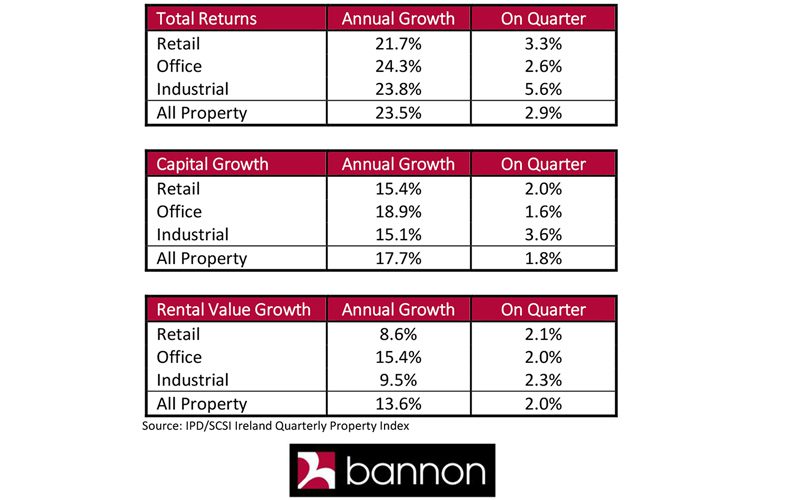

Prime office and retail rents in Dublin are expected to rise by about 12% in 2016, while residential development land values in the capital are expected to rise by a similar amount according to a new commercial property survey by the Society of Chartered Surveyors Ireland.

Surveyors expect prime office rents in the rest of the country to increase by between 5% to 6% while retail rents are expected to increase by 7% to 8% in Munster and Leinster (excluding Dublin) but by 4.5% in Connacht.

The survey found that investment in the commercial property market reached approximately €3.7 billion in 2015. While this figure is below the record investment level of €4.5 billion achieved in 2014, it nevertheless represents an exceptionally buoyant year for Irish property investment, as all sectors of the market recorded marked increases in activity.

The 2015 property market has seen investment spread more broadly through the regions compared to 2014, when investment was largely focused on the Dublin Region.

Close to 500 Chartered Surveyors were surveyed for the SCSI annual report which was developed and published in conjunction with Future Analytics Consulting.

Office Sector

According to the report there was a 24.1% year on year increase in prime office rents in Dublin in 2015 which reflects the continued demand for city centre locations from new and existing investors, particularly from technology based companies. Positively, respondents also noted an increase in investment activity and a rise in the number of firms that located in suburban areas in 2015, enticed by lower rental prices and newly renovated facilities.

The Review found that prime office rents in the capital were priced at €561 per sq.m at the end of 2015 but are set to increase by a further 11.7% this year.

Regional locations also experienced an increase in office sector demand. Respondents reported a marked increase in activity and demand for office space in the regional cities as the economic recovery resulted in an increase in new company formations and expansions.

This trend is likely to continue in 2016 as respondents predict that prime office rents in Connacht/Ulster will increase by 5.2% and in Munster and Leinster (excluding Dublin) by 5.9% and 6.1% respectively.

Brian Meldon, SCSI Commercial Agency Professional Group Chair, said; “While some respondents are anticipating an increase in supply in 2017, no new office space has been delivered to the Dublin market for the last five years and as a result demand continues to surpass supply. As a result, there are ongoing concerns about Dublin’s ability to continue to attract service sector Foreign Direct Investment in the absence of appropriate office space.”

“Concerns have also been raised by respondents about the lack of housing for potential future employees, as well as access to high quality public transport which could act as barriers to investment in the office sector in the short term. These concerns should weigh heavily on the minds of Ireland’s political parties who will contest the upcoming general election on the back of their plans for further job creation” he said.

Retail

In the retail sector, retail rents in Dublin’s Grafton Street grew by approximately 17.9% in 2015. Rents increased by 16.8% for prime rental in Dublin as Zone A prices reached €5,247 per sq.m. Respondents to the survey expect prime retail rents in Dublin to increase by 11.5% in 2016. In Connacht/Ulster, they are expected to increase by around 4.5% and in Munster and Leinster by approximately 8.0% and 7.2% respectively.

Brian Meldon said rental value growth within the retail sector had increased progressively throughout the course of 2015.“This reflects a strengthening domestic economic recovery and improving consumer sentiment. However, demand in town centres, suburban areas and neighbourhood shopping centres remains subdued and higher vacancy rates will likely remain a challenge within these areas in 2016, despite the positive forecasts for rental value growth”

Development Land

Development land values continued to increase in 2015. Most notably, residential development land increased by 19.7% in Dublin, 16.7% in Munster, 15.1% in Leinster and 10.0% in Connacht/Ulster. SCSI members anticipate residential development land values in Dublin will increase by around 12.1% in 2016.

However, growth in the value of office development land in Dublin surpassed all other development land types in all regions, with a rise of 26.7% in 2015. This growth is set to continue in to 2016 with expected increases of 16%. Notably, Dublin is the only region in which growth in the value of office development land exceeds growth in the value of residential land.

Brian Meldon said the increasing demand for housing and office units has strongly contributed to a growth in development land activity.

“Development finance remains the biggest single issue in ensuring additional new residential and commercial units are built over the short-term. Many contractors are reportedly experiencing very limited access to finance, with lending of only 30% to 50% being offered by financial institutions; with high interest rates and other inputs adding further to development costs. Ensuring the availability of development finance for measured speculative development, as well as speeding up the planning system will address supply issues and create a more sustainable market.”

Industrial

The industrial sector also experienced positive growth, and while much of this was focused on the Dublin market, the Munster Region experienced the greatest levels of rental growth, albeit from a low base. In Dublin, prime industrial rents under 500 sq.m increased to €84 per sq.m, representing an increase of approximately 2% year-on-year, while secondary rents on properties over 500 sq.m increased by 34.1% to €55 per sq.m.

“Industrial rental values continued to strengthen in 2016. Demand was strong for logistic-type properties, as the logistics networks expanded to meet the growing online retail phenomenon. There is an undersupply of these large-scale, modern logistic-style units, and build costs for such units remains high, undermining the financial viability of any speculative development” Meldon concluded.

Survey by SCSI

We were delighted to hear our Executive Chairman Neil Bannon interviewed on Executive Chair, part of Newstalk’s “Down to Business” radio show on Saturday. Neil and Bobby discussed the big changes to the nature of the Office and how it will move from being functional to experiential. He provided the valuable insight that Investors and Employers are now going to be more concerned about the experience of being in the office. It will no longer simply be a place with a desk but instead somewhere you look forward to visiting in the new hybrid working world.

We were delighted to hear our Executive Chairman Neil Bannon interviewed on Executive Chair, part of Newstalk’s “Down to Business” radio show on Saturday. Neil and Bobby discussed the big changes to the nature of the Office and how it will move from being functional to experiential. He provided the valuable insight that Investors and Employers are now going to be more concerned about the experience of being in the office. It will no longer simply be a place with a desk but instead somewhere you look forward to visiting in the new hybrid working world.

Hibernia REIT has let the remaining space in its 2WML building to online fashion platform Zalando Ireland.

Hibernia REIT has let the remaining space in its 2WML building to online fashion platform Zalando Ireland.

Connectivity is firmly established as a necessary utility for office tenants. However, there are still many office locations that don’t deliver the connectivity that businesses require. A Bisnow survey carried out in September found that 69% of businesses had moved location to improve connectivity, while 41% of respondents said poor quality connectivity hindered them from doing their job properly on a weekly basis.

Connectivity is firmly established as a necessary utility for office tenants. However, there are still many office locations that don’t deliver the connectivity that businesses require. A Bisnow survey carried out in September found that 69% of businesses had moved location to improve connectivity, while 41% of respondents said poor quality connectivity hindered them from doing their job properly on a weekly basis.