Household Finance and Consumption Survey (HFCS) 2018

The Central Statistics Office has today issued results from the Household Finance and Consumption Survey (HFCS) for 2018 and comparable data for 2013, the previous year this survey was run.

Commenting on the report, Stephen Lee, Statistician, said: “The HFCS is the only household survey that collects combined information on asset, income and debt levels of Irish households.

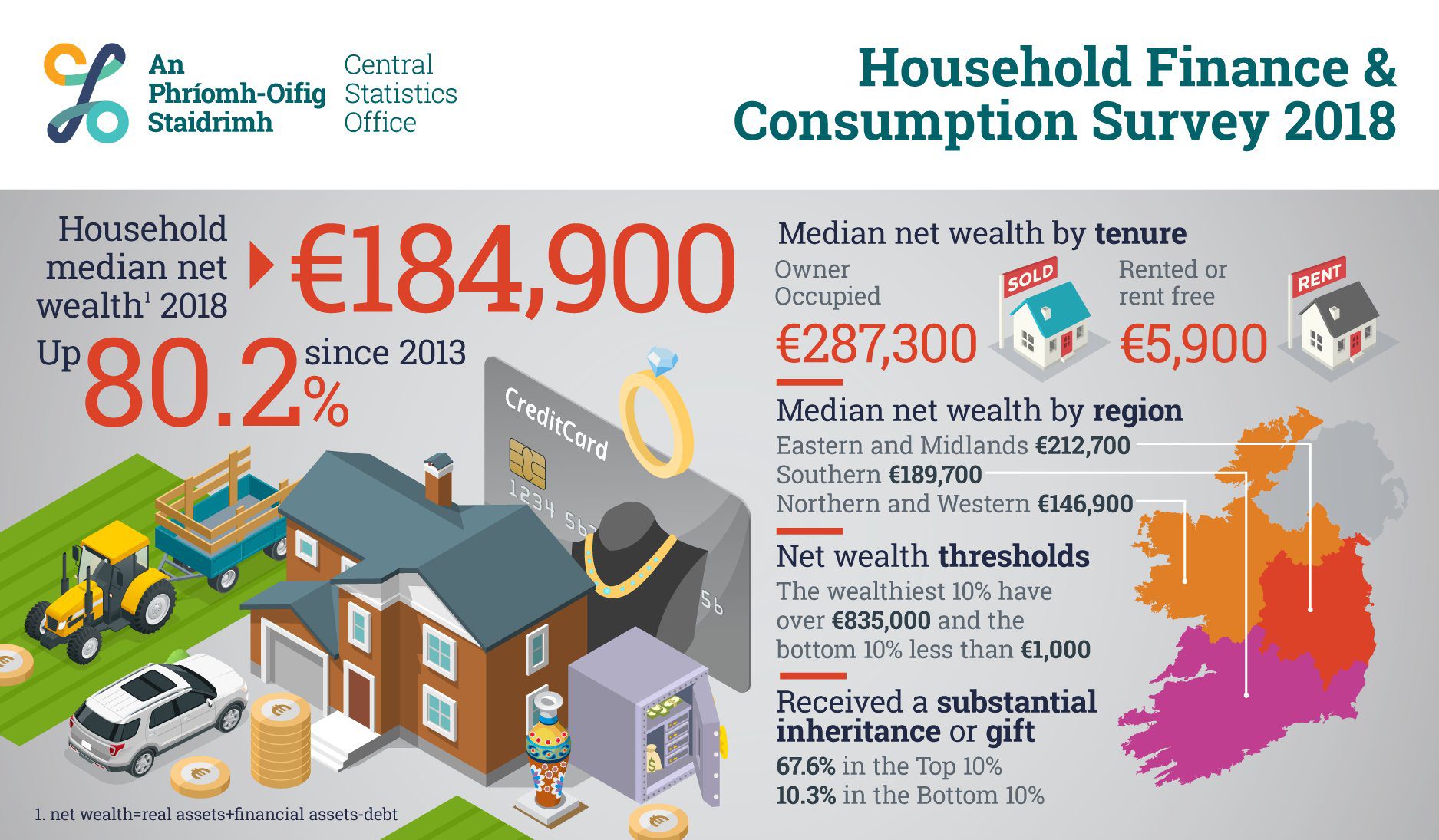

The results show that in Ireland, the wealthiest 10% of all households have a net wealth greater than €835,000 while the bottom 10% have a net wealth of less than €1,000. Net wealth is calculated as the value of all assets minus debt.

In 2018, the median net wealth value of Irish households was €184,900, representing an increase of 80.2% on the 2013 value of €102,600.

The median value is obtained by arranging all households in ascending order from the smallest to the largest value and then selecting the middle value. In terms of wealth, the median provides a truer reflection of the average household as it is not influenced by extreme values.

The value of the household’s main residence is a key component of wealth. In Ireland, 69.5% of households own their own residence. In 2018, the median value for households’ main residence was €250,000, up from €150,000 in 2013.

The median net wealth of households that own their own home is €287,300 while for renters it is considerably less at €5,900.

We see that wealth is more concentrated in the ‘Eastern and Midlands’ region with a median net wealth of €212,700, compared to €189,700 in the ‘Southern’ region and €146,900 in the ‘Northern and Western’ region.

Almost one third of households (32.7%) reported that they received an inheritance or a substantial gift at some time in the past. However, this varies depending on how wealthy a household is. Over two thirds (67.6%) of the wealthiest 10% of households received a substantial inheritance or gift but this drops to just over one tenth (10.3%) for the 10% of households with the lowest net wealth.

More than nine out of every ten households (94.3%) own some form of financial asset including savings, shares, bonds, investments and voluntary pensions. For households that own financial assets the median value is €7,900 up from €6,300 in 2013.

Over half (51.5%) of all households have some form of debt including mortgages, loans, credit cards and overdrafts, down from 56.8% in 2013. Overall, the median value of debt, for those households that have debt, has dropped by over €20,000 since 2013, from €63,000 to €42,300.

For households that have a mortgage on their home, the median loan to value (ltv), the ratio of the outstanding amount of the mortgage to the current value of the property, is 45.3%, down from 73.5% in 2013.

In 2013, 31.9% of all homes owned with a mortgage were in negative equity, whereas the 2018 rate is 3.9%.”