Returns on Irish Commercial Property Increase 12.4% in 2016

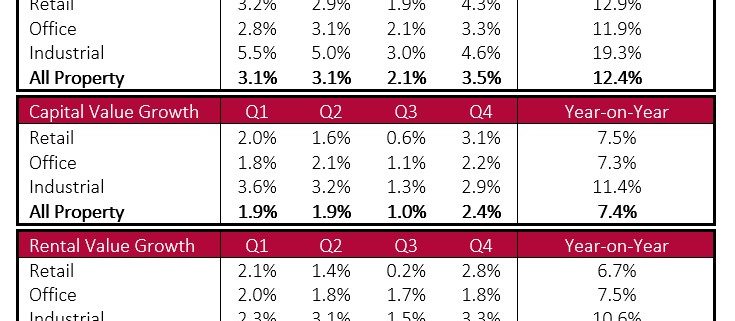

Strong performance in Ireland’s commercial property sector continued throughout 2016, albeit at a slower pace than was seen in 2015, with total returns across all property types up 12.4% annually according to recent figures from the SCSI/IPD Ireland Quarterly Property Index.

The market picked up across all property types in Q4 following a lull in Q3, with industrial leading the way with a total return of 4.6% on quarter bringing annual returns to 19.3% year-on-year. Within this sector the strongest performing category was Industrial North Dublin, which recorded a total annual return of 20.4% driven by capital and rental value growth of 12.6% and 12.2% respectively.

Retail was a close second in Q4, returning 4.3% to bring annual growth to 12.9% relative to 2015. This growth was driven predominantly by prime high street properties on Grafton and Henry/Mary Street, which saw annual returns on investment of 17% and 16.5% respectively. Most importantly, provincial retail is finally beginning to show signs of recovery with capital and rental value growth of 6% and 5.6% driving a total annual return of 14.5%.

Office returned 3.3% in Q4 with prime City Centre properties driving growth to bring total returns to 11.9% annually. This was driven by continued strong growth in prime city centre locations, with Dublin 2 and 4 recording returns of 11% and 12% respectively.

An annual return of 12.4% is almost double the 7.6% recorded in the U.S. and more than three times the 3.5% growth recorded in the U.K., where June’s ‘Brexit’ referendum heavily impacted rental and capital value growth in the latter half of the year. This marks Ireland as one of the best performing commercial property markets again in 2016.

The main quarterly and annual results for 2016 are outlined above.

Kate Ryan, Research Department