After the pandemic: in Dublin’s bare city

After the pandemic: in Dublin’s bare city. Our streets must be reimagined to entice visitors rather than cater to workers. Bannon advises on this in The Sunday Times.

After the pandemic: in Dublin’s bare city. Our streets must be reimagined to entice visitors rather than cater to workers. Bannon advises on this in The Sunday Times.

After the pandemic: in Dublin’s bare city. Our streets must be reimagined to entice visitors rather than cater to workers. Bannon advises on this in The Sunday Times.

After the pandemic: in Dublin’s bare city. Our streets must be reimagined to entice visitors rather than cater to workers. Bannon advises on this in The Sunday Times.

Covid 19 and level 5 restrictions have continued to impact the Dublin office market this quarter with just 14 transactions recorded across the sector.

As the vaccination rollout continues we are seeing a notable increase in market activity and re-activation of requirements, as companies plan for a return to the office. This is highlighted further by the increase in office accommodation reserved, which currently stands at over 500,000 sq.ft. across the capital.

Wishing all our clients and friends a very Happy Easter from all the team at Bannon

Wishing all our clients and friends a very Happy Easter from all the team at Bannon

Despite the backdrop of Covid 19, Q1 turnover was a healthy €1.22bn, with 58% weighting to the residential sector. Strong demand in the sector for good product continues on a standing asset and forward commit basis. With restrictions on travel / viewings still in play the more traditional sectors have had a subdued quarter but should rebound later in the year. If you wish to discuss the quarter in more detail or general investment, please contact Rod Nowlan or David Carroll.

With vacancy levels for prime industrial stock reaching record lows and limited development opportunities available along the main arterial routes around the capital, agent Bannon expects to see strong demand for a 22-acre land holding fronting on to the M3 motorway.

Located next to junction 4, less than five-minutes’ drive from the M50 and 15km from Dublin city centre, the M3 Gateway site is fully serviced and offers the potential for a logistics/distribution or data-centre development of about 400,000sq ft (37,161sq m) subject to planning permission.

The land adjoining the site has in recent years been transformed by the development of two hyper-scale data centres by Facebook. Further data centres are situated nearby in Blanchardstown and Mulhuddart where Amazon Web Services is progressing a 223,000sq ft facility. The area has also proven to be popular among pharmaceutical and logistics companies, with MSD, Astellas, Helsinn Birex, Geodis and Masterlink all situated nearby.

The commuter towns of Dunboyne and Clonee are situated on the opposite side of the M3 with rail stations at Dunboyne and the M3 Parkway park-and-ride facility at Pace.

The land has direct road frontage on to both the M3 slip road and the Kilbride road. Notably services including mains drainage, water and gas supply pass through the southern portion of the site and are capped for future connection. The presence of these services is expected by the selling agent to enhance the prospects for the land when brought forward for development. The entire holding is zoned “enterprise and employment” and “warehousing and distribution” within the Meath county development plan.

The property is being offered for sale by tender on Thursday, May 6th at a guide price of €10 million.

Commenting on the sale, Niall Brereton, director at Bannon, said: “In addition to the terrific data-centre potential the lands at M3 Gateway offer institutional investors an unrivalled opportunity, subject to planning permission, to enhance the logistics/distribution allocation within their portfolios and capitalise on the significant demand amongst third-party logistics providers, pharmaceutical companies and online retailers for modern industrial stock within touching distance of the M50 and the city’s main arterial corridors.”

Happy St. Patrick’s Day to all our clients and friends from Ireland’s largest indigenous Commercial Property Advisor.

Happy St. Patrick’s Day to all our clients and friends from Ireland’s largest indigenous Commercial Property Advisor.

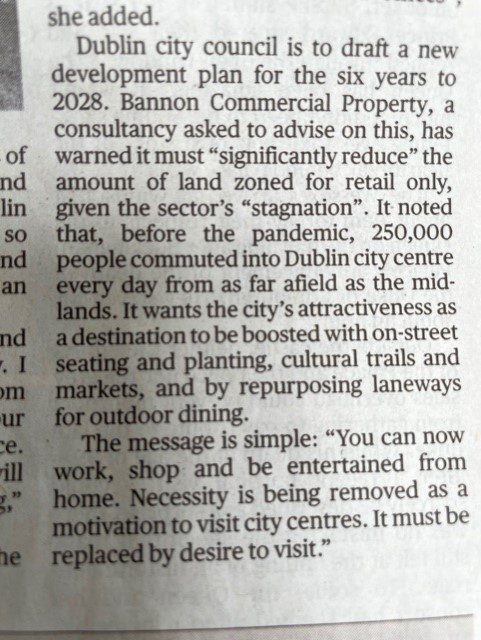

A shot from today’s Bannon town hall meeting. We simply can’t wait to get back to work with this great team in the non virtual world….

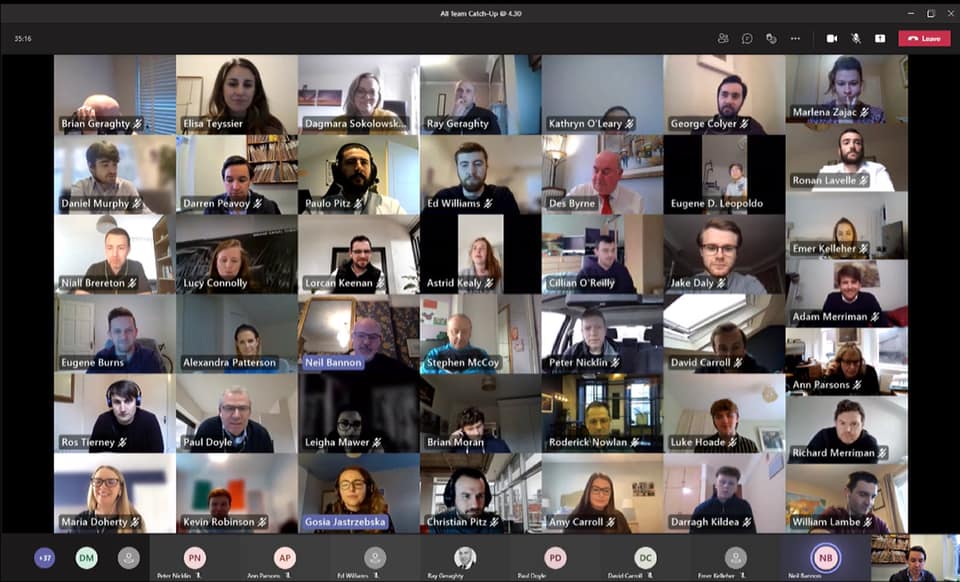

The dramatic improvement in the balance sheets of Irish Consumers in the last decade is astounding, savings are up 35% and debt is down 33%, a €70bn nett turnaround. The potential for a positive impact on the retail sector post reopening is clear, the question is where will the money be spent. We are modelling the potential impact on the different retail sub-sectors and expect to see a very different outturn to the 2013 recovery.

Hambleden House

19-26 Pembroke Street Lower

Dublin 2

D02 WV96

Ireland

»Map

Phone: +353 (1) 6477900

Fax: +353 (1) 6477901

Email: info@bannon.ie