Shop Local this Christmas

Despite the uncertainty of COVID, it is great to see such optimism across our property management portfolio with over 40 new openings since we emerged from lockdown in May 2021. Shop Local this Christmas!

Despite the uncertainty of COVID, it is great to see such optimism across our property management portfolio with over 40 new openings since we emerged from lockdown in May 2021. Shop Local this Christmas!

We are delighted to announce the winners of the Bannon “ESG Signage” Art competition run in conjunction with Loreto Junior School Stephens Green.

Congratulations to Amy He (Power Down), Sorcha Murray (Pause before you print) & Grace Yu (Recycle) for their fantastic artwork.

A big thank you to everyone who got involved! Amazing talent from such a young group!

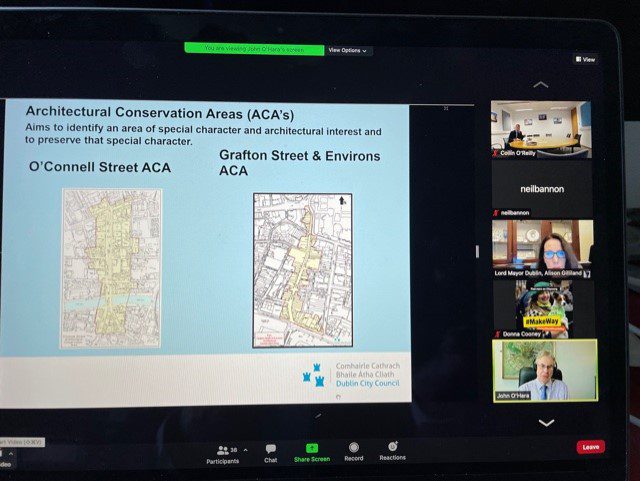

Our chairman and head of Consultancy Neil Bannon was invited to present to Dublin City Council this morning on how to tackle retail vacancy in Dublin City Centre, really positive session with great sharing of ideas & initiatives.

Bannon is pleased to have assisted Penneys in sourcing a 15.3 hectare (38 acre) site at Great Connell, Newbridge, Co. Kildare to facilitate the development of a state of the art logistics hub/distribution centre for the retailing giant.

Kildare County Council granted planning permission for the 55,277 sq m (595,000 sq ft) facility which will be accessed off the Newbridge South Orbital Relief Road. When constructed the building will serve all 36 Penneys stores across Ireland. The warehouse will feature 20 metres clear eaves height, 34 HGV dock leveller loading doors and an extensive automated goods handling system.

The area is home to several other high profile companies including Pfizer, Lidl (Regional Distribution Centre), Murphy Group and KDP Ireland (Keurig Dr. Pepper). It is also situated close to Junction 10 (Newhall) on the M7 motorway.

The site was sourced on an off-market basis following an extensive selection process. Niall Brereton who handled the transaction commented “We are delighted to have been able to acquire such an extensive and highly accessible site for Penneys. It will play a huge role to ensure the company’s continued growth as Ireland’s most popular retailer”.

CGI of Proposed Scheme (Model Works)

CGI of Proposed Scheme (Model Works)

The winner of the Bannon “ESG Signage” Art competition run in conjunction with Loreto Junior School Stephens Green being adjudicated by today.. Keep an eye out on our page as we will be announcing the winners over the next few days!

We’re delighted to see the new Regatta Great Outdoors store open in Nutgrove Shopping Centre, Dublin 14.

This was our first acquisition on behalf of our new client Regatta Ltd.

The super smart looking store, which will also incorporate Craghoppers and Dare 2b products, will serve the catchment well and the strong customer base who are embracing the outdoors even more since the arrival of Covid.

It was a great team effort to get the store open and ready for Black Friday and the run into Christmas, working with Brian Fox and the Regatta Team and Andrew Johnston.

We are continuing to look for more opportunities countrywide.

Covid-19 has flipped the performance of retail assets on their head. The previously-held view was that the prime to tertiary hierarchy was – city high street, major town centre, retail park, grocery retail and local necessity centres. However, in terms of demand and performance from the occupiers on the ground, this traditional hierarchy has now been reversed and is resulting in differentiation within a sector previously considered by many investors as a homogeneous entity.

Footfall is a very effective barometer to highlight this shift. High street has undoubtedly been the most negatively impacted retail market sector with Covid-19 decimating footfall and in-shop spend. Bannon estimates that there are almost 40 shops either vacant or available on Grafton Street and Henry/Mary Street out of a total of 162. Similarly the hospitality sector, including food and beverage, like non-essential retail, has been severely impacted during Covid-19. Despite a strong recovery city centre footfall counts for Q3 2021 were still 30 per cent below 2019 levels. According to the IPD Index year-on-year total returns within the sector are showing minus 12.5 per cent.

In stark contrast the necessity retail sector (being grocery, medical and service-related offers) as well the retail parks have proved to be exceptionally resilient through Covid and continue to perform very strongly. Car counts in many retail parks for Q2 and Q3 2021 exceeded 2019 levels with retailers reporting considerable turnover growth. Provincially convenience-focused shopping centres have remained resilient with limited vacancy as shoppers choose convenience and to shop locally. We are seeing footfall levels return by up to 90 per cent of their 2019 equivalents.

In the latter half of 2021 the ‘money’ began to follow the data into retail parks as is evidenced by the position taken by AM Alpha in Nutgove Retail Park (€66.3 million) and M&G Investments through the acquisition of the Parks Collection Portfolio (€74.5 million) and the agreed acquisition of Manor West (€56 million). We estimate retail parks transactions will represent more than two thirds of all retail transactions in 2021 and will be the only retail sector within the IPD showing positive total returns for 2021 (currently running at plus 6.3 per cent).

Supported largely by the threat of inflation, the resurgence in the retail grocery sector had already commenced pre-Covid in the UK and Europe, with long-let standalone grocery often trading at yield levels of between 4 and 5 per cent. This demand is beginning to emerge in the Irish market, with a shrinking gap between what the sector is trading at in the UK and the perceived value in Ireland. More recently we have seen a number of transactions which are at materially stronger yield levels than market expectation and these are due to sign before the end of the year.

Due to the structural limitations in scalability in the “grocery market” sector in Ireland (where most anchor stores are owner occupied) and the large delta which is developing between “pure grocery retail” and “necessity retail” (being service, health, medical and food-related occupiers) this sub-sector may come into more mainstream investment focus in 2022. The disconnect between the emerging grocery yields (5 per cent to 5.5 per cent) and those in the supporting “necessity retail” (9 to 10 per cent plus) seem irrationally high, especially as the necessity retail operator’s turnover is derived from the same customer base as their high-value grocery anchor neighbours. These centres along with retail parks serve to highlight opportunity within the sector where the negative narrative in the overall retail sector is keeping yields high despite resilient trading.

Rod Nowlan is an executive director at Bannon

It’s beginning to look a lot like Christmas here in Bannon!

![]()

Background

The Property Management team at Bannon currently manage over 70 commercial sites across Ireland. The portfolio is made up of Shopping Centres, Retail Parks, Business Parks and Office Parks.

In recent years there has been an unquestionable shift in weather patterns, and this is particularly noticeable in the colder winter months. One such example was the severe weather experienced in February 2018 when Storm Emma hit Ireland. During the course of the storm, we saw significant accumulations of snow across our sites and temperatures as low as –11.0°C.

In any given year we see c.100 million visits to Bannon managed sites across the country and maintaining safe access to these sites is a crucial part of our role as Property Managers. We manage this risk by appointing contractors to carry out gritting services during periods of cold weather and snow clearance when required.

A number of years ago we recognised the obvious synergies associated with managing our winter maintenance services on a portfolio basis. For that reason, we have split our portfolio into three distinct zones (see below) and we tender the contract every 3 years.

Zone 1 – Greater Dublin Area

Zone 2 – South & South East

Zone 3 – Midlands, West & North West

Tender

A sub-team of Property Managers were appointed to oversee the tendering of the Winter Maintenance contract for the portfolio. The following tender process occurred;

Phase 1 – Review of portfolio geography and creation of 3 distinct zones

Phase 2 – Preparation of Request for Tender (RFT) document

Phase 3 – Shortlisting of suitable contractors including a visit to contractors’ facilities

Phase 4 – Issue RFT to shortlisted parties

Phase 5 – Review & analysis of tenders

Phase 6 – Selection & contract award to winning tenderers

In total the RFT was issued to 10 contractors and we received 6 complete tender submissions. The submissions were assessed and ranked based on pre-set criteria. All but one tenderer submitted a proposal for all three zones. The sub-team assessed the proposals and made a recommendation to the directors of the department to appoint three separate contractors (one per zone). This recommendation was followed and the contracts were awarded to the following parties;

Zone 1 – Greater Dublin Area – SAP Landscapes

Zone 2 – South & South East – O’Brien Facilities

Zone 3 – Midlands, West & North West – Ken Fitzsimons Landscaping

Benefits

The benefits of carrying out a procurement process of this nature are far reaching, to include;

Overall, we have seen significant benefits in procuring our Winter Maintenance services on a portfolio wide basis. Our retail clients can enjoy consistency of service across all sites. With a proactive and data driven approach, we ensure that footfall does not drop and visitor health and safety is managed.

Hambleden House

19-26 Pembroke Street Lower

Dublin 2

D02 WV96

Ireland

»Map

Phone: +353 (1) 6477900

Fax: +353 (1) 6477901

Email: info@bannon.ie