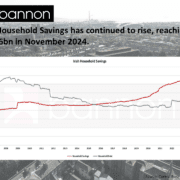

Irish Household Savings has Continued to Rise

The Central Bank of Irelands tracking of Household savings continues to show positive growth reaching €159.6bn in November 2024. This marks a 5.1% year-on-year increase and a modest 0.3% rise from October. In contrast, household debt grew at a much lower rate, up by 2.2% year-on-year, with no change month-on-month. Household savings have increased by an impressive 45% since 2019 and Debt has grown by only 12%. As a result, savings are €56 bn higher than debt. The strong savings position shown by Irish households provides more financial flexibility for consumer spending and a potential for further increase in retail sales.