A contentious and topical issue for some time now, the Residential Zoned Land Tax (RZLT) will impact a range of stakeholders across the development land sector. The RZLT, which was introduced in the Finance Act 2021 effectively replaces the Vacant Site Levy, with a similar objective of increasing the supply of residential accommodation.

As an annual tax charge, it will be calculated at 3% of the market value of land zoned suitable for residential development which is or can be readily serviced. Each local authority is obliged to generate a residential zoned land tax map, with draft maps published from the start of November 2022.

Land suitable for residential development from the 1st of January 2022 and development not commenced prior to the 1st of February 2024 will be liable for taxation. Landowners seeking to be omitted from the tax have until the 1st of January 2023 to make an appeal to their Local Authority. Impacted landowners will be expected to self-assess or engage with a registered valuer to conclude the market value of their land in anticipation of the 23rd of May 2024 tax return date.

The limited circumstances under which the RZLT may be deferred include the following:

– Planning permission has been granted in respect of the residential land and a commencement notice, in respect of the residential development, has been lodged with the relevant Local Authority.

– If an appeal relating to the inclusion of the site on the register has not yet been determined.

– Judicial review or appeal to An Bord Pleanála is brought by a third party in relation to the planning permission that was granted.

For more information on the potential implications of RZLT contact nbrereton@bannon.ie.

The first Bannon Pulse of 2023 is now live. We look back at the strong level of activity in 2022, highlighted by the large number of lettings and new market entrants. Our occupancy trackers finished 2022 in positive form, as did our trading analysis across the retail categories. Neil Bannon gives his take on the market concluding that, ‘The opportunity for informed investors is to acquire retail assets with robust performance but priced to reflect a negative narrative’.

The first Bannon Pulse of 2023 is now live. We look back at the strong level of activity in 2022, highlighted by the large number of lettings and new market entrants. Our occupancy trackers finished 2022 in positive form, as did our trading analysis across the retail categories. Neil Bannon gives his take on the market concluding that, ‘The opportunity for informed investors is to acquire retail assets with robust performance but priced to reflect a negative narrative’.

Our final Retail Pulse of 2022 has just gone live. All in all, an exceptionally busy year for the team at Bannon. 2023 is looking very promising for Retail.

Our final Retail Pulse of 2022 has just gone live. All in all, an exceptionally busy year for the team at Bannon. 2023 is looking very promising for Retail.

Bannon’s latest monthly Retail Pulse has now gone live. Neil Bannon looks at recent retail sales data to demonstrate how the negative narrative continues to clash with reality.

Bannon’s latest monthly Retail Pulse has now gone live. Neil Bannon looks at recent retail sales data to demonstrate how the negative narrative continues to clash with reality.

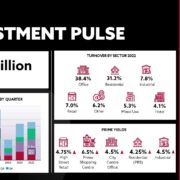

The Bannon Dublin Office Market report is available now. Take up for the third quarter reached 819,000 sq.ft. representing a 60% increase on Q2 and a 77% increase in the same period last year. Lease flexibility continues to be sought in the short term as companies continue to assess their office requirements as remote and hybrid models are fully determined.

The Bannon Dublin Office Market report is available now. Take up for the third quarter reached 819,000 sq.ft. representing a 60% increase on Q2 and a 77% increase in the same period last year. Lease flexibility continues to be sought in the short term as companies continue to assess their office requirements as remote and hybrid models are fully determined.