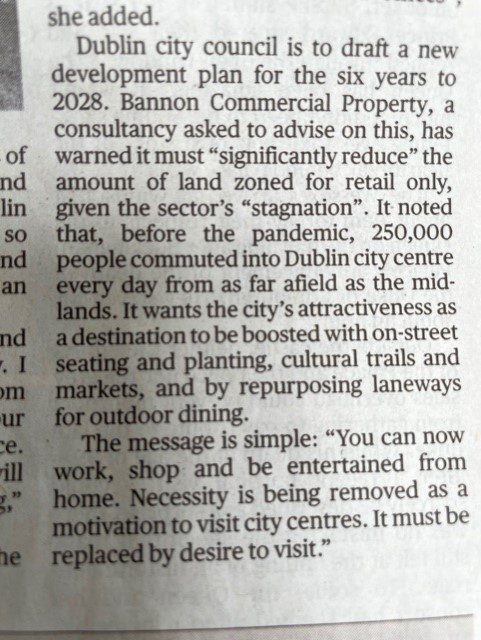

After the pandemic: in Dublin’s bare city

After the pandemic: in Dublin’s bare city. Our streets must be reimagined to entice visitors rather than cater to workers. Bannon advises on this in The Sunday Times.

After the pandemic: in Dublin’s bare city. Our streets must be reimagined to entice visitors rather than cater to workers. Bannon advises on this in The Sunday Times.

After the pandemic: in Dublin’s bare city. Our streets must be reimagined to entice visitors rather than cater to workers. Bannon advises on this in The Sunday Times.

After the pandemic: in Dublin’s bare city. Our streets must be reimagined to entice visitors rather than cater to workers. Bannon advises on this in The Sunday Times.

Covid 19 and level 5 restrictions have continued to impact the Dublin office market this quarter with just 14 transactions recorded across the sector.

As the vaccination rollout continues we are seeing a notable increase in market activity and re-activation of requirements, as companies plan for a return to the office. This is highlighted further by the increase in office accommodation reserved, which currently stands at over 500,000 sq.ft. across the capital.

Wishing all our clients and friends a very Happy Easter from all the team at Bannon

Wishing all our clients and friends a very Happy Easter from all the team at Bannon

Despite the backdrop of Covid 19, Q1 turnover was a healthy €1.22bn, with 58% weighting to the residential sector. Strong demand in the sector for good product continues on a standing asset and forward commit basis. With restrictions on travel / viewings still in play the more traditional sectors have had a subdued quarter but should rebound later in the year. If you wish to discuss the quarter in more detail or general investment, please contact Rod Nowlan or David Carroll.

With vacancy levels for prime industrial stock reaching record lows and limited development opportunities available along the main arterial routes around the capital, agent Bannon expects to see strong demand for a 22-acre land holding fronting on to the M3 motorway.

Located next to junction 4, less than five-minutes’ drive from the M50 and 15km from Dublin city centre, the M3 Gateway site is fully serviced and offers the potential for a logistics/distribution or data-centre development of about 400,000sq ft (37,161sq m) subject to planning permission.

The land adjoining the site has in recent years been transformed by the development of two hyper-scale data centres by Facebook. Further data centres are situated nearby in Blanchardstown and Mulhuddart where Amazon Web Services is progressing a 223,000sq ft facility. The area has also proven to be popular among pharmaceutical and logistics companies, with MSD, Astellas, Helsinn Birex, Geodis and Masterlink all situated nearby.

The commuter towns of Dunboyne and Clonee are situated on the opposite side of the M3 with rail stations at Dunboyne and the M3 Parkway park-and-ride facility at Pace.

The land has direct road frontage on to both the M3 slip road and the Kilbride road. Notably services including mains drainage, water and gas supply pass through the southern portion of the site and are capped for future connection. The presence of these services is expected by the selling agent to enhance the prospects for the land when brought forward for development. The entire holding is zoned “enterprise and employment” and “warehousing and distribution” within the Meath county development plan.

The property is being offered for sale by tender on Thursday, May 6th at a guide price of €10 million.

Commenting on the sale, Niall Brereton, director at Bannon, said: “In addition to the terrific data-centre potential the lands at M3 Gateway offer institutional investors an unrivalled opportunity, subject to planning permission, to enhance the logistics/distribution allocation within their portfolios and capitalise on the significant demand amongst third-party logistics providers, pharmaceutical companies and online retailers for modern industrial stock within touching distance of the M50 and the city’s main arterial corridors.”

Happy St. Patrick’s Day to all our clients and friends from Ireland’s largest indigenous Commercial Property Advisor.

Happy St. Patrick’s Day to all our clients and friends from Ireland’s largest indigenous Commercial Property Advisor.

A shot from today’s Bannon town hall meeting. We simply can’t wait to get back to work with this great team in the non virtual world….

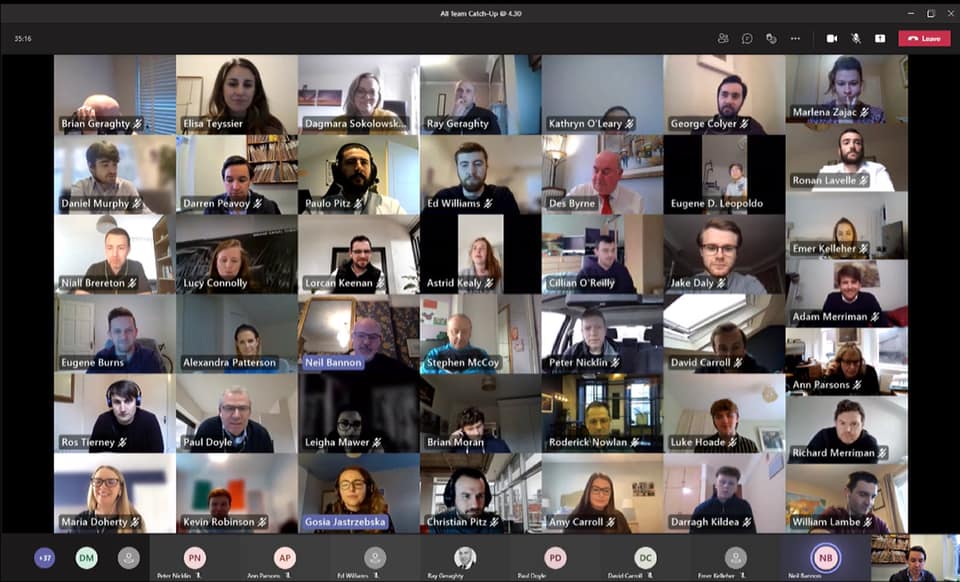

The dramatic improvement in the balance sheets of Irish Consumers in the last decade is astounding, savings are up 35% and debt is down 33%, a €70bn nett turnaround. The potential for a positive impact on the retail sector post reopening is clear, the question is where will the money be spent. We are modelling the potential impact on the different retail sub-sectors and expect to see a very different outturn to the 2013 recovery.

With the rollout of Covid-19 vaccines now under way, the owners of Blanchardstown Centre are gearing up for the return of significant numbers of shoppers to its stores, with three additions to the west Dublin outlet’s food and beverage line-up.

Having played host in 2018 to US donut giant Krispy Kreme’s most-successful opening globally, Blanchardstown has added boutique coffee house The Art of Coffee and specialist donut brand Off Beat to its offering. They will be joined later this year by gourmet burger chain Bunsen.

The Art of Coffee’s unit is its first in a shopping centre and is located at the red mall entrance beside BT2. The new 65sq m (700sq ft) store was added as part of the same development that saw German supermarket chain Aldi open a new 2,200sq m (23,680sq ft) store last December. Off Beat’s new store is located near Dunnes Stores in the green mall.

Bunsen’s new restaurant will be located immediately next door to Krispy Kreme. Extending to 190sq m (2,045sq ft), it will represent the popular chain’s first foray into a shopping centre since its establishment in 2013.

Commenting on the decision of the three brands to locate at Blanchardstown Centre, Sharon Walsh, leasing director at Falcon AM, said: “All three brands are best in class and Irish-owned. We are delighted that when they looked at growing their businesses in these challenging times, Blanchardstown was their destination of choice. These new additions will appeal to a broad demographic and enhance and compliment the already-wide food and beverage offering at Ireland’s largest shopping and leisure location.”

BNP Paribas and Bannon are the joint leasing agents at Blanchardstown Centre.

Joint agents CBRE and Bannon are guiding a price of €2.5 million for lands zoned for the development of retail and residential in the commuter town of Dunboyne, Co Meath.

The subject site extends to 3.54 acres and is located at the centre of the town, to the rear of St Peter and Paul’s church and immediately adjacent to the new SuperValu development. Dunboyne train station is situated 1km from the property. The front section of the site is currently in use as a car park, while the rear section is under grass.

The site is located in an area zoned “B1 town/village centre” under the draft Meath County Development Plan 2020-2026. It is also identified as a “retail opportunity site” OS 1, under which additional retail development for the town could be accommodated. Residential development is also permitted under the current zoning objective.

Dunboyne is a well-established residential location, with an abundance of amenities including sports clubs, shops, cafes and restaurants. There are several schools in the town, including Dunboyne Primary School, Gaelscoil Thulach na nÓg and St Peter’s College secondary school.

There are a number of employment hubs located within close proximity to the town, including Dunboyne Business Park, the IBM campus in Mulhuddart, Blanchardstown and Damastown Industrial Park, MSD and Facebook Clonee.

Dublin city centre is located just 18km from Dunboyne and is readily accessible via the M3 motorway. In terms of public transport, Dunboyne train station offers a regular service to Dublin each day, with a travel time of about 30 minutes to the Dublin Docklands station. There are also in excess of 30 Dublin Bus services per day.

Darragh Deasy of CBRE’s development land division says: “This is a rare opportunity to acquire a development site in one of Meath’s most desirable residential locations. The subject site has terrific development potential, subject to planning permission, and should appeal to a wide pool of purchasers.”

Niall Brereton, director at Bannon, adds: “Dunboyne has been identified as a strategic development area within the Dublin Metropolitan Area Strategic Plan. Given the central location of these lands, they offer undoubted potential to develop a mixed-use scheme, subject to planning permission.”

Are you interested in the history of some of Dublin’s past and present retailers?

Well, the Central Library are hosting a new series by Dublin City Council Historian in Residence Dr Mary Muldowney which takes a look at retail streets like Henry Street and how they have changed over the last 100 years or so. The series features Dublin favourites Arnotts, Clerys, Roches Stores and other major retailers that have disappeared; as well as featuring the small businesses.

In her opening talk on 8 February, Mary introduced us to the history of retail in Dublin City Centre.

The next talk, Shopping in Dublin City Centre 1790-1990. Henry Street and the women who worked there is on 8 March at 7pm.

This lecture will take place on Zoom and, in honour of International Women’s Day on 8th March, it will focus on the women who ran and worked in the many retail businesses on Henry Street.

Bannon is delighted to support the @scsi recently launched Climate & Biodiversity Emergency Declaration. The “Surveyor’s Declare” document is an important resource for Surveyors who have signed up in support of a framework for Surveyors who are committing to play their part in the climate change challenge.

Despite the well documented shortage of prime industrial accommodation throughout Dublin, Bannon are pleased to have advised the purchaser of this modern warehouse facility at Unit J Aerodrome Business Park, Rathcoole. The 20,000 sq ft detached building is situated on a 1.1 acre site with 9.2m eaves height within the warehouse. The acquisition, which progressed successfully throughout Covid restrictions, was concluded on behalf of a company operating in the importation and distribution sector. Niall Brereton advised the purchaser, the price paid was in excess of €2.5m. Philip Harvey and Kieran Casey of HARVEY were the selling agents.

Despite the well documented shortage of prime industrial accommodation throughout Dublin, Bannon are pleased to have advised the purchaser of this modern warehouse facility at Unit J Aerodrome Business Park, Rathcoole. The 20,000 sq ft detached building is situated on a 1.1 acre site with 9.2m eaves height within the warehouse. The acquisition, which progressed successfully throughout Covid restrictions, was concluded on behalf of a company operating in the importation and distribution sector. Niall Brereton advised the purchaser, the price paid was in excess of €2.5m. Philip Harvey and Kieran Casey of HARVEY were the selling agents.

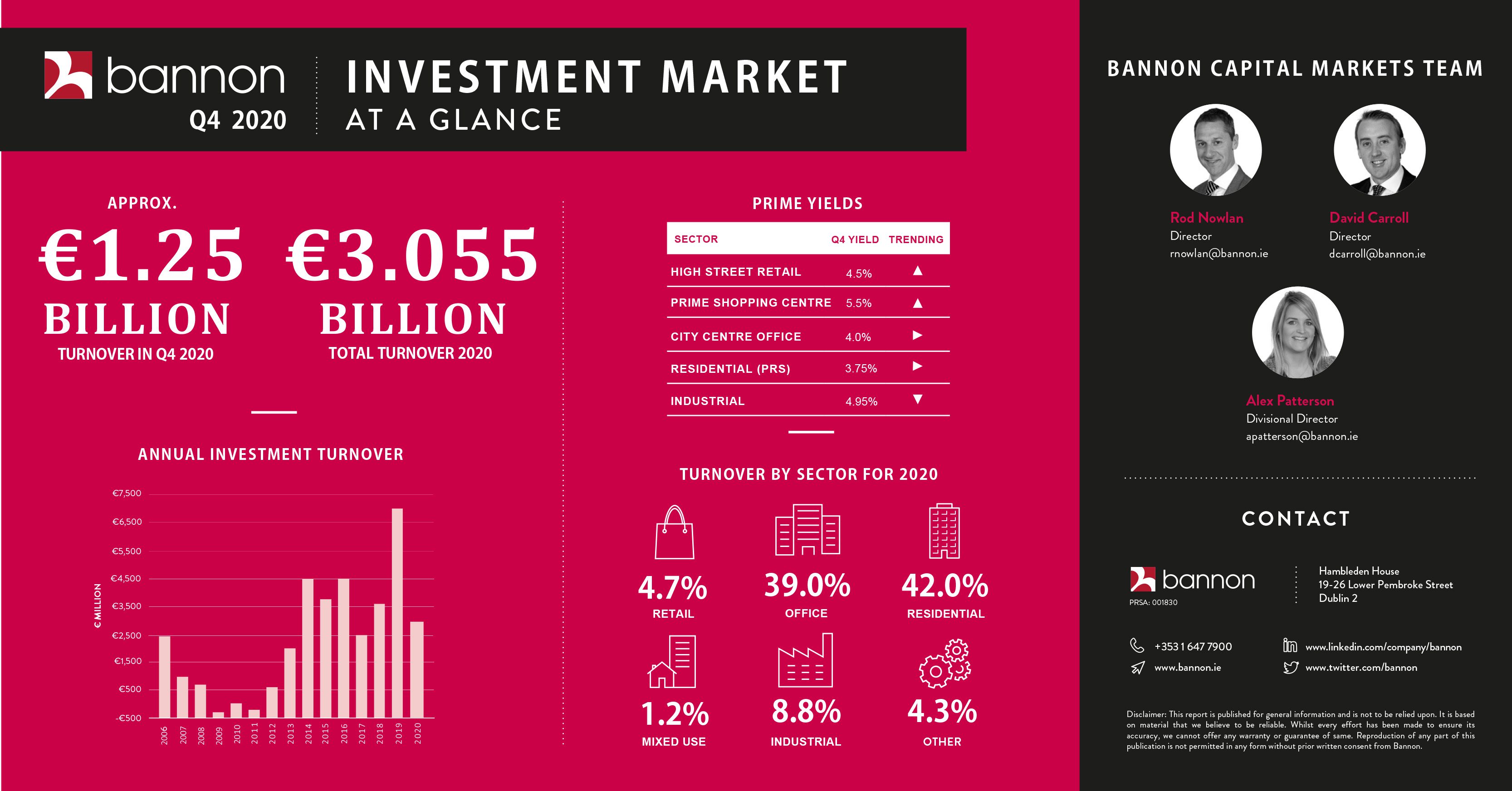

Last minute residential deal tips market over €3bn.

Last minute residential deal tips market over €3bn.

Despite the challenges facing the north-east this year due to impending Brexit and stricter lockdowns than their counterparts on either side of the border, it’s great to have some positive news and see Harry Corry open their latest store in Cavan Retail Park. Harry Corry are an international retailer specialising in home furnishings and this letting brings the park to full occupancy, further re-affirming the resilience of the retail park market.

Despite the challenges facing the north-east this year due to impending Brexit and stricter lockdowns than their counterparts on either side of the border, it’s great to have some positive news and see Harry Corry open their latest store in Cavan Retail Park. Harry Corry are an international retailer specialising in home furnishings and this letting brings the park to full occupancy, further re-affirming the resilience of the retail park market.

It’s difficult to imagine things getting any worse for the retail sector than they did in 2020. But the chief driving force behind the decline of investor interest began long before Covid-19 arrived. There has been growing concern in relation to the impact of online retail and changing consumer trends on the long-term supply-demand dynamic for the bricks-and-mortar format. Much of this has been imported from the US where retail supply is five times that of Ireland, and the UK where it is 25 per cent higher and undergoing a sustainability crisis.

While the relative performances of these markets may already have been up for debate, the impact of Covid has ended the discussion. By mid-March the sector became virtually un-investable due to Covid-related uncertainties attaching to rental payments being added to those longer-term occupational concerns. The consequence of this is manifest in year-end investment turnover figures where retail will represent a record low 2.5 per cent of an anticipated total investment market turnover of € 3 billion. This from a sector that represented 24 per cent of investment turnover for the last decade (to 2019), but descending rapidly from a high of 53 per cent in 2016 to a previous record low in 2019 of 9 per cent.

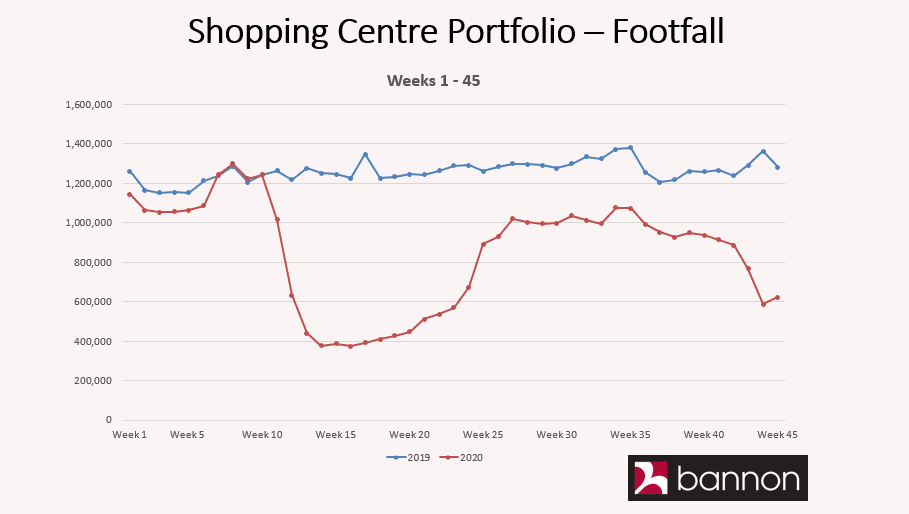

Unsurprisingly for 2020 High Street retail has been worst affected with Grafton Street top of the list experiencing a 66 per cent reduction in footfall for March to October. While the street’s footfall figures had been holding steady at 25 million for the last two years, the 2020 outcome will be closer to 13 million.

No surprise then that almost a quarter of the units on the street are effectively available. Henry Street performed a little better as did some of the other city’s high streets, but the tone is similar. Next in line were the “comparison led” shopping centres which, as a general rule, saw footfall collapse during the first lockdown and rent collections plummet below 35 per cent. However, they did improve quickly and were less affected by the second lockdown. The burden of the service charge costs of running these mall-based schemes was exposed during these periods and will be a key factor in assessing the risk of ownership of these asset types in the future.

The resilience of the grocery sector shone through. No surprise therefore that 65 per cent of the limited 2020 retail investment transactions were grocery deals. Similarly, smaller grocery-led schemes performed better and recovered quicker than major town centres but weaker covenant strength and holding costs affected net rental collections.

Low holding costs

The retail sector’s star performers, however, have been the retail parks. Indeed, in the case of the 15 retail parks under Bannon management (between nationwide lockdowns) car throughput actually increased year on year for the period with rent collection rates approaching 100 per cent and impressive turnover increases. Even where tenants were adversely affected, low holding costs relative to shopping centres maximised the net income return to landlords.

If this crisis has accelerated the sector’s movement to the “retail endgame”, then retail parks and their occupiers have risen to the challenge. In this regard we envisage this asset type, along with grocery, to be the most liquid and popular sector for the year ahead.

Outside of this and following both Brexit and an anticipated mid-January lockdown we foresee a post-vaccine period of rebuilding balance sheets and filling occupational voids. While this period could take 12 to 24 months, there is little doubt that the rebasing of the sector generally will attract new investors wishing to get ahead of the recovery. This will probably manifest as loan trades first with a focus on fundamentally-sustainable schemes and high streets at attractive yields with occupiers who have embraced the omnichannel experience.

More sophisticated investors will recognise the buying opportunity that Covid-19 presents, especially if valuers fail to acknowledge the vast differences in performance across the sector.

Rod Nowlan is investment director at Bannon

Gateway Shopping Park will soon have an exciting and state of the art gym opening. The Warehouse Gym has just signed a lease with the shopping park and is due to open in the second quarter of 2021. It will be one of the biggest gyms in the west of Ireland at 18,000 sq. ft and it will be their third location in Galway.

The Warehouse Gym was founded in County Galway in 2013 and has exploded in popularity due to its large selection of strength equipment, free weights, machines and cardio equipment. As their community grew, they expanded out of the city centre to Oranmore in the outskirts of Galway, where they continue to serve their loyal members. The new gym in Gateway Shopping Park will host Galway’s largest selection of free weights, squat racks, cardio equipment and resistance machines. Services offered include personal training, InBody scans, virtual coaching software and nutritional consultations which are all bookable through a mobile application.

Michael Shortall, the General Manager of The Warehouse Gym, said “As a local business, The Warehouse Gym is super excited to be opening the largest gym in the west of Ireland right here in the heart of Galway. Gateway Shopping Park is the perfect location for serving the health and fitness needs of the Knocknacarra and surrounding communities. It’s our mission to fulfil that need by providing a welcoming, clean and modern health club for all ages and interests.”

Sigma Retail Partners are the asset management company for Gateway Shopping Park. Paddy O’Connor, Asset Manager for the park, said: “Finding the right fitness offering for our park was a key strategy for us. We wanted to ensure that we selected the right gym operator to provide the local community and the surrounding areas with a state of the art and well-run fitness centre. We are so pleased that a well-established gym in Galway will be joining our newly extended shopping park. The Warehouse Gym will be the eighth new addition to the Phase 2 extension and we look forward to welcoming them into our shopping park next year.”

The new shopping park extension is the first provision of retail space outside of Dublin since 2008 and the first in Galway in more than two decades. The development provided over 150 jobs during construction phase and is expected to create over 300 jobs in Knocknacarra and Galway when fully occupied. It will have open-use retail units and food and beverage units.

Gateway Shopping Park already has an impressive line-up of retailers including Dunnes Stores, B&Q, New Look, Next and McSharry Pharmacy, with new tenants recently opened in the Phase 2 extension, Harvey Norman, Boots, Carraig Donn, Petstop and Sonas Childcare. With the inclusion of The Warehouse Gym, the Phase 2 extension will be over 90% let.

Bannon are delighted to welcome Bag City to Marshes Shopping Centre, Dundalk in the lead up to Christmas despite a turbulent 2020. Jennifer Mulholland, Divisional Director, comments that the addition of Bag City to the Tenant mix at Marshes is another positive testament for the scheme which continues to be the North East’s most dominant retail scheme.

Bannon are delighted to welcome Bag City to Marshes Shopping Centre, Dundalk in the lead up to Christmas despite a turbulent 2020. Jennifer Mulholland, Divisional Director, comments that the addition of Bag City to the Tenant mix at Marshes is another positive testament for the scheme which continues to be the North East’s most dominant retail scheme.

Great to welcome Name It to The Square Town Centre, Tallaght! Fantastic news to start off the Christmas season.

Great to welcome Name It to The Square Town Centre, Tallaght! Fantastic news to start off the Christmas season.

As we exit level 5 restrictions, there is cause for double celebrations yesterday in Swords Pavilions Shopping Centre with the opening of 2 new stores. Great to see both Golden Discs & Catch open their doors in the lead up to Christmas.

As we exit level 5 restrictions, there is cause for double celebrations yesterday in Swords Pavilions Shopping Centre with the opening of 2 new stores. Great to see both Golden Discs & Catch open their doors in the lead up to Christmas.

We are delighted to be part of the team to deliver the new Aldi store in Blanchardstown. This will be a fantastic addition to the scheme which continues to grow and improve with new tenants and mall improvements.

We are delighted to be part of the team to deliver the new Aldi store in Blanchardstown. This will be a fantastic addition to the scheme which continues to grow and improve with new tenants and mall improvements.

Great to see local menswear brand Walker & Hunt going from strength to strength and gradually making the shift from online to bricks and mortar, taking space in Athlone Town Centre for the second year in a row, opening soon.

Great to see local menswear brand Walker & Hunt going from strength to strength and gradually making the shift from online to bricks and mortar, taking space in Athlone Town Centre for the second year in a row, opening soon.

The Ireland-based commercial property practice will drive efficiencies in their property management portfolio and tenant management with the Yardi platform

DUBLIN, Ireland (16, November 20) – Bannon Commercial Property Consultants Ltd. (Bannon) will manage over 7 million square feet of real estate on Yardi® Voyager, a cloud-based property management and accounting platform. The firm will also adopt Yardi® Lease Manager for a comprehensive view of tenant activities and portfolio performance.

Lease Manager, part of the Yardi® Elevate Suite, offers extensive data and oversight options. Finance and asset management teams can visualise total number of deferrals and abatements and aging accounts receivable. Property management teams can oversee rent collection and tenant communications.

Bannon will also adopt the Yardi® Procure to Pay Suite, an end-to-end procurement solution that includes Yardi PAYScan® for paperless invoicing and VendorCafe® for centralised vendor management. CommercialCafe®, an easy-to-use, self-service tenant portal will digitalise tenant communication for Bannon. CommercialCafe enables tenants to make online payments, access lease records and manage service requests.

“We are looking forward to the benefits of a cloud-based property management solution. We provide a ‘best-in-class’ approach to outsourced property management with quality at the core and we see synergies in Yardi’s offering. The Voyager platform will ensure consistency and modernisation in the way we report and manage our clients’ assets,” said Richard Muldowney, director and head of finance at Bannon.

“Yardi continues to expand its presence in Ireland, one of the fastest-growing real estate markets in Europe. We’re excited to support Bannon with technology that will facilitate strategic growth,” said Neal Gemassmer, vice president of international at Yardi.

Learn more about how Yardi is supporting real estate and investment clients in the UK and across Europe.

About Bannon Commercial Property Consultants Ltd.

Bannon is the leading indigenous commercial property practice in Ireland with a particular emphasis and track record in the retail space. The firm currently has 75 assets under management. For more information on Bannon, please visit bannon.ie.

About Yardi

Yardi® develops and supports industry-leading investment and property management software for all types and sizes of real estate companies. Established in 1984, Yardi is based in Santa Barbara, Calif., and serves clients worldwide from offices in Australia, Asia, the Middle East, Europe and North America. For more information, visit yardi.co.uk.

In general the footfall across our portfolio is remarkably consistent every year, however 2020 is very different. We remain hopeful that people will shop with purpose when the restrictions are eased at the start of December.

In general the footfall across our portfolio is remarkably consistent every year, however 2020 is very different. We remain hopeful that people will shop with purpose when the restrictions are eased at the start of December.

Businesses across the country need a strong finish to the year and we can all help to make it happen.

Currently in the final stages of construction, Fitzwilliam 28 has been entirely pre-let to Slack Technologies upon completion of the building. The global tech giant is moving out of its current property on Hatch Street and into Fitzwilliam 28, which will act as their new EMEA headquarters.

Located between Merrion & Fitzwilliam Squares in Dublin’s CBD, the location is one of the most sought after in the City and once complete, Fitzwilliam 28 will comprise c. 12,600 sq m of prime Grade-A office accommodation over 8 floors and will be one of the most prestigious office buildings in the Dublin market.

ESB, Ireland’s largest utilities company, is developing the asset alongside its own headquarters at Fitzwilliam 27, which is also under development.

Sustainability and energy efficiency have been a key focus and as such, Fitzwilliam 28 will benefit from BREEAM Excellent accreditation, A3 BER Rating and will be one of Dublin’s first NZEB (Near Zero Energy Building) compliant developments.

On completion, the acquisition will represent Amundi Real Estate’s first deal in the Irish market in a bid to expand the presence of their flagship fund in key European jurisdictions.

Savills and Bannon advised ESB on this transaction. Knight Frank advised Amundi Real Estate.

Ronan Sheehy ESB Head of Property and Security commented:

“We are delighted to confirm the exchange of Fitzwilliam 28 with Amundi Real Estate. This flagship development by ESB has been built with the highest standards of sustainability in mind. A tireless amount of work has gone into ensuring the delivery of what we believe is the finest office development to complete in recent times, and we look forward to completing this deal with Amundi Real Estate in the coming weeks.”

Rod Nowlan, Director at Bannon, commented:

“This is an important transaction for the Dublin market, representing a deal which both underpins values and illustrates continued international demand with this new market entrant.”

Fergus O’Farrell, Director of Investments at Savills, commented:

“The quality of the asset was reflected in the strong demand for the investment. This investment by Amundi Real Estate is further endorsement of Dublin as location for international investment.”

Harvey Norman has just opened their brand new 45,000 sq. ft store in Sligo Retail Park on Thursday, 5th November. It is Harvey Norman’s first store in County Sligo and the 16th store in Ireland. The store is opening under the Government guidelines on a restricted basis due to level 5 lockdown with only essential goods and click and collect available.

It is also the fifth Harvey Norman store in Sigma Retail Partners’ portfolio, with other Harvey Norman stores in Naas Retail Park, Drogheda Retail Park, Waterford Retail Park and Gateway Shopping Park.

With over 290 stores worldwide and currently 16 in the Republic of Ireland, Harvey Norman is the leading retailer of furniture, bedding, computer and electrical goods. The first Harvey Norman store opened in Swords in Dublin in August 2003. Its stores have over 750,000 square feet of retail space and boast a massive range of goods. Harvey Norman has a worldwide presence with stores in eight countries across the globe, including Singapore, Malaysia, Slovenia, New Zealand, Croatia and of course Ireland.

Paddy O’Connor, Asset Manager from Sigma Retail Partners, said “We are very pleased that one of the biggest and most well-known global retailers in household and electrical goods has joined Sligo Retail Park. It is the completion of a lengthy asset management strategy with a focus to bring Harvey Norman to Sligo and the wider North West catchment. We are very confident that Harvey Norman will perform extremely well in Sligo and they are a great addition to our other fantastic retail partners in Sligo Retail Park.”

Sligo Retail Park is the primary retail park destination in the North West catchment area with stores catering to a wide variety of customers and accommodates diverse retail use. It has a total of 14 retailers that include JYSK, Currys PC World, Smyths Toys, Homebase, Castle Davitt, Right Price Tiles, Homestore & More, EZ Living, McDonalds, Costa and KFC, with 1,000 free car parking spaces.

The inconsistent and illogical nature of the imposition of essential goods only sales in retail across the country is causing serious damage to the sector.

The inconsistent and illogical nature of the imposition of essential goods only sales in retail across the country is causing serious damage to the sector.

We have reports from across the portfolio of local Jewellers who are operating on a Click & Collect basis being told to pull their shutter, a news agency being advised that can sell cigarettes and lotto tickets but not books or magazines, a florist being told to close who traded during the last (and more severe) lockdown.

The government needs to think about where this spend will go. A customer told they cannot buy a magazine or a book in a shop that is already open is one click away from redirecting spend from a small local business to Jeff Bezos

September Retail Sales indicate that at least one part of the economy is definitely experiencing a K shaped recovery. The stellar numbers that continue to come out of the DIY sector (YOY: Hardware +27.6% YOY, Electrical +21.1% & Furniture +11.9%) contrast sharply with Bars which are predictably down 48%.

September Retail Sales indicate that at least one part of the economy is definitely experiencing a K shaped recovery. The stellar numbers that continue to come out of the DIY sector (YOY: Hardware +27.6% YOY, Electrical +21.1% & Furniture +11.9%) contrast sharply with Bars which are predictably down 48%.

What’s interesting is that total value of retail sales was up 7.2% year on year which means Irish consumers spent a lot more this September than last year.

This was all before the lockdowns started again which if recent experience is anything to go by will exacerbate the K shaped nature of the market performance.

Gateway Shopping Park in Galway has opened a Sonas Early Learning Centre that offers childcare to children from 6 months up to 12 years. It is the fifth unit to open in the shopping park’s newly completed extension in the last three months.

Sonas Early Learning Centre offers quality childcare to babies, toddlers, pre-school and after school children, in a caring, comfortable, and child-led environment. The centre has large, secure outdoor play areas equipped with infant-friendly surfaces, climbing equipment, play equipment and sports and exercise equipment. Sonas is part of the Spraoi Early Learning Centre group and this is Spraoi’s sixth centre in Galway and its eighth centre in Ireland.

Theresa Murphy from Spraoi said “We are delighted to announce that our newest early years service is now open, delivering excellence in childcare in our state of the art, purpose designed, spacious 5 playroom service. Our services focus on the delivery of a child led early years experience, implementing a curriculum under the Aistear Curriculum framework. Our service has recently undergone a TUSLA inspection and achieved full compliance with all the regulatory requirements. Our on site chef delivers delicious and nutritious meals prepared with the nutritional needs of your child in mind. We look forward to welcoming you.”

Sigma Retail Partners are the asset management company for Gateway Shopping Park. Paddy O’Connor, Asset Manager for the park, said: “There are many young families in and around the surrounding areas of Gateway Shopping Park and coupled with a school right next door, we knew that a crèche would be a wonderful addition to the development. We are therefore very pleased that Sonas has joined our newly extended park and we wish them all the best.”

The new shopping park extension is the first provision of retail space outside of Dublin since 2008 and the first in Galway in more than two decades. The development provided over 150 jobs during construction phase and is expected to create over 300 jobs in Knocknacarra and Galway when fully occupied. It will have open-use retail units, food and beverage units and a gym.

Gateway Shopping Park already has an impressive line-up of retailers including Dunnes Stores, B&Q, New Look, Next and McSharry Pharmacy, with four new stores recently opened in the Phase 2 extension, Harvey Norman, Boots, Carraig Donn and Petstop.

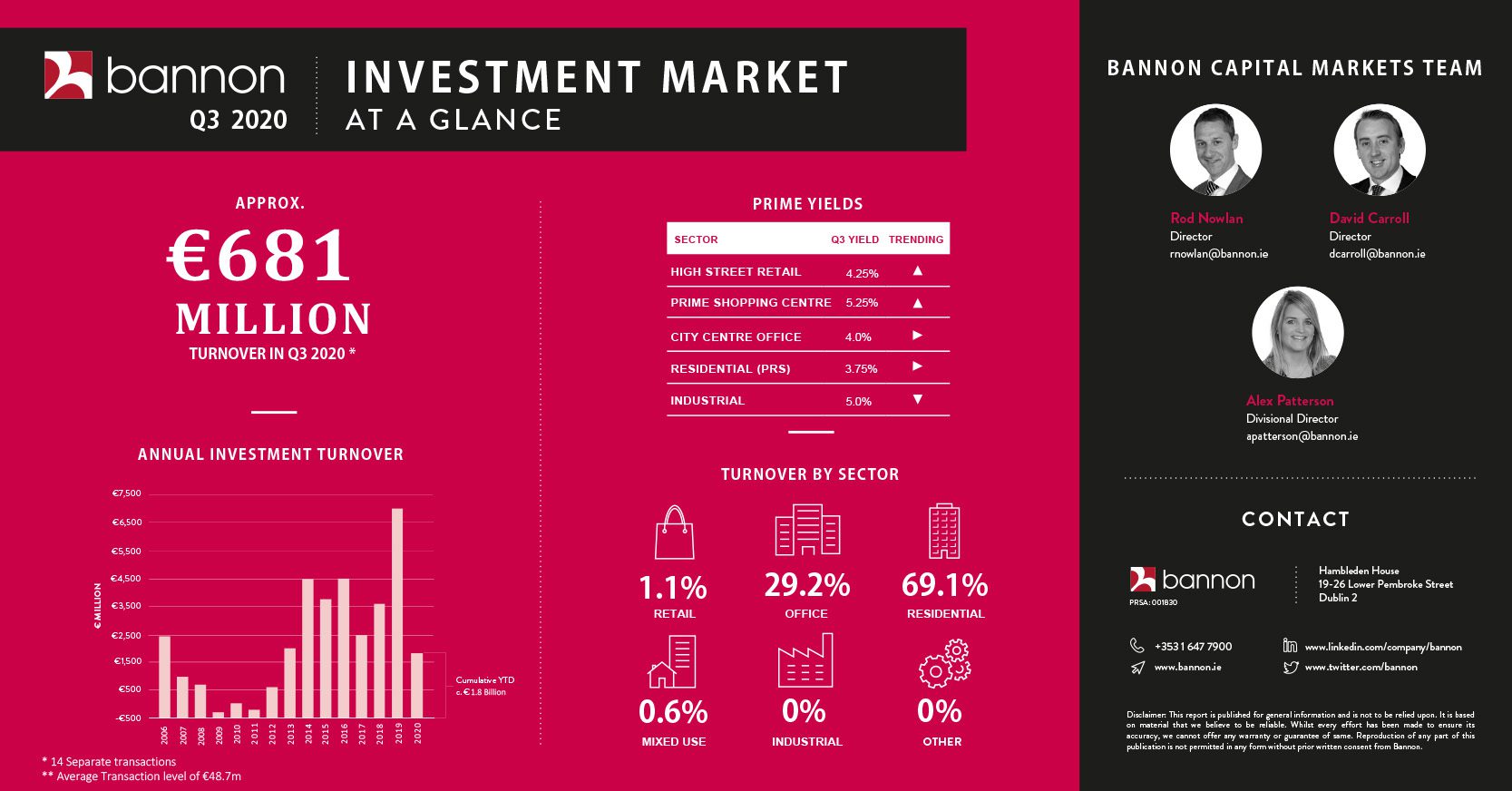

David Carroll, Investment Director – “Q3 2020 turnover of €681m continued to illustrate the domination of PRS investment versus other asset classes with circa. 70% of value attributed to the sector. Covid-19 impacts continue to effect the supply and demand factors of traditional investment sectors. There is now close to €2bn of office product being marketed publicly and privately thus Q4 should provide some clarity on where investor appetite is at”.

David Carroll, Investment Director – “Q3 2020 turnover of €681m continued to illustrate the domination of PRS investment versus other asset classes with circa. 70% of value attributed to the sector. Covid-19 impacts continue to effect the supply and demand factors of traditional investment sectors. There is now close to €2bn of office product being marketed publicly and privately thus Q4 should provide some clarity on where investor appetite is at”.

In a matter of weeks the newly extended Gateway Shopping Park in Galway has opened its fourth new store, Petstop. The new store has a floor area of 6,500 sq. ft and brings the total number of Petstop stores in Ireland to eight, which include The Park Carrickmines and Limerick One Shopping Park.

Petstop is a chain of pet shops in Ireland stocking pet foods, pet supplies and pet accessories. They are a one-stop-shop for all petcare needs with over 7,000 products in their stores. Established 25 years ago in 1995, they are one of the leading pet store chains in Ireland.

Anthony Gallagher, the Managing Director of Petstop said “Petstop are delighted to have opened our latest store at Gateway Shopping Park in Galway. The reaction so far from pets and their parents has been fantastic. I hope we can welcome many more pet families to visit us at Knocknacarra. I would like to send my warmest congratulations to all my colleagues at Petstop in Galway and my friends at Sigma Retail Partners for making our opening such a success.”

Sigma Retail Partners are the asset management company for Gateway Shopping Park. Paddy O’Connor, Asset Manager for the park, said: “On behalf of Sigma, we are absolutely delighted to welcome Petstop to Gateway Shopping Park and feel they are a great addition to the existing line-up of retailers. Petstop will join top quality retailers including the recently opened Harvey Norman, Boots and Carraig Donn, as well as the impressive list of existing retailers. We wish them all the best in their new store.”

The new shopping park extension is the first provision of retail space outside of Dublin since 2008 and the first in Galway in more than two decades. The development provided over 150 jobs during construction phase and is expected to create over 300 jobs in Knocknacarra and Galway when fully occupied. It will have open-use retail units, food and beverage units, a creche and a gym.

Gateway Shopping Park already has an impressive line-up of retailers including Dunnes Stores, B&Q, New Look, Next and McSharry Pharmacy, with three new stores recently opened in the Phase 2 extension, Harvey Norman, Boots and Carraig Donn.

As per the Retail Sales figures released by the CSO and our own experience across our retail park portfolio DIY & Household goods sales have been the stand out performer of the Retail sector since March.

As per the Retail Sales figures released by the CSO and our own experience across our retail park portfolio DIY & Household goods sales have been the stand out performer of the Retail sector since March.

Retail Parks continue to perform well with rolling restrictions on other retail outlets redirecting spend into home improvements.

Interestingly this is a sector with very low levels on pure online penetration although we have been actively engaging with a number of occupiers about facilitating their client and collect offer.

Bannon are delighted to have concluded the deal that sees Ray-Ban now trading from 32 Grafton Street. Congratulations to Ray-Ban for carrying out an amazing fitout.

Bannon are delighted to have concluded the deal that sees Ray-Ban now trading from 32 Grafton Street. Congratulations to Ray-Ban for carrying out an amazing fitout.

Carraig Donn will open a new store in Gateway Shopping Park in Galway on Friday 11th September. The new store will be the largest of all their retail stores with a floor area of 4,700 sq. ft and it will bring the total number of Carraig Donn stores in Ireland to 42.

Carraig Donn is Ireland’s premier retailer of fashion, jewellery and giftware products. Carraig Donn was established 55 years ago in 1965 and has its head office in Westport, County Mayo. It is 100% Irish owned and currently employs over 500 people nationally.

Pat Hughes is the Managing Director of Carraig Donn and the company was founded by his parents, Padraig and Maire Hughes. Pat Hughes said “We’re delighted to announce the opening of our new flagship store, and our third store in Galway. Despite the challenges that exist in our industry as a result of Covid-19, we are committed to our growth and expansion plan. We have a loyal customer base in Galway, and we are delighted to bring the very best of Irish fashion, jewellery and homeware to Knocknacarra”.

Sigma Retail Partners are the asset management company for Gateway Shopping Park. Paddy O Connor, Asset Manager for the park, said: “On behalf of Sigma and indeed the wider design team and the owners, we are thrilled to welcome Carraig Donn to our newly extended and re-branded Gateway Shopping Park. Carraig Donn will join top quality retailers including Boots and Harvey Norman who also opened their fantastic new stores within the last few weeks, and will join existing tenants Dunnes, B&Q, Next, New Look and McSharry Pharmacy.”

The Phase 2 extension is the first provision of new retail space outside of Dublin since 2008 and the first in Galway in more than two decades. The development provided over 150 jobs during construction phase and is expected to create over 300 jobs in Knocknacarra and Galway when fully occupied. The new extension will have open-use retail units, food and beverage units, a creche and a gym.

Gateway Shopping Park already has an impressive line-up of retailers, including Dunnes Stores, B&Q, New Look, Next and McSharry Pharmacy, with two new stores recently opened, Harvey Norman and Boots, and Petstop opening soon in the upcoming weeks.

On the face of it the recovery in the retail sector is astounding. Excluding Cars the value of retail sales in Ireland in July was 5.9% higher than in July 2019. These are boom type numbers. Dig deeper and the continued polarisation of the Retail sector’s recovery is laid bare.

On the face of it the recovery in the retail sector is astounding. Excluding Cars the value of retail sales in Ireland in July was 5.9% higher than in July 2019. These are boom type numbers. Dig deeper and the continued polarisation of the Retail sector’s recovery is laid bare.

Bars, Books, Fuel & Department stores (Debenhams closure might be a large part of this) are still way down on last year meaning that the increase in sales in other sectors is stratospheric. Electrical up 26.5%, Furniture & Hardware up 20%, Food & Beverage up 16% and this is in comparison to 2019 not the lock down period. Bodes very well for Retail Parks.

Also positive to see 3.6% annual growth in the value of Clothing & Footwear. A note of caution, the natural rhythm of the retail sector has been greatly disrupted by COVID & lockdowns so we will be monitoring how sales in different sub-sectors balance out over the months ahead.

FunTech is now open on Level 1 in Blanchardstown Centre. Phones, gadgets and accessories all available.

FunTech is now open on Level 1 in Blanchardstown Centre. Phones, gadgets and accessories all available.

Liverpool FC have launched a brand new pop-up store in the Swords Pavilions Shopping Centre, making it the second official club store in Dublin.

Liverpool FC have launched a brand new pop-up store in the Swords Pavilions Shopping Centre, making it the second official club store in Dublin.

International homeware retailer JYSK will open a new store in Sligo Retail Park on Thursday, 27th August. The store will have a floor area of 10,000 sq. ft and it will be JYSK’s eighth store in Ireland. It will also be the fifth store in Sigma Retail Partners’ portfolio, the other JYSK stores in its portfolio are Naas Retail Park, Drogheda Retail Park, Navan Retail Park and Parkway Retail Park (Limerick).

JYSK is an international retail chain from Denmark that sells household goods such as mattresses, bedding, sofas, furniture, curtains, dining sets and soft furnishings. JYSK is the largest Danish retailer operating internationally with close to 2,800 stores in 52 different countries, and many more stores will follow with its worldwide expansion plans. It was the founder and Chairman of the board Lars Larsen’s goal from the beginning to open and grow more and more stores and the aim to expand is a central part of JYSK’s plans. JYSK’s first entry into Ireland was in April 2019 with a store in Naas Retail Park.

Roni Tuominen, Country Manager at JYSK UK & Ireland, said: “The appetite for JYSK’s offering is there amongst Irish consumers. As a result we want to find new JYSK locations in towns and cities all over Ireland so we can contribute to the local economy, especially in smaller communities where our job creation will be extremely valuable.”

“We’re very excited to open the first JYSK store in Sligo which will be the centre of our operations in the West of Ireland going forward. We look forward to delivering exceptional quality products at great prices to our Sligo based consumers”, he added.

Patrick O’Connor, Asset Manager from Sigma Retail Partners, said “New retailers always bring a fresh new feeling and a sense of excitement into a retail park. The fact that JYSK is relatively new to Ireland adds even more to this excitement. We are delighted to have JYSK on board in Sligo Retail Park and we wish them the best of luck with their upcoming store openings.”

In addition to JYSK, Harvey Norman is also due to open a 40,000 sq. ft store in October. Sligo Retail Park is the primary retail park destination in the North West catchment area with stores catering to a wide variety of customers and accommodates diverse retail use. It has a total of twelve retailers that include Currys PC World, Smyths Toys, Homebase, Castle Davitt, Right Price Tiles, Homestore & More, EZ Living, McDonalds, Costa and KFC, with 1,000 free car parking spaces.

Yours Clothing, a plus-size retailer, is now open in the Ilac Shopping Centre.

The Phase 2 development provided over 150 jobs during the construction phase and is expected to create over 300 jobs in Knocknacarra and Galway when fully occupied. It is also the first provision of new retail space outside of Dublin since 2008.

After the absence of any retail construction activity in Galway for more than 10 years, the brand new Gateway Shopping Park Phase 2 expansion has just been completed, with the first two retailers, Harvey Norman and Boots opening their stores this month. Boots opened their store early July with Harvey Norman opening their new flagship store of 60,000 sq. ft on 22nd July.

The newly completed Phase 2 extension will have open-use retail units, food and beverage units, a creche and also a gym. It will include over 320,000 sq. ft of retail and leisure space and will make it one of Ireland’s largest shopping destinations. Aside from Harvey Norman and Boots, Carraig Donn, Spraoi Early Learning and Evergreen, Esquires are also included in the line-up of new retailers in the expansion.

Gateway Shopping Park already has an impressive list of current retailers, including Dunnes Stores, B&Q, New Look, Next and McSharry Pharmacy. The asset management company Sigma Retail Partners, on behalf of the owners Targeted Investment Opportunities ICAV, worked extensively on the project and the newly expanded retail asset will reinforce the shopping park as a primary shopping destination.

Gateway Shopping Park is located in Knocknacarra on Western Distributor Road, just across from the new gaelscoil that was built last year, Gaelscoil Mhic Amhlaigh. Gateway Shopping Park is also just a 10-minute drive from Galway city centre.

Harvey Norman are set to open their premium store in the new Phase 2 development at Gateway Shopping Park, Knocknacarra, Galway on Wednesday the 22nd July. Harvey Norman will anchor the recently completed Phase 2 extension with the existing Phase 1 anchored by Dunnes Stores and B&Q.

The largest retailer of appliances, technology and interiors in Ireland, Harvey Norman, will open a new premium 60,000 sq. ft. store which will trade over 2 levels and will include furniture, bedding, homewares, technology and appliances. There is also a Synge & Byrne café located upstairs. Harvey Norman will be an exciting addition to the already impressive line-up which includes Dunnes Stores, B&Q, Boots, New Look and Next.

Commenting on the store opening, Harvey Norman CEO Peter Hearn said, “We are very excited to open the doors to our Galway store. Our team has created THE key shopping destination in Galway for furniture, bedding, appliances and technology. We are proud to showcase our large range of the latest Irish-made furniture and bedding, we’ve installed a huge kitchen display area, a games hub, a Wonder Photo Shop and more. The biggest global brands highlighted by the latest store fit design plus safe shopping measures are all in place for our Galway customers.” There have been 47 jobs created within the store and warehouse.

Paddy O’Connor of Sigma Retail Partners, the asset managers for Gateway Shopping Park, said “we are absolutely delighted with the opening of Harvey Norman in our shopping park. We are excited to finally be able to welcome Harvey Norman to Galway and wish the Harvey Norman team all the best in their impressive new store. This is the first large scale retail development in the country for a number of years and the confidence shown in the scheme, Galway and also traditional retail can be seen with the quality of the international and national renowned retailers we are partnering with. Harvey Norman and the new Phase 2 tenants will solidify Gateway Shopping Park as a leading retail destination in the Galway catchment”.

The new Phase 2 extension is the first provision of new retail space outside of Dublin since 2008 and the first in Galway in more than two decades. The development provided over 150 jobs during construction phase and is expected to create over 300 jobs in Knocknacarra and Galway when fully occupied.

The Phase 2 extension will have open-use retail units, food and beverage units, a creche and a gym. Gateway Shopping Park will include over 320,000 sq. ft of retail and leisure space and will make it one of Ireland largest shopping destinations.

Gateway Shopping Park already has an impressive line-up of retailers, including Dunnes Stores, B&Q, Boots, New Look, Next and McSharry Pharmacy.

More exciting retailers will be announced in the coming weeks.

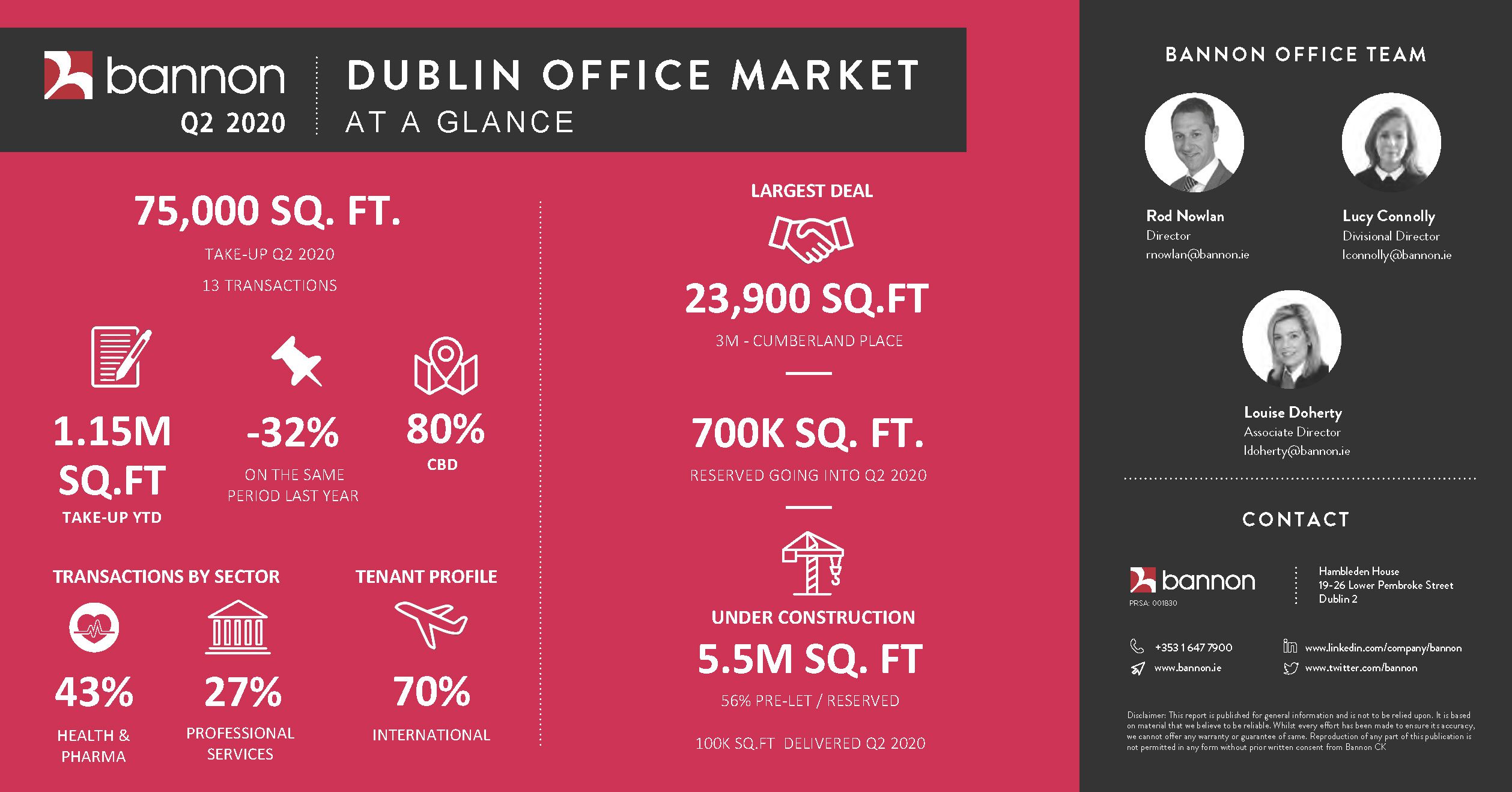

Lucy Connolly – Divisional Director – “The anticipated impact of covid-19 on the Dublin office market translated to a take up figure of 75,000 sq.ft. this quarter. We do expect to see a busier Q3 with over 700,000 sq.ft. of accommodation reserved, with some large transactions close to completing in the coming weeks. We commenced the quarter on a positive note with the recent announcement that Gilead are to create 140 new jobs following their letting of over 30,000 sq.ft. at North Dock”.

Lucy Connolly – Divisional Director – “The anticipated impact of covid-19 on the Dublin office market translated to a take up figure of 75,000 sq.ft. this quarter. We do expect to see a busier Q3 with over 700,000 sq.ft. of accommodation reserved, with some large transactions close to completing in the coming weeks. We commenced the quarter on a positive note with the recent announcement that Gilead are to create 140 new jobs following their letting of over 30,000 sq.ft. at North Dock”.

Another exciting addition soon to Manor Mills Shopping Centre in Maynooth, Sasta by the River restaurant, offering healthy food & drinks, including a great selection of vegetarian, vegan and gluten-free options, homemade cakes and pastries.

This new eatery is exactly what Maynooth has been looking for. It is great news to have new local businesses emerging in what has been very difficult times for the retail sector. Keep an eye on Sasta by the River social media pages where they will be documenting their fit-out towards their opening.

Boots is set to be the first store to open in the new Phase 2 development at Gateway Shopping Park, Knocknacarra, Galway on Wednesday 1st July. Boots will come as an excellent addition to the existing park, currently anchored by Dunnes Stores and B&Q.

Boots will occupy a large store of over 7,500 sq.ft and will come as wonderful news to customers of Gateway Shopping Park and the loyal shoppers in Knocknacarra and the wider catchment.

Boots Ireland is a leading pharmacy-led health and beauty retailer with 89 stores in Ireland and over 2,000 employees. Boots is at the heart of the communities it serves and is a staple health and beauty retailer for many people in Ireland. Customers visiting the new store will have access to a wide range of pharmacy services, including prescription service, blood pressure monitor, vaccinations, healthy heart support and hearing care service.

Commenting on the store opening, Store Manager David Boyce said: “We are delighted to open the doors to our new Boots Ireland store in Knocknacarra. The new store will provide local residents with access to our wide range of pharmacy, health and beauty products and services. Our new store has created 16 new jobs in the locality and both myself and the team are looking forward to welcoming customers over the coming days.”

Paddy O’Connor of Sigma Retail Partners, the asset managers for Gateway Shopping Park, said “we are absolutely delighted with the opening of Boots in our shopping park and feel they are a great addition to the existing line-up of retailers. Boots and the new Phase 2 tenants will solidify Gateway Shopping Park as a leading retail destination in the Knocknacarra and wider Galway catchment”.

The new Phase 2 extension is the first provision of new retail space outside of Dublin since 2008 and the first in Galway in more than two decades. The development provided over 150 jobs during construction phase and is expected to create over 300 jobs in Knocknacarra and Galway when fully occupied.

The Phase 2 extension will have open-use retail units, food and beverage units, a creche and a gym. Harvey Norman is also scheduled to open a new flagship 60,000 sq.ft store in July. Gateway Shopping Park will include over 320,000 sq. ft of retail and leisure space and will make it one of Ireland largest shopping destinations.

Gateway Shopping Park already has an impressive line-up of retailers, including Dunnes Stores, B&Q, New Look, Next and McSharry Pharmacy.

More exciting retailers will be announced in the coming weeks.

Since the introduction of the Local Government Reform Act 2014, Local Authorities have been given autonomy to vary the level of rates relief granted to owners of vacant properties. As a result, the level of refunds on commercial rates available to Landlords of vacant properties varies significantly between Local Authorities. In Dublin City Council for example the owner of a vacant property is responsible for 75% of the annual rates bill (with 25% relief granted by DCC) where a property remains vacant and unlet.

| Local Authority | Vacancy Relief 2020 |

| Dublin City Council | 25% |

| Dun Laoghaire Rathdown County Council | 35% |

| Fingal County Council | 50% |

| South Dublin County Council | 50% |

These levels of vacancy relief will come under increased scrutiny later in the year as Council’s prepare Budgets for 2021 and beyond. Owners of unoccupied properties should carefully consider options on how to mitigate against increased vacancy voids.

Hambleden House

19-26 Pembroke Street Lower

Dublin 2

D02 WV96

Ireland

»Map

Phone: +353 (1) 6477900

Fax: +353 (1) 6477901

Email: info@bannon.ie

| Title | Price | Status | Type | Area | Purpose | Bedrooms | Bathrooms |

|---|