Address

Hambleden House

19-26 Pembroke Street Lower

Dublin 2

D02 WV96

Ireland

»Map

Contact Us

Phone: +353 (1) 6477900

Fax: +353 (1) 6477901

Email: info@bannon.ie

Bannon is delighted to announce that it has entered into a partnership with Site Passport to establish the Bannon Verified Supplier platform. Site Passport transforms the way companies access, evaluate, monitor and analyse their supply chain. They do this by providing smarter, integrated and automated solutions that deliver increased competitiveness, enhanced reputation and reduced risk.

The Bannon Verified Supplier platform is a bespoke online resource designed in conjunction with Site Passport to ensure that all contractors working on Bannon managed sites meet the highest levels of standards. In order to qualify as a Bannon Verified Supplier, our partners must meet the following minimum criteria:

To date we have verified over 80 contractors through the process. The verifying process ensures that only the most proactive and efficient contractors are engaged on Bannon managed sites. We insist that all our contractors are committed to meeting sustainability and environmental goals in line with our company ethos. All contractors must demonstrate that they have a proactive sustainability policy that is being adhered to and actively monitored We also encourage contractors to use the most efficient and environmentally friendly products available to the market.

As market leaders, Bannon manages over 75 commercial assets including Shopping Centres, Retail Parks and Offices with a combined footfall of over 100 million visitors per annum. Therefore, we put a premium on ensuring that all contractors who work on Bannon managed sites are industry leaders who like us, strive to meet the highest of standards. This is imperative to our role as managing agents. Bannon is committed to ensuring that all assets under our management are safe, clean and a welcoming environment for all users. This is achieved by partnering with contractors who share our values and are committed to our best-in-class approach. The Bannon Verified Supplier platform is another tool to help Bannon achieve this.

Author: William Lambe, Divisional Director, Bannon

Date: 1st April 2022

Major reform of the Leaving Cert is being planned from 2024 onwards which will include spreading project work and exams over fifth and sixth year.

The move aims to reduce student stress levels around the traditional written exams and introduce teacher-based assessment for projects and other course components.

Minister for Education Norma Foley is keen to proceed with reforms which would see students entering senior cycle in September 2023 sitting Paper One in English and Irish at the end of fifth year.

Over several years, 60 per cent of marks for all Leaving Cert subjects will be based on written exams and 40 per cent on additional assessment components such as project work, orals or practicals.

Teacher-based assessment of these additional components will be externally moderated by the State Examinations Commission.

The announcement on Tuesday follows a four-year review of the senior cycle by the National Council for Curriculum and Assessment (NCCA), based on consultations with students, teachers, parents and industry.

The review found while there was broad agreement exams should remain, it proposed giving greater weight to continual assessment, projects or other course components over a two- or three-year period.

On foot of Tuesday’s announcement, a selection of schools will shortly be invited to become pilot schools and participate at an early stage in revised curriculum and assessment arrangements.

Among the changes announced are:

* The introduction of two new subjects – drama, film and theatre studies; and climate action and sustainable development – which will be ready for students in pilot schools starting fifth year in 2024;

* An initial tranche of new and revised subjects will be available in pilot schools from September 2024, when students entering fifth year will study updated subject curricula, with updated assessment models in chemistry, physics, biology and business;

* Future oral exams and the music practical performance will take place during the first week of the Easter break of sixth year, as is the case this year;

* Leaving Certificate Applied (LCA) students will have improved access to maths and foreign languages from September 2022;

* A new qualification will be introduced at level one and two on the National Qualification framework to provide an appropriate level of assessment to some students with special educational needs, building on the equivalent programme at Junior Cycle level;

* Access for all students to a revised transition year programme will be encouraged.

Under Ms Foley’s plans, the NCCA and the State Examinations Commission will develop, in consultation with education partners, how an externally moderated, school-based form of assessment would operate.

However, teachers’ unions on Tuesday moved quickly to voice their opposition to any plan that involves members assessing their own students.

Teachers’ Union of Ireland (TUI) general secretary Michael Gillespie said: “Our members are fundamentally opposed to assessing their own students for State certificate purposes and therefore external assessment and State certification – which retain significant public trust – are essential for all written examinations and all additional components of assessment.”

Association of Secondary Teachers’ Ireland (ASTI) president Eamon Dennehy said certification in State exams must be “entirely externally assessed”.

“This must be retained in all aspects of the development of the Leaving Cert. It is vital that the integrity of the state exams system is maintained,” he said.

Ms Foley said the redeveloped senior cycle aims to deliver “equity and excellence for all”.

“This programme is timely and ambitious – we must not rush, but cannot delay. The timing I have set out will ensure that students will feel the benefits at the earliest possible time, with notice of these in advance.”

She said the reforms will reduce the pressure on students that comes from final assessments based primarily on exams.

“We will move to a model that uses other forms of assessment, over a less concentrated time period, in line with international best practice,” she said.

Ms Foley said these changes will enable the education system to maintain its high standards.

“Our current system has many strengths. But we know that it can be improved, to better support our students, to reduce pressure while maintaining standards, to keep pace with the changes in practices internationally and to meet the needs and expectations of our students and of our society in preparing our young people for the world ahead,” she added.

Agent Bannon is guiding a price of €1.9 million for a community retail investment opportunity comprising four retail units and a standalone creche at Adamstown in west Dublin.

The units, which are below a modern residential development called the Sentinel Building, are occupied by Londis (with a guarantee from parent company BWG), Mizzoni’s Pizza and Pamper Yourself, together with one small vacant unit. The creche is operated by Giraffe Childcare. All of the units are presented in excellent condition throughout and benefit from prominent road frontage.

The annual passing rent is currently €163,375 with substantial reversionary potential. The asking price offers the prospective purchaser an attractive initial yield of 7.84 per cent, rising to a potential double-digit yield on the letting of the vacant unit and the settlement of the outstanding Londis and creche rent reviews. The properties extend to a total floor area of 15,264sq ft and have a weighted average unexpired lease term (Wault) to break of 6.43 years and a Wault to lease expiry of 8.72 years.

The subject units are in the southeast of Adamstown and 750m from Adamstown train station. The surrounding area is predominantly in residential use with a mix of high- and low-density housing. Current population estimates suggest a resident population of about 5,000 and once fully complete this is projected to be 25,000 people.

Ros Tierney of Bannon expects to see “significant interest from investors seeking a high-profile grocery and necessity portfolio with value-add potential through asset management”.

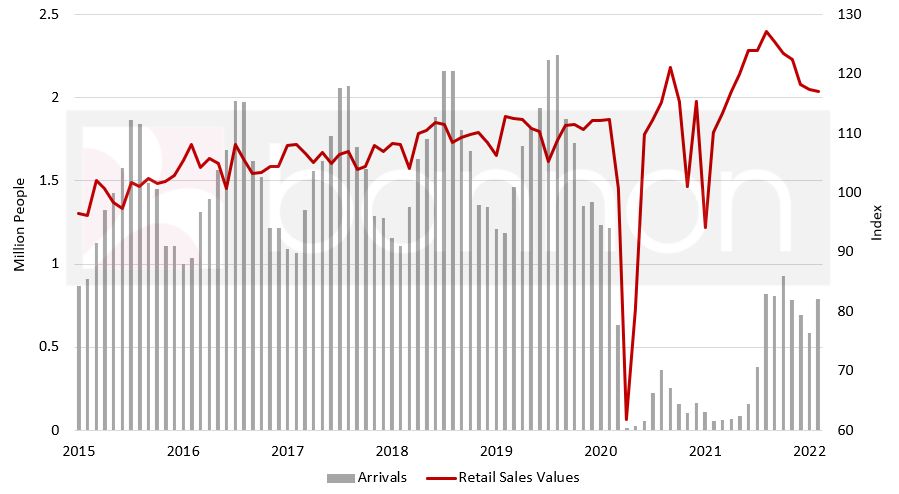

The CSO (Central Statistics Office Ireland) reported retail sales values for all business increased 4.3% on pre-pandemic levels. Taking a deeper dive this figure includes bars which remain 28.45% below 2019 data. When bars and motor trade are excluded, retail sales values have jumped 11.6% when compared to 2019 and 2020.

This positive performance is despite the level of overseas travelers to Ireland remaining 35% below 2019 and 2020 figures. The full return of tourists to Ireland will spell further good news for the retail sector.

Despite the negative narrative in the press recently the Retail Sales figures released by the CSO paint a very positive picture of the sector. Overall the value of retail sales (excluding cars & bars) were up 11.6% on February 2019. The only red figures on the index are bars, department stores and books, all other 19 indicators are positive versus February ’19 & ’20. The real stand out number is Clothing & Footwear which was almost 1/3 higher than in February 2019.

Despite the negative narrative in the press recently the Retail Sales figures released by the CSO paint a very positive picture of the sector. Overall the value of retail sales (excluding cars & bars) were up 11.6% on February 2019. The only red figures on the index are bars, department stores and books, all other 19 indicators are positive versus February ’19 & ’20. The real stand out number is Clothing & Footwear which was almost 1/3 higher than in February 2019.

These figures do not reflect the downturn in Consumer Sentiment that has been recorded since the war in Ukraine hit the headlines and in the past the Irish Consumer has proven very sensitive to macro economic events as evidenced in the Summer of 2016 after the Brexit vote. It will be interesting to see how the CSO data is portrayed in the press.

We have pleasure in enclosing The Bannon Retail Pulse Report for March 2022. March witnessed further improvement in footfall trends, reflecting the lifting of restrictions earlier in the year. This will improve further as we can now look forward to an increase in tourist numbers in the months ahead. Transactional activity was extremely busy in Q1 and will continue into Q2.

We have pleasure in enclosing The Bannon Retail Pulse Report for March 2022. March witnessed further improvement in footfall trends, reflecting the lifting of restrictions earlier in the year. This will improve further as we can now look forward to an increase in tourist numbers in the months ahead. Transactional activity was extremely busy in Q1 and will continue into Q2.

For retail enquiries and intelligence, please contact any of the team.

To view the full report, please click here.

A big welcome to this year’s interns from everyone at Bannon (including our office dog – Lily).

Mark Hayden, Stephen Keegan, Alison O’Gorman, Brian Morton, Dwane Martin.

Premium fashion group Flannels has signed a deal for its second Dublin store.

Having committed earlier this year to occupy half the retail space at the Clerys Quarter on O’Connell Street, the luxury retailer is to open for business at the Blanchardstown Centre.

Flannels, which is part of Mike Ashley’s Frasers Group, will occupy the ground floor of the former Debenhams unit. At 45,000sq ft, the space will be the larger of the two outlets committed to by the retailer in the Irish market to date. Flannels’ premises at the redeveloped Clerys store will extend to 30,000sq ft.

Commenting on the opening of the latest store, a spokesperson for Frasers Group said: “We’re excited to open Flannels in Blanchardstown and bring a world-class shopping experience to a new destination. Our ambitious expansion plans mark a pivotal moment for the business, and we’re pleased to be opening in Blanchardstown as part of our next cohort of store openings in Ireland.”

Pat Nash, managing director at the west Dublin retail scheme’s asset manager Falcon AM, added: “Flannels’ commitment to a new lease in Blanchardstown Centre is a huge endorsement of the scheme and follows the completion of a major €17 million mall refurbishment. This is in line with our ongoing strategy to strengthen and reposition the asset . We are excited to be welcoming new retailers to the centre and indeed the Irish market during these unpredictable times.”

Falcon AM made the decision to split the Debenhams’ unit, which comprises more than 100,000sq ft in its entirety, to meet with current retailer demand according to the firm’s leasing director, Sharon Walsh. Ms Walsh said that a further announcement will be made in relation to the upper level of Debenhams’ former premises in the coming weeks.

BNP Paribas Real Estate and Bannon are the joint leasing agents for the Blanchardstown Centre.

No sun (glasses obligatory) but plenty of business to be done at this years MIPIM 2022 for the Bannon team…. Call if you’re around and would like a “coffee”.

Great to get back to MIPIM 2022 (15-18th March) for Neil Bannon and Roderick Nowlan.

Please feel free to get in touch if you would like to arrange a meeting.

Best of luck to the Square management team, security, facilities and all the store staff with the “Cycle for Ukraine” fundraiser. The fundraiser will run today and tomorrow in the Centre Mall, from 11.00am – 6.00pm.

All funds raised will go to the Irish Red Cross to help those affected get food, medicine, shelter and water. Donations will also help those displaced by the conflict.

Cash donations are welcome, however if you cannot make it in person, you can donate online here or by scanning the QR Code in the image attached.

Happy International Women’s Day.

To mark the day and The Square’s Club Together initiative, please watch the video below that celebrates amazing “Strong Women” in the local community.

Tallaght is blessed to have so many influential role models in the community. Their amazing achievements inspire the younger generations and help create a thriving society where equality duly prevails.

We are very fortunate to work with some amazing women in Bannon and across our wider portfolio. Thank you for all your help and support.

Urban Transportation Hubs. A snazzy name for a car park or a way of rethinking how we move about our cities and towns?

There is an opportunity to reimagine the role of car parks. Giving over space within the facilities to accommodate secure bike parking, charging stations for electric bikes and scooters, dedicated spaces for car share schemes and a range of EV charging options for those that need rapid charging, to the owner who just needs a slow charge overnight can turn these buildings into true transport hubs.

They can form a central part of a transport interchange where customers pivot from one form of transport to another pre-booking their required option on a dedicated app. Arrive on your bike, park it securely for the day and take out pre-booked EV charge appropriately to make a trip to Galway. Arrive on a shared scooter and rent out an electric bike.

Reusing and refocussing existing infrastructure intelligently is ultimately the key to sustainability, why not start with car parks?

Blog post written by Cillian O’Reilly, our Sustainability Manager. You can contact Cillian by email on coreilly@bannon.ie

The strength of the Irish Consumer was further emphasised this week with the CSO reporting a 2.0% annual increase in weekly earnings to €864.51 for Q4 2021. When compared to pre-pandemic levels this increase jumps to 9.9%.

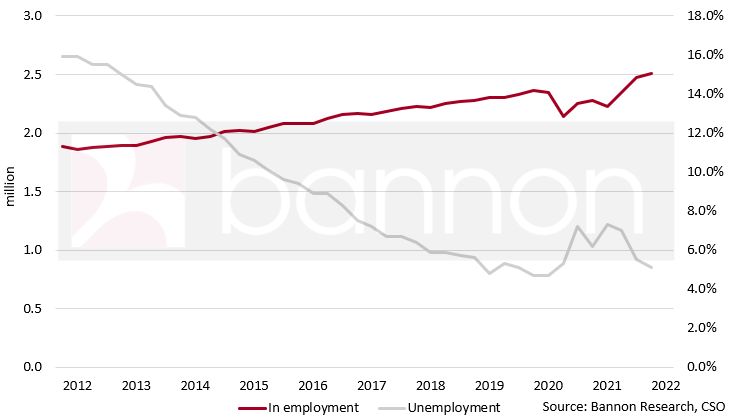

The CSO Labour Force Survey also reported a year-on-year increase in the Labour Force (8.9%) along with a decrease in unemployment to 5.3% which resulted in record employment of 2.5 million people.

The result of these two factors can only be positive for the Irish retail market.

Author: Cillian O’Reilly, Surveyor, Sustainability Manager, Bannon

Date: 2nd March 2022

It is fascinating how the Irish media can find the negative in any piece of data. Today’s Irish Times has a headline proclaiming that retail sales are down 1.5%, a downbeat message that seems at odd with the economy at large and our own data. The comparison is between retail sales in January and December. In reality there are very few years when retail sales in January reach 98.5% of those achieved in December given when Christmas falls!

Not worthy of inclusion in the article is that retail sales excl. cars in January were 7% higher than in in pre COVID January 2020! They are 17% higher than January last year but the comparison with COVID impact periods would be as misleading as the IT article. It shows the benefits for investors of real data and expert analysis and the negative narrative does create opportunities for the well informed astute investor. For more information contact Consultancy@bannon.ie

Author: Neil Bannon, Executive Chairman, Bannon

Date: 2nd March 2022

Bannon are delighted to bring you our February Retail Pulse. As we look towards a complete removal of COVID restrictions on Monday next what does our latest report tell us about how the market is likely to perform over the coming months?

To view the full report, please click here.

Thank you to everyone who has supported us in our 100 Miles in a Month fundraiser for The Mater Foundation. It’s been a tough challenge but even storm Eunice couldn’t stop our team and with only one week left to go, we can all agree that it has been an incredible experience so far.

There is still time to donate, which would be hugely appreciated.

To support us, click here.

Bannon is seeking a Senior Property Manager/ Associate Director – Property Management Department, Associate Director – Investment Department and Agency Surveyor – Retail Department based in Dublin’s City Centre.

Bannon is seeking a Senior Property Manager/ Associate Director – Property Management Department, Associate Director – Investment Department and Agency Surveyor – Retail Department based in Dublin’s City Centre.

Check out all the positions here.

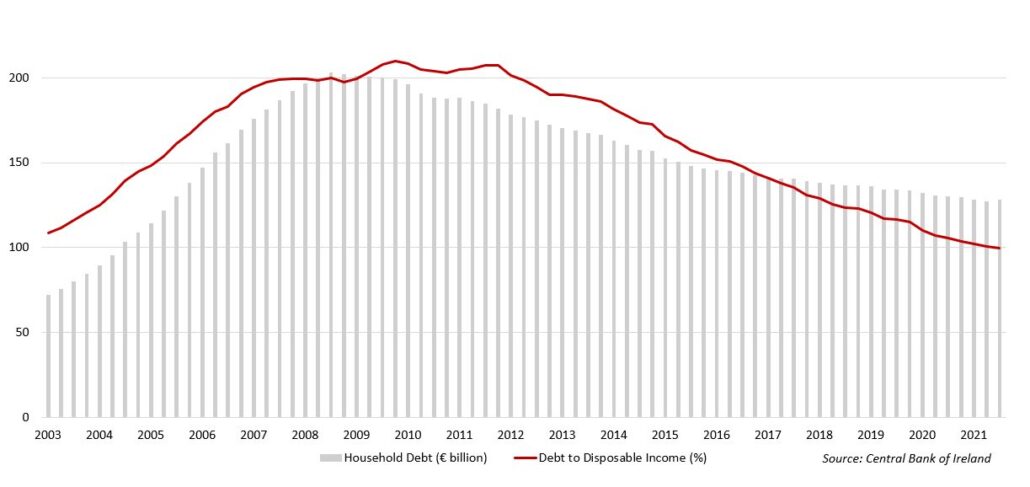

The strength and resilience of the Irish consumer has shone through once again in the Central Bank of Ireland’s Quarterly Financial Accounts. The accounts show household net worth rose by 9% in the year to Q3 2021 and now equates to €188,457 per capita. In the same period household debt dropped by 2%. As a result, Ireland’s household debt has fallen to 99.7% of disposable income, down from 106% one year ago and below 100% for the first time since the series began in 2002. Ireland’s household debt to disposable income ratio is now the seventh highest across the euro area.

There is a word in the Irish language which describes a storyteller. It is “seanchaí”. The author, Frank Rose, has explored storytelling and its effect on human behaviour and decision making in his recently released book “The Sea We Swim In” published by Random House. One of the themes of his book is the role of storytelling in the marketing of products. Telling the story of a product’s journey rather than simply including it in a catalogue, results in increased sales.

This theory is based on the belief that consumers make a purchasing choice based on available product information. When invested in the product’s origin story and journey, they are persuaded to purchase in greater quantities and at a higher price point. Through our retail clients, we see increasing consumer queries regarding the provenance of the goods they are buying and the story of the journey the products have taken to arrive on our shelves.

In recent LinkedIn articles we have provided updates on the great number of retail occupiers who are refurbishing and redesigning the space that they occupy within our centres. In these refurbishments there has been a shift towards lifestyle designs. This allows the retail space to enable and promote the story of the products. Consumers can handle and explore in-store before a potential purchase or online order.

Post lockdown, we have worked with over 20 retailers who have invested in store refits across our portfolio of 50 shopping centres and retail parks. In our recent Retail Pulse Jan 22 / Q4 2021, sales in shopping centres for December 2021 was 6% above the same period in 2019. This shows that there is an increased amount of business available to support this investment in stores.

Consumer behaviour regarding the story, provenance and origin of retail products is also matched by investors’ Environmental Social and Governance (ESG) requirements regarding their property portfolio. In future updates we will highlight case studies on how our current retail stock is being refurbished and redesigned to include sustainability and environmental factors. This may in turn be an opportunity to evolve and harness the consumer movement towards a more immersive retail story telling retail journey.

For now, we at Bannon will continue to be the seanchaí for the Retail Sector in Ireland!

Author: Peter Nicklin, Property Management Surveyor, Bannon

Date: 14th February 2022

LEGO is to open its first ever store in Ireland with the new store set to open in Dublin’s Grafton Street this summer.

The new Dublin LEGO store will feature the “Retailtainment” concept which blends physical and digital experiences that allow shoppers to immerse themselves in the LEGO brick, as well as create personalised products.

About 10 to 15 jobs will be created when the new store opens.

Simone Sweeney, Vice President of Global LEGO Retail Development, said the company had been looking for the perfect site in Dublin, so it was very excited when the opportunity came about to open on Grafton Street.

“The new LEGO Store will be amongst some of the biggest and best brands in Dublin, in a shopping district loved by many local families and visitors alike,” Ms Sweeney said.

She said that Dublin has been part of LEGO Retail’s expansion strategy for many years given the existing huge number of LEGO Fans in Ireland and the international customers typically found in the city.

“The new LEGO Store in Dublin will allow builders of all ages to be inspired by endless play possibilities and for new builders to welcome them into a new exciting journey of discovery into the LEGO universe,” she added.

The new LEGO store will be housed at number 41 Grafton Street – the former Topman store – in a building which is owned by Irish Life Investment Managers.

The deal was negotiated on behalf of Irish Life Investment Managers by Savills Ireland and Bannon.

The LEGO Group was founded in Denmark in 1932 by Ole Kirk Kristiansen and its name derived from the two Danish words LEg GOdt, which mean “Play Well”.

Today, the LEGO Group remains a family-owned company headquartered in Billund in Denmark and its products are now sold in more than 140 countries worldwide.

The planning system in Ireland is currently undergoing a raft of proposed changes with more changes likely to come in the coming years as the Government seeks to implement its ‘Housing for All’ strategy. While these changes will seek to address the constraints being experienced by the planning system, and which in turn impacts on housing output, new Development Plans being put forward by some Local Authorities are likely to have a detrimental impact on housing delivery.

The recently published Draft Dublin City Development Plan 2022-2028 proposes significant changes to lands which are zoned ‘Z15 – Institutional and Community’. Lands with this use designation typically relate to properties such as colleges, residential institutions, and healthcare facilities such as hospitals. Within the previous Development Plan, residential uses were open for consideration on Z15 lands subject to certain criteria such as the provision of 25% public open space and the preparation of an overall masterplan.

However residential uses will no longer be open for consideration under the new Draft Plan and will only be considered in “highly exceptional circumstances”. It is estimated that there are some 1,833 acres within the Dublin City Council administrative area with a Z15 land use zoning. While a large proportion comprise schools and educational facilities there is a significant portion occupied by religious institutions and bodies. With the decline in vocations over the past number of decades and the ageing profile of the members of most religious orders, a number of them have taken the decision to rationalise their property footprints and release their lands for residential development. This trend is likely to continue over the coming years. High profile examples of residential developments on Z15 lands include Marinella in Rathgar, Ardilaun Court in Raheny, Hampton and Grace Park Wood both in Drumcondra.

If Local Authorities are serious about delivering on the Government’s ‘Housing for All’ plan then all potential options for the delivery of housing should be maintained, including on Z15 lands, particularly when this zoning has successfully delivered quality housing projects in the past.

Submissions on the Draft Development Plan are being invited on or before next Monday, 14th February 2022.

Author: Niall Brereton, Director of Professional Services, Bannon

Date: 8th February 2022

Ireland’s largest, domestically owned commercial property consultancy firm Bannon, has been appointed by Davy Real Estate to manage Stephens Green Shopping Centre. Located in the most prestigious and cultural area of Dublin city centre, the shopping centre comprises over 320,000 sq. ft. of lettable retail floor area.

Bannon manages over 50 retail shopping centres and retail parks across the country, covering six million sq. ft. of commercial real estate worth c. €2 billion. As market leaders, Bannon has advised and managed the country’s most notable retail spaces in the last thirty years such as Dundrum Town Centre, Blanchardstown S.C., Swords Pavilions. and The Square. Commenting on the appointment, Director of the Bannon Property Management team, Ray Geraghty said “We are extremely proud to be working with Davy Real Estate on Ireland’s most iconic retail destination and the first premium shopping centre built in the country. The appointment is further validation of the team’s unrivalled experience managing assets in the retail sector.”

Since the start of 2022, Bannon are responsible for the management of the shopping centre which includes over 100 retail outlets. As the retail sector emerges from the effects of COVID-19 lockdowns, Bannon’s management role will involve the smooth day-to-day running of the busy centre and ensuring rent and service charge collection is maximised for Davy Real Estate.

Ray Geraghty continued “Our experience is supported by a strong cross departmental approach in Bannon. The Property Management team work seamlessly with the Consultancy, Agency and Professional Services arms of the business. This results in a consistent line of communication to our clients. We are excited to get to know the occupiers of Stephens Green Shopping Centre, and working closer with them, centre management and the investors to make the centre stronger, more profitable and more sustainable.”

Achieving progress in the move to greater sustainability in any organisation requires fundamental changes in how we manage and direct our businesses. This requires the buy in of all the stakeholders, the internal team, our clients and our suppliers. Our experience with change management is that it is only truly successful if you change culture.

That’s why, when Bannon started on its sustainability journey a number of years ago, we stopped using plastic bottled water and switched to chilled tap water, provided keep cups for the team’s caffeine obsession and started using electric scooters, thankfully now legal, and Dublin City Council bikes to get to local meetings.

Simple changes like this accompanied the more significant changes such as moving our entire Property Management portfolio to renewable energy sources. Making the big moves required for a sustainable future is easier to achieve when the simple changes are clear and evident.

Blog post written by Cillian O’Reilly, our Sustainability Manager. You can contact Cillian by email on coreilly@bannon.ie

In our latest Dublin Office Market Review and outlook, we examine activity in the sector over the last 12 months and look at some key predictions for 2022.

To read the full report, click here.

Snap Fitness has opened its doors in Waterford Retail Park today and, similar to all Snap Fitness gyms around the world, the new Waterford gym will open 24/7 around the clock and will have a list of comprehensive cardio and strength-training equipment that are the highest in industry standards.

Snap Fitness has opened its doors in Waterford Retail Park today and, similar to all Snap Fitness gyms around the world, the new Waterford gym will open 24/7 around the clock and will have a list of comprehensive cardio and strength-training equipment that are the highest in industry standards.

Snap Fitness has a global network with more than 1,000 centres worldwide in over 20 countries, including Ireland, United Kingdom, the United States, Australia, Canada and Hong Kong. Founded in 2003, Snap Fitness allows people to work out at a time and in a way that works best for them whether it is doing cardio, lifting weights, personal training or group fitness. They also use the latest fitness technology to elevate the experience, from the equipment in the gym to tracking via Myzone and the new Snap App.

Paddy O’Connor from Sigma Retail Partners, the asset manager for Waterford Retail Park, said “Snap Fitness is especially exciting for us as it is a unique offering to Waterford Retail Park and we are very happy that they are joining our strong tenant line-up. As part of our long-term strategy, we identified health and fitness as a category that would be very beneficial for the retail park. We are very pleased with the arrival of Snap Fitness and I am sure they will do very well.”

Waterford Retail Park is easily accessed from Waterford City and is less than 10 minutes’ drive away. The retail park is located along one of the main access routes to Waterford City from the M8 and N25 (Cork Road) and benefits from free customer parking. It is also located close to the Waterford Greenway and the new Costa Coffee store will be a great pit-stop for visitors heading to and from the Greenway.

We are delighted to launch our new look Retail Pulse.

2021 had a challenging start for the majority of occupiers and investors as uncertainty on the back of Covid continued to take a hold on the sector. As the year progressed however retail sales improved across most of the sub-sectors which contributed to occupancy rates remaining high. We remain very confident for 2022.

Keep an eye out for our monthly bullets as we track movement and give our insight into the retail sector.

To view the full report, please click here.

We at Bannon are delighted to be taking part in The Mater Foundation 100-mile challenge. The aim is to walk/run/jog 100 miles in the month of February and help raise money for the Mater Public Hospital which provides national, specialist care for cancer, heart disease, transplants, spinal injuries, major physical trauma and infectious diseases.

It would be greatly appreciated if you could support our efforts by making a contribution, big or small, to help change patients lives for the better.

To donate, click here.

Despite month on month reductions, recently released CSO Retail Sales Index figures for December 2021 report a 3.6% increase in sales values and 2.2% reduction in sales volumes when compared to 12 months prior however these figures do not paint the full picture. When motor trades and bars are excluded, these figures rise to increases of 5.4% and 0.4% respectively. The true strength of the retail sector shows through when the data is compared to pre-pandemic levels which shows a 10.2% increase in sales values and 11.4% increase in sales values compared to December 2019.

Taking a deeper dive into the data it is evident the traditional festive rush was more subdued in December 2021 with a stronger November trade showing evidence of consumers forward planning.

Top performing sectors for December 2021 were bars following their recent reopening (value increase 39.8%, volume increase 36.5%) and pharmaceutical, medical and cosmetic articles (value increase 11.1%, volume increase 9.9%).

Bannon were delighted to act on behalf of client, Belgard Estates Ltd (a subsidiary of CRH plc), in the sale of their lands at Slane Road. It is a substantial landholding on the outskirts of Drogheda which extends to a gross area of approximately 18.6 ha (45.6 acres).

The entire site is zoned ‘Mixed Use’ in the Louth County Development Plan 2021-2027 and presents an excellent opportunity to advance a mixed-use scheme with residential and commercial uses, subject to planning permission. M1 Retail Park, which is occupied by Woodies, Smyths, Sports Direct and Dealz is situated less than 500 metres to the north-west. Drogheda is earmarked to further expand on its status as the largest town in Ireland with a target population of 50,000 by 2031. The town has been designated a self-sustaining employment centre on the Dublin-Belfast (M1) Economic Corridor.

The property garnered significant interest from a range of parties. Following a tender process, a local property speculator secured the property. The guide price was €3.75m.

Every rent review has its own peculiarities. It is essential to take account of such items as the hypothetical term, break clauses, headline rent versus net effective rent and the specification of the premises to be reviewed. It is also important to ascertain if any occupier improvements have been carried out and whether these are to be disregarded for rent review purposes.

Des Byrne, Director at Bannon, has over 30 years’ experience in rent reviews on all types of commercial property and is an experienced Arbitrator. Des answers some key questions about rent reviews.

1. What types of rent review exist?

2. Is the rent to be calculated by reference to the Consumer Price Index where the CPI is tracked?-

3. How would my Rent Review be instigated?

Leases may provide that the rent review may be agreed between the parties at any time, it may require that it be triggered by a rent review notice which may be issued by the owner or by either party.

4. How is my rent calculated?

The rent will be calculated by reference to the provisions of the rent review clause, taking into consideration certain assumptions and disregards.

5. Can I agree my rent by negotiation?

Yes, this is the normal practice and in the event of negotiations proving inconclusive. However if negotiation fails to result in agreement, there would normally be provision that the matter may be referred to an Arbitrator or to an Independent Expert.

6. What is involved in Third Party Adjudication (Arbitration / Independent Expert)? How is an Arbitrator or independent expert appointed?

The lease would normally advise as to how the third-party valuer may be appointed. There may be provision where the Arbitrator/Independent Expert can be agreed between the parties.

Failing agreement, there may be provision that the matter can be referred to an appointing body such as the Society of Chartered Surveyors Ireland or the Law Society for such an appointment. Once an appointment is made, the Arbitrator or Independent Expert will write to both sides indicating how the matter may proceed. It may proceed either by way of an Oral Hearing or by written documents i.e., the forwarding of Submissions and Counter-Submissions.

Each side will have to prove their case at Arbitration and offer their true opinion of rental value and they will attempt to prove this rental value by a reference to comparative transactions.

The parties themselves may agree in advance of the Arbitration as to how the costs can be split (perhaps each side agreeing to pay their own costs and half of the Arbitrators costs). When this is not possible the Arbitrator has power under the Arbitration Act to determine costs.

A party who wishes to limit their exposure to costs may decide to serve a Calderbank Offer on the other side which may have the effect of limiting their exposure to costs. A Calderbank Offer is an offer to settle the rent review at a particular figure without prejudice save as to costs.

7. Is it possible to Regear my Lease?

Sometimes this is possible particularly where occupiers have the benefit of break clauses or when a lease is due to expire within a short period of time.

In such circumstances, it may be possible to agree a lower rent in recognition of an occupier agreeing to forfeit their break option or agreeing to extend the lease by a particular period.

8. Other Considerations?

Particularly in relation to office rent reviews, it is important to determine the category of office with which one is dealing i.e., is it Grade A space or of a different quality. The specification of the building is also important particularly in relation to fitting out, mechanical systems and floor to ceiling heights.

In the current economic climate, comparisons may be viewed upon as pre-pandemic, during pandemic and post pandemic if we reach that point.

Retail rent reviews are tending to become contentious with the occupiers seeking lower rents in city centre locations affected by the pandemic. On the other hand owners are seeking higher rents in suburban shopping centres which are beginning to be rediscovered by employees who are now working on an agile basis.

For further information, contact Des Byrne, Director in the Professional Services and Valuation Team at Bannon (Email: dbyrne@bannon.ie).

Pan European investor and asset manager M7 Real Estate has paid just under €15 million for two office blocks in south Dublin.

Developed in the late 1980s as part of the wider Merrion Shopping Centre scheme, the Nutley and AIG buildings comprise an overall floor area of 4,016sq m (43,235sq ft) along with 83 undercroft car parking spaces. The subject property is currently generating total rental income of €1,439,932 a year.

The Nutley Building is let to a number of occupiers including Bonkers Money, the Japanese Embassy, the Austrian Embassy and Global Standards while the AIG Building is let to a single tenant with a number of sub leases in place.

While The Irish Times reported that the deal for the two offices was close to being finalised in October 2020, it is understood the proposed transaction was completed only in recent weeks. Commercial real estate consultants Bannon handled the sale.

Following its latest purchase, M7’s Irish portfolio now comprises 18 assets extending to just under 1,100,000sq ft, primarily in industrial and logistics space.

In October 2020, the company paid about €13.5 million for the long leasehold interest of five fully let units at the Sandyford Business Centre in south Dublin.

The purchase of the portfolio gave it control of five of the scheme’s 10 units along with an associated provision of 200 car parking spaces. The portfolio’s office accommodation covers a combined area of 4,532sq m (48,786sq ft) and is producing annual rental income of €1,192,578 with a weighted average unexpired lease term of 5.8 years, with breaks at 4.6 years.

In August 2020, the company paid €6.25 million for the former Kildare headquarter office and distribution facility of convenience store operator ADM Londis, while in January 2020 it acquired the Primeside Park industrial estate in Dublin for €6.75 million.

The group also controls the Century Business Park in Finglas, which it acquired for €4.47 million in September 2019, and the Westlink industrial estate in Dublin 10, which it bought for €13,870,000 in 2018.

Its first investment here came in 2017 when it bought Fumbally Lane, a combined office and residential development in Dublin 8 which was on the market for €24 million. M7 sold Fumbally Lane to BCP Asset Management in 2018 for €33.5 million, following the completion of a comprehensive asset management programme which enabled the property’s vacancy rate to plummet from 17 per cent to 2 per cent through the addition of 19 new tenants, and its annual rental income grow by €1.14 million.

M7 operates across 14 countries. It manages a portfolio of about 835 retail, office and industrial assets with a value of about €5.1 billion.

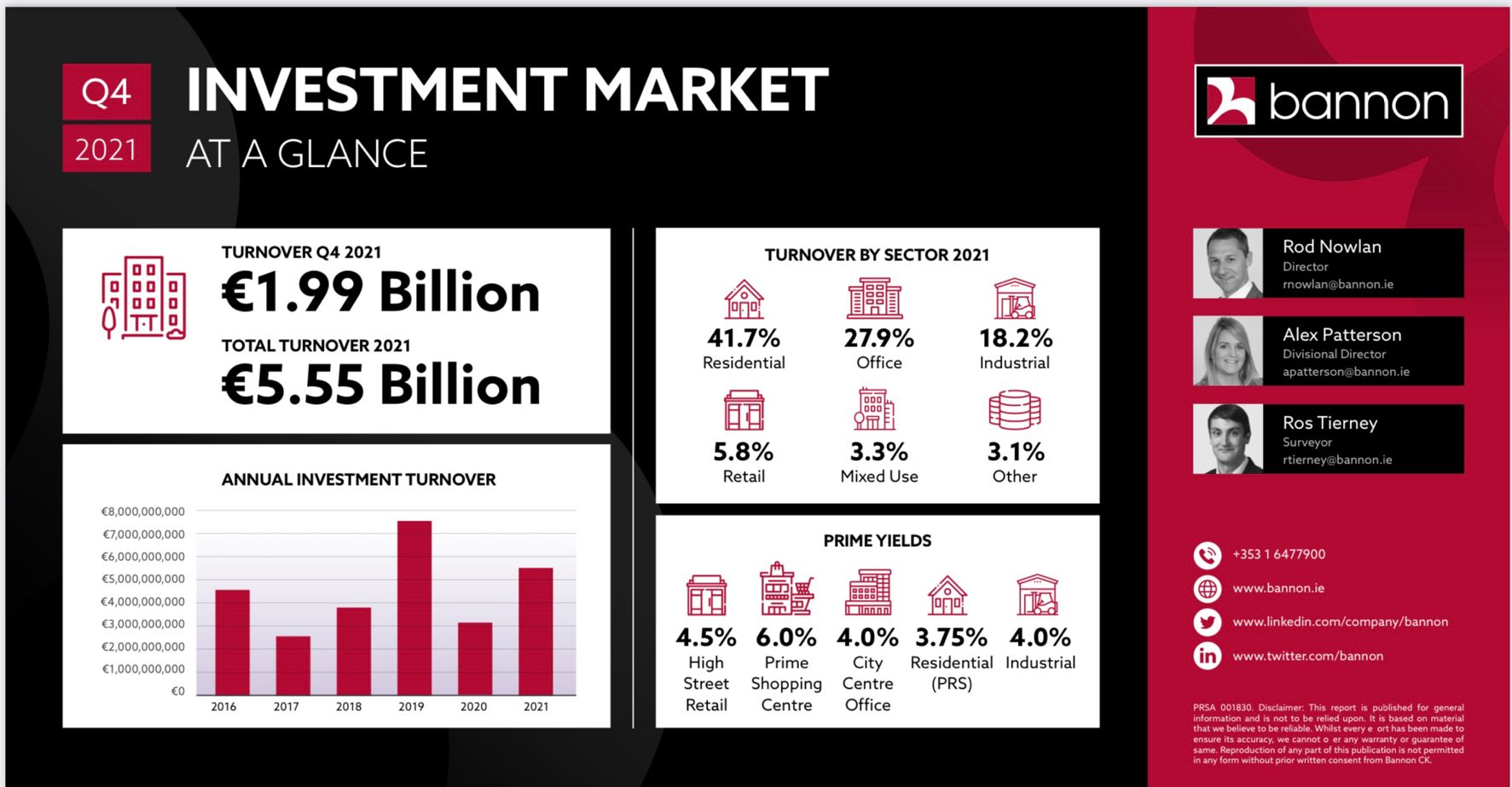

Take up for 2021 exceeded 1,700,000 sq.ft. There was a notable increase in market activity from H2, with Q4 attributing over 1,000,000 sq.ft. to the final years take up figure. This was largely boosted by 2 transactions in excess of 200,000 sq.ft. (representing 29% of total take up).

We are off to a strong start for 2022 with over 800,000 sq.ft. of accommodation currently reserved.

The Bannon snapshot shows an exceptional year for PRS with almost 42% of turnover (despite a weak Q4) and the wider market as a whole showing the second-highest annual turnover on record. 2022 likely to see the resurgence of retail and consolidation of sheds!

From all of us here at Bannon, we would like to wish you and your families a very happy and healthy Christmas with every success for 2022.

Since the retail sector emerged from lockdown in May 2021 we have worked with 20 retailers who have invested in store refits cross our portfolio of 31 shopping centres and 19 retail parks. Shop local this Christmas!

Revised street categorisation reflects retail shift to focus on shopper experience.

The recently published Draft Dublin City Development Plan 2022-2028 proposes changes to Dublin City Council’s approach to retail in the City Retail Core (Henry and Grafton Street environs). The revised categorisation of some streets aims to support a more diverse retail experience while preserving the role of Grafton and Henry Street at the top of the retail hierarchy.

Street categorisation involves recognising key shopping streets within the Core as suitable for specific use, protecting them as shopping destinations. The changes were informed in part by the ‘Role and Function of Retail in the Dublin City Centre’ retail study carried out by Bannon for Dublin City Council in early 2021.

Street Category Changes

Category 1 designation focuses on a predominately higher order retail user mix at street level, aiming to promote premium retail within the city centre. Under Category 1 low-order retail services are not permitted and non-retail services may be provided for, on merit, providing they do not undermine the primary retail function. The revised plan has allocated the Category 1 designation to Henry/Mary Street (O’Connell to Jervis Street) and Grafton Street only. O’Connell Street, Middle Abbey Street, Liffey Street Lower, Wicklow Street, South Anne Street, Duke Street and South King Street have all been moved from Category 1 to Category 2 streets.

Category 2 applies to streets where there is an existing mix of operators, such as retail, food and beverage, cultural and entertainment, or where there is the opportunity for increased diversity of retail character on the street. The objective is to allow for a retail mix that is complimentary to the Category 1 street while enhancing the vibrancy of the shopping experience within the City Centre.

This plan underscores Henry and Grafton Street as the City’s premier retail destinations whilst the re-categorisation shall be supportive of a more diverse and vibrant retail offer within the broader retail core. The changes will allow the City Centre to better reflect what is happening in the global retail market with a shift to Omni Channel Retailing and a greater focus on the experience that retail destinations offer rather than just the products they sell. This approach strengthens the City Retail Core’s ability to attract spend from the workers, students and tourists that have been so sorely missed.

South Anne Street (pictured) has changed from a Category 1 to a Category 2 Street. This will be supportive of the burgeoning F&B activity in the area.

George Colyer is a member of Bannon’s Consultancy Team. It provides strategic solutions for stake holders in the Property Market.

Despite the uncertainty of COVID, it is great to see such optimism across our property management portfolio with over 40 new openings since we emerged from lockdown in May 2021. Shop Local this Christmas!

We are delighted to announce the winners of the Bannon “ESG Signage” Art competition run in conjunction with Loreto Junior School Stephens Green.

Congratulations to Amy He (Power Down), Sorcha Murray (Pause before you print) & Grace Yu (Recycle) for their fantastic artwork.

A big thank you to everyone who got involved! Amazing talent from such a young group!

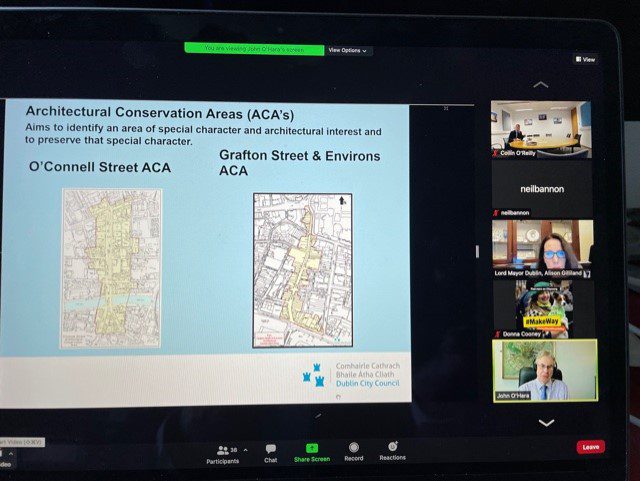

Our chairman and head of Consultancy Neil Bannon was invited to present to Dublin City Council this morning on how to tackle retail vacancy in Dublin City Centre, really positive session with great sharing of ideas & initiatives.

Bannon is pleased to have assisted Penneys in sourcing a 15.3 hectare (38 acre) site at Great Connell, Newbridge, Co. Kildare to facilitate the development of a state of the art logistics hub/distribution centre for the retailing giant.

Kildare County Council granted planning permission for the 55,277 sq m (595,000 sq ft) facility which will be accessed off the Newbridge South Orbital Relief Road. When constructed the building will serve all 36 Penneys stores across Ireland. The warehouse will feature 20 metres clear eaves height, 34 HGV dock leveller loading doors and an extensive automated goods handling system.

The area is home to several other high profile companies including Pfizer, Lidl (Regional Distribution Centre), Murphy Group and KDP Ireland (Keurig Dr. Pepper). It is also situated close to Junction 10 (Newhall) on the M7 motorway.

The site was sourced on an off-market basis following an extensive selection process. Niall Brereton who handled the transaction commented “We are delighted to have been able to acquire such an extensive and highly accessible site for Penneys. It will play a huge role to ensure the company’s continued growth as Ireland’s most popular retailer”.

CGI of Proposed Scheme (Model Works)

CGI of Proposed Scheme (Model Works)

The winner of the Bannon “ESG Signage” Art competition run in conjunction with Loreto Junior School Stephens Green being adjudicated by today.. Keep an eye out on our page as we will be announcing the winners over the next few days!

We’re delighted to see the new Regatta Great Outdoors store open in Nutgrove Shopping Centre, Dublin 14.

This was our first acquisition on behalf of our new client Regatta Ltd.

The super smart looking store, which will also incorporate Craghoppers and Dare 2b products, will serve the catchment well and the strong customer base who are embracing the outdoors even more since the arrival of Covid.

It was a great team effort to get the store open and ready for Black Friday and the run into Christmas, working with Brian Fox and the Regatta Team and Andrew Johnston.

We are continuing to look for more opportunities countrywide.

Covid-19 has flipped the performance of retail assets on their head. The previously-held view was that the prime to tertiary hierarchy was – city high street, major town centre, retail park, grocery retail and local necessity centres. However, in terms of demand and performance from the occupiers on the ground, this traditional hierarchy has now been reversed and is resulting in differentiation within a sector previously considered by many investors as a homogeneous entity.

Footfall is a very effective barometer to highlight this shift. High street has undoubtedly been the most negatively impacted retail market sector with Covid-19 decimating footfall and in-shop spend. Bannon estimates that there are almost 40 shops either vacant or available on Grafton Street and Henry/Mary Street out of a total of 162. Similarly the hospitality sector, including food and beverage, like non-essential retail, has been severely impacted during Covid-19. Despite a strong recovery city centre footfall counts for Q3 2021 were still 30 per cent below 2019 levels. According to the IPD Index year-on-year total returns within the sector are showing minus 12.5 per cent.

In stark contrast the necessity retail sector (being grocery, medical and service-related offers) as well the retail parks have proved to be exceptionally resilient through Covid and continue to perform very strongly. Car counts in many retail parks for Q2 and Q3 2021 exceeded 2019 levels with retailers reporting considerable turnover growth. Provincially convenience-focused shopping centres have remained resilient with limited vacancy as shoppers choose convenience and to shop locally. We are seeing footfall levels return by up to 90 per cent of their 2019 equivalents.

In the latter half of 2021 the ‘money’ began to follow the data into retail parks as is evidenced by the position taken by AM Alpha in Nutgove Retail Park (€66.3 million) and M&G Investments through the acquisition of the Parks Collection Portfolio (€74.5 million) and the agreed acquisition of Manor West (€56 million). We estimate retail parks transactions will represent more than two thirds of all retail transactions in 2021 and will be the only retail sector within the IPD showing positive total returns for 2021 (currently running at plus 6.3 per cent).

Supported largely by the threat of inflation, the resurgence in the retail grocery sector had already commenced pre-Covid in the UK and Europe, with long-let standalone grocery often trading at yield levels of between 4 and 5 per cent. This demand is beginning to emerge in the Irish market, with a shrinking gap between what the sector is trading at in the UK and the perceived value in Ireland. More recently we have seen a number of transactions which are at materially stronger yield levels than market expectation and these are due to sign before the end of the year.

Due to the structural limitations in scalability in the “grocery market” sector in Ireland (where most anchor stores are owner occupied) and the large delta which is developing between “pure grocery retail” and “necessity retail” (being service, health, medical and food-related occupiers) this sub-sector may come into more mainstream investment focus in 2022. The disconnect between the emerging grocery yields (5 per cent to 5.5 per cent) and those in the supporting “necessity retail” (9 to 10 per cent plus) seem irrationally high, especially as the necessity retail operator’s turnover is derived from the same customer base as their high-value grocery anchor neighbours. These centres along with retail parks serve to highlight opportunity within the sector where the negative narrative in the overall retail sector is keeping yields high despite resilient trading.

Rod Nowlan is an executive director at Bannon

It’s beginning to look a lot like Christmas here in Bannon!

![]()

Background

The Property Management team at Bannon currently manage over 70 commercial sites across Ireland. The portfolio is made up of Shopping Centres, Retail Parks, Business Parks and Office Parks.

In recent years there has been an unquestionable shift in weather patterns, and this is particularly noticeable in the colder winter months. One such example was the severe weather experienced in February 2018 when Storm Emma hit Ireland. During the course of the storm, we saw significant accumulations of snow across our sites and temperatures as low as –11.0°C.

In any given year we see c.100 million visits to Bannon managed sites across the country and maintaining safe access to these sites is a crucial part of our role as Property Managers. We manage this risk by appointing contractors to carry out gritting services during periods of cold weather and snow clearance when required.

A number of years ago we recognised the obvious synergies associated with managing our winter maintenance services on a portfolio basis. For that reason, we have split our portfolio into three distinct zones (see below) and we tender the contract every 3 years.

Zone 1 – Greater Dublin Area

Zone 2 – South & South East

Zone 3 – Midlands, West & North West

Tender

A sub-team of Property Managers were appointed to oversee the tendering of the Winter Maintenance contract for the portfolio. The following tender process occurred;

Phase 1 – Review of portfolio geography and creation of 3 distinct zones

Phase 2 – Preparation of Request for Tender (RFT) document

Phase 3 – Shortlisting of suitable contractors including a visit to contractors’ facilities

Phase 4 – Issue RFT to shortlisted parties

Phase 5 – Review & analysis of tenders

Phase 6 – Selection & contract award to winning tenderers

In total the RFT was issued to 10 contractors and we received 6 complete tender submissions. The submissions were assessed and ranked based on pre-set criteria. All but one tenderer submitted a proposal for all three zones. The sub-team assessed the proposals and made a recommendation to the directors of the department to appoint three separate contractors (one per zone). This recommendation was followed and the contracts were awarded to the following parties;

Zone 1 – Greater Dublin Area – SAP Landscapes

Zone 2 – South & South East – O’Brien Facilities

Zone 3 – Midlands, West & North West – Ken Fitzsimons Landscaping

Benefits

The benefits of carrying out a procurement process of this nature are far reaching, to include;

Overall, we have seen significant benefits in procuring our Winter Maintenance services on a portfolio wide basis. Our retail clients can enjoy consistency of service across all sites. With a proactive and data driven approach, we ensure that footfall does not drop and visitor health and safety is managed.

With works now complete, we are pleased to welcome Greenlight Reinsurance as the first occupier of #50CityQuay, the latest company to join the #WindmillQTR. With two further floors currently reserved, we have one ‘own door’ office floor available to lease (1,313sq.ft). Please contact Lucy Connolly or Ros Tierney for further information on 01 647 7900.

Hambleden House

19-26 Pembroke Street Lower

Dublin 2

D02 WV96

Ireland

»Map

Phone: +353 (1) 6477900

Fax: +353 (1) 6477901

Email: info@bannon.ie

| Title | Price | Status | Type | Area | Purpose | Bedrooms | Bathrooms |

|---|