Address

Hambleden House

19-26 Pembroke Street Lower

Dublin 2

D02 WV96

Ireland

»Map

Contact Us

Phone: +353 (1) 6477900

Fax: +353 (1) 6477901

Email: info@bannon.ie

Hibernia Reit has sold a south docklands office block for €6.9 million more than it paid for it 14 months ago.

The sale, in which Bannon acted for the vendor and Knight Frank for the purchaser, is to a German pension fund which has secured an initial yield of 4.65%. This off-market transaction underlines the considerable weight of international capital competing for exposure to the Dublin market.

Hibernia bought the mid-sized office building at 77 Sir John Rogerson’s Quay last February for €28.7 million.

Its sale for €35.6 million, after deducting €200,000 on improvement works, marks a 24% rise in value.

After buying the building, Hibernia quickly agreed to let it to Regus on a 25-year lease from mid-2018 at an initial rent of €1.8 million and a nine-month, rent-free period. This letting was also handled by Bannon.

Built in 2004

The six-storey building was built in 2004 and includes 3,196 sq.m (34,400 sq.ft) of office space and 20 basement car-parking spaces. Individual floor plates extend to 540 sq.m (4,812 sq.ft).

Prior to its sale last year, it had been used as serviced offices by Fitzwilliam Properties since 2006. A number of high-profile foreign direct investment companies – including LinkedIn, PTC Bio, Indeed, Zendesk and Future Finance – got their first taste of the south docklands through short-term rental arrangements at No 77.

The area around the building is one of the most vibrant hubs in the docklands, with the tenant line-up including Accenture, Airbnb, BOI, Facebook, Google, State Street, TripAdvisor, Matheson, LogMein and BNY Mellon.

It will be interesting to see if the sale of 77 will renew interest in the nearby Reflector office block on Hanover Quay which went on the market in February through Savills and CBRE with a guide price of €155 million.

This prime block is probably the standout Dublin asset on the market at the moment. It will produce an annual rent roll of about €7 million and, given its asking price, would suggest a net initial yield of 4.2%.

No 77 is within 10 minutes’ walk of Luas and Dart services and is close to the Bord Gáis Energy Theatre and the 3 Arena.

Bannon are delighted to have secured Petstop for the former Maplin unit in Limerick One Shopping Park.

At a rent of €24 per sq.ft for the 7,500 sq.ft unit, this letting further illustrates Limerick One’s regional importance as a premier retail trading destination.

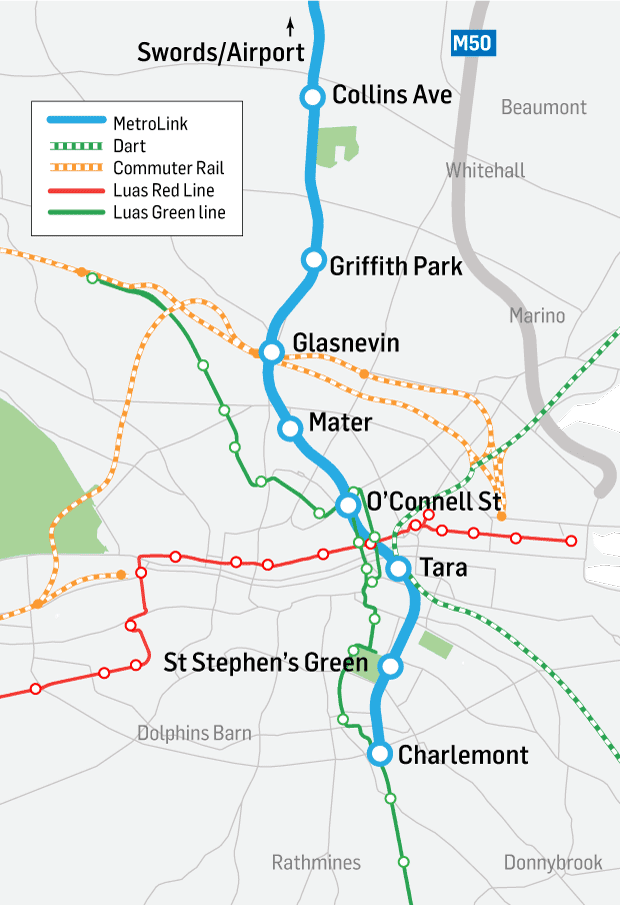

The upgrade of the Luas Green line to a metro service will not be needed “for 20 years or so” the National Transport Authority (NTA) has said.

The upgrade of the Luas Green line to a metro service will not be needed “for 20 years or so” the National Transport Authority (NTA) has said.

The NTA has today confirmed the MetroLink line, which had been due to run from Swords to Sandyford, will terminate at Charlemont north of Ranelagh, where it meets the Luas Green line.

Last March, the NTA announced plans for the line which would connect Dublin Airport to the city by rail, with the construction of new track from Swords to Charlemont, and an upgrade of the Luas Green line between Charlemont and Sandyford.

Minister for Transport Shane Ross last month said he would “not countenance” significant disruption to the Luas line and any plan which “requires an unacceptable level of shutdowns” to the Luas service would “not be tolerated”.

The NTA said it will tunnel past the Charlemont stop to allow the conversion of the Luas to metro “to occur at an appropriate point in the future” but the upgrade would not be required “for some time – perhaps twenty years or so”.

The new route will also see a station construction site in Glasnevin moved from lands owned by Na Fianna GAA club on St Mobhi Road to an adjacent training pitch belonging to Home Farm Football Club, following complaints by the GAA which were backed by Mr Varadkar. A tunnel boring machine, due to enter the ground at this site, will be moved to Ballymun.

The NTA today said the Home Farm station would be “more compact” than previously planned which would reduce the construction time from seven years to three years. There will be “no impact” on the Na Fianna pitches it said.

The revised route will also see reduced disruption to traffic in the city centre, the NTA said. The proposed station at St Stephen’s Green East will be moved slightly south and west to avoid the closure of Hume Street during construction However, St Stephen’s Green park itself “will be impacted to a small extent as a result”.

At O’Connell Street the proposed station will be moved to underneath the old Carlton cinema and the vacant plot beside it, where a shopping centre is planned stretching from O’Connell Street to Moore Street. The previous station location in the middle of the street, “would have presented a significant challenge to Luas services, bus services, and vehicular traffic on O’Connell Street” the NTA said.

However, the NTA still plans to go ahead with plans to demolish the College Gate apartment block and Markievicz leisure centre on Townsend Street to facilitate an underground station at Tara Street.

It said it did investigate alternatives, including locating the station under the Hawkins House development site, but “reluctantly concluded” demolishing the block of 70 apartments and the swimming pool, remained “the most feasible option”. It has however, reversed plans to demolish the smaller Court apartment building at Dalcassian Downs in Glasnevin.

The new route will be available for public consultation from today. The NTA expects to make an application to An Bord Pleanála for MetroLink next year, with construction expected to take six to seven years.

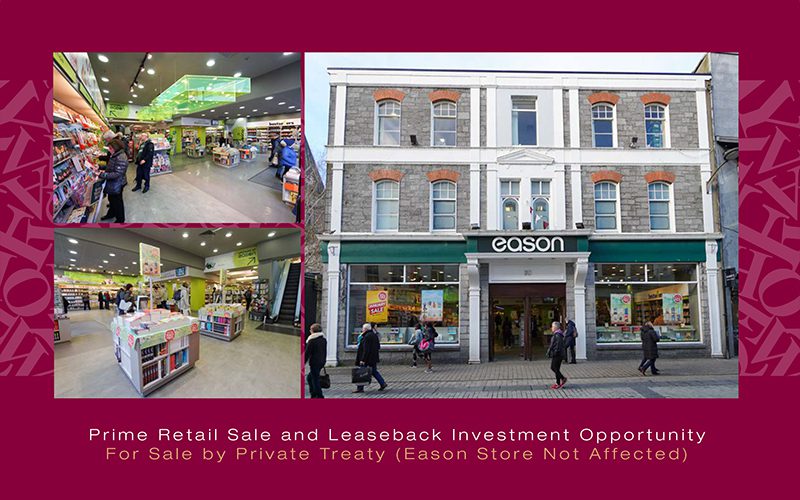

One of the best shops in Galway city centre is on the market for more than €8 million through agent Bannon. It is being sold on a sale-and-leaseback basis by books and stationary retailer Eason, which has occupied the building at 33 Shop Street for the past 30 years.

Eason is to take a 25-year lease on the premises at a rent of €525,000 per annum, and, given the guide price, this would reflect a net initial return of 6%. A guarantee from Eason Operations Ltd will cover 10 years of the lease (but any payment in relation to this will be limited to two years’ rent).

The retailer announced last year that it was to sell 13 properties in the Republic which could generate a €60 million windfall. Some €20 million of this would be transferred to its retail business, and the rest divided among its 220 shareholders. This disposal process will also include the sale of its flagship store on O’Connell Street in Dublin.

In January the retailer agreed to sell its 17,176 sq.m (184,886 sq.ft) St Margaret’s warehouse on 8.4 acres in north Dublin to Irish property fund Iput for €19 million. This marked the start of its property sales programme, which is now moving on to its retail assets.

The Galway sale – a prime asset – is very much about testing the appetite among investors for its retail portfolio. Further sales of its provincial stores are expected to follow shortly.

No 33, on a prime stretch of pedestrianised Shop Street, is a part two-storey and part three-storey building extending to 1,042.9 sq.m (11,226 sq.ft) with 834.1 sq.m (8,978 sq.ft) of retail space over ground and first-floor levels. This is considerably larger than most other stores on the street, and of a scale sought after by many modern retailers.

The open-plan retail area underwent complete refurbishment in 2013. It includes books, news and magazines at ground floor, and stationary and gifts on the first floor.

Nearby retailers include River Island, Tommy Hilfiger, Schuh, Lifestyle Sports, Holland & Barrett and Boots.

Brown Thomas and Edwards Square shopping centre are close by on William Street.

Contact Alex Patterson or Rod Nowlan of Capital Markets Team today on 01 647 7900 for further information.

A majority stake in Navan town Centre, which was on the market in 2016 for €62 million, has just been bought for about €43 million.

However, the off-market sale, which was handled by Rod Nowlan of Bannon and has just received clearance from competition authorities, did not include a residential element valued at less than €5 million that formed part of the 2016 offering.

The stake was sold to a fund controlled by Davy at an attractive yield of about 9-9.5%. This is undoubtedly a strong return for an asset of this scale in the Irish market at this time. However, the fall in value of the stake since 2016 is reflective of a softening market for provincial retail assets at a time when traditional retailing faces a significant challenge from eCommerce.

‘Stampede’

Declan Stone pointed to some notable retail transactions recently – principally Kilkenny, Carlow and Globe retail parks (all acquired by Friends First) – but suggested that retail as a sub-sector of the overall Irish investment market had its heyday in 2016 when retail transactions accounted for some 50% of a €4.4 billion market.

“In 2017 it fell to 28% of a €2.28 billion market and up to the third quarter of 2018 only accounted for about 11% of the total €2.53 billion spend,” says Stone.

“For me, the charge into retail in 2016 was somewhat surprising and seemed far more driven by the weight of capital than by underlying occupier demand. Put simply, retail yields tumbled – driving up capital values – but in the background there was little tenant demand to underpin this, and in fact in the intervening 24 months the occupational market has worsened.”

The 65% majority stake in Navan Town Centre came on the market in September 2016 through Savills and Cushman & Wakefield. CarVal Investors had bought loans underpinning the centre during the crash.

A number of deals were reportedly agreed for the stake at a price of about €54 million, but the major international investor concerned did not proceed with a transaction.

Driving force

The 65% shareholding was generating a rent roll of about €4.7 million as recently as 2017.

The balance of the shares in the centre are held by Irish Life.

Iput is to invest about €3 million refurbishing a large logistics facility it has just acquired for €19 million beside Dublin Airport. The acquisition is sizeable and significant in terms of the industrial market, which has been experiencing renewed interest from investors due to growth in online retailing.

Refurbishment works are already under way at Unit 1 in the Dublin Airport Logistics Park and the building should be ready for occupation this summer.

Industrial specialist William Harvey has been appointed sole letting agent. The going rate for letting similar space in the area is about €96.8-€102.25 per square metre (€9-€9.50 per square foot).

Unit 1 extends to 17,176 sq.m (184,886 sq.ft) and sits on a site of 8.4 acres. It was bought with vacant possession in an off-market deal. The building has a clear internal height of 9.5m with extensive loading access from 15 dock levellers and five grade-level loading doors.

Dublin Airport Logistics Park is close to the M1, M2, M50 and Dublin Airport.

Michael Clarke, head of investment at Iput, said the property fund was continuing to “strategically increase” its exposure to the logistics sector and now owns and manages more than 222,96 7sq.m (2.4 million sq.ft) of high-quality logistics space in Dublin.

“This acquisition reflects our strategy of acquiring large-scale logistics buildings in strategic locations which can be repositioned to provide enhanced income returns for shareholders,” he said.

Last year Iput acquired two significant logistics facilities in Dublin 15. It paid €12.3 million for 103 Northwest Business Park – a 10,904 sq.m (117,380 sq.ft) warehouse with 1,589 sq.m (17,104 sq.ft) of offices – and immediately embarked on a €2 million upgrade. Another logistics facility, extending to 9,800 sq.m (105,500 sq.ft), was acquired in the same park. “Both of these were pre-let on long-term leases,” said Mr Clarke.

Philip Harvey of William Harvey advised Iput on its latest acquisition at Dublin Airport Logistics Park and Rod Nowlan of Bannon represented the vendors.

The construction industry is expanding rapidly, with commercial building leading the way, and although the pace of gains in house-building slowed slightly from November it is at levels seen before the crash, according to Ulster Bank’s Construction Purchasing Managers’ Index (PMI).

The overall index hit 56.3 in December, up from 55.5 in November, a four-month high.

“Overall, the December survey results round off another strong year for Irish construction firms, with the PMI pointing to ongoing very healthy expansion throughout 2018,” said Simon Barry, chief economist Republic of Ireland at Ulster Bank.

“Moreover, momentum behind the sector’s recovery continues to look solid, with new orders continuing to rise solidly in December indicating that activity trends look set to remain positive in early 2019.”

The commercial construction activity index hit 58.5 in December, up sharply from 57.5 in November.

Housing activity growth moderated somewhat to a reading of 56 from 58.2.

A reading above 50 indicates expanding activity.

Civil engineering activity, however, bucked the stronger trend seen in commercial and housing construction, with the sector reading coming in at 45.5.

The rising levels of activity were mirrored in stronger employment in the sector, and the survey showed that the number of jobs in the sector rose for the 64th successive month.

Irish consumers spent €995m on groceries in December

Shoppers spent an average of €694 on groceries in December (€151 more than the typical month).

“Irish shoppers showed a willingness to splash out over the festive break,”

“Branded and premium private label ranges grew by 3.8% and 11.2% respectively as shoppers spoiled themselves and their families over Christmas.”

Danish global home retail brand, JYSK, will open 15 stores across Ireland in the next two years, creating more than 200 jobs.

Founded in Denmark in 1979 by Lars Larsen, over the past four decades JYSK has expanded to 51 countries with more than 2,700 stores worldwide employing 23,000 people.

The first Irish store will open in Naas, Kildare in April, with two further stores opening in Drogheda, Louth and Navan, Meath in May, and a fourth store opening in Portlaoise, Laois opening during the summer.

Roni Tuominen, head of retail, said Ireland is a very important market for JYSK, given the prominent position the retail industry holds in the country for employment and the economy. “As a company, we focus on entering a new market each year, and we are excited that 2019 is the year we bring our brand to Ireland. We will open here with our latest concept stores and deliver exceptional quality products at great prices to Irish consumers,” he said.

JYSK offers a range of products for the home, from the bedroom to the garden. The brand has also enjoyed a world-wide reputation for expertise and knowledge in sleeping culture, which continues to this day, offering everything from mattresses to frames and bases.

Hambleden House

19-26 Pembroke Street Lower

Dublin 2

D02 WV96

Ireland

»Map

Phone: +353 (1) 6477900

Fax: +353 (1) 6477901

Email: info@bannon.ie