Address

Hambleden House

19-26 Pembroke Street Lower

Dublin 2

D02 WV96

Ireland

»Map

Contact Us

Phone: +353 (1) 6477900

Fax: +353 (1) 6477901

Email: info@bannon.ie

International real estate firm Hines has formally acquired the second phase of Chatham & King, a new high-profile mixed-use scheme next to the Gaiety Theatre on South King Street in Dublin city centre.

Hines’s acquisition of the 3,950sq m (42,500sq ft) portfolio marks the culmination of the €165 million deal it agreed with US private equity giant Lone Star for the wider Chatham & King development in 2018. In acquiring the scheme, Hines fended off three rival bids. Two of the competing offers came from German funds, while the third bid came from the billionaire founder of the Zara fashion chain, Amancio Ortega.

In securing ownership of the development, Hines gained immediate control of a mixed-use building with retail units comprising 3,112sq m (33,500sq ft) occupied by Zara, H&M and Warehouse, along with 2,879sq m (31,000sq ft) of overhead office space occupied by data analytics management firm Qualtrics as its European headquarters.

The second phase, which has now been completed by Lone Star, comprises six residential units, five retail units totalling 1,486sq m (16,000sq ft) and 2,461sq m (26,500sq ft) of office space which will be occupied by Qualtrics. The €40 million cost of developing the new building on Chatham Street and Clarendon Row was included as part of the €165 million deal agreed on behalf of Hines European Core Fund (HECF) in 2018.

Hines says that negotiations are at an advanced stage on each of the five new retail units, which range in size from 46sq m (495sq ft) to 1,178sq m (12,680sq ft). The incoming tenants will sit alongside the existing tenants, which include Zara, H&M and Apple-reseller CompuB, which recently signed a new lease for a 315sq m (3,400sq ft) retail unit on South King Street.

The Chatham & King scheme has a prime location next to Grafton Street and St Stephen’s Green, and sits within close proximity to the Westbury Hotel and the new Dublin headquarters of the European Parliament, which is scheduled for completion in November 2023.

Simone Pozzato, managing director and deputy HECF fund manager at Hines, said: “The acquisition of phase two of Chatham & King completes the final element of this portfolio and marks the delivery of an LEED-accredited asset in the Dublin office and retail sector at an opportune time. The property is an excellent fit for HECF given its central location in Dublin, a city which continues to show strong economic growth.

“We are already encouraged by the promising engagements to date from some very exciting retail brands who would be ideally suited to this prestigious shopping district. We hope to have further announcements in this regard in the near future.”

Peter Lynn, director with Hines Ireland, added: “We are delighted to make this timely announcement as Dublin city centre continues to reopen and as Chatham Street itself has recently undergone a significant transformation with Dublin City Council’s pedestrianisation programme. Chatham & King is a high-quality addition to this historic street and our new retail spaces will represent a significant enhancement to the city’s most fashionable shopping district. We are also equally excited to be working with Qualtrics as our lead office occupier as they continue on their growth story.”

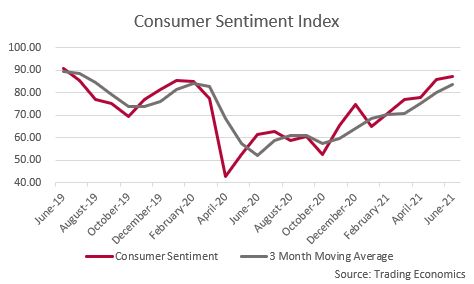

Irish consumer sentiment is at a two-year high following a modest 1.6% monthly increase in June. This increase brings the index back in line with the 25-year average of the series suggesting sentiment has been normalised. This is further supported by the fact that June marks the fifth successive monthly increase in the index, the first time that has happened since the beginning of 2007. These results suggest that Irish consumers are becoming less concerned about their current circumstances and less fearful about the future which bodes very well the retail sector. Furthermore, trends over the past decade show consumer sentiment as a very accurate leading indicator of retail sales.

There is an air of positivity coming from our shopping centre & retail park management teams across the country. It has been great to see the rebound in footfall since full reopening of our portfolio on the 17th of May last. The first three weeks since reopening have seen weekly footfall jump back to 86% of the levels seen in 2019. What’s much more significant is the number of retailers reporting May 2021 sales information (a total of 14 days) being ahead of May 2019 (31 days). There is no question that retailers need to see a sustained period of brisk trade but the data so far is pointing in the right direction.

With online shopping having come into its own following the unwelcome arrival of Covid-19, the sale by New York-headquartered Marathon Asset Management of three of Ireland’s best-known retail parks is set to test the post-pandemic appetite of investors for traditional bricks-and-mortar retail.

The Parks Collection is being offered to the market individually or as one lot by joint agents Cushman & Wakefield and Savills at a guide price of €78 million. The portfolio comprises Belgard Retail Park in Tallaght, Dublin 24, the M1 Retail Park in Drogheda, Co Louth, and Poppyfield Retail Park in Clonmel, Co Tipperary.

While the sale of the entire offers the prospective purchaser the opportunity to secure a collection of strongly-performing retail parks and an attractive net initial yield of 8.43 per cent, the portfolio’s assets are expected to see interest on an individual basis also.

Belgard Retail Park, for its part, is regarded as one of the foremost retail parks in the capital. Located on the Belgard Road in Tallaght and 11km from Dublin city centre, the scheme comes for sale fully-occupied and anchored by B&Q, the largest home improvement and garden centre retailer in the UK and Ireland. Other occupiers include Homestore & More, Dealz, Carpet Right, Halfords, Right Style Furniture, Burger King and Starbucks.

While the scheme currently extends to 12,728sq m (137,000sq ft) with 482 car parking spaces, it has planning permission for an additional retail warehouse unit of 2,404sq m (25,877 sq ft) over two levels with 1,409 sq m (15,166 sq ft) of ground-floor space and 995sq m (10,710sq ft) of retail warehouse/storage space at mezzanine level.

The total current rent is about €3.13 million per annum with a weighted average unexpired lease term of 7.3 years. B&Q contributes around 67 per cent of the income on a lease until 2028 with an upward-only rent review clause.

The M1 Retail Park is located 3km west of Drogheda town centre and just off the M1 motorway connecting Dublin and Belfast. It comprises a mix of retail, office and leisure accommodation extending to a total of 24,805sq m (267,000sq ft), along with 600 car-parking spaces. The majority of the development is taken up by retail and leisure (89 per cent) and is anchored by Woodie’s DIY who occupy 4,885sq m (52,585sq ft). The park’s other tenants include Smyths Toys, Sports Direct /Brand Max, Dealz, Equipet and EZ Living amongst others.

The total current rent is €2.44 million per annum with a weighted average unexpired lease term of 8.4 years. Woodies (with lease guarantees from Grafton Group plc) contributes around 40 per cent of the income on a lease until September 2030 with upward-only rent reviews.

The scheme also includes Mellview House, a four-storey building comprising 25,048sq ft of office space, a 30,483sq ft gym at ground floor, basement and mezzanine levels operated by Gym Plus and a number of other smaller retail units. Another building known as the Pavilion is home to Costa Coffee and TC Matthews with a recent new letting to Lanu Medi Spa.

An additional site adjacent to M1 Retail Park also forms part of the Parks Collection sale. The land extends to 27 acres and comprises three adjoining plots with proposed zoning under the Draft Louth County Development Plan 2021-2027 for three uses, namely ‘A2 New Residential’, ‘ C1 Mixed Use’ and ‘ B4 District Centre’.

99% occupied

Poppyfield Retail Park is located 2.5km from Clonmel town centre at the junction of the Cahir Road and the N24. Developed in 2004, the scheme extends to 12,821sq m (138,000sq ft) and comprises a mix of 14 retail warehousing units, a neighbourhood centre and 393 car-parking spaces. The park is 99 per cent occupied and anchored by Woodie’s DIY (with a lease guarantee from Grafton Group plc) and SuperValu. Other high-profile tenants include Harry Corry, Maxi Zoo, EZ Living, World of Wonder and DID Electrical. The neighbourhood centre is occupied by Costa Coffee, Sam McCauley, along with a hair and beauty studio and fish-and-chips operator. KFC also have a drive-through at the entrance to the park which does not form part of the sale.

The total current rental income is €1.43 million per annum and the weighted average unexpired lease term is seven years. Woodie’s and SuperValu contribute around 52 per cent of the income, and have seven and eight years remaining on their respective leases.

Marathon Asset Management acquired the M1 and Poppyfield parks originally as part of a larger portfolio in 2014, which also included The Park, Carrickmines; Lakepoint Retail Park, Mullingar; and the Four Lakes Retail Park in Carlow. Belgard Retail Park was acquired separately.

Marathon has undertaken significant asset management and phased disposal of these assets since then. The latest sale from its Irish retail portfolio was completed only this week and saw a private high net worth investor paying close to €7 million to secure ownership of Lakepoint Retail Park in Mullingar.

The scheme, which is anchored by Woodie’s DIY, is generating total rent of €516,000 per annum giving the purchaser an initial return of just under 7 per cent. The deal was brokered on Marathon’s behalf by Rod Nowlan of Bannon while Declan Bagnall of Bagnall Doyle McMahon represented the purchaser.

One of the recommendations in our recent report on City Centre retail for Dublin City Council was to improve connectivity between the Retail Core and the Office and Cultural hubs within the City making it easier for City workers and tourists to connect to the shopping areas. Delighted to see the works taking place on Merrion Row and Baggot St which will both improve the pedestrian experience and facilitate on street dining.

Dublin Town reporting footfall in the City Centre at 87% of 2019 levels last Saturday, given the lack of Tourists that’s a very encouraging recovery. It will be interesting to see which retailers benefit most from the return of the consumer.

Dublin Town reporting footfall in the City Centre at 87% of 2019 levels last Saturday, given the lack of Tourists that’s a very encouraging recovery. It will be interesting to see which retailers benefit most from the return of the consumer.

Following the government’s transposition of IORP II, any new One Member Arrangements (OMA) will now be largely prevented from borrowing for their investments and be required to hold at least 50% of their investment in regulated markets e.g. listed shared and/or bonds.

Following the government’s transposition of IORP II, any new One Member Arrangements (OMA) will now be largely prevented from borrowing for their investments and be required to hold at least 50% of their investment in regulated markets e.g. listed shared and/or bonds.

Commercial properties had been an attractive option for OMA pension funds which could buy a €2.0m property with a €1.0m pension pot and borrowings. The income could be applied to the loan to allow the pension to grow to the €2.0m cap without relying upon growth. The combination of restricting borrowings and the 50% cap has the nett effect of limiting property purchases to €0.5m largely ruling out directly held commercial real estate.

Happy to discuss the implications and opportunities further.

#bannon #bannonconsultancy #bannonresearch

Agent Bannon is guiding a price of €3.75 million for a 46-acre landbank strategically positioned on the Slane Road between the M1 motorway and Drogheda town centre.

The property, which is in agricultural use currently, is expected to see strong interest from both residential and commercial developers, given its potential to accommodate a variety of uses. The entire holding is zoned “mixed-use (C1)” under the terms of the draft Louth County Development Plan 2021-2027. The objective of this zoning is “to provide for commercial, business and supporting residential uses”.

The final county development plan is expected to be adopted by the end of 2021. According to the draft plan, Drogheda is earmarked to further expand on its status as the largest town in Ireland with a target population of 50,000 by 2031. The town has been designated as a self-sustaining employment centre on the Dublin-Belfast Economic Corridor.

The subject site is well placed to benefit from this expected growth thanks to its location. The lands are situated on the Slane and Mell Road, with the M1 motorway (junction 10) to the northwest and Drogheda town centre to the southeast. The M1 Retail Park, which is occupied by Woodies, Smyths, Sports Direct and Dealz, is situated less than 500 metres to the northwest.

Niall Brereton, director at Bannon, said: “This is an excellent opportunity to develop a mixed-use scheme of scale, subject to planning permission, at a strategic location close to Drogheda town centre and the M1 motorway, within a town which has been identified as a regional growth centre.”

The property is being offered for sale by way of tender with a guide price of €3.75 million. The last date for receipt of tenders is noon on Thursday June 10th.

Hambleden House

19-26 Pembroke Street Lower

Dublin 2

D02 WV96

Ireland

»Map

Phone: +353 (1) 6477900

Fax: +353 (1) 6477901

Email: info@bannon.ie