The Great Office Reshuffle Accelerates

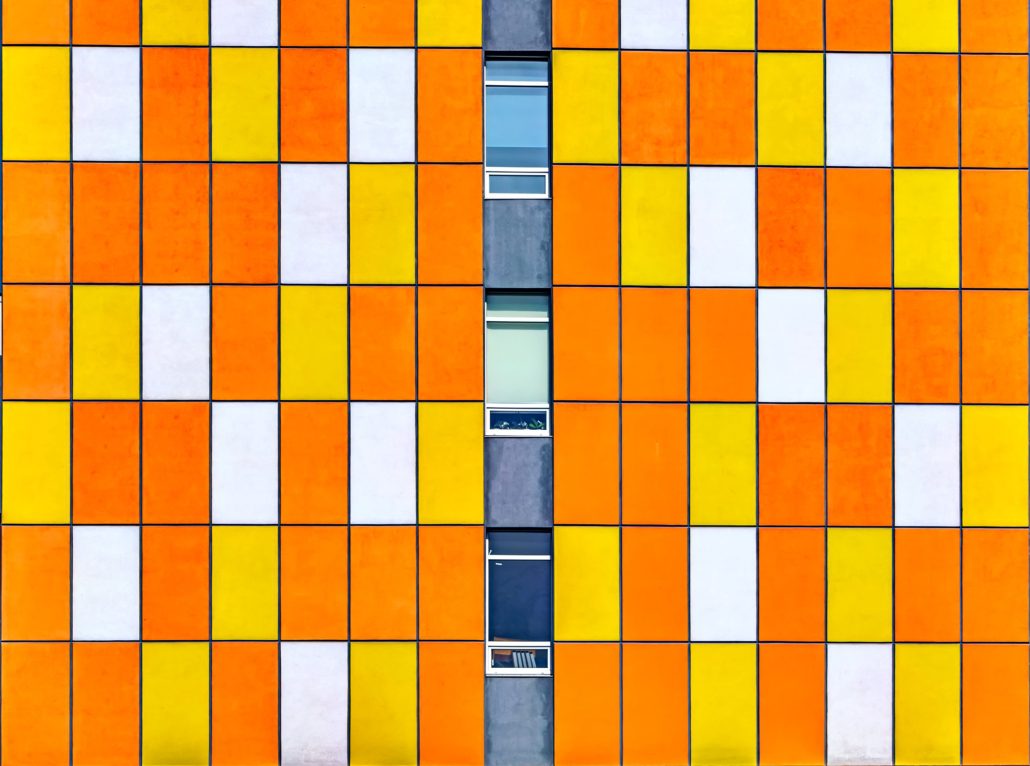

There is a puzzle which involves moving the one empty space around a collection of tiles to make the correct image and it comes to mind when looking at the near-term future of the Dublin Office market.

The headline stats on the office market will tell you that there is 5.6m sq.ft. under construction but that 2.2m of it is pre-let. What these stats hide is that some of that pre-let space is actually available. Take 2 & 3 Wilton Place which are currently being built by IPUT for LinkedIn who have advised the market that they no longer want to occupy these buildings. IPUT’s investment is secure as the buildings are effectively let to a Microsoft business who are legally committed but from the market perspective 330,000 sq.ft. has just moved from the pre-let column to the available to let column and it’s not just buildings that are under construction. As agents on the redevelopment of the ESB headquarters we pre-let 28 Fitzwilliam Place to the tech company Slack subsequently selling the investment to the large European Investors Amundi. Slack were subsequently bought by Salesforce and 28 Fitzwilliam although fully complete since 2021 has never been occupied. To these examples can be added the buildings in the Facebook / Meta HQ in Ballsbridge which they have decided not to occupy although it is not clear that they will be bringing these to the leasing market or just mothball them for the time being.

What this adds up to is a much greater availability of brand-new top-grade office stock than the headline stats would suggest. We have no doubt that all this brand new ESG compliant stock will be occupied. They are good quality buildings in good locations that comply with the sustainability needs of large corporate occupiers. What it will do however is speed up the movement of the tiles around the board. It accelerates the ability of large corporate occupiers currently residing in non ESG compliant buildings to move to the buildings they need. When the image is complete the empty tiles will correspond to the older non ESG compliant buildings which will need to be upgraded, converted to alternative uses or generate a much lower rent than they have achieved heretofore.

At Bannon the Office & Consultancy teams are actively working with clients to solve the more complex problem, how to generate the best return from well located office stock that fails the sustainability test.

Author: Neil Bannon, Executive Chairman, Bannon

Date: 14th November 2022