Address

Hambleden House

19-26 Pembroke Street Lower

Dublin 2

D02 WV96

Ireland

»Map

Contact Us

Phone: +353 (1) 6477900

Fax: +353 (1) 6477901

Email: info@bannon.ie

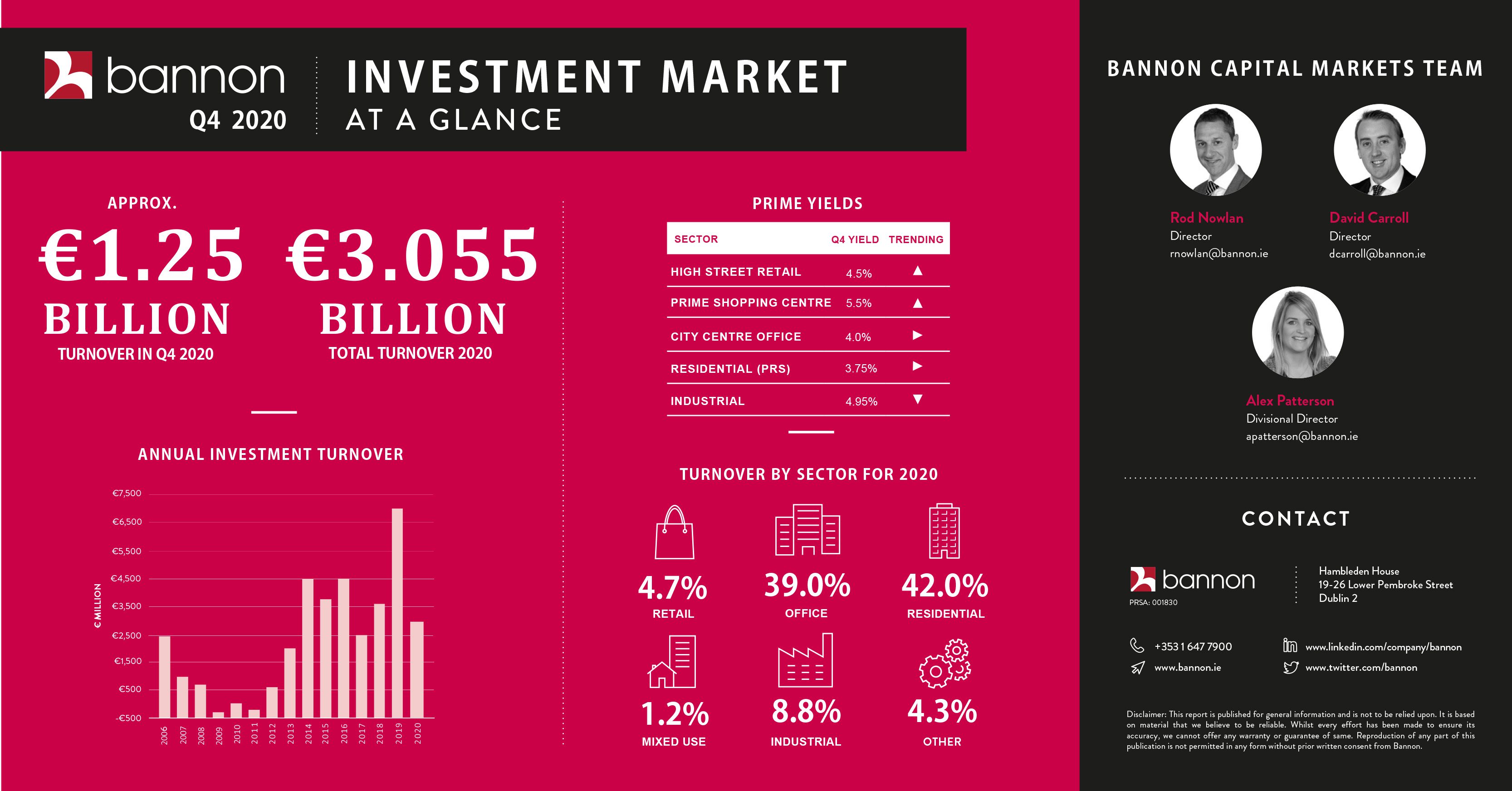

Last minute residential deal tips market over €3bn.

Last minute residential deal tips market over €3bn.

It’s difficult to imagine things getting any worse for the retail sector than they did in 2020. But the chief driving force behind the decline of investor interest began long before Covid-19 arrived. There has been growing concern in relation to the impact of online retail and changing consumer trends on the long-term supply-demand dynamic for the bricks-and-mortar format. Much of this has been imported from the US where retail supply is five times that of Ireland, and the UK where it is 25 per cent higher and undergoing a sustainability crisis.

While the relative performances of these markets may already have been up for debate, the impact of Covid has ended the discussion. By mid-March the sector became virtually un-investable due to Covid-related uncertainties attaching to rental payments being added to those longer-term occupational concerns. The consequence of this is manifest in year-end investment turnover figures where retail will represent a record low 2.5 per cent of an anticipated total investment market turnover of € 3 billion. This from a sector that represented 24 per cent of investment turnover for the last decade (to 2019), but descending rapidly from a high of 53 per cent in 2016 to a previous record low in 2019 of 9 per cent.

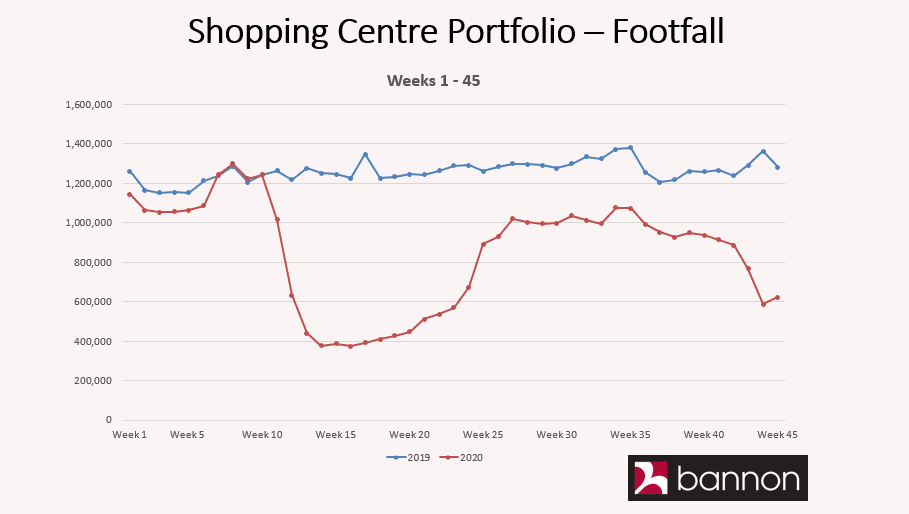

Unsurprisingly for 2020 High Street retail has been worst affected with Grafton Street top of the list experiencing a 66 per cent reduction in footfall for March to October. While the street’s footfall figures had been holding steady at 25 million for the last two years, the 2020 outcome will be closer to 13 million.

No surprise then that almost a quarter of the units on the street are effectively available. Henry Street performed a little better as did some of the other city’s high streets, but the tone is similar. Next in line were the “comparison led” shopping centres which, as a general rule, saw footfall collapse during the first lockdown and rent collections plummet below 35 per cent. However, they did improve quickly and were less affected by the second lockdown. The burden of the service charge costs of running these mall-based schemes was exposed during these periods and will be a key factor in assessing the risk of ownership of these asset types in the future.

The resilience of the grocery sector shone through. No surprise therefore that 65 per cent of the limited 2020 retail investment transactions were grocery deals. Similarly, smaller grocery-led schemes performed better and recovered quicker than major town centres but weaker covenant strength and holding costs affected net rental collections.

Low holding costs

The retail sector’s star performers, however, have been the retail parks. Indeed, in the case of the 15 retail parks under Bannon management (between nationwide lockdowns) car throughput actually increased year on year for the period with rent collection rates approaching 100 per cent and impressive turnover increases. Even where tenants were adversely affected, low holding costs relative to shopping centres maximised the net income return to landlords.

If this crisis has accelerated the sector’s movement to the “retail endgame”, then retail parks and their occupiers have risen to the challenge. In this regard we envisage this asset type, along with grocery, to be the most liquid and popular sector for the year ahead.

Outside of this and following both Brexit and an anticipated mid-January lockdown we foresee a post-vaccine period of rebuilding balance sheets and filling occupational voids. While this period could take 12 to 24 months, there is little doubt that the rebasing of the sector generally will attract new investors wishing to get ahead of the recovery. This will probably manifest as loan trades first with a focus on fundamentally-sustainable schemes and high streets at attractive yields with occupiers who have embraced the omnichannel experience.

More sophisticated investors will recognise the buying opportunity that Covid-19 presents, especially if valuers fail to acknowledge the vast differences in performance across the sector.

Rod Nowlan is investment director at Bannon

The Ireland-based commercial property practice will drive efficiencies in their property management portfolio and tenant management with the Yardi platform

DUBLIN, Ireland (16, November 20) – Bannon Commercial Property Consultants Ltd. (Bannon) will manage over 7 million square feet of real estate on Yardi® Voyager, a cloud-based property management and accounting platform. The firm will also adopt Yardi® Lease Manager for a comprehensive view of tenant activities and portfolio performance.

Lease Manager, part of the Yardi® Elevate Suite, offers extensive data and oversight options. Finance and asset management teams can visualise total number of deferrals and abatements and aging accounts receivable. Property management teams can oversee rent collection and tenant communications.

Bannon will also adopt the Yardi® Procure to Pay Suite, an end-to-end procurement solution that includes Yardi PAYScan® for paperless invoicing and VendorCafe® for centralised vendor management. CommercialCafe®, an easy-to-use, self-service tenant portal will digitalise tenant communication for Bannon. CommercialCafe enables tenants to make online payments, access lease records and manage service requests.

“We are looking forward to the benefits of a cloud-based property management solution. We provide a ‘best-in-class’ approach to outsourced property management with quality at the core and we see synergies in Yardi’s offering. The Voyager platform will ensure consistency and modernisation in the way we report and manage our clients’ assets,” said Richard Muldowney, director and head of finance at Bannon.

“Yardi continues to expand its presence in Ireland, one of the fastest-growing real estate markets in Europe. We’re excited to support Bannon with technology that will facilitate strategic growth,” said Neal Gemassmer, vice president of international at Yardi.

Learn more about how Yardi is supporting real estate and investment clients in the UK and across Europe.

About Bannon Commercial Property Consultants Ltd.

Bannon is the leading indigenous commercial property practice in Ireland with a particular emphasis and track record in the retail space. The firm currently has 75 assets under management. For more information on Bannon, please visit bannon.ie.

About Yardi

Yardi® develops and supports industry-leading investment and property management software for all types and sizes of real estate companies. Established in 1984, Yardi is based in Santa Barbara, Calif., and serves clients worldwide from offices in Australia, Asia, the Middle East, Europe and North America. For more information, visit yardi.co.uk.

In general the footfall across our portfolio is remarkably consistent every year, however 2020 is very different. We remain hopeful that people will shop with purpose when the restrictions are eased at the start of December.

In general the footfall across our portfolio is remarkably consistent every year, however 2020 is very different. We remain hopeful that people will shop with purpose when the restrictions are eased at the start of December.

Businesses across the country need a strong finish to the year and we can all help to make it happen.

The inconsistent and illogical nature of the imposition of essential goods only sales in retail across the country is causing serious damage to the sector.

The inconsistent and illogical nature of the imposition of essential goods only sales in retail across the country is causing serious damage to the sector.

We have reports from across the portfolio of local Jewellers who are operating on a Click & Collect basis being told to pull their shutter, a news agency being advised that can sell cigarettes and lotto tickets but not books or magazines, a florist being told to close who traded during the last (and more severe) lockdown.

The government needs to think about where this spend will go. A customer told they cannot buy a magazine or a book in a shop that is already open is one click away from redirecting spend from a small local business to Jeff Bezos

September Retail Sales indicate that at least one part of the economy is definitely experiencing a K shaped recovery. The stellar numbers that continue to come out of the DIY sector (YOY: Hardware +27.6% YOY, Electrical +21.1% & Furniture +11.9%) contrast sharply with Bars which are predictably down 48%.

September Retail Sales indicate that at least one part of the economy is definitely experiencing a K shaped recovery. The stellar numbers that continue to come out of the DIY sector (YOY: Hardware +27.6% YOY, Electrical +21.1% & Furniture +11.9%) contrast sharply with Bars which are predictably down 48%.

What’s interesting is that total value of retail sales was up 7.2% year on year which means Irish consumers spent a lot more this September than last year.

This was all before the lockdowns started again which if recent experience is anything to go by will exacerbate the K shaped nature of the market performance.

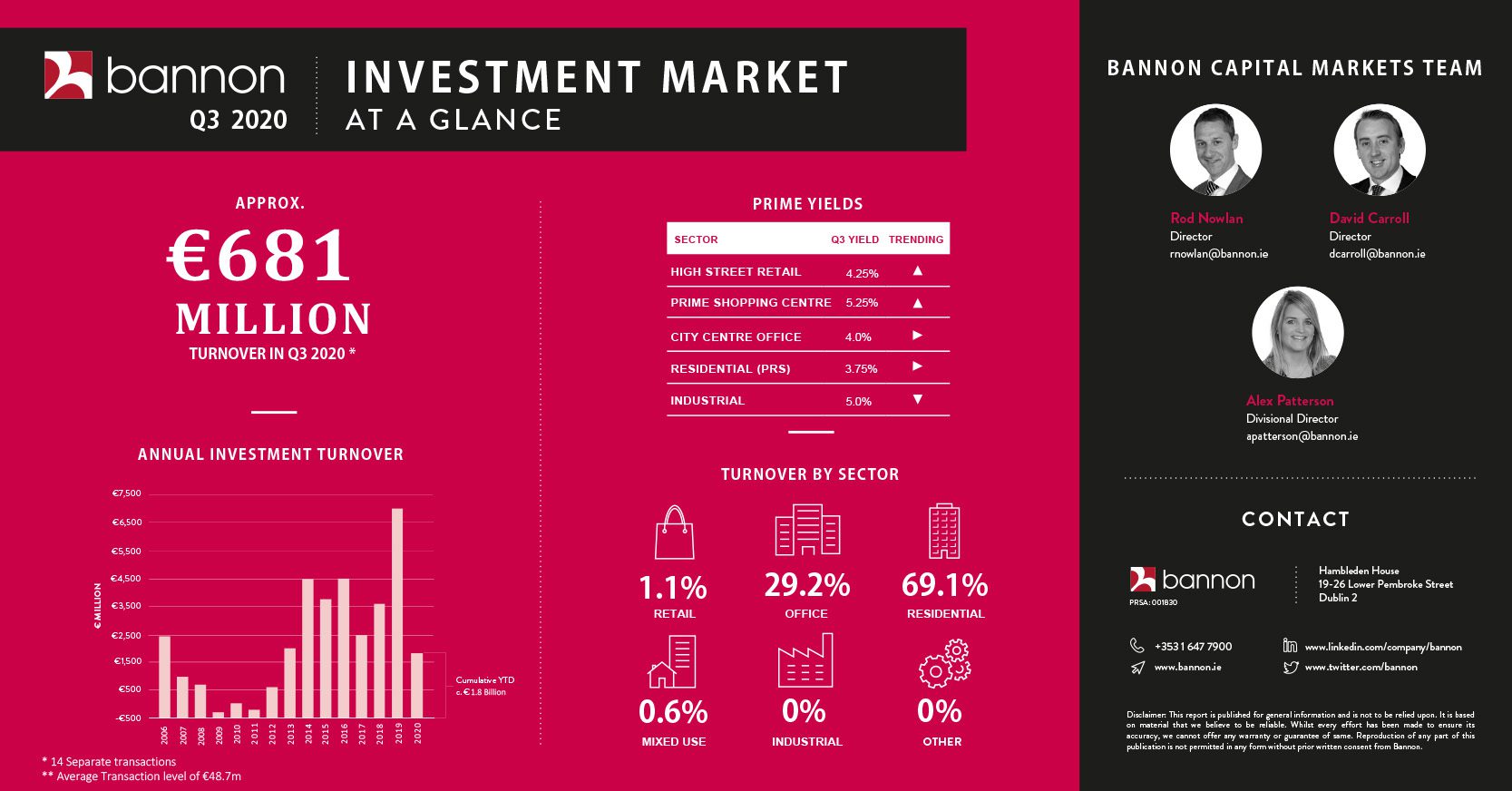

David Carroll, Investment Director – “Q3 2020 turnover of €681m continued to illustrate the domination of PRS investment versus other asset classes with circa. 70% of value attributed to the sector. Covid-19 impacts continue to effect the supply and demand factors of traditional investment sectors. There is now close to €2bn of office product being marketed publicly and privately thus Q4 should provide some clarity on where investor appetite is at”.

David Carroll, Investment Director – “Q3 2020 turnover of €681m continued to illustrate the domination of PRS investment versus other asset classes with circa. 70% of value attributed to the sector. Covid-19 impacts continue to effect the supply and demand factors of traditional investment sectors. There is now close to €2bn of office product being marketed publicly and privately thus Q4 should provide some clarity on where investor appetite is at”.

As per the Retail Sales figures released by the CSO and our own experience across our retail park portfolio DIY & Household goods sales have been the stand out performer of the Retail sector since March.

As per the Retail Sales figures released by the CSO and our own experience across our retail park portfolio DIY & Household goods sales have been the stand out performer of the Retail sector since March.

Retail Parks continue to perform well with rolling restrictions on other retail outlets redirecting spend into home improvements.

Interestingly this is a sector with very low levels on pure online penetration although we have been actively engaging with a number of occupiers about facilitating their client and collect offer.

Hambleden House

19-26 Pembroke Street Lower

Dublin 2

D02 WV96

Ireland

»Map

Phone: +353 (1) 6477900

Fax: +353 (1) 6477901

Email: info@bannon.ie