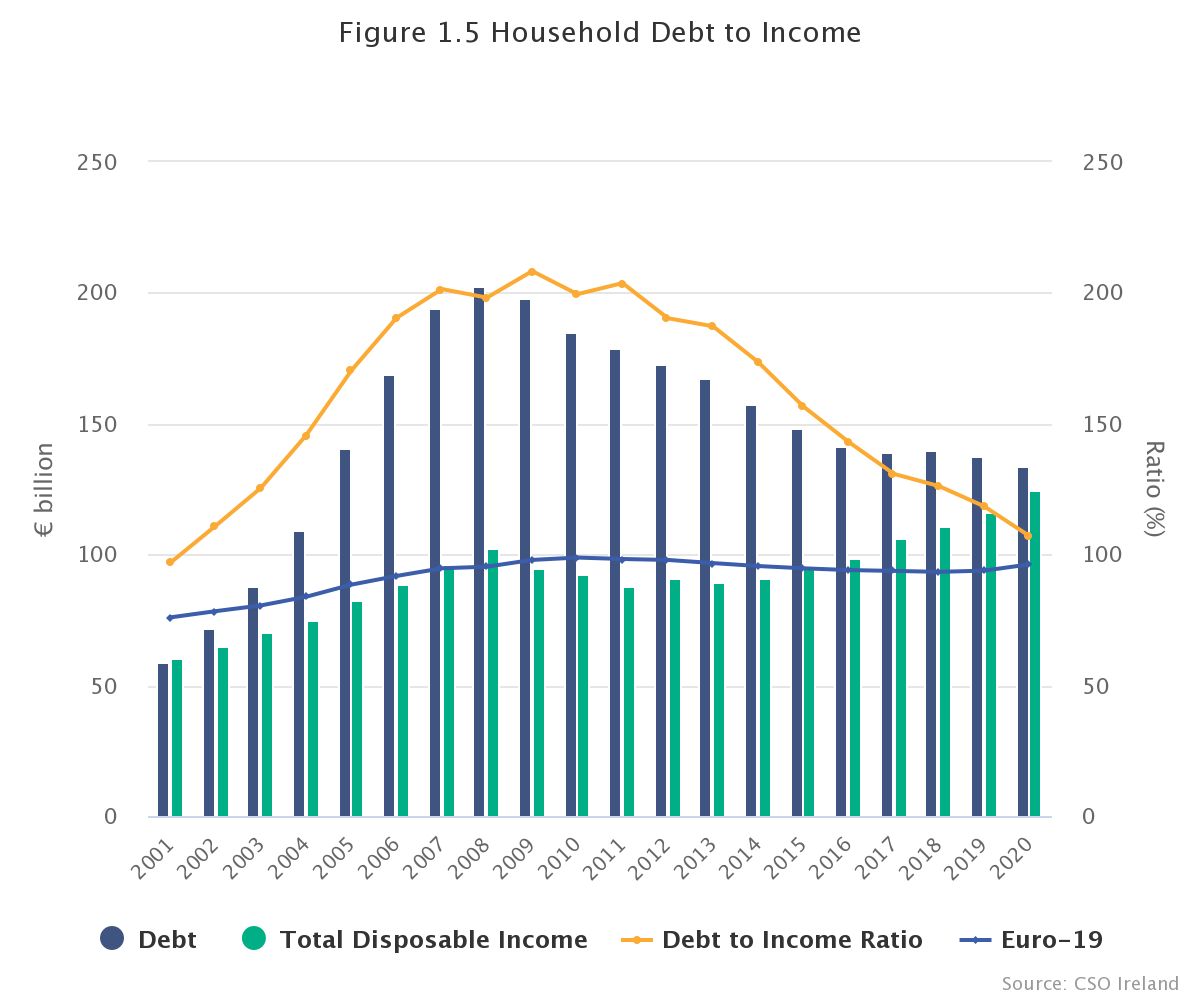

Household Debt to Income

Yesterday the CSO released a version of Ireland’s national accounts. It shows that Irish Households now have more savings than ever before (€139bn up €50bn since 2016) & the debt to income ratio has fallen by half in the last decade. We have gone from being the most personally indebted consumers in Europe to being in line with the EU average, despite a younger population and a higher propensity to own our own homes. In real money that’s €70bn less debt. Added together that’s a €120bn (€24k per capita) turnaround in the nett position before you factor any impact from the increase in the value of housing.

The current strength in spending we are witnessing in our retail management portfolio is therefore not surprising but it’s hard to find much coverage of this benign backdrop in press commentary which is drawing comparisons with 2006. Irish consumers couldn’t be in a more different place than in 2006.