Offices Fall Behind Retail and Industrial Sectors in Q1

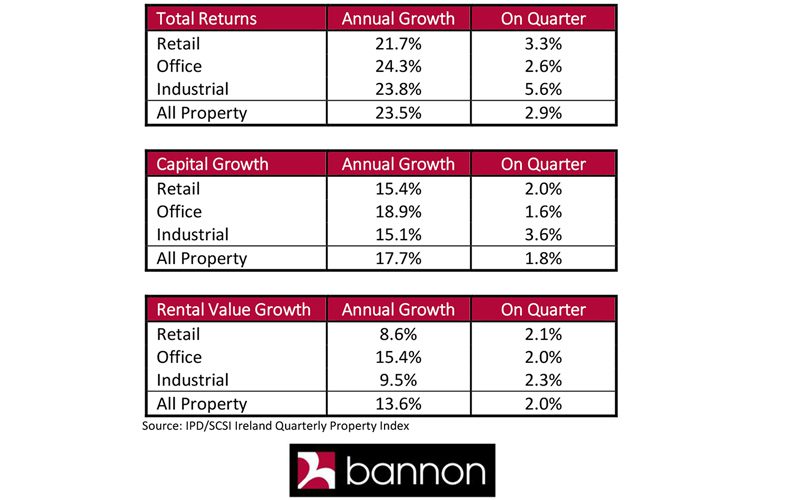

Investment returns from Irish commercial property cooled off in the first quarter of 2016, according to new data from the IPD/SCSI Ireland Quarterly Property Index. Total returns from Irish investment property closed at 2.9% in Q1 2016, down from the 6% recorded in the final quarter of 2015. The twelve-month return for Irish commercial property of 23.5% to the end of March 2016 remains significantly higher than that of the UK which reached 11.7% according to the IPD UK Monthly Property Index.

Industrial property has now emerged as the strongest performing asset class with total returns of 5.6% and capital value growth of 3.6%, reflecting robust levels of rental growth in the sector. Industrial property in South West Dublin performed particularly well in Q1, with returns up 6.5%.

Retail property is now seeing sustained growth, with returns up 3.3% in Q1 driven by rental growth of 2.1%. Performance on Dublin’s two main high streets remains strong, with quarterly returns of 4.3% and 4.2% recorded for Grafton and Henry Street respectively as rental values continue to increase in line with a steadily improving consumer economy. Moreover, the data suggest that the recovery is now spreading beyond Dublin, with total returns from retail property in provincial locations also closing at 3.3% in Q1.

Following stellar growth over the past two years associated with a strongly improving economy and shortage of office space in prime locations, offices are now the weakest performing asset sector registering a return of 2.6% in Q1, down from 5.7% in the previous quarter. Office capital value growth moderated to 1.6% while rental value growth was 2% in Q1.

Muted returns in the first quarter could be a sign of uncertainties among Irish and overseas investors alike following an inconclusive general election result and the impending Brexit vote, the consequences of which on the Irish economy are unclear as yet. Stability will be crucial to maintaining confidence in the sector and ensuring the recovery continues to spread nationally.