100 Miles Mater Challenge

Thank you to everyone who has supported us in our 100 Miles in a Month fundraiser for The Mater Foundation. It’s been a tough challenge but even storm Eunice couldn’t stop our team and with only one week left to go, we can all agree that it has been an incredible experience so far.

There is still time to donate, which would be hugely appreciated.

To support us, click here.

We at Bannon are delighted to be taking part in The Mater Foundation 100-mile challenge. The aim is to walk/run/jog 100 miles in the month of February and help raise money for the Mater Public Hospital which provides national, specialist care for cancer, heart disease, transplants, spinal injuries, major physical trauma and infectious diseases.

It would be greatly appreciated if you could support our efforts by making a contribution, big or small, to help change patients lives for the better.

To donate, click here.

From all of us here at Bannon, we would like to wish you and your families a very happy and healthy Christmas with every success for 2022.

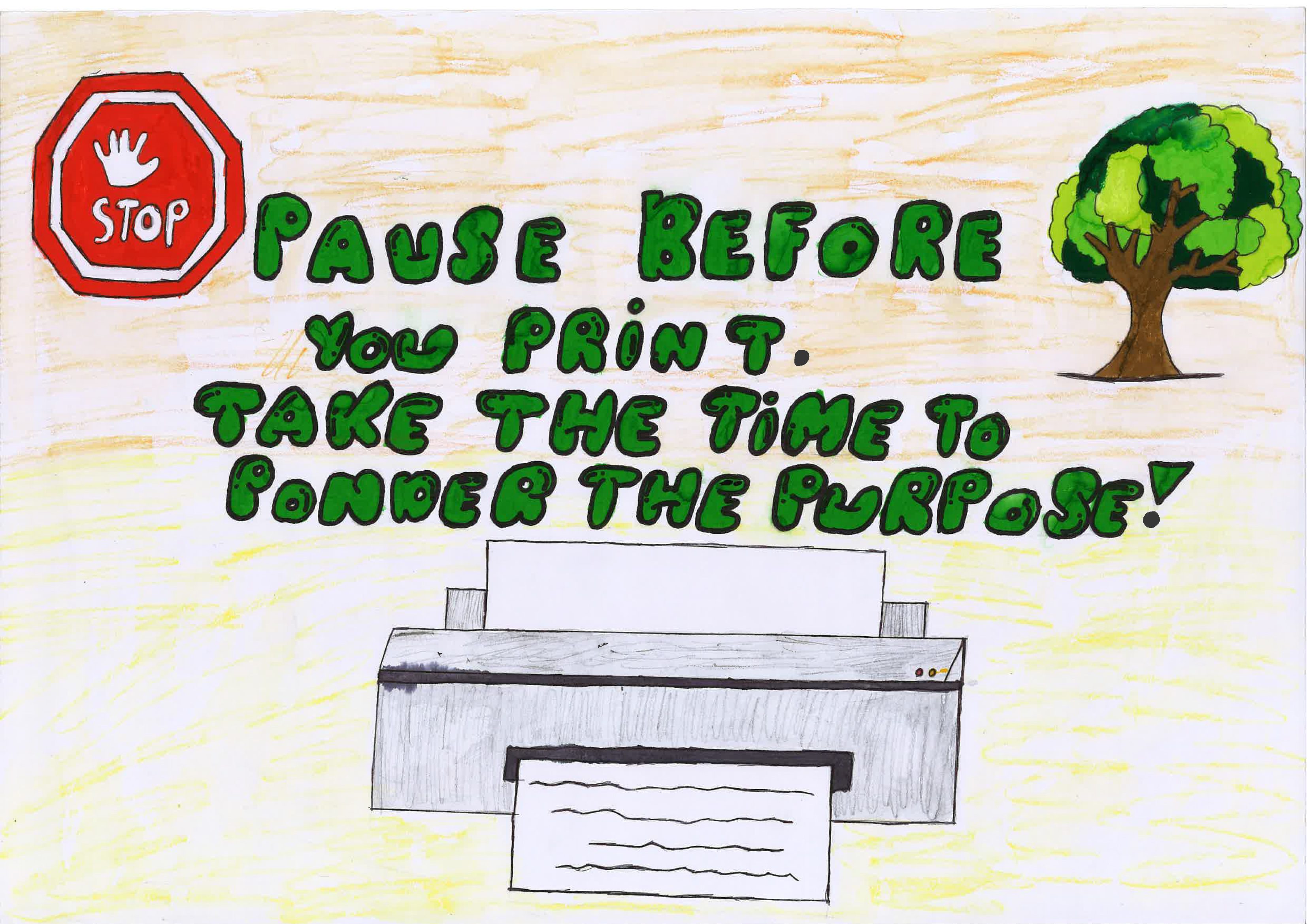

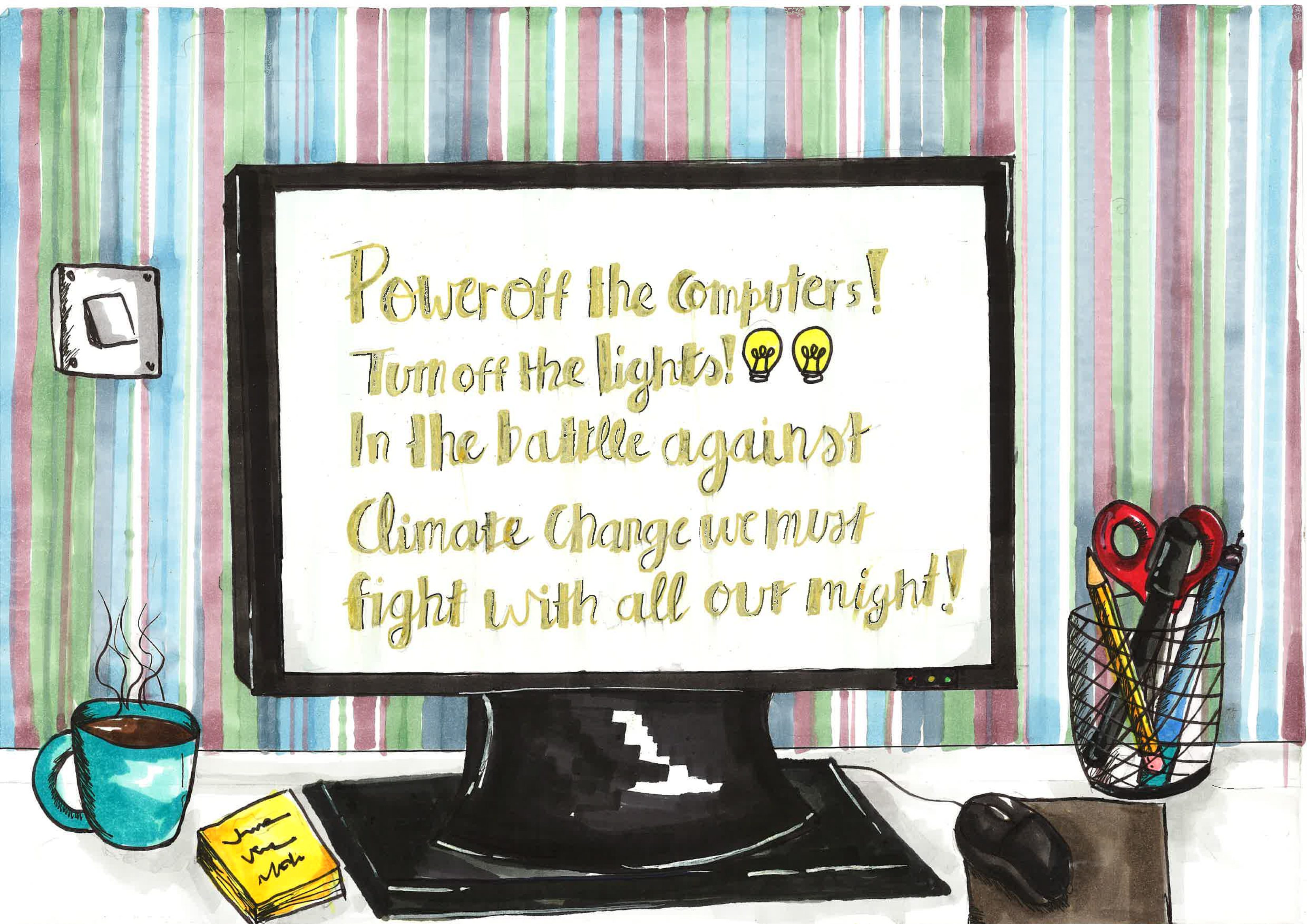

We are delighted to announce the winners of the Bannon “ESG Signage” Art competition run in conjunction with Loreto Junior School Stephens Green.

Congratulations to Amy He (Power Down), Sorcha Murray (Pause before you print) & Grace Yu (Recycle) for their fantastic artwork.

A big thank you to everyone who got involved! Amazing talent from such a young group!

The winner of the Bannon “ESG Signage” Art competition run in conjunction with Loreto Junior School Stephens Green being adjudicated by today.. Keep an eye out on our page as we will be announcing the winners over the next few days!

It’s beginning to look a lot like Christmas here in Bannon!

Bannon recently welcomed a number of new colleagues to the team. Our Managing Director Paul Doyle commented, ‘We are delighted to be expanding our team across the business, to provide a greater depth of expertise to our wide client base. We wish our new colleagues every success and enjoyment in Bannon’.

Roderick Nowlan and Neil Bannon back on the conference circuit again. Great to be back at EXPO REAL meeting people in person.

Great to get back to Munich for Expo (11-13th Oct) for Roderick Nowlan and Neil Bannon.

Great to get back to Munich for Expo (11-13th Oct) for Roderick Nowlan and Neil Bannon.

Get in touch for a chat on Irish Real Estate Opportunities and the impact of ESG on the Irish market.

We were delighted to hear our Executive Chairman Neil Bannon interviewed on Executive Chair, part of Newstalk’s “Down to Business” radio show on Saturday. Neil and Bobby discussed the big changes to the nature of the Office and how it will move from being functional to experiential. He provided the valuable insight that Investors and Employers are now going to be more concerned about the experience of being in the office. It will no longer simply be a place with a desk but instead somewhere you look forward to visiting in the new hybrid working world.

We were delighted to hear our Executive Chairman Neil Bannon interviewed on Executive Chair, part of Newstalk’s “Down to Business” radio show on Saturday. Neil and Bobby discussed the big changes to the nature of the Office and how it will move from being functional to experiential. He provided the valuable insight that Investors and Employers are now going to be more concerned about the experience of being in the office. It will no longer simply be a place with a desk but instead somewhere you look forward to visiting in the new hybrid working world.

As a result, he mentioned that Bannon had seen a notable increase in clients seeking to have the firm leverage our market leading Retails skills and apply them to the Office. Other topics covered included how Neil’s Law degree helps with complex lease and purchase negotiations, setting up Bannon with his father Joe and how an independent, Irish owned business, excels at competing with multi-national competitors in this market.

Take a listen…..

The Sq Arts Project is a new creative arts initiative with the aim of delivering vibrant, creative spaces throughout the centre, that delights customers, champions artistic talent, and promotes local and worthy causes.

The Sq Arts Project will deliver this through a series of individual projects. Keep an eye for upcoming opportunities!

CONTACT

fiona.power@thesquare.ie

Sq Arts Project – The Future is Bright!

Take a stroll around The Square and check out our vibrant new artworks!

Featuring 9 original artworks from 5 local artists, all celebrating the theme “The Future is Bright” as we emerge from lockdowns and step into a brighter day, with playful positivity and uplifting messages.

“I’m delighted to be involved with such an amazing arts project. It’s a great opportunity to show my work to such a large audience, and see local artists supported. Tallaght is full of creativity!”

Lisa Murray, featured artist.

“We are delighted to showcase the work of local creatives here at The Square. There is a wealth of talent on our doorstep, in Tallaght and beyond.

We’re proud to show them off, while at the same time adding pops of joy, colour and creativity around the place!”

Fiona Power, Commercial Operations Manager at The Square.

This collections is the first in a series of installations, as part of The Sq Arts Project.

The Sq Arts Project aims to deliver vibrant, creative space throughout the centre that delights customers, champions artistic talent, and promotes local and worthy causes.

“The future truly is bright here at The Square, and Tallaght. With a vibrant, creative community, and exciting developments coming down the line, there is great opportunity and cause for optimism.

We look forward to working with more artists and organisations in the near future.”

Interest in The Sq Arts Project can be addressed to: Fiona.power@thesquare.ie

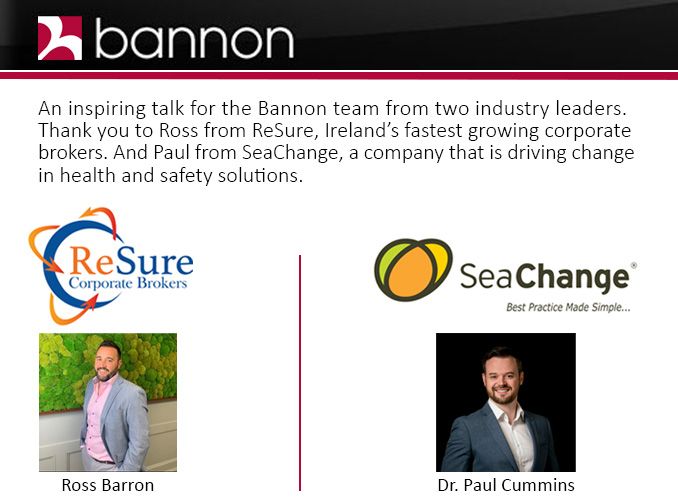

Bannon would like to extend a big thank you to Ross Barron (Director – Resure Corporate Brokers) and Dr. Paul Cummins (Managing Director – SeaChange) for their recent presentation on Liability Insurance / Health & Safety. It was also great to see such a strong attendance from the on site teams across our portfolio. We all gained some very valuable insights on subjects which play a huge part in our industry.

We are very grateful for all the support we have received for our upcoming golf event in Carton House in aid of North Westmeath Hospice. The event has been sponsored by Joule and we have 28 teams golfing on the day. All in all a great result for the WDBN and our charity partner. All we need now is for the weather to play ball!

Wishing all our clients and friends a very Happy Easter from all the team at Bannon

Wishing all our clients and friends a very Happy Easter from all the team at Bannon

A shot from today’s Bannon town hall meeting. We simply can’t wait to get back to work with this great team in the non virtual world….

Bannon is delighted to support the @scsi recently launched Climate & Biodiversity Emergency Declaration. The “Surveyor’s Declare” document is an important resource for Surveyors who have signed up in support of a framework for Surveyors who are committing to play their part in the climate change challenge.

Liverpool FC have launched a brand new pop-up store in the Swords Pavilions Shopping Centre, making it the second official club store in Dublin.

Liverpool FC have launched a brand new pop-up store in the Swords Pavilions Shopping Centre, making it the second official club store in Dublin.

Since 2017, TU Dublin and Chartered Surveyors and Commercial Property Consultants, Bannon, have collaborated on an Applied Investment and Asset Valuations module for final-year Property Economics students.

Since 2017, TU Dublin and Chartered Surveyors and Commercial Property Consultants, Bannon, have collaborated on an Applied Investment and Asset Valuations module for final-year Property Economics students.

The joint venture between Paul Doyle and Roderick Nowlan of Bannon, and Emer Byrne and Eloise Heron of TU Dublin underpins the appetite for both the university and industry to engage collaboratively around a real-world challenge in the property market. Speaking in May 2019 – Rod Nowlan, Executive director at Bannon outlined “the importance of the industry to engage early with students to help them transition from conceptual learning to actual live case files”.

The module, Applied Investment and Asset Valuations, challenges students to connect what they have learned over four years on the Property Economics degree to solve a real-world Asset Valuation and Investment challenge in the property industry.

Speaking at the prize-giving ceremony, Emer Byrne, Real Estate and Valuations Lecturer in TU Dublin said, “This module allows Property Economics students to use their learning to develop a deeper understanding of the complexities in the property sector.”

The 2018/2019 winners were as follows: Aine O’Flaherty, Kevin O’Rourke, Jane Donnelly, Daniel Marshall, Joseph Lee

The 2017/2018 winners were as follows: Sylvia Warren, Claire Meade, Natalia Delaney, Hanna McKenna, Matthew Foster

Staff from Bannon are excited to volunteer their day today to Alone Ireland.

The day will be spent on a variety of activities which included general maintenance work, decorating and gardening in Willie Bermingham Place, Kilmainham. This is a ALONE development which provide assisted housing to people who are homeless or at risk of homelessness. Thank you to the very generous contributions from Bannon partners we were able to donate supplies Lynch Interact and MCR Group.

In 2018 Bannon staff volunteered for 2 days with Alone. The first day was spent carrying out cleaning, maintenance and painting to residential units which were acquired by Alone for permanent housing for older people who are homeless or at risk of homelessness.

On the second day, Bannon staff carried out grounds maintenance to one of Alone’s residential developments, this helped tidy up the landscape areas and provide the residents with a colourful, safe area to enjoy. See us in action!

This year, Bannon staff are gearing up to volunteer with Alone again and are tasked with more gardening and maintenance on the 16th August.

Not only do these volunteering days give back to our local community, it reminds us of the importance of caring for our elderly and the challenges that some face in the older years.

The Peter McVerry Trust’s Wexford Cycle is looking for people to take part next month in order to raise money for homelessness.

The Peter McVerry Trust’s Wexford Cycle is looking for people to take part next month in order to raise money for homelessness.

Weaving its way from UCD to Wexford Town, the hugely popular cycle passes through some of Wicklow and Wexford’s most scenic spots.

This year marks the event’s 30th anniversary and will see around 400 cyclists take part, a far cry from the original event, when just four students from UCD set off to raise money for the homeless charity.

The cycle is geared up to provide a fun day out for cyclists of all abilities and provides a great opportunity to experience the splendour of the sunny South East.

The event is rounded off with a BBQ and music in Clayton Whites Hotel in Wexford Town, where participants can relax and enjoy the post-cycle celebrations.

With over 10,000 people currently experiencing homelessness, the Peter McVerry trust provides well needed support to all that need it. The cycle takes place on the 14th of September.

If you wish to take part please click here to their website for further details.

Another great 5km run thanks to Dublin Airport Central. One of many events hosted by Dublin Airport Central for tenants of the campus.

#connectyourbusinesstotheworld

Scandinavian furniture and homeware chain JYSK opened their second Irish store this morning at Drogheda Retail Park as people queued up to get into the new JYSK store which was officially opened at 9.00 am.

Founded in Denmark in 1979, JYSK , (it’s pronounced “Yusk”), is a global retail chain with more than 2,700 stores worldwide selling everything for the home, it has a turnover of €3.6 billion a year and employs some 23,000 people.

The Drogheda JYSK store is the group’s second in Ireland, it opened its first branch in Naas in April and stores are also scheduled to open in Navan later this month and Portlaoise in August.

Occupancy at Dublin’s hotels reached a record level last year helped by a large number of events held in the capital.

According to data from travel research company STR, Dublin’s hotels far outperformed their European peers as absolute occupancy rose to 83.8% – the highest level for any year in STR’s Dublin database.

Revenue per available room (RevPar) recorded its eighth consecutive year of growth. Compared to 2017, RevPar rose 7.2% to €121.70.

STR analysts said they attribute the strong performance to a large number of events including the Six Nations Rugby Championship, the St Patrick’s Festival and a number of concerts from performers such as U2, Florence and the Machine and Snow Patrol.

Last year saw fewer UK visitors travel to the Republic on the back of Brexit, although tourists from other jurisdictions compensated for that. In the 11-month period to the end of November, the latest month for which figures are available, more than 9.8 million people travelled to the Republic, an increase of 6.8% on the same period in 2017.

Outperforming

Ultimately, that led to Dublin hotels far outperforming their European rivals both in occupancy and revenue terms. Europe’s hotel industry as a whole recorded a 1.2% increase in occupancy to 72.4% while RevPar grew 5.2% to €81.43.

The construction of hotels is picking up and almost 1,000 new rooms were added to the Dublin market last year including the 145-bedroom Iveagh Gardens Hotel on Harcourt Street and the 140-bedroom Maldron Hotel on Kevin Street in Dublin 8.

A further 2,500 hotel rooms are due to open either this year or next.

More than 800 participants and 70 teams took part in this year’s Dragons at the Docks property industry fund raising event at Grand Canal Dock in Dublin on Thursday.

The dragon boat-racing competition raised €250,000 for charity with two-thirds of the proceeds going to the Dublin Simon Community and the balance to be distributed to local charities.

“Working together, we have the ability to deliver many more permanent homes, ensuring that people never have to face the uncertainty and anxiety of homelessness again,” said Sam Guinness, chief executive of the Dublin Simon Community.

Dalata, Glenveagh Property and Hines joined the original six companies who launched the event last year: Cairn Homes, Green Reit, Hammerson, Hibernia Reit, Ires Reit and Kennedy Wilson Europe Real Estate.

Second year

“It’s great to be part of the second year of the Dragons at the Docks for what is an even bigger and better event than last year,” said Pat Gunne, chief executive of Green Reit.

“With over 700 people taking part and ma

ny more coming down to enjoy the event, it is fantastic that there has been so much support to help us raise money for important causes like the Dublin Simon Community.”

(L-R back row) Stephen Fawcett, Rod Nowlan, Paul Doyle, Kathryn O’Leary, Evelyn Finegan, Rebecca Jones and Aisling Woods. (L-R front row) Richard Muldowney, Ciaran Curley, Luke Kelly and Barry Gorham.

Staff from Bannon Commercial Property Consultants happily volunteered 2 days of their time to Alone Ireland in July and August.

Over 30 Bannon employees volunteered their time over the two days. The days were spent on a variety of activities which included general maintenance work, decorating and gardening in Earls Court, Reuben Street & Bermingham Place, Kilmainham. These are two ALONE developments which provide assisted housing to people over 60 who are homeless or at risk of homelessness. Due to very generous contributions from Bannon partners we were able to donate surplus funds to ALONE Ireland.

About ALONE

ALONE is a national organisation that supports older people to age at home. ALONE works with the older person and their families, giving them options for the type of support that’s best for them, regardless of their situation. They offer support through an award-winning Befriending service, Housing with Support, Support Coordination, and Campaigns for Change.

In 2017, there were 6,663 people over 60 on the waiting list for public housing. ALONE received 20 applications for every house they have available, and there is always a waiting list. These numbers will rise even further as our population ages.

View Gallery

A special thanks to the following companies who donated materials:

The challenge of creating innovative housing solutions was on the agenda at the most recent meeting of the Donegal Dublin Business Network (DDBN) as Eoghan Murphy TD, Minister for Housing, Planning and Local Government, addressed the organisation.

A panel discussion on the subject of housing took place at the group’s April gathering in Iveagh House on St Stephen’s Green, followed by a Q&A session overseen by DDBN chairman Paul Doyle (MD of Bannon Commercial Property Consultants) and committee member Danielle Conaghan (Partner in Arthur Cox). Minister Murphy was joined on stage at the event by two other guests of the network. Margaret Sweeney, a native of Kilcar, is CEO of IRES REIT Plc – a company that is Ireland’s largest private landlord with more than 2,500 units.The third industry expert present was Richard Barrett, founder of Bartra Capital Property, a development and investment platform active in areas including private residential development, social housing, nursing homes, commercial real estate and renewable energy. Bartra recently acquired a holiday resort with 27 homes on 186 acres of land in Carrigart.

Making his introductions, Chairman Paul Doyle acknowledged the high calibre of speaker who had joined group members to discuss a topic that has dominated political and social debate in recent years. An open and informative discussion lasting almost 90 minutes followed and the topics debated included the cost of housing delivery, affordability and access to funding.

The key role of the National Development Plan and Project Ireland 2040 were referenced throughout the debate in terms of how they aim to attract a more even spread of national investment into regions including the north west, where Letterkenny has been identified as a centre for regional growth. One interesting idea advanced towards the end of the evening involved embracing affordable opportunities for converting commercial premises in town and village centres that have been left vacant for many years into residential housing, thereby reintroducing a soul back into towns and villages in regional areas.

Wrapping up the event, Danielle Conaghan acknowledged and thanked the panel for their openness, and observed that a fast fix to the current housing situation was not going to be easy. She added that it was encouraging to be advised that the private sector was now embracing government policy and opportunities to stimulate a more rapid supply of housing.

Article published in the Donegal Dublin Business Network

Staff from Bannon Commercial Property Consultants took on a Spinathon in Nutgrove, Pavilions, Blanchardstown, Athlone and Swan Shopping Centre on September 2nd in aid of Irish Heart Foundation.

Irish Heart is the national charity fighting heart disease and stroke. Their mission is to affect positive change in the lifestyles of Irish people, to achieve better outcomes for those affected by heart disease and stroke and to challenge when the health of our nation is put at risk.

Every hour someone in Ireland suffers from a stroke. Every day, hundreds of Irish people are diagnosed with heart disease.

Thank you to everyone involved and the generous donations made. The total donated is €20,000.

Join Irish Heart in the fight against heart disease and stroke.

Irish consumer sentiment held broadly steady in July as an improved buying climate, likely boosted by summer sales and holiday spending plans, contrasted with a more cautious assessment of household finances. At current levels, the survey paints a reasonably positive picture of Irish economic conditions but also continues to highlight concerns about consumers’ personal financial circumstances.

The KBC Bank/ESRI Consumer Sentiment Index stood at 105.1 in July, effectively unchanged from the June reading of 105.0 but that marginal increase – which isn’t statistically significant- means last month’s results were the strongest since February 2016.

This is an encouraging result and one that is consistent with the positive trajectory of most recent Irish economic indicators. However, we would caution that the onset of back to school and other seasonal costs, coupled with likely efforts to downplay the scope for positive news in the upcoming Budget 2018 means there may be scope for somewhat weaker sentiment readings in coming months.

The positive Irish sentiment reading for July contrasted with weaker results for comparable surveys elsewhere as consumers in these jurisdictions re-evaluated their situations and prospects. In the case of Ireland, our sense is that Irish consumers had braced themselves for some fallout from Brexit and/or changed US economic policies but the first half of 2017 has proven notably less traumatic for the Irish economy than may have been feared. However, in other countries, earlier hopes may have given way to varying degrees of disappointment of late.

In the US, consumer sentiment continued the trend decline of recent months away from the January ‘Trump honeymoon’ peak as consumers continue to revise down expectations both for the economy and their household finances in spite of relatively healthy current economic conditions. In the Euro area, July saw a slight correction of the strongly improving recent trend with a softer French reading hinting that notably increased optimism about political progress has run well ahead of the current circumstances of most consumers.

In the UK, a further drop in consumer confidence last month to the lowest level since the Brexit vote appears to reflect weaker economic conditions of late and the particular erosion of household spending power through higher inflation. As a result, this July’s result implies that earlier consumer optimism about UK economic prospects now seems to be undergoing a marked re-assessment.

While the headline Irish Consumer Sentiment Index for July was little changed from June, there were some contrasting movements in the key components of the survey. After a notable improvement in the June survey, the two principal ‘Macro’ elements of the July survey held broadly steady in July. In recent months, Irish consumers appear to have taken on board a continuing sequence of better than expected indicators and upwardly revised forecasts for the Irish economy.

As a result, the Irish economic environment in mid-2017 while still beset by uncertainty appears far less immediately threatening than previously envisaged. This translates into positive views on the Irish economic outlook outnumbering negative views by three to one in July whereas the split was two to one six months ago and somewhat less than that twelve months ago.

While Irish consumers remained more confident about the general economic outlook and the prospects for employment in July, they were a little more cautious about their own personal finances than in June. Our sense is that this reflects limited income growth and the perception that they are not sharing adequately in the widely heralded economic recovery. The monthly changes in this area of the survey were modest in July but they show a modest drop in numbers reporting stronger household finances in the past year and a slight increase in numbers expecting weaker household finances in the coming year. It remains the case that only about one in four consumers are reporting improvements in their past or future financial circumstances.

Although the bulk of the July sentiment survey was taken before the latest national accounts data were published on July 14th, the details of that release appear to offer some support for the view that the average Irish household may have fallen somewhat behind the pace of recovery in the Irish economy as a whole. Not only did these data show that compensation of employees is on a notably weaker trajectory than many had envisaged but, as the diagram below illustrates, the share of national economic income going to households has declined progressively in recent years to the point where it now stands well below historic norms. As the diagram suggests, the recent decline in the share of household income in national income is not simply a reflection of the increased role of multinationals in the economy. The share of household income in GNI* (the metric chosen to adjust for exceptional multinational activities) has also fallen through the recovery.

In such circumstances, it may seem slightly surprising that the most positive element of the July sentiment survey related to spending plans. We think this reflects a response to further price discounting in summer sales as well as planned spending on summer holidays. As such, we think this pick-up is likely temporary in nature and we would expect some pull-back in this area of the survey in coming months.

That said, we take the view that the spending plans component of the July survey may be picking up some key elements of the ‘new normal’ for Irish consumers. One element is a tendency towards ‘compressed’ spending for big ticket items that means such purchases are increasingly concentrated at sale time or in response to heavy price discounting.

Of course, this pattern is also consistent with the reality that many households have a relatively fixed amount of money income and how far that goes each month depends on price movements. Either way, these developments speak of a notably increased price sensitivity on the part of Irish consumers in recent years (a trend that shows up statistically in a notably increased negative correlation between monthly price and volume changes in retail sales data).

A second aspect of the ‘new normal’ appears to be increased travel related spending. The bounce in spending plans may partly be due to lower costs- according to CSO, June air travel costs were 7.6% lower than a year earlier. As a result, it may be vulnerable to a correction in the August data as air fares rebounded in July to stand 1% higher than a year ago.

We don’t think cost factors fully explain an increased tendency towards travel related spending of late. It may signal a greater level of confidence on the part of consumers that the Irish economy and household finances are on a more sustainable trajectory. Of course, it may also speak of a broader change in consumer preferences that places increased emphasis on getting a break from circumstances that are still challenging for many Irish households.

Congratulations to our Quayside Shopping Centre manager Christine Dolan who was runner up for the Young Achiever of The Year 2017.

Bannon took over as managing and letting agents of Quayside in August 2016 and soon after it was clear that Christine was a key member of the management team, had great potential and she was quickly promoted to the role of Centre Manager & Head of Marketing. The centre has seen a significant resurgence since Bannon took over and this award is reflection of Christine’s hard work and dedication to the centre.

The Sceptre awards recognise the best practice and the best people in the shopping centre industry.

They are the pre-eminent accolades in the shopping centre industry, putting the spotlight on management teams, retailers and suppliers that demonstrate real excellence.

Huge queues at Grand Opening of new superstore, The Range, in Liffey Valley on Friday.

After months of anticipation the day finally arrived for Liffey Valley’s newest superstore, The Range, to open its doors. The launch took place at 9am Friday 19th of May at The Retail Park, Liffey Valley in front of a huge queue of eager customers. The store was officially opened by the Mayor of South Dublin, Guss O’Connell. He was joined for the celebrations by owner and founder of The Range, Chris Dawson. The crowd was overflowing with excitement and the ribbon cutting was met with smiles and applause.

Enthusiastic customers queued from 7pm the day before to secure their star prize of a Lay-Z-Spa Paris hot tub with others joining them to receive a runner up prize. They all could not wait to enter the store and discover the great variety of products that The Range has to offer.

Friendly staff were joined by Captain Range, the company’s own mascot and Livvie the Bear from The Retail Park, to welcome customers to the store. Once open, shoppers packed inside their new store to find themselves some fantastic bargains.

Friendly staff were joined by Captain Range, the company’s own mascot and Livvie the Bear from The Retail Park, to welcome customers to the store. Once open, shoppers packed inside their new store to find themselves some fantastic bargains.

The Liffey Valley store has an extensive Homewares department, as well as large DIY, Arts & Crafts and a spacious outdoor garden centre. There is also a large seasonal area offering a vast selection of luxury garden furniture, barbeques and solar lighting. There are some fantastic opening offers running across all departments until 4th June with many exclusive bargains available.

Dublin’s 98 FM promo team, the Thunder, were in-store to entertain the crowds in their fun zone with goody bags and face painting. The celebrations are set to continue over the weekend with free face painting by Snazaroo taking place at the new store on Saturday 20th May and a free Trimcraft demo in-store on Sunday 21st May.

Devon-based entrepreneur, Chris Dawson commented on the opening: “Opening a new store is always a proud moment for the company and it is great to continue with our overseas expansion so close to Dublin. It was great to have so many people turn up to celebrate our opening this morning and we hope all our customers managed to find themselves some fantastic bargains. We would like to thank the council and The Retail Park for all of their support in welcoming us to Liffey Valley”.

With 1 day to go until the Grand Opening of value superstore The Range in Liffey Valley, staff have been busy adding the finishing touches to the store ahead of Friday’s 9am opening.

The new Range outlet will be the third home, leisure and garden superstore to open from the retail chain in the Republic of Ireland and is located at The Retail Park Liffey Valley near Dublin.

Special guest Mayor of South Dublin, Guss O’Connell will be there to officially open the new store.

The Liffey Valley store will have an extensive Homewares department, offering kitchen appliances to tableware and hoovers to home storage, as well as large DIY, Arts & Crafts and Patio sections and a spacious outdoor garden centre. There will be some fantastic opening offers across all departments until 4th June with many exclusive bargains available.

To celebrate the opening, Dublin’s 98 FM radio will be running promotions all week on the 12-4pm show for the listeners to win a share of €1,000 in vouchers for The Range. There is a whole selection of activities planned for the opening day, starting with amazing giveaways for the first 50 people in the queue including a Lay-Z-Spa Paris worth €700 for the first in line! Dublin’s 98 FM radio will be in-store on the day with their fun zone, goody bags and face painting.

The company’s own mascot, Captain Range will also be attending the opening to provide balloons and entertainment for the young and young at heart! There will be free face painting for children by Snazaroo on Saturday and a free craft demo by Trimcraft on Sunday.

The new store is bringing around 80 new jobs to the area, which is a tremendous boost for the economy and is sure to be a welcome addition to the already busy retail park.

Chris Dawson commented: “We are really looking forward to opening our store in Liffey Valley at the end of this week. We are confident that the jobs we are providing with the launch of the new store should help to boost the local economy. We would like to invite the people of Liffey Valley and beyond, to come and join us on Friday to celebrate the grand opening.”

THE NEW STORE WILL BE LOCATED AT:

The Retail Park Liffey Valley, Coldcut Road, Quarryvale, County Dublin

Smiggle, the world’s hottest stationery brand opened its first Irish store in Dundrum Town Centre this morning.

As the original creator of colourful, fun and fashion-forward stationery, Smiggle designs, develops and markets an expansive range of products that are perfect for the office, school, homework, birthdays and fun.

Smiggle, where a smile meets a giggle, appeals to the young and young at heart, and is designed for everyone with a love of innovative, bright and fun products.

The Australian retailer who opened in Melbourne in 2003 now has some 300 stores worldwide. Smiggle has exciting plans for their business in Ireland both in the Republic of Ireland as well as Northern Ireland with commitment to open 20 stores within the next two to three years. This will result in the creation of some 250 to 300 new jobs.

Bannon are proud to represent this exciting world known brand in their expansion drive in Ireland.

Visit www.smiggle.com.au

Well done to the Bannon retail team for their recent letting. Check out Inglot this weekend at Athlone Towncentre

Bannon will close Friday 23rd December 2016 at 1pm and will reopen on Tuesday 3rd January 2017.

Best wishes for the festive season from all the staff at Bannon.

Congratulations to everyone that cycled from UCD to Wexford and to everyone who donated and helped to make the Wexford Cycle 2016 happen.

Find out more about Peter McVerry Trust here.

Following the success of our inaugural charity fundraiser in 2015 we decided that we would go one better in 2016.

This year we chose The Friends of St. Luke’s Cancer Care in Rathgar as our charity and the event was held in honour of our late colleague Philip O’Keeffe.

The event itself consisted of one group (16 participants) cycling 110km from Dublin to Glenmalure Lodge whilst a separate group (19 participants) hiked to the top of Lugnaquilla.

We set an original fundraising target of €10,000 but due to the unbelievable generosity of our clients, colleagues and friends we raised an incredible total of €22,500.

Bannon is proud to announce our most recent senior appointments.

Pictured above is: (L-R) Richard Muldowney to Director of Property Management; Ray Geraghty to Divisional Director of Property Management; (centre is Managing Director Paul Doyle); Cian McMorrow to Divisional Director of Offices; and Declan Kiersey to Director of Property Management.

Following 2015’s inaugural charity event, Bannon successfully completed their 2016 Charity Event in aid of the Friends of St. Luke’s Cancer Care on Saturday 21st May.

The event saw the team cover a combined total of 2,016km by cycling from their offices to Glenmalure together with a hike up Lugnaquilla, Leinsters highest mountain.

Bannon are delighted to have raised €22,500 for St. Luke’s. This brings the total raised over the last 2 years to €40,000.00.

Following on from last year’s inaugural event, Bannon will be running a 2016 KM charity event in aid of The Friends of Saint Luke’s Cancer Care on Saturday the 21st of May 2016. The challenge will be split between groups of walkers and cyclists with walkers hiking 20km’s to the top of Lugnaquilla in the Wicklow Mountains and finishing at the Glenmalure Lodge. Cyclists will be cycling 110km’s from Bannon’s office in Dublin City Centre to Glenmalure Lodge. It is anticipated that there will be in the region of 40 people participating in this challenging event.

Each of the participants will be individually fundraising and in addition to this we are seeking corporate sponsorship. While we understand that you are most likely inundated with requests for donations, we are sure you will agree that this is a very worthwhile cause that has touched most families in some way. We hope that the funds raised will go some way to helping St. Luke’s invest in their facilities in the coming months.

In light of the above we would be delighted if you would consider making a donation. All proceeds raised will be donated to the Friends of St. Luke’s. Details can be found at www.friendsofstlukes.ie. Bannon will be paying all costs incurred relating to the event so you can be assured that all sums collected will go to this worthy cause.

Donations can be made by returning a cheque made payable to “Bannon” or alternatively by donating via https://give.everydayhero.com/ie/bannon-2016-km-s-charity-event.

Your support would be greatly appreciated.

Pictured following their recent promotions at Bannon are: (left to right)

Niall Brereton (Divisional Director – Professional Services) is with Bannon since its inception in 2005. Niall specialises in all aspects of professional work including Valuations, Landlord and Tenant, CPO and Rating. Niall also acts on behalf of a number of religious congregations across the country.

David Carroll (Divisional Director – Investment) joined Bannon in 2007. David has had an exceptionally busy 24 months on large domestic investment sales and acquisitions.

Barry Gorham (Associate Director – Property Management) is with Bannon 10 years. Barry is an accountant in the busy property management department.

Ben Semple (Associate Director) is a key member of the Professional Services team, primarily involved in Valuations and Rent Reviews.

The recent promotions are pictured with Bannon Chairman Neil Bannon and Managing Director Paul Doyle.

On September 12th the staff and friends of Bannon will be doing a 50km charity walk in aid of the Dublin Simon Community along the Royal Canal. The majority of participants are Bannon staff, with a small number of close friends or family numbers making up the balance. The starting point will be just outside Longwood in Co. Meath and will be finishing at the Halfway House in Ashtown.

We chose the Simon Community because of the on-going homeless crisis in the Dublin area and felt that our funds could help in the run up to Christmas 2015. The directors of Bannon have generously agreed to cover all costs associated with the event which will mean that every euro raised will go to the charity.

To donate, please visit our fundraising page www.mycharity.ie/event/bannon_50km_charity_walk/

Any donation,no matter how small is hugely appreciated!

The Board of Bannon Commercial Property Consultants is delighted to announce the appointment of Paul Doyle to the role of Managing Director.

Paul is one of the founding members of Bannon and since the inception of Bannon in January 2005 has been head of the Professional Services Team. Paul will continue in that role.

Former Managing Director Neil Bannon will continue as head of Asset and Property Management and, in a strategic move for the company, will be dedicating more of this time to business development with a particular focus on the practice’s international client base. Neil’s concentration on this area reflects the ever increasing importance of providing professional services to an international standard.

Joe Bannon will continue in his role as Executive Chairman.

In commenting on his appointment Paul said, “I look forward to starting my role from an excellent platform within Bannon, surrounded by some of the most experienced staff in the Irish commercial property market. Anticipating a very strong 2015 on the back of strong economic indicators, a noted acceleration in new development to cater for the supply shortage in certain sectors and another busy year in the transaction market, we look forward to satisfying the specialist requirements of our expanding client base. On the back of our confidence in the market we will, over the next few months, be increasing our staff from 55 to over 60, by adding five new surveyors. 2014 was an extremely busy year for Bannon, and in 2015 we see ourselves even more so at the fore of the market”.

Neil Bannon commented “Bannon has matured into one the most significant players in the Irish property market and is now the largest Irish owned Commercial Property practice. We credit this success to the calibre and commitment of the energetic team that has been attracted to Bannon over the last decade. The Irish property market promises to be an exciting and prosperous environment over the next decade as we move to a new more sophisticated Commercial property environment where the reliance on ‘best in class’ property professionals will become ever more important”.

Bannon will close Tuesday 23rd December 2014 and will reopen on Monday 5th January 2015

Best wishes for the festive season from all the staff at Bannon

The 25th Welcome Home Wexford Cycle took place on Saturday, 20th September and our fellow colleagues did us proud.

In support of the Peter McVerry Trust, which was established in 1983 by Fr Peter McVerry to tackle homelessness, drug misuse and social disadvantage.

A record 3,856 runners making up 964 teams took part in the third annual Grant Thornton Corporate 5k Team Challenge on Tuesday 2nd September in the Dublin Docklands. Well done to everyone who attended and supported this team challenge and this amazing charity.

Both Bannon teams made it home in one piece with a wide range of talent on display. Starting from far left:

Emma Cole, Neil Bannon, Darren Peavoy, Rod Nowlan, Adam Merriman, Richard Muldowney, Damian Bannon and Kathryn O’Leary.

LauraLynn – Ireland’s Children’s Hospice was the nominated charity this year who provide palliative care and support to children with life-limiting conditions and their families.

Retail Ireland, the Ibec Group that represents the Irish retail sector, has welcomed the opportunity to participate in this week’s inaugural session of the Government’s new Retail Consultation Forum.

Retail Ireland has long campaigned for the establishment of a dedicated engagement forum between Government and the sector and welcomed the decision to establish the Retail Consultation Forum, announced earlier this year, as part of a number of initiatives under the Action Plan for Jobs 2014. The establishment of the Forum and the opportunity for Retail Ireland to participate in it is an endorsement of Ibec’s ongoing campaign to place retail firmly at the heart of Government thinking.

The Forum will meet quarterly with a different topic under consideration at each session. At this week’s meeting, Retail Ireland had the opportunity to engage with other industry representative groups to propose fiscal measures and other initiatives to support the industry under this year’s budget.

Information sourced from www.ibec.ie

The National Treasury Management Agency (NTMA), which manages the national debt, announces that it will hold a bond auction tomorrow, 8th May. The auction will be conducted on the Bloomberg Auction System and will be confined to recognised primary dealers. A non-competitive auction for 15 per cent of the amount sold in the competitive auction will immediately follow and will close at 10:00 am on Friday 9 May.

The details of the auction are as follows:

• Bond to be auctioned: 3.40% Treasury Bond 2024

• Auction size: €750 million

• Auction opens: 8:00 am

• Auction closes: 10:00 am

• Settlement Date: 13 May 2014

The NTMA raised €1bn in a bond auction last month. That issue was 2.8 times oversubscribed. The auction of the 3.4pc treasury bonds resulted in a yield of 2.917pc. Following that auction, the NTMA has raised €5.75bn in the bond markets so far this year, which is more than 70pc of its €8bn funding target for the full year.

Please see the NTMA’s website www.ntma.ie for further details of the Primary Dealer System and bond issuance arrangements.

Hambleden House

19-26 Pembroke Street Lower

Dublin 2

D02 WV96

Ireland

»Map

Phone: +353 (1) 6477900

Fax: +353 (1) 6477901

Email: info@bannon.ie

| Title | Price | Status | Type | Area | Purpose | Bedrooms | Bathrooms |

|---|